In an age of rapid technological change, the traditional corporate R&D process just won’t cut it. Bureaucracy and slow decision making are impediments to a company’s ability to innovate and the speed of execution. As younger companies like Tesla are surpassing incumbents in their industries, the established players need to change to keep up.

Rather than trying to make a corporate R&D department into something it’s not, corporations are finding additional ways to bring innovation into their established business models – by making venture investments. For larger corporations, corporate venture capital can be a way to outsource some of their research and development efforts in new and unproven technologies without assuming all of the costs and risks.

Corporate venture capital (CVC) is on the rise; the global number of active CVCs tripled between 2011 and 2016, according to Forbes. Accordingly, activity has also been robust: the number of corporate VC-backed deals in the U.S. rose from 545 in 2010 to 1,268 in 2015, according to Pitchbook. CVC-backed deals have totaled over $30 billion in both 2015 and 2016. However, this high level of corporate venture investing in the past three years came as startup funding had already peaked. Now, as traditional venture capital firms are starting to slow down their funding, CVCs appear to be dialing back as well.

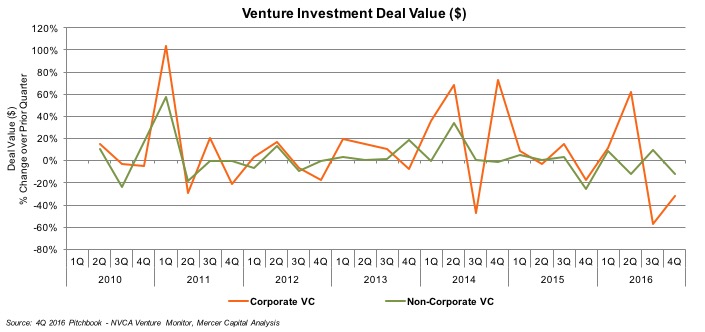

From 2010 to 2013, corporate venture capital investing represented less than one-third of all investment activity on average. However, as investors began pouring money into high-value startups, CVC activity ramped up faster. CVC-backed financing rose to 40% of all investment activity in 2Q14 and 58% in 2Q16. From 2010 to 2016, corporate venture capital investing was more volatile than VC financing overall. When non-CVC financing activity rose 17% on average in the first two quarters of 2014, CVC financing rose 52% on average for the quarters. When traditional VC financing began stagnating in 2016, corporate venture capital followed. CVC-backed financing fell 57% and then 32% in 3Q16 and 4Q16, respectively.

With the rapid rise of corporate venture capital and increasing pressure to jump on board with startups, it seems that many companies across the industry spectrum are making venture investments. As the rest of the year unfolds, we will be interested to see how corporate interest in venture investing persists. Will increased corporate participation increase the availability of funding and support for even more startups or will it simply drive prices higher for a select few?

Related Links:

- How to Value Venture Capital Portfolio Investments

- Updated: Valuation Best Practices for Venture Capital and Private Equity Funds

- Non-Traditional Venture Investors are Changing The Rules Of The Game

- Marking Illiquid Investments in Liquid Funds

- Interview: A Few Thoughts on Valuing Investments in Startups

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.