Last week, Lands’ End, Inc. (NASDAQ: LE) announced that it would write down the value of its flagship trade name asset (Lands’ End). Management’s preliminary guidance is for a charge of $90 million to $110 million, which could lower the asset’s value by 20% from $528 million to $418 million. Obviously, a non-cash impairment charge is just that, non-cash, but what does it mean for stakeholders and how is such a charge actually determined?

Lands’ End was purchased by Sears Holdings Corp. in 2002 for approximately $1.9 billion. Despite its plans to use Lands’ End to bolster its online presence and attract more customers to its stores, Sears struggled to execute its strategy. The Company unsuccessfully attempted to sell the Lands’ End business to a private equity buyer in 2012 and finally elected to spin off the business to existing shareholders as a separate publicly-traded company in April 2014.

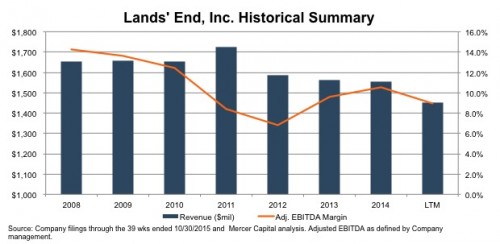

As shown below, total revenue has trended downward in recent years, including a decline of nearly 10% in the year-to-date period ended October 30, 2015. The company’s fiscal year end follows a retail convention, ending on the Friday preceding the Saturday closest to January 31 each year. Management attributed the decline in revenue to multiple factors, including a decrease in catalog circulation, lower customer acceptance in a challenging retail environment, and a decline in same-store walk-in sales. Adjusted EBITDA margin for the company dipped from 10.6% of revenue in 2014 to 8.9% in the most recent twelve months.

In its last quarterly filing (for the period ending October 30, 2015), management acknowledged that a continued decline in revenues could negatively impact future revenue forecasts and might lead to potential impairment charges. It appears that this is exactly what happened.

The Lands’ End trade name is classified as an indefinite-lived intangible asset with a carrying value of $528 million. The company’s financial statements note that management uses the income approach, specifically the relief-from-royalty method, when testing the asset for potential impairment. The relief-from-royalty method seeks to measure the incremental net profitability generated by the owner of the subject intangible asset through the avoidance of royalty payments that would otherwise be required to enjoy the benefits of ownership of this asset. The primary inputs in the relief-from-royalty method are (1) the appropriate royalty rate to apply to the expected revenue stream, (2) the projected revenue stream itself, and (3) the appropriate discount rate used to measure the present value of the avoided royalty payments.

In the case of Lands’ End, it is likely that the principal driver behind the impairment charge is a lower revenue forecast. Despite revenue fluctuations in the past, the company was not required to recognize an impairment charge in prior periods. In fact, the most recent 10-K filing noted that that fair value of the trade name exceeded its carrying value by 12%, which implies a fair value on the order of $591 million. At the current date, however, it may also be that the discount rate used to calculate the present value of the cash flows has increased. Through the end of January 2016, the company’s stock price had declined by roughly 37% over the previous twelve months. Valuation is a function of cash flow, growth, and risk – and the risk part of that equation may have increased in light of a weakened competitive position.

What does such a charge portend for stakeholders? Academic studies frequently suggest that impairment charges (be they for goodwill or other intangible assets) are often already incorporated by investors into the stock price. Given the pressure on the Lands’ End stock price over the last year, that may be the case here. One interesting note in this situation however, is that the trade name is the name and identity of the Company itself, not just the name of a product line or logo. In fact, the $528 million carrying value of the Lands’ End name is nearly equal to the current equity market capitalization of the company (approximately $697 million as of the date of this writing) and almost half of the firm’s total invested capital (including $502 million in interest bearing debt). It remains to be seen what charge the company will ultimately record and what steps management will take to turn the situation around.

Mercer Capital has deep experience valuing tradenames and other forms of intellectual property for a variety of purposes. Contact a Mercer Capital professional today to discuss your valuation needs in confidence.

Related Links

- What’s in a Name: Valuing Trademarks and Trade Names

- A Game of Names: Licensing and Tradename Valuation

- Getting Brand Intangibles Right

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.