Parsley’s Acquisition of Jagged Peak Highlights Key Consolidation Trends

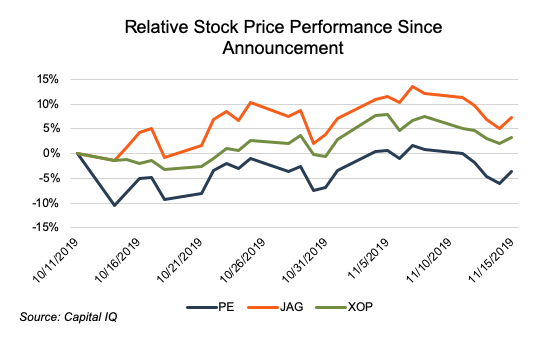

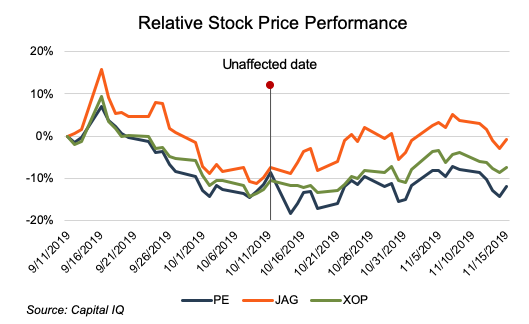

On October 14, 2019, Parsley (PE) announced that it was acquiring Jagged Peak (JAG) in an all-stock transaction valued at $2.27 billion. The market’s reaction to the announcement was generally negative, as Parsley closed down more than 10% on the date of the announcement. This appears to be driven, at least in part, by investors’ desire for Parsley to be acquired rather than be the acquirer.

Despite the negative market reaction, we believe this transaction is emblematic of key trends we expect to see during the next wave of consolidation.

All-Stock Transaction

Jagged Peak shareholders will receive 0.447 shares of Parsley stock per JAG share. Legacy Parsley shareholders will own 77% of the combined company, while legacy Jagged Peak shareholders will own 23% of the combined company.

With equity capital markets largely closed to E&P companies and investor concerns regarding leverage, we don’t expect to see any cash/debt-financed acquisitions in the near future. The exception might be a transaction by a supermajor as Exxon and Chevron reported cash balances of $5.4 billion and $11.7 billion, respectively, at the end of September.

Low- or No-Premium Acquisition

Consideration to Jagged Peak shareholders represented an 11.2% premium relative to JAG’s preceding closing price. However, given JAG’s recent stock price decline, the implied price was only a 1.5% premium to JAG’s 30-day VWAP.

Investors are increasingly focused on metrics like return on capital employed and cash flow per share accretion/dilution. As an acquisition premium increases, these metrics worsen.

After Callon announced its acquisition of Carrizo for 2.05 CPE shares per CRZO share, implying a 25% premium based on closing prices before the announcement (though the press release cited the lower 18% premium based on Carrizo’s 60-day VWAP), Callon faced intense investor pushback, especially by hedge fund manager John Paulson. Last week, Callon and Carrizo announced revised deal terms in which Carrizo shareholders will receive only 1.75 CPE shares per CRZO share, resulting in a more modest 11% premium based on prevailing prices. However, the press release again cited a lower premium, this time of 7% based on pricing just before the original transaction announcement in July.

Low- or no-premium acquisitions are more palatable to sellers in all-stock transactions as they have the potential to realize the transaction’s synergistic benefits over time given their continued ownership interest in the combined entity. With an all-cash acquisition, benefits to the sellers can only be realized from the purchase price, so meaningful take-over premiums are typically necessary.

Corporate, Rather than Asset, Transaction

A&D activity recently has been modest, with wide bid/ask spreads separating buyers and sellers. However, with corporate transactions, public stock prices help align buyers and sellers on value. Also, the inherent G&A expense associated with a corporation gives the buyer an obvious target for synergies.

Focus on Concrete Cost Synergies Rather than Nebulous Strategic Rationale

In the acquisition presentation, the “Synergy Scorecard” slide (page 10) clearly emphasizes the G&A and operational synergies that Parsley expects to realize from the acquisition. While the strategic benefits are also highlighted (and take up most of the real estate on the page), it is clear that these take a backseat to the tangible cost reductions.

Conclusion

Parsley’s acquisition of Jagged Peak largely follows the playbook we expect to see in upcoming M&A announcements. Despite the expected cost synergies and strategic benefits, shareholders reacted negatively to the news. Even with the addition of Jagged Peak, Parsley’s status as the fourth largest operator in the Permian (based on rig count) would remain unchanged. This will likely cause management teams to re-evaluate their thoughts on optimal size and scale as they survey the acquisition landscape.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights