Opportunity Times Two?

Estate Planning Opportunities Abound as a Result of Low Valuations and Low Interest Rates

If a window of opportunity appears, don’t pull down the shade.

– Management guru Tom Peters

As family business leaders tackle the many operating challenges thrust upon them by the COVID-19 pandemic, it is tempting to let tasks like estate planning fall to the bottom of the to-do list. While estate planning may appear to be less pressing than other issues, the positive impact of effective planning on the long-term health of both the family and the family business is hard to overstate. If you are confident in the long-term resilience of your family business, you should not miss the current opportunity for tax-efficient estate planning activity.

We’ve discussed the impact of coronavirus on fair market value in a recent post. While the S&P 600 small cap index has gained a bit over 20% since we wrote that post, the index remains nearly 30% below its February peak. So valuations for many family businesses remain favorable for tax-efficient planning.

Normally, stock prices and interest rates are inversely related. In other words, lower stock prices are often correlated with higher interest rates. However, thus far in 2020, we have witnessed both lower stock prices and lower interest rates. As described in a recent article from law firm Baker Hostetler, low interest rates further increase the efficiency of estate planning techniques such as intra-family loans, sales to grantor trusts, grantor retained annuity trusts, and charitable lead annuity trusts.

The IRS publishes monthly tables identifying what is known as the applicable federal rate, or AFR. The AFR is significant for estate planning because it established the threshold interest rate for private loans. Exhibit 2 summarizes monthly AFR rates in 2020.

Mid-term AFR rates (applicable to loans with terms up to nine years) have fallen from 1.75% in February to 0.58% in May. A quick example will illustrate the “double opportunity” for family shareholders provided by lower valuations and lower interest rates.

First, assume that a family shareholder sells shares having a fair market value of $10 million to a family member in exchange for an eight-year note at the AFR rate of 1.75%. The expected total return on the shares at that date was 8.0%. Exhibit 3 presents the net shares transferred to the family member over the life of the note, assuming that shares are used to repay the note.

Since the appreciation on the family business shares exceed the AFR, the borrower is able to service the debt and repay the note at the end of the term using only a portion of the shares owned, retaining approximately $6.6 million worth of shares in the family business.

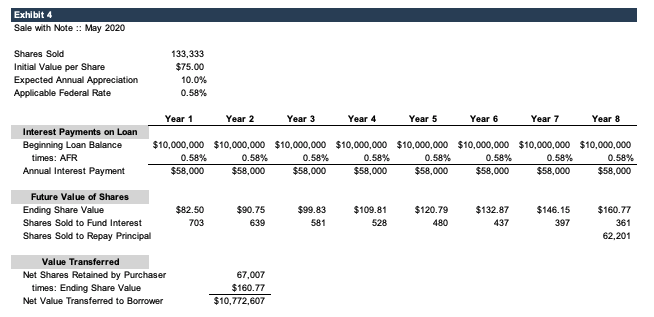

Exhibit 4 assumes that a similar transaction is undertaken in May 2020, with three differences:

- Because the share value is lower ($75 per share, compared to $100 per share in Exhibit 3), the acquirer is able to purchase a greater number of shares for the same $10.0 million price (133,333 shares, compared to 100,000 shares in Exhibit 3).

- Since the family business is assumed to be resilient, the current lower share price is expected produce higher future capital appreciation (10%, versus 8% in Exhibit 3). Under this assumption, the terminal share value in Exhibit 4 ($160.77) remains approximately 13% less than the corresponding value in Exhibit 3 ($185.09). Expected annual appreciation of 12% would result in equivalent terminal share values.

- The lower AFR reduces annual interest expense on the note by $117,000, which reduces the drag on returns from the family business shares.

The hypothetical May transfer results in an additional $4.1 million of value transferred relative to the hypothetical February transfer. Approximately 68% of this increase is attributable to the lower share value (and correspondingly higher expected returns), with the balance attributable to the reduction in the AFR.

Conclusion

We are not tax advisors, and the simple example in this post is intended only to illustrate the relative contribution of lower share values and lower interest rates on potential estate planning outcomes. Consult your tax planning professionals today to discuss how best to take advantage of the “double opportunity” presented by depressed share prices and low interest rates. Many strategies will require a current valuation of your family business, and our professionals are here to help.

For those families that are confident in the ability of their family business to survive and thrive in a post-COVID 19 world, the window of opportunity is clearly open. Don’t pull the shade.

Family Business Director

Family Business Director