BlackRock Sees Opportunity in Challenging Environment for Asset Managers

A Whole New World

BlackRock’s Aladdin® platform (a proprietary operating system offering sophisticated risk analytics and portfolio management to investment managers around the globe) saw 13% year-over-year revenue growth on rising demand for risk management products and software. Image Credit: Disney

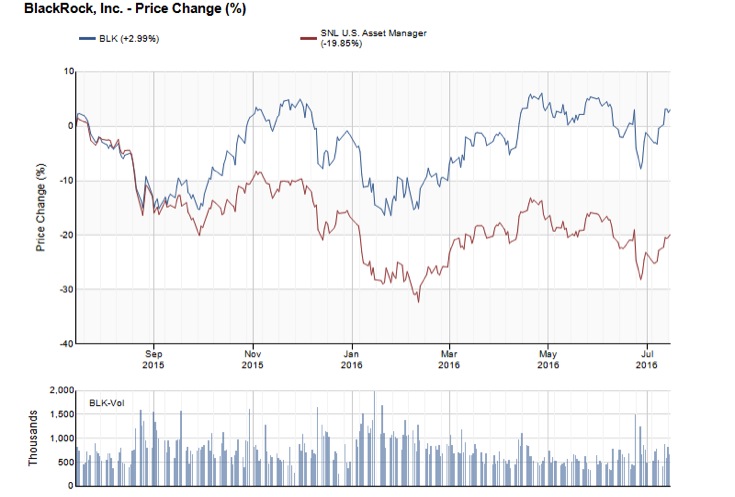

Often branded as an industry bellwether for its size and breadth of services, BlackRock (ticker: BLK) has been as solid as the name would imply given the recent fallout in asset manager valuations. In last week’s earnings call, CEO Larry Fink attributes the company’s recent success to “the differentiating platform we have built at BlackRock over the past 28 years…, the diversity of our product offerings, the risk capabilities of Aladdin, [and] the market insights offered by the BlackRock Investment Institute.”

Specifically, BLK benefited from $126 billion in net inflows over the last year as many RIAs have leaked client assets to passive funds and robo-advisors. BlackRock is clearly gaining market share within the industry and currently manages $4.9 trillion in client assets. This scale has allowed it to make the necessary investments in technology and talent to continue the upward growth trajectory in a sideways market. In addition, BlackRock has also recently invested in ETF businesses to take advantage of the rising popularity of indexing strategies. In essence, BlackRock has used its size (and balance sheet) to evolve with the industry and gain market share in the process.

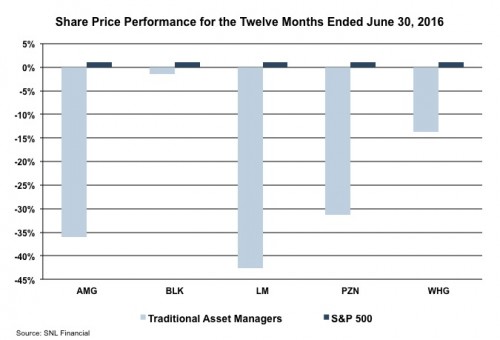

Still, the last twelve months have been anything but a magic carpet ride for most industry participants. A low yield environment dominated by ETFs and passive products has not been conducive to many RIAs, especially active managers like Pzena and Legg Mason, which are down 31% and 43%, respectively, over the six months ended June 30, 2016.

As we discussed last week, investors are growing increasingly intolerant of the high fee/low performance combination, so both traditional and alternate asset managers are feeling the heat. Mounting regulatory pressures are additional headwinds as the Financial Stability Oversight Council is currently reviewing six areas of the asset management business for potential enhancements to regulatory oversight – liquidity and redemption, leverage, securities lending, data and disclosure, operational risk of service provider concentrations, and resolvability and transition planning. The SEC is also assessing the sector’s systemic risk exposure and should finalize three proposals on mutual fund and ETF regulation at some point this quarter.

While the current trend toward passive investing hasn’t shown any signs of strain, we don’t foresee active management ever going away for good. In fact, best-in-class stock and bond pickers should build market share as enterprising investors seek the few diamonds in the rough (last Aladdin reference, I swear) that have actually outperformed their relevant benchmark. Depressed valuations may induce further consolidation, so this trend could ease the number of stand-alone active management firms as competitively priced passive strategies continue to collect AUM. With over 11,000 RIAs and aging owner demographics, such consolidation is probably long overdue.

RIA Valuation Insights

RIA Valuation Insights