Family-Owned Real Estate in the Aftermath of COVID-19

For many enterprising families, owning real estate is a cornerstone of family wealth.

Here is a story that is common to many families:

Once upon a time, the family business had grown to the point that it needed a new facility from which to operate. Rather than leasing the needed real estate, the first-generation shareholders cobbled together a down payment and took out a mortgage for the rest to buy the property.

The owners then leased the property to the family business. The rent payments received from the family business were sufficient to service the mortgage debt and maintain the property.

Decades passed, and steady capital appreciation in the real estate along with the debt retirement funded by rental payments from the family business resulted in the owners owning an attractive parcel of commercial real estate with no debt.

Rinsing and repeating as necessary over the life of the family business, the value of the accumulated real estate portfolio became a significant portion of the family’s total wealth. Once the real estate holding was sufficiently deleveraged, the family elected to reinvest cash flow from the real estate portfolio in yet more real estate.

Accumulating real estate seems to be a natural strategy for many family business owners. After all, real estate is generally assumed to be less risky than the operating business of the family. Further, so long as the real estate has a reasonable range of alternative future uses, the returns to the real estate portfolio often have a low correlation to the returns from the operating business.

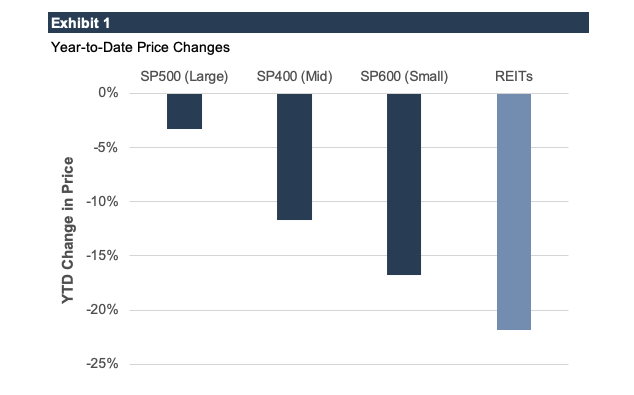

If the observable returns on publicly traded real estate investment trusts (REITs) are any indication, the current coronavirus-induced economic downturn may put those beliefs to the test. While, through the end of mid-June, broader market indices have regained much of the value lost during late February and March, REIT shares have lagged, as shown in Exhibit 1.

To the extent public market behavior is a guide to broader valuation trends for family businesses, the data presented in Exhibit 1 suggests that – rather than providing stability to family wealth – real estate holdings may have actually contributed to overall volatility. We were intrigued by this, so we decided to take a closer look at the data.

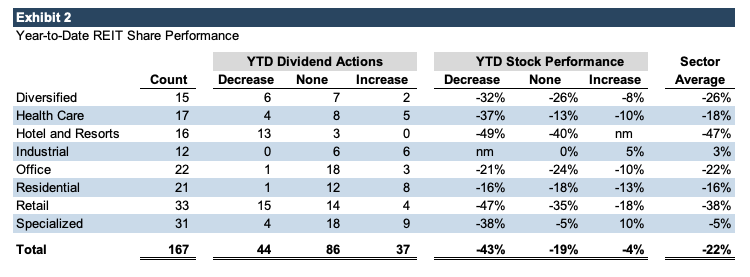

As summarized in Exhibit 2, we examined share price data for the 167 REITs in the Russell 3000 index for which comprehensive data was available through Capital IQ.

- The overall average price change was -22% over the period. Receipt of distributions during the first five months of the year would enhance the total return for most REITs by about 2%, give or take.

- Performance was driven by property type. Unsurprisingly, hospitality and retail REITs underperformed, falling 47% and 38%, respectively, while industrial REITs led the way with an average price increase of 3%.

- Apart from the hospitality and retail sectors, REITs announcing dividend increases outnumbered those instituting cuts by a nearly 2-to-1 margin (33 increases to 16 decreases). On a combined basis, the hospitality and retail sectors saw 28 dividend reductions, compared to just 4 increases. Of those announcing dividend cuts, over half (19) were REITs that totally suspended dividends.

- REIT share prices are closely tied to dividend expectations. As shown in Exhibit 2, the average price change for the 44 REITs cutting dividends was -43%, compared to -19% for those with no announced changes and -4% for the 37 REITs which increased dividends.

Takeaways

What should family business leaders think about with respect to their current (and future) real estate holdings considering the performance we have reviewed in this post?

- The pandemic may have fundamentally changed the demand for real estate in our economy. Consider the office sector: even though only one REIT announced a dividend cut, the share price for the average office REIT fell 24% from the end of 2019. This occurred despite a decrease in interest rates, as the 10-year treasury yield fell from 1.92% to 0.75% over the same period. This suggests that the market is concerned about longer-term trends in demand for space and lease rates following a lengthy mandatory “work from home” experiment. In contrast, the (relatively) strong performance of industrial REITs suggest that the market may perceive a future trend toward more domestic manufacturing, as well as the increased need for warehouse space to meet the fulfillment demands of web-based retail.

- Correlations between real estate and the performance of your operating business may be higher than previously assumed. For example, the move toward on-line shopping has been such a pervasive trend that owning a portfolio of commercial real estate zoned for retail is probably not much of a hedge for struggling family businesses in the retail space. For families contemplating additional real estate investments, it may be worthwhile to balance the temptation to “invest in what you know” against opportunities to better diversify the family balance sheet by looking outside your industry for real estate investments. For example, a family in the manufacturing business may look to reinvest cash flow in health care or residential properties rather than taking on more exposure to the industrial economy.

- Perhaps even more than politics, all real estate is local. We have not attempted to discern any geographic trends in the data we analyzed for this post. Family business leaders should carefully evaluate the local market dynamics that are influencing the value of real estate portfolios.

- For families with real estate held outside the family business, this may be a fortuitous time for estate planning strategies involving real estate holdings. Consult your tax advisor to see if real estate transfers could make sense for you.

- How do rents paid by the family business compare to the current market? If there are significant differences from market rents, that can introduce distortions among family members that own differing proportions of the family business and the family’s real estate holdings.

- Finally, it may be a good time to evaluate your overall real estate strategy. Do you have one? What economic role does real estate play in your family’s overall balance sheet? What role should it play? More broadly, what does your family business “mean” to your family? Is there alignment among your family shareholders regarding that meaning? How well do your family’s real estate holdings align with that meaning?

Of course, markets move every day, and the market signals regarding commercial real estate may be quite different a month or a year from now. We are not recommending knee-jerk reactions, but we do think real estate strategy would be a worthwhile addition to your next board meeting agenda.

Family Business Director

Family Business Director