How to Combat the Margin Blues?

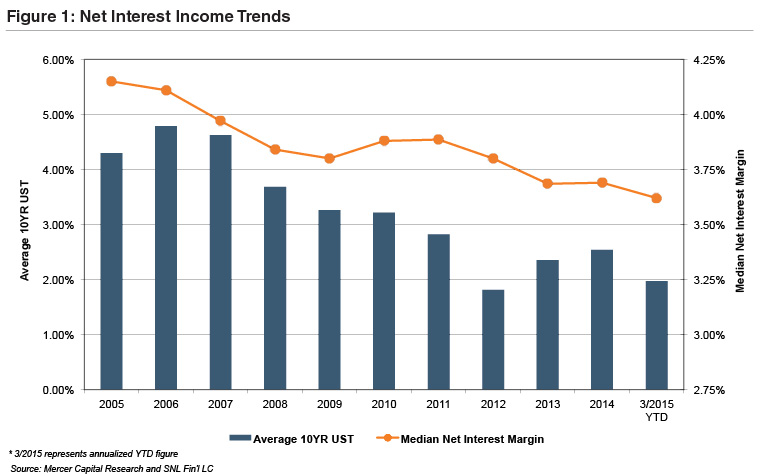

Following the Great Recession, significant attention has been focused on bank earnings and earning power. While community bank returns on equity (ROE) have improved since the depths of the recession, they are still below pre-recession levels. One factor squeezing revenue is falling net interest margins (i.e., the difference between rates earned on loans and securities, and rates paid to depositors). Community banks are more margin dependent than their larger brethren and have been impacted to a greater extent from this declining NIM trend. As detailed in Figure 1 below, NIMs for community banks (defined to be those with assets between $100 million and $5 billion) have steadily declined and were at their lowest point in the last ten years in early 2015.

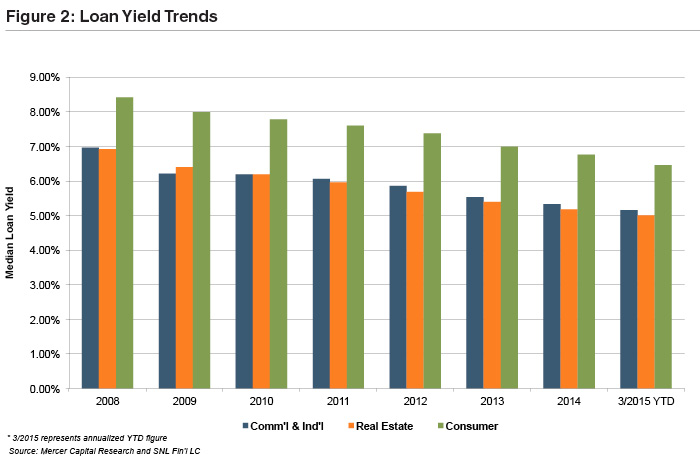

While there are a number of factors that impact NIMs, the primary culprit for the declining trend is the interest rate environment. As the Federal Reserve’s zero-interest rate policy (“ZIRP”) grinds on, earning asset yields continue to reprice lower while deposit costs reached a floor several quarters ago. Loan growth has also been challenging for many banks for a variety of reasons, which has stoked competitive pressures and negatively impacted lending margins. While competitive pressures can come in many forms, several data-points indicate intense loan competition giving way to easing terms. For example, the April 2015 Senior Loan Officer Opinion Survey on Bank Lending Practices noted continued easing on terms in a number of loan segments. This appears to be supported further by reported community bank loan yields, which have slid close to 200 basis points (in all loan segments analyzed) since 2008 as shown in Figure 2.

Aside from paying tribute to the late B.B. King and playing “Everyday, everyday I have the blues,” what can community bankers do in order to combat the margin blues? While not all-encompassing, below we have listed a few strategic options to consider:

- Increase Leverage. One strategic consideration to maintain ROE in light of declining NIMs may be to increase leverage subject to regulatory limits. Some potential ways to deploy available capital include growing loans organically, M&A, stock buybacks, and/or shareholder dividends. For those below $1 billion in assets, recent legislation has relaxed holding company capital requirements by exempting them from the consolidated regulatory capital ratios. For those that are capable, small bank holding companies may choose to upstream excess capital to the holding company from bank dividends or lever the holding company to fund special dividends and/or buybacks. This higher leverage strategy may be viewed as too aggressive by some shareholders and investors though.

- Consider M&A. An investor at a recent community bank conference noted that he would rather see banks sell than head down lending’s slippery slope. This is not surprising to hear because competitive lending pressures usually seed tomorrow’s problem assets. M&A represents a classic solution to revenue headwinds in a mature industry whereby less profitable smaller companies sell to the larger ones creating economies of scale and enhanced profitability. Some signs of this can be seen in recent periods as deal activity has picked up. Beyond expense synergies, acquirers may see temporary NIM relief resulting from accretion income on the acquired assets, which are marked to fair value at acquisition. For those community banks below $1 billion in assets, the combination of the relaxed capital requirements for their holding companies and more options for holding company debt may attract some to consider M&A as a strategic option.

- Acquire/Partner with Non-Financials. Another strategic option may be to expand into non-traditional bank business lines that are less capital intensive and offer prospects for non-interest income growth such as acquisitions or partnerships with insurance, wealth management, specialty finance, and/or financial technology companies. We have spoken on acquiring non-financials in different venues and there is some evidence of increased activity in the sector. For example, a recent article noted a growing trend in acquisitions of insurance brokers or agencies by banks and thrifts, with deal volume on pace to significantly exceed 2014. Another interesting example of this strategy being deployed includes the recent partnership announced between Lending Club and BancAlliance that allows over 200 community banks to access the peer-to-peer lending space.

- Improve Efficiency by Leveraging Financial Technology. While compliance and regulatory costs continue to rise as NIMs decline, the industry faces intense pressure to improve efficiency. Technology is an opportunity to do so as both commercial and consumer customers become more comfortable with mobile and online banking. Thus, many banks may view the margin blues as a catalyst to consolidate and/or modernize their branch network and/or invest in improved technology offerings to reduce longer-term operating costs and still meet or exceed customer expectations.

- Maintain Status Quo. Experience may lead bankers to wait on the Fed to act and usher a return to “normal” yields and “normal” NIMs. Banks with a healthy amount of variable rate loans and non-interest bearing deposits will see an immediate bump in revenue if short-term rates rise, while most traditional banks eventually will see a reversal in NIM trends. But as has been enumerated in past Bank Watch articles, rates have been expected to rise for a “considerable time,” and yet continue to remain at historic lows. Further, the potential negative impact of rising rates on credit quality is difficult to foretell. Yet, even this status quo strategy may present some opportunities for those bankers to employ certain of the other strategies mentioned previously in small doses.

Mercer Capital has a long history of working with banks and helping to solve complex problems ranging from valuation issues to considering different strategic options. If you would like to discuss your bank’s unique situation in confidence and ways that your bank may consider addressing the margin blues, feel free to give us a call or email.