April 2020 SAAR

April Showers Bring May Flowers? High Optimism Following a Historically Low April SAAR

April SAAR Update

Last month, we mentioned the troubles that the auto industry is experiencing were most likely going to get worse before they got better considering the increases in COVID-19 cases and stay-at-home orders. April was always going to be the low point with the first part of March largely unimpacted, and cities and states now beginning to ease restrictions in May.

SAAR (a measure of Light-Weight Vehicle Sales: Autos and Light Trucks) declined to 8.8 million units in April, its lowest level since the data started being recorded in 1976. This was a 47.6% drop compared to April 2019, and seasonally adjusted sales volumes were 24.5% below March, which was already 32.2% below February.

SAAR declined to 8.8 million units in April, its lowest level since the data started being recorded in 1976.

It is important to note that while overall volumes fell precipitously, the impact was felt differently throughout the country due to differences in state and local laws and responses to the pandemic. NADA noted that states with fewer restrictions on selling vehicles outperformed markets where restrictions were more stringent. Dealerships in the Northeast and West most likely felt stronger effects than those in the South or Plains. With no statewide stay-at-home orders in place in April for Arkansas, Iowa, Nebraska, North Dakota, South Dakota, Utah, or Wyoming, dealerships in these states may have not felt the same pain as their counterparts in breakout areas such as New York and New Jersey.

Another factor contributing to dealership performance in April was the allowance of online car sales. Pennsylvania went from mid-March to April 20th without vehicle sales as a law had to be passed to allow for remote notarization to facilitate online sales with contactless delivery. Kentucky and Hawaii were also among the last states to ease online restrictions. Online sales during this pandemic have been important in keeping numbers up, though the transition was not seamless which likely had a negative effect on April volumes towards the beginning of the month.

Financing Deals Supporting April Sales

Despite the grim numbers, dealerships and experts remain optimistic about the industry during this time. One important reason for this is that although volumes declined throughout the country, dealerships managed to surpass expectations based on the impact on the Chinese auto market. During February, at the peak of coronavirus in China, Chinese automakers experienced almost an 80% drop. With less than a 50% decline, dealers in America are faring better than expected. How did the U.S. manage to avoid China’s fate? A lot of it comes down to financing and incentives.

While April sales decreased, zero-percent financing deals hit a record last month. More than one in every four new vehicles sold in April featured 0% financing, up from about 5% of new cars in March. Furthermore, lenders are offering loans for both new and used vehicles that allow borrowers to delay making payments for up to 4 months. With the Fed’s cuts putting downward pressure on interest rates, 0% financing is not as costly for dealerships as it might have been under normal conditions. A caveat to this is that some dealers are avoiding long-term 0% financing as it can be harmful to resale values and thus, risky for car buyers. Bob Carter, Executive Vice President for Sales at Toyota Motor’s North American unit said, “We’re not into zero-for-84 months. It’s not only not healthy for the industry, but also for the consumer.” Prevalence of 0% financing has certainly increased, though likely only for certain qualified buyers with good credit.

Cost Effectiveness of 0% Interest Rate Deals

With so many dealers delaying payments or offering 0% financing, we were curious to see the impact these would have on profits. To do this, we used a present value calculation with certain assumptions to see the effects of 0% financing. Basic assumptions include:

We assumed a depreciation cost associated with the vehicle sitting on the lot. Although determining a depreciation cost per day isn’t an exact science, we based this on the Sonic Automotive Earning Call, where Jeff Dyke, President of Sonic Automotive, equated sitting on inventory like a “banana rotting every day, $50, $100, $175 a day, whatever the number is, it’s rotting every day. If you’re sitting on it, you’re just creating a big bubble, and you’re going to have to pay for it at some point.” For illustrative purposes, we settled on a $100 a day depreciation cost.

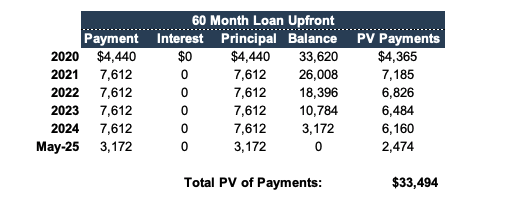

The following charts show a summary of the results from three present value calculations.

As seen above, delaying payments by two months only reduces the present value of the loan from $38,174 to $37,848, or about $325. This represents less than 1% of the value of the car, and these terms would likely appeal to furloughed consumers who expect to be rehired between the purchase and the beginning of payments.

If instead, the dealer offers 0% financing for the life of the loan, the present value of payments received drops to $33,494. That is a $4,680 difference between 0% financing and a 5.27% interest rate. While offering a 0% loan would not come from a bank, captive lending arms may find the F&I loss is worth the vehicle sale. These calculations illustrate that dealerships would be indifferent between selling a car today with 0% financing or waiting about 47 days to sell a car financed at 5.27%. Implicit in our depreciation assumption is that price concessions would likely have to be made to move the inventory. Additionally, every day a car sits on the lot costs dealerships on floorplan interest costs. It may be more comfortable for some to wait things out instead of accepting an upfront loss on F&I, but these calculations demonstrate that there are also costs to waiting, even if they are not as upfront.

May SAAR Expectations

The outlook for the industry and the economy as a whole is steadily improving.

Looking forward, expectations are high for a rebound in May. Sonic Automotive has said that the second quarter will be “the worst in our history” but believes declines due to the coronavirus pandemic bottomed out in early April, and the summer will bring a return to pre-virus levels. Lithia Motors CEO Bryan DeBoer has a similar stance, saying in their Q1 earnings call that, “I would say in vehicle sales, there’s no chance that it will trough again unless there’s a relapse or something in COVID-19 and the states get more strict because we’re already seeing relaxation of stay-at-home orders and early indications are we’re plus 10[%] week over week in new [vehicle sales]; we’re plus 30[%] week over week in used [vehicle sales].” Both Sonic and Lithia are planning on monthly announcements as to what they project their volumes to be. Market data supports this optimism, as TrueCar CEO Mike Darrow said that the raw data he has been following had been growing more positive in the last several days of April. Furthermore, JD Power released data and analysis suggest a rebound in the used car market mid-April.

As stay-at-home restrictions and the outbreak of the virus begin subsiding, it is logical to assume that there will be an uptick in vehicles sold to both meet consumer current demand, as well as handling the pent up demand that the pandemic has caused. It is important to remember the uncertainties still concerning how successful the economy will be in reopening, but fortunately, the outlook for the industry and the economy as a whole is steadily improving.

As I still sit at my desk working from home and reflecting on how I spent much more time watching shows than I did cleaning out my apartment like I had planned on during this pandemic, I am heartened to remember that although the uncertainty surrounding this time period can generate a lot of anxiety, there will be a day where we can leave our homes, hug our friends and family, and go back to living our normal lives. I hope that everyone out there is staying healthy and continues to check-in on their loved ones.

Auto Dealer Valuation Insights

Auto Dealer Valuation Insights