Economic troubles in a faraway land and an agitating stock market closer to home appear to have precipitated a gloomier outlook for the funding prospects of young companies (technology startups). Whether or not the mood persists in the coming months, these times remind us that potential future states of the world include scenarios with less-than-spectacular results. Time, then, to spend a few minutes thinking about a choice that purports to deliver substantial tax savings to startup employees.(1)

An IRC Section 83(b) election allows an employee receiving equity compensation in the form of restricted stock to pay income taxes based on the fair market value of the award at the grant date. Increases in stock prices subsequent to the grant date are taxed at capital gains rates. If such an election is not made, the fair market value of the award is taxable at the higher ordinary income rates when and if the restricted shares vest. Critically, taxes paid pursuant to an 83(b) election will not be refundable in the future even if (a portion of) the awards do not vest, or if the shares turn out to be worthless.

It is easy to see how employees receiving restricted shares and making a Section 83(b) election can benefit if the price of the stock rises between the grant and vesting dates. An 83(b) election may appear especially appealing to (early stage) startup employees who tend to be (preter) naturally optimistic about the prospects of their employer companies. However, the benefits of a Section 83(b) election – especially after consideration of the risks involved – may be less significant than originally anticipated. Three conditions (often outside the control of the employees) must be met for an 83(b) election to provide a (risk-adjusted) advantage:

- Securities awarded as compensation have relatively low values at the time of grant.

- The exit event for the employer company, or other transactions that may provide liquidity to the employees, occurs at relatively high implied valuations.

- Employees remain employed at the granting company until the awards vest.

This blog post will primarily address the first condition.

An Example

A common misconception is that shares awarded as compensation have minimal (if any) value at the grant date and thus, the underlying stock price has nowhere to go but up. In our experience, employees too often make the 83(b) election under the assumption that the fair market value of the stock is at or near $0 per share at the grant date. A fictitious example can perhaps illustrate why this may be a faulty assumption in the face of a contemporaneous funding round (or transactions involving common shares or other securities of the company).

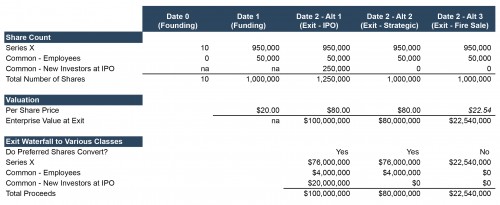

A couple of entrepreneurs found Company A at Date 0, and proceed to introduce a disruptive technology and begin to achieve some market traction. At a subsequent Date 1, Company A raises $19 million in equity by issuing 950,000 Series X Preferred shares at $20 per share. A VC firm and the founders participate in the Series X Round. Concurrently, Company A also issues 50,000 Common shares as equity compensation to its employees in the form of restricted shares.

The Series X Preferred shares have the following rights and downside protections:

- Liquidation preferences equal to 1.2x invested capital ($22.8 million). The liquidation preference would not be available in the case of an IPO exit.

- Conversion rights to exchange the Series X Preferred for Common shares at $20 per share.

Assume that the investment decision at Date 1 was predicated on three exit scenarios for Company A at Date 2, four years after the funding.

- An IPO to sell (new) 250,000 Common shares at $80 per share. Series X Preferred shares convert to Common immediately preceding the IPO. Based on the IPO price, the aggregate value of the Series X shares is $76 million, while the employees’ stock will be worth $4 million.

- A strategic sale of Company A for $80 million. Again, Series X Preferred shares convert to Common and collect $76 million. Common shareholders (employees) receive the balance (or $4 million) of the exit proceeds.

- A fire sale of the Company for $22.5 million, such that the entirety of the proceeds is used to satisfy the liquidation preferences of the Series X Preferred shares. The common shareholders (employees) receive nothing.

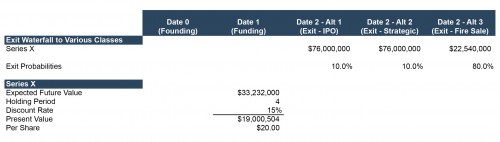

Let us further assume that a rate of return (discount rate) of 15% is consistent with Series X investor expectations. Given the holding period of 4 years, assigned probabilities of 10% for the IPO exit, 10% for the strategic sale, and 80% for the fire sale scenario reconcile to the Series X Preferred price at Date 1 ($20 per share). (2)

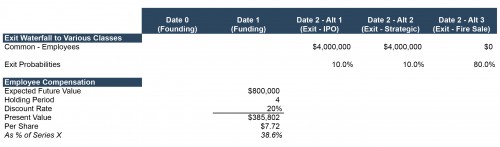

The foregoing outlines a barebones framework around the investment decision. The assumptions used within this framework are almost sufficient to derive an implied price for the Common shares granted as employee compensation. In light of the rate of return for the Series X investors, let us assume that a reasonable discount rate for the common shares is 20%. The same framework we used to examine the Series X investment price implies a price of $7.72 per Common share (or approximately 39% of the price of Series X Preferred per share). (3)

What is Reasonable?

We stress that 39% is only an illustrative figure, which is the result of the simple assumptions we make regarding capital structure and exit prospects of a fictitious company. The objective of the example is to simply illustrate that given expectations of potentially successful exits for the company, it is reasonable to conclude a value of greater than $0 per Common share.

Actual values of Common shares relative to Preferred will vary based on the length of the expected holding period, exit scenarios (price and likelihood), rights and protections accorded to the Preferred, potential dilution from future funding rounds, appropriate discount rates, DLOMs, and other factors. To simplify considerably, the values of the various securities in the capital stack represent a zero-sum carve-out of the enterprise value. Accordingly, more rights and protections accorded to the Preferred shares results in a relatively lower value conclusion for the Common shares. For instance, all else equal, if the Series X Preferred in our example also had participation rights (no cap), the value of the Common would decrease to $6.62 per share before the application of DLOM. Assuming a 20% DLOM would suggest a value of $5.29 per share (or approximately 26% of the price per Series X Preferred share).

As the foregoing example shows, economic logic suggests that it may be unreasonable to expect shares awarded as compensation to have minimal value at the grant date, especially if there are contemporaneous funding or transaction activities. Valuation best practices codified in the AICPA Accounting & Valuation Guide Valuation of Privately-Held-Company Equity Securities Issued as Compensation confirm the necessity of using a valuation approach that recognizes the value accruing to common shares attributable to the right to participate in successful exits. As a result, potential appreciation of the shares between the grant and vest dates may be more limited than is commonly believed.

Other Conditions

The second condition necessary for a Section 83(b) election to be beneficial to employees concerns the exit price commanded by the employer company (or, the Common shares if secondary avenues to liquidity are available). This condition relates to the risk inherent in making an 83(b) election for employees of early-stage companies. The exit potential of an employer company may depend on many more factors than just the effort put forth by the employees (not a comprehensive list):

- Technical viability of the product or service the company is pursuing.

- Market acceptance of the product or service.

- Competitive forces.

- Prudent management.

- Market perception of the industry within which the company operates.

- Prospects of the broader (even global) economy.

- Relative over-valuation in prior funding rounds.

Finally, the third condition necessary for a Section 83(b) election to be beneficial to employees relates to the likelihood of continued employment at the granting company. While any number of circumstances could lead to early termination of employment at the company that grants stock compensation, an 83(b) election usually represents a wrong-way bet on the part of the employees. Early termination from a job (for whatever reason) results in a double economic hit – 1) forfeiture of unvested shares, and 2) inability to recoup taxes already paid taxes for unvested shares. All this at a time when the employee could probably least afford economic hits in the first place.

Conclusion

To summarize:

- It is not reasonable to assume that Common shares in early stage (or late stage, for that matter) companies are near-worthless. Following best practices (and economic logic), even out-of-the-money equity awards will have value in accord with the holder’s right to participate in future successful exists, should they occur.

- If prospects of the employer company sour after an 83(b) election, employees will have already paid (certain) taxes based on a higher value for a security that is now less valuable than at the grant date (and vesting may yet be uncertain).

Nothing in this blog post is intended to be legal or tax advice, but we hope all employees facing the prospect of a Section 83(b) election will make well-considered choices.

- We are not tax experts. Those interested in specific guidance for tax or legal matters should seek competent professional advice.

- {10%, 10%, 80%} is just one of many possible assumption sets that reconciles to $20 per Series X Preferred share.

- The price of $7.72 per share is before the application of any discount for lack of marketability (DLOM), which is almost always a valid consideration for Common shares. For example, if the appropriate DLOM were 20%, the conclusion of value would be $6.17 per Common share (or approximately 31% of the price per Series X Preferred share). We will address DLOMs within the context of valuing various securities that make up the capital stack of young companies in a future blog post.

Related Links

- Consequences of Calcified Cap Charts: A Few Thoughts on Startup Equity-Based Compensation

- How to Value Venture Capital Portfolio Investments

- Equity-Based Compensation: Tax Considerations

Mercer Capital’s Financial Reporting Blog

Mercer Capital monitors the latest financial reporting news relevant to CFOs and financial managers. The Financial Reporting Blog is updated weekly. Follow us on Twitter at @MercerFairValue.