Boston Private Bank & Trust Company Acquisition of Banyan Partners

This article is reprinted from Mercer Capital’s Asset Management Industry newsletter (Q2, 2014). For a review of a prior transaction referenced in this article (Tri-State Capital’s acquisition of Chartwell Investment Partners), see the Q4, 2013 issue of Asset Management newsletter.

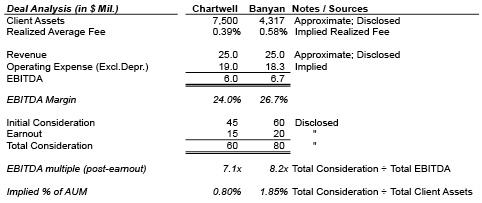

On July 16th, 2014 Boston Private Financial Holdings, Inc. (NASDAQ ticker: BPFH), the holding company of Boston Private Bank & Trust Company, entered an asset-purchase agreement to acquire Banyan Partners, LLC, a Registered Investment Advisor (RIA) headquartered in Palm Beach Gardens, Florida with approximately $4.3 billion in client assets. Key attributes of this deal and another recent bank acquisition of an asset manager are presented in Figure 1 below for perspective on industry pricing metrics.

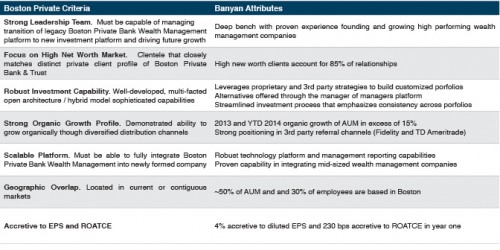

Similar to the Tri-State/Chartwell deal earlier this year, management delineated how Banyan’s attributes met Boston Private’s investing criteria as shown in Table 1.

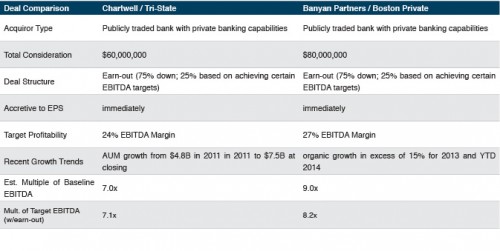

Table 2 depicts other similarities and key attributes of the Tri-State/Chartwell and Boston Private/Banyan Partners deals as banks continue to target advisors for exposure to fee income and higher margin products.

These recent deals are particularly instructive to other industry participants since, of the nearly 11,000 RIAs nationwide, approximately 80 (<1%) transact in a given year, and the terms of these deals are rarely disclosed to the public. Part of this phenomenon is attributable to sheer economics – a new white paper from third-party money manager, CLS Investments, argues that many advisors lose out financially in an outright sale of the business. Another recent publication titled "Advisors: Don't Sell Your Practice!" in research magazine ThinkAdvisor notes that many principals earn more in salary and bonuses than they would from the consideration they would otherwise receive in an earn-out payment over a period of time, as many of these deals are structured. In other words, returns on labor exceed potential returns on capital for many advisors, particularly for smaller asset managers that typically transact at lower multiples of earnings or cash flow. In these instances, an internal transaction with junior partners might make more sense for purposes of business continuity and maximizing proceeds. For larger RIAs, recent deals at 7-9x EBITDA suggest that buyers are willing to pay a little more for the size and stability of an advisor with several billion under management.

For more information or if we can assist you in any way, please feel free to contact us.

Reprinted from Bank Watch, September 2014.