Are Public RIA Dividend Yields a Mirage?

Investors Quarantine Their Positions Despite the Search for Income, Strong Fundamentals

Say what you want – for a few customers, it served a purpose. 1976 Cadillac Mirage (photo from www.bringatrailer.com)

Twenty-five years before the marketing group at General Motors rebadged a humble Yukon to create the first Cadillac SUV, the Escalade, a body shop in California called Traditional Coach Works was modifying Coupe de Villes into a car/truck configuration they dubbed the Mirage. Whether or not anybody really needed a Cadillac to haul a 4×8 sheet of plywood was beside the point; the car was aptly named for the double-take any casual observer might have upon seeing one. The Mirage was sold through Cadillac dealers at nearly twice the cost of a standard Coupe de Ville, and in spite of that premium, buyers saw enough function in the form to order over 200 of them. A few are still around.

Since the Coronavirus pandemic settled into the American consciousness in mid-March, industry pundits such as myself have been actively musing about the impact of the crisis on the RIA community. Two months later, we’ve learned:

- Most investment management firms can work very effectively on a virtual basis (at least for months at a time), and,

- The Fed is not afraid of moral hazard, and is, in fact, more than willing to socialize the cost of market disruptions (remember the other Golden Rule: whoever has the gold makes the rules).

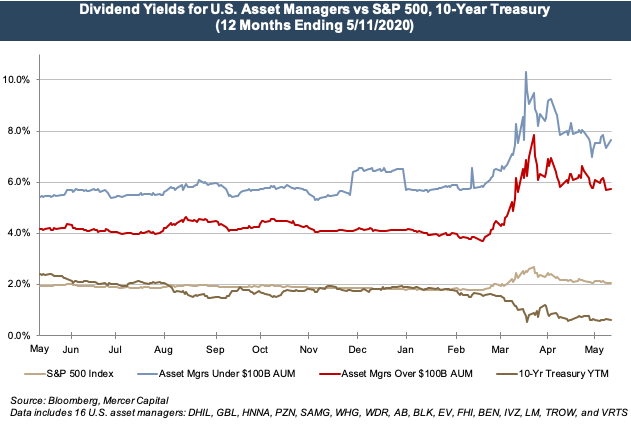

This should be calming, even inspiring, to shareholders of investment management firms. RIA operations are mostly unaffected by this pandemic, and RIA financial performance has been supported by massive central bank intervention. None of this explains the pricing of publicly traded RIAs, however; especially when you look at the impact that slumping valuations have had on RIA dividend yields.

Are we really in a yield-starved environment? One would think so, with longer dated Treasuries priced more on the basis of a return OF capital than return ON capital. The broader market has shrugged off the likelihood of steep declines in earnings, leaving the dividend yield on the S&P 500 mostly unchanged from what it was before the advent of COVID-19. RIA pricing, ironically, has not enjoyed the same support.

The valuation dysphoria facing the investment management industry does not make sense. RIAs are viewed by many as an ideal growth and income asset: with durable customer relationships producing revenue streams that drift upward with financial markets, and cost structures that can be leveraged to improve distributable cash flow per dollar of revenue. Despite this very supportable investment thesis and the absence of many alternatives, the market seems to have lost interest in the RIA sector. Why?

A review of comments from first quarter earnings calls does not suggest that most industry participants are getting ready to cut dividends:

- Silvercrest Asset Management Group (6.0% yield): “Silvercrest currently pays a generous quarterly dividend of $0.16 or an annual dividend of $0.64 per Class A share of common stock. The firm anticipates that it can support the current dividend for a sustained period of time, even while continuing to invest in the business.” – Rick Hough, Chairman and CEO

- Waddell & Reed (7.1% yield): “…we feel pretty comfortable with respect to the level of the dividend at this point. There’s quite a difference between the cash flows that we generate versus reported net income. And at this point, we feel very comfortable with the current level of dividend, [and] the sustainability of that.” – Philip Sanders, CEO

- Blackrock (2.9% yield): “As we’ve previously announced in late January, we increased our quarterly cash dividend by 10% to $3.63 per share and have no plans to reduce our dividend during the remainder of the year.” – Gary Shedlin, Chief Financial Officer

- Franklin Resources (5.5% yield): “…just to complete the capital management with dividends. We [intend to] keep where they are, as you know we’re pretty – a sacrament to us. We want to continue to pay out [the] dividend.” – Matthew Nicholls, Chief Financial Officer

The one exception to this otherwise reassuring chorus is Invesco, which has suffered greatly from asset outflows, and recently cut its dividend in half:

- Invesco (7.9% forward yield): “Our decision to reduce our common dividend by 50% was done certainly with an understanding that the environment could weaken from here. It wasn’t necessarily our working assumption, but certainly we’re not thinking that we’re seeing a snap back going forward. But we don’t intend, and we certainly don’t intend to make another difficult decision like this again, and we do feel confident that this was the right action at the sufficient level to give us the flexibility that we desire to manage the balance sheet, even if the environment were to deteriorate from here, and we’ve stress tested this all which ways.” – Loren Starr, Chief Financial Officer

Whether Invesco is the bellwether or uniquely challenged remains to be seen. On the whole, it’s difficult to rationalize a business leveraged off of market performance that has become priced so differently than the market. Either the RIA industry is being unfairly punished (and therefore represents a nice yield play at these prices) or broader equity markets are due for a comeuppance, or some combination of the two.

Dividend stocks haven’t gotten much love in the growth obsessed market of the past couple of decades. But with bonds priced to yield very little, talk of negative rates, and little in the way of meaningful income from shares in other industries, the coupon-with-upside opportunity represented by public RIAs won’t go unnoticed forever. The yields available from much of the public RIA community may seem like a mirage, but they may, instead, prove to be an income oasis in the investment desert of ZIRP.

RIA Valuation Insights

RIA Valuation Insights