A Review of M&A Activity in the Downstream Oil & Gas Space

Nesting Dolls of Refinery Acquisitions

On April 30, 2018, Marathon Petroleum announced its acquisition of the newly formed Andeavor making Marathon the largest refiner in the U.S. (by capacity) and one of the top five refiners in the world. The merger is moving into its final stages, and Marathon’s CEO is positive about the combination of the two well situated companies.

In this post, we analyze the recent acquisition history of Western Refining, Tesoro, and Marathon, which has started to look somewhat like nesting dolls of acquisitions.

For an industry that has had sluggish M&A activity in the last couple years, this line of acquisitions seems to hint to a possible trend of consolidation. Domestic oil production has increased significantly over the last couple years. Even though export bans on crude oil were lifted a couple years ago, overall, there is more crude oil in the U.S. that needs to be refined. According to the EIA, U.S. refining capacity is “virtually unchanged from 2017 to 2018.” Domestic refineries are now running at average utilization figures of 90%, as compared to the IEA’s global average of 70%. Building a new refinery takes time and money and has significant regulatory hurdles; thus U.S. refiners appear to be combining in order to increase efficiencies and meet the higher demand for their services as a result of the recent increase in domestic crude oil production.

Recent Acquisition History

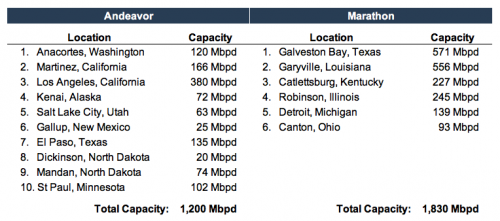

The table below shows metrics from the line of acquisitions leading up to Marathon’s acquisition of Andeavor, along with other recent transactions in the downstream space for comparison.

Western Refining’s Acquisition of Northern Tier for $1.6 Billion

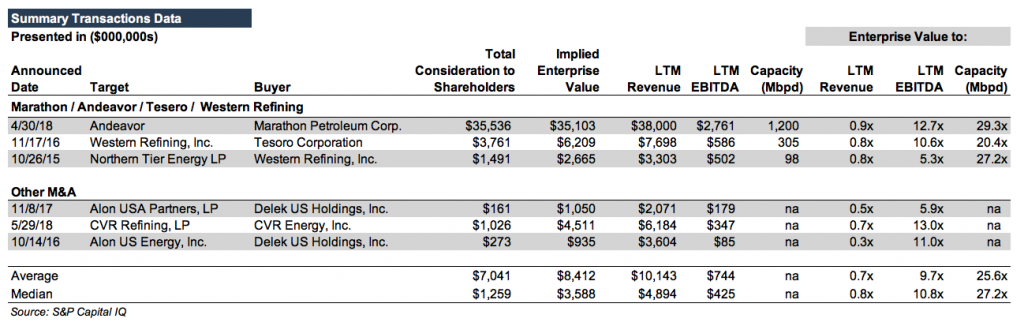

In late 2015, Western Refining bought all remaining shares of Northern Tier Refining, not already owned by Western Refining and its subsidiaries, for $1.6 billon. (Western Refining previously bought a controlling interest in Northern Tier for $775 million in 2013.) The resulting company had three refineries in Gallup, NM; St Paul, MN; and El Paso, TX.

Western Refining paid 5.3x EBITDA for the remaining minority position in Northern Tier. Some analysts such as Albert Alfonso, originally believed that the deal was undervalued. While the deal multiples were quite a bit lower than the multiples observed in the downstream space at the time, it is important to consider the premiums paid for acquisitions of control versus the price paid in this acquisition of a minority position by a company that previously paid for control. For comparison purposes, this transaction is more similar to Delek’s 2017 acquisition of the remaining shares of Alon at 5.9x EBITDA for a minority stake.

Tesoro’s Acquisition of Western Refining for $6.4 Billion

In November 2016, Western Refining and Tesoro Corporation merged to form Andeavor. Tesoro bought Western Refining for 10.6x EBITDA and 80% of revenues, which at the time was in line with the earnings multiples observed in Delek’s acquisition of shares of Alon U.S. Energy for 11.0x EBITDA. (Through this transaction, Delek gained control of the entity of which they originally owned 48%.) The newly formed Andeavor was the fourth largest independent refiner in the U.S.

Tesoro had refineries in California, Washington, Alaska, Utah, and North Dakota. The addition of Western Frontier expanded their presence by adding refining locations in Texas, New Mexico, and Minnesota.

Western Refining shareholders received either 0.4350 Tesoro shares, or $37.30 in cash per share. As compared to the previous day’s closing price of Western Refining, the shareholders received a 22.3% premium, according to a Fortune article about the transaction. In order to prevent dilution from the offering of additional shares, Tesoro announced it would increase its buyback program by $1 billion. The deal was expected to create between $350 and $425 million in synergies to be realized in the first two years of their combination.

In addition to expanded refining capacity, the combined companies had over 3,000 retail stations.

Marathon’s Acquisition of Andeavor for $23.3 Billion (Enterprise Value of $35.6 Billion)

Marathon Petroleum is expected to close on its acquisition, newly formed Andeavor for 12.7x EBITDA, which shows a slight premium to the few transactions observed in the refining space lately. Andeavor shareholders will have the option to choose 1.87 shares of MPC stock, or $152.27 in cash per share. This represents a 25% premium to the closing price the day before the transaction was announced. In order to prevent dilution from the issuance of additional MPC shares, Marathon’s Board approved $5 billion repurchase authorization.

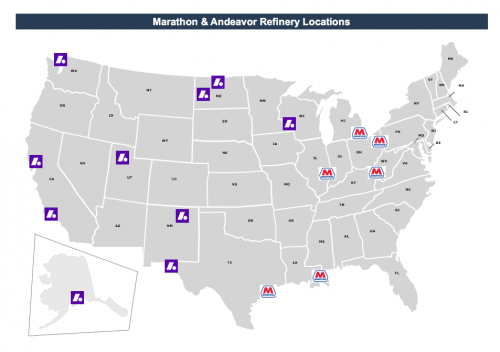

The two companies were largely located in different parts of the country as shown in the map below. Andeavor Chairman and CEO Greg Goff (who will become Executive Vice Chairman at MPC) explained,

“Look at the map of the two companies and the way they are positioned geographically in the United States and you come to the conclusion that this is a great opportunity to be able to bring the companies together.”

The map below shows the locations of both Marathon and Andeavor’s refineries.

Marathon had six refineries in the eastern half of the U.S. and Andeavor had 10 refineries in the western U.S. and Alaska. The combined company will have approximately 15% of total fuel making ability in the U.S.

Additionally, the combined companies have over 7,800 branded fuel stations.

Immediately Accretive Deal

Accretive deals add more value than they cost, either over time or immediately. The Marathon and Andeavor deal is expected to be immediately accretive to earnings per share; meaning the price paid by Marathon is lower than the immediate expected boost in earnings per share post-acquisition.

The deal is expected to create significant synergies resulting in around $1 billion over the first three years. These synergies will come as a result of stronger purchasing power, system optimizations, procurement efficiencies, leveraging of assets, and retail network efficiencies. Additionally, according to Marathon’s Chairman and CEO, Gary Heminger, thinks that the potential synergies could be even greater than the estimated $1 billion. However, that remains to be seen. Many analysts are sometimes skeptical of synergies due to their somewhat abstract nature.

Did Marathon Pay Too Much?

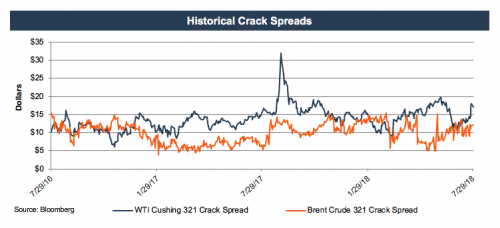

Marathon’s acquisition of Andeavor comes at a time when U.S. refineries are positioned to benefit from the increase in domestic production of oil and gas. Many refineries that purchase WTI crude are currently benefitting from the discount of WTI to Brent, which has lowered their costs of sales as refined product prices are still increasing. Refineries margins have increased 8% worldwide and almost 25% in the U.S. Midwest year over year according to British Petroleum’s Refiner Marker Margins and crack spreads have increased as shown in the graph below.

Management of both companies seem positive regarding the deal and there seems to be little reason to believe that the deal would face any resistance from regulators as there was is little overlap in the locations of the refiners. However, investors of MPC could ask if MPC paid too much?

Stock buybacks are generally a signal to investors that the Company views its own stock as a good investment. Additionally, management will generally not buy back shares if they think the stock is currently overpriced. Marathon’s announcement of a buyback should somewhat ease investors’ concerns.

Conclusion

It is hard to pinpoint the root cause of the recent consolidation activity in the downstream oil and gas space. The pressure of RIN expenses on smaller refineries that do not have the capacity to blend their renewable fuels could be one cause of consolidation. The immediate need for more operating capacity as U.S. oil production has increased might be pressuring larger refiners to purchase rather than build additional capacity. Additionally, the recent tumult of the global trade environment adds an additional layer of uncertainty for U.S. refineries whose main export market is Mexico.

In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results.

Whether you are selling your business, acquiring another business or division, or have needs related to mergers, valuations, fairness opinions, and other transaction advisory needs, we can help. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights