What is the Order of Testing for Impairment?

When testing the goodwill of a reporting unit for impairment, the order of operations matters. Because the units themselves may contain assets subject to impairment testing, it is important to first reflect accurate carrying values for those assets before testing the goodwill of the unit overall.

If the goodwill of the unit is tested before a write down of certain of its assets occurs, there may be increased risk of inaccurately allocating impairment between the assets and goodwill of the unit. Similarly, failing to address the order of testing could lead to the false conclusion that the goodwill of a reporting unit is impaired, when there is really only impairment of its underlying identifiable assets. These errors occur when the unit’s fair value of goodwill is compared to an inaccurately high carrying value that results from failing to adjust asset values first.

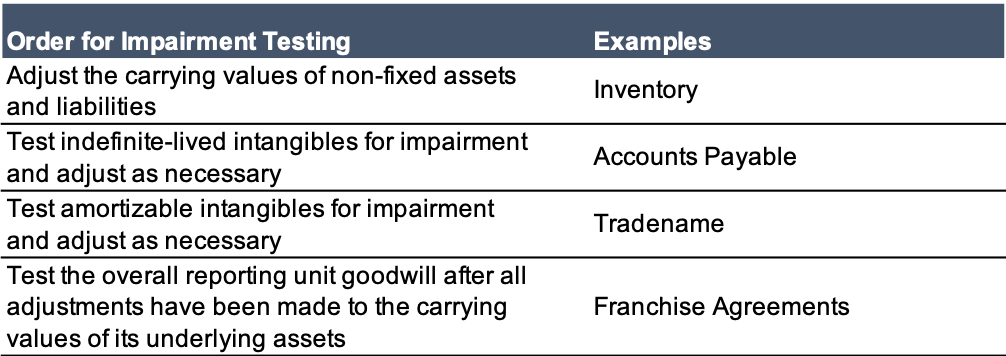

According to the AICPA Accounting & Valuation Guide: Testing Goodwill for Impairment [paragraph 2.57], the order of impairment testing should be as follows:

Financial statement preparers should not neglect the proper order of impairment testing to ensure current allocation of impairment.

Originally appeared in Mercer Capital’s Financial Reporting Update: Goodwill Impairment