Stress Testing and Capital Planning for Banks and Credit Unions During the COVID-19 Pandemic

A stress test is defined as a risk management tool that consists of estimating the bank’s financial position over a time horizon – approximately two years – under different scenarios (typically a baseline, adverse, and severe scenario).

The concept of stress testing for banks and credit unions is akin to the human experience of going in for a check up and running on a treadmill so your cardiologist can measure how your heart performs under stress. Similar to stress tests performed by doctors, stress tests for financial institutions can ultimately improve the health of the bank or credit union (“CU”).

The benefits of stress testing for financial institutions include:

- Enhancing strategic/capital planning

- Improving risk management

- Enhancing the value and earning power of the bank or credit union

As many public companies in other industries have pulled earnings guidance due to the uncertainty surrounding the economic outlook amid the coronavirus pandemic, community banks and CUs do not have that luxury. Key stakeholders, boards, and regulators will desire a better understanding of the ability of the bank or CU to withstand the severe economic shock of the pandemic. Fortunately, stress testing has been a part of the banking lexicon since the last global financial crisis began in 2008. We can leverage many lessons learned from the last decade or so of this annual exercise.

Conducting a Stress Test

It can be easy to get overwhelmed when faced with scenario and capital planning amidst the backdrop of a global pandemic with a virus whose path and duration is ultimately uncertain. However, it is important to stay grounded in established stress testing steps and techniques.

Below we discuss the four primary steps that we take to help clients conduct a stress test in light of the current economic environment.

Step 1: Determine the Economic Scenarios to Consider

It is important to determine the appropriate stress event to consider. Unfortunately, the Federal Reserve’s original 2020 scenarios published in 1Q2020 seem less relevant today since they forecast peak unemployment at 10%, versus the recent peak national unemployment rate of 14.7% (April 2020). However, the Federal Reserve supplemented the original scenario with a sensitivity analysis for the 2020 stress testing round related to coronavirus scenarios in late 2Q20, which provides helpful insights.

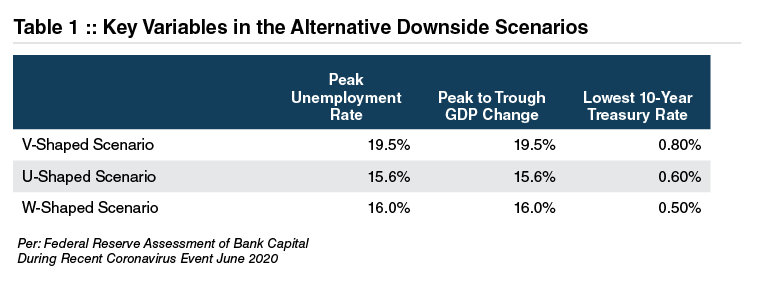

The Federal Reserve’s sensitivity analysis had three alternative downside

scenarios:

- A rapid V-shaped recovery that regains much of the output and employment lost by year-end 2020

- A slower, more U-shaped recovery in which only a small share of lost output and employment is regained in 2020

- A W-shaped double dip recession with a short-lived recovery followed by a severe drop in late 2020 due to a second wave of COVID

Some of the key macroeconomic variables in these scenarios are found in Table 1.

In our view, these scenarios provide community banks and credit unions with economic scenarios from which to begin a sound stress testing and capital planning framework.

Step 2: Segment the Loan Portfolio and Estimate Loan Portfolio Stress Losses

While determining potential loan losses due to the uncertainty from a pandemic can be particularly daunting, we can take clues from the Federal Reserve’s release of results in late 2Q20 from some of the largest banks. While the specific loss rates for specific banks weren’t disclosed, the Fed’s U, V, and W sensitivity analysis noted that aggregate loss rates were higher than both the Global Financial Crisis (“GFC”) and the Supervisory Capital Assessment Program (“SCAP”) assumptions from the prior downturn.

We note that many community banks and CUs may feel that their portfolios in aggregate will weather the COVID storm better than their larger counterparts (data provided in Table 2). We have previously noted that community bank loan portfolios are more diverse now than during the prior downturn and cumulative charge-offs were lower for community banks as a whole than the larger banks during the GFC. For example, cumulative charge-offs for community banks over a longer distressed time period during the GFC (four years, or sixteen quarters, from June 2008 – June 2012) were 5.1%, implying an annual charge-off rate during a stressed period of 1.28% (which is ~42% of what larger banks experienced during the GFC). However, we also note that this community bank loss history is likely understated by the survivorship bias arising from community banks that failed during the GFC.

Each community bank or CU’s loan portfolio is unique, and it will be important for community banks and CUs to document the composition of their portfolio and segment the portfolio appropriately. Segmentation of the loan portfolio will be particularly important. The Fed noted that certain sectors will behave differently during the COVID downturn. The leisure, hospitality, tourism, retail, and food sectors are likely to have higher credit risk during the pandemic. Proper loan segmentation should include segmentation for higher risk industry sectors during the current pandemic as well as COVID-modified/restructured loans.

Once the portfolio is segmented, loss history over an extended period and a full business cycle (likely 10-12 years of history) will be important to assess. While the current pandemic is a different event, this historical loss experience can be leveraged to provide insights into future prospects and underwriting strength during a downturn and relative to peer loss experience.

In certain situations, it may also be relevant to consider the correlation between those historical losses and certain economic factors such as the unemployment rate in the institution’s market areas. For example, a regression analysis can determine which variables were most significant statistically in driving historical losses during prior downturns and help determine which variables may be most relevant in the current pandemic. For those variables deemed statistically significant, the regression analysis can also provide a forecasting tool to estimate and/or test the reasonableness of future loss rates based on assumed changes in those variables that may be above and beyond historical experience.

Lastly, higher risk loan portfolio segments (such as those in more economically exposed sectors) and larger loans that were modified during the pandemic may need to be supplemented by some “bottom-up” analysis of certain loans to determine how these credits may fare in the different economic scenarios previously described. To the extent losses can be modeled for each individual loan, these losses can be used to estimate losses for those particular loans and also leveraged to support assumptions for other loan portfolio segments.

Step 3: Estimate the Impact of Stress on Earnings

Step 3 expands the focus beyond just the loan portfolio and potential credit losses from the pandemic modeled in Step 2 and focuses on the institution’s “core” earning power and sensitivity of that over the economic scenarios modeled in Step 1.

When assessing “core” earning power, it is important to consider the potential impact of the economic scenarios on the interest rate outlook and net interest margins (“NIM”). While the outlook is uncertain, Federal Reserve rate cuts have already started to crimp margins.

Beyond the headwinds brought about by the pandemic, it is also important to consider any potential tailwinds in certain countercyclical areas like mortgage banking, PPP loan income, and/or efficiency brought about by greater adoption of digital technology and cost savings from branch closures. Ultimately, the earnings model over the stressed period relies on key assumptions that need to be researched, explained, and supported related to NIM, earning assets, non-interest income, expenses/efficiency, and provision expense in light of the credit losses modeled in Step 2.

Step 4: Estimate the Impact of Stress on Capital

Step 4 combines all the work done in Steps 1, 2, and 3 and ultimately models capital levels and ratios over the entirety of the forecast periods (which is normally nine quarters) in the different economic scenarios.

Capital at the end of the forecast period is ultimately a function of capital and reserve levels immediately prior to the stressed period plus earnings or losses generated over the stressed period (inclusive of credit losses and provisions estimated). When assessing capital ratios during the pandemic period, it is important to also consider the impact of any strategic decisions that may help to alleviate stress on capital during this period, such as raising sub-debt, eliminating distributions or share repurchases, and slowing balance sheet growth. For perspective, the results released from the Federal Reserve suggested that under the V, U, and W shaped alternative downside scenarios, the aggregate CET1 capital ratios were 9.5%, 8.1%, and 7.7%, respectively.

What Should Your Bank or Credit Union Do with the Results?

What your bank or credit union should do with the results depends on the institution’s specific situation. For example, assume that your stress test reveals a lower exposure to certain economically exposed sectors during the pandemic and some countercyclical strengths such as mortgage banking/asset management/

PPP revenues. This helps your bank or CU maintain relatively strong and healthy performance over the stressed period in terms of capital, asset quality, and earnings performance. This performance could allow for and support a strategic/capital plan involving the continuation of dividends and/or share repurchases, accessing capital and/or sub-debt for growth opportunities, and proactively looking at ways to grow market share both organically and through potential acquisitions during and after the pandemic-induced downturn. For those banks and CUs that include M&A in the strategic/capital plan over the next two years, improved stress testing capabilities at your institution should assist with stress testing the target’s loan portfolio during the due diligence process.

Alternatively, consider a bank that is in a relatively weaker position. In this case, the results may provide key insight that leads to quantifying the potential capital shortfall, if any, relative to either regulatory minimums or internal targets. After estimating the shortfall, management can develop an action plan, which could entail seeking additional common equity, accessing sub-debt, selling branches or higher-risk loan portfolios to shrink the balance sheet, or considering potential merger partners. Integrating the stress test results with identifiable action plans to remediate any capital shortfall can demonstrate that the bank’s existing capital, including any capital enhancement actions taken, is adequate in stressed economic scenarios.

How Mercer Capital Can Help

A well-reasoned and documented stress test can provide regulators, directors, and management the comfort of knowing that capital levels are adequate, at a minimum, to withstand the pandemic and maintain the dividend. A stress test can also support other strategies to enhance shareholder value, such as a share buyback plan, higher dividends, a strategic acquisition, or other actions to take advantage of the disruption caused by the pandemic. The results of the stress test should also enhance your bank or credit union’s decision-making process and be incorporated into strategic planning and the management of credit risk, interest rate risk, and capital.

Having successfully completed thousands of engagements for financial institutions over the last 35 years, Mercer Capital has the experience to solve complex financial issues impacting community banks and credit unions during the ups and downs of economic cycles. Mercer Capital can help scale and improve your institution’s stress testing in a variety of ways. We can provide advice and support for assumptions within your bank or credit union’s pre-existing stress test. We can also develop a unique, custom stress test that incorporates your institution’s desired level of complexity and adequately captures the unique risks you face.

Regardless of the approach, the desired outcome is a stress test and capital plan that can be used by managers, directors, and regulators to monitor capital adequacy, manage risk, enhance the bank’s performance, and improve strategic decisions.

For more information on Mercer Capital’s Stress Testing and Capital Planning solutions, contact Jay Wilson at wilsonj@mercercapital.com.

Originally appeared in Mercer Capital’s Bank Watch, July 2020.