A Guide to Corporate Finance Fundamentals

Part 3 | Finance Basics: Capital Budgeting

This post is the third of four installments from our Corporate Finance in 30 Minutes whitepaper. In this series of posts, we walk through the three key decisions of capital structure, capital budgeting, and dividend policy to assist family business directors and shareholders without a finance background to make relevant and meaningful contributions to the most consequential financial decisions all companies must make.

Three Questions

Corporate finance is the search for rational answers to three fundamental questions.

- The Capital Structure Question: What is the most efficient mix of capital? In other words, is there such a thing as too little or too much debt?

- The Capital Budgeting Question: What capital projects merit investment? In other words, given the expectations of those providing capital to the business, how should potential capital projects be evaluated and selected?

- The Distribution Policy Question: What mix of returns do shareholders desire? In other words, do shareholders prefer current income or capital appreciation? Do these shareholder preferences “fit” the company’s strategic position? Can these shareholder preferences be accommodated within the existing capital structure?

These three questions do not stand alone, but the answer to each one influences the answers to the others.

Question #2: Capital Budgeting

Extending the image of the company as a portfolio of capital projects, senior management’s role can be conceived of as managing investments on behalf of the shareholders, allocating available capital to selected projects.

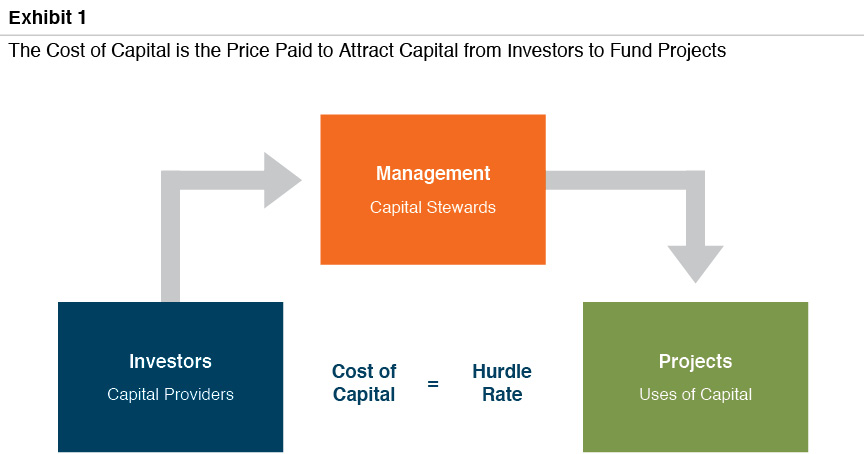

As depicted in Exhibit 1, management discharges its stewardship role by selecting capital projects for which the expected return equals (or, ideally, exceeds) the cost of capital. On this view, management acts as an intermediary, matching investors with capital projects. There is a symbiotic relationship between the returns required by investors and the riskiness of the capital projects identified by management. Viewed from one side, management that has the responsibility of stewarding high- cost capital will rationally seek out risky projects with corresponding high returns. Viewed from the other side, a portfolio of risky, high-return projects will attract risk-seeking capital. This relationship underscores the importance of management and directors communicating realistic and transparent expectations to capital providers. For public companies, this occurs through quarterly earnings calls and SEC filings; for private companies, it is no less important, but is often ignored since the regulatory mandate is absent.

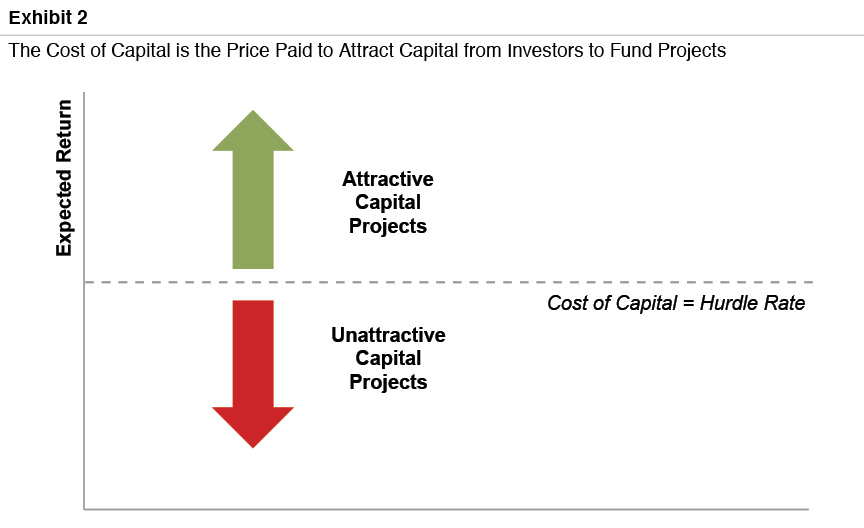

While specific techniques of capital budgeting are beyond the scope of our discussion, the goal of the capital budgeting process is to identify potential capital projects and evaluate whether the expected return from such projects meets or exceeds the hurdle rate.

When reviewing the results of a capital budgeting process, directors and shareholders should acknowledge the tension, or conflict, that may naturally emerge between management and shareholders. Recall that, from the perspective of shareholders, systematic risk (the contribution of a given project to the overall risk of a diversified portfolio) is more relevant than absolute risk (the dispersion of potential outcomes on a standalone basis). Careers are not readily diversifiable, however; as a result, it may be natural for managers to evaluate a project from the perspective of absolute risk. In a private company, shareholder portfolio diversification may be limited, so the absolute risk perspective may well accord with the shareholders’ risk preferences. In any event, directors and shareholders need to be aware of the different risk perspectives and be able to reconcile them.

Topics for Board Discussion

Detailed capital budgeting is the responsibility of management; for significant projects, the board should evaluate management’s analysis and recommendations.

- What are the relevant cash inflows and outflows? The relevant cash flows for capital budgeting are those at the margin – what revenues will the company earn and costs will the company incur upon completion of this project that would not be earned/incurred in the absence of this project? For example, fixed operating costs that will be incurred whether or not the project is undertaken are not relevant to the capital budgeting decision.

- How are available capital projects ranked? Available capital for investment is always constrained at some level. Beyond a simple thumbs-up/thumbs-down evaluation of individual projects, how has management prioritized the available opportunities?

- What non-financial constraints does the company face? In addition to limited financial resources, companies have limited managerial, human capital, and other resources. Will undertaking the proposed capital project violate any of the non-financial constraints? If so, do the relevant cash flows include the financial cost of dealing with such constraints?

- What is the strategic rationale for the proposed project? With the “right” inputs, a capital budgeting spreadsheet can always generate a positive net present value. Going beyond the mere numbers, does management have a compelling strategic narrative for why the project “fits”? Is the project an extension of the company’s current strategy, or does it supplement or reverse the strategy in some way? How does the project contribute to efforts to differentiate the company from competitors?

- What returns have prior projects earned? In a strict sense, historical results are not relevant to the capital budgeting decision. However, a program for monitoring actual performance relative to projections on prior projects is a key element of a sustainable capital investment process, highlighting potential “blind spots” or biases with regard to the projected financial results for the project under consideration. Capital projects that increase the size of the company may be attractive to management without being beneficial to shareholders. A process of calculating realized returns on projects can help ward off capital project bloat.

WHITEPAPER

Family Business Director

Family Business Director