Asset Manager Deal Activity Accelerates, Still Room to Run

RIAs have long faced structural headwinds and consolidation pressure from increasing compliance and technology costs, broadly declining fees, and slowing organic growth for many active managers. While these pressures have been compressing margins for years, asset manager M&A has historically been muted, due in part to challenges specific to asset manager combinations, including the risks of cultural incompatibility and size impeding alpha generation. Nevertheless, the industry structure has a high degree of operating leverage, which suggests that scale could alleviate margin pressure for certain firms.

Current Consolidation Considerations

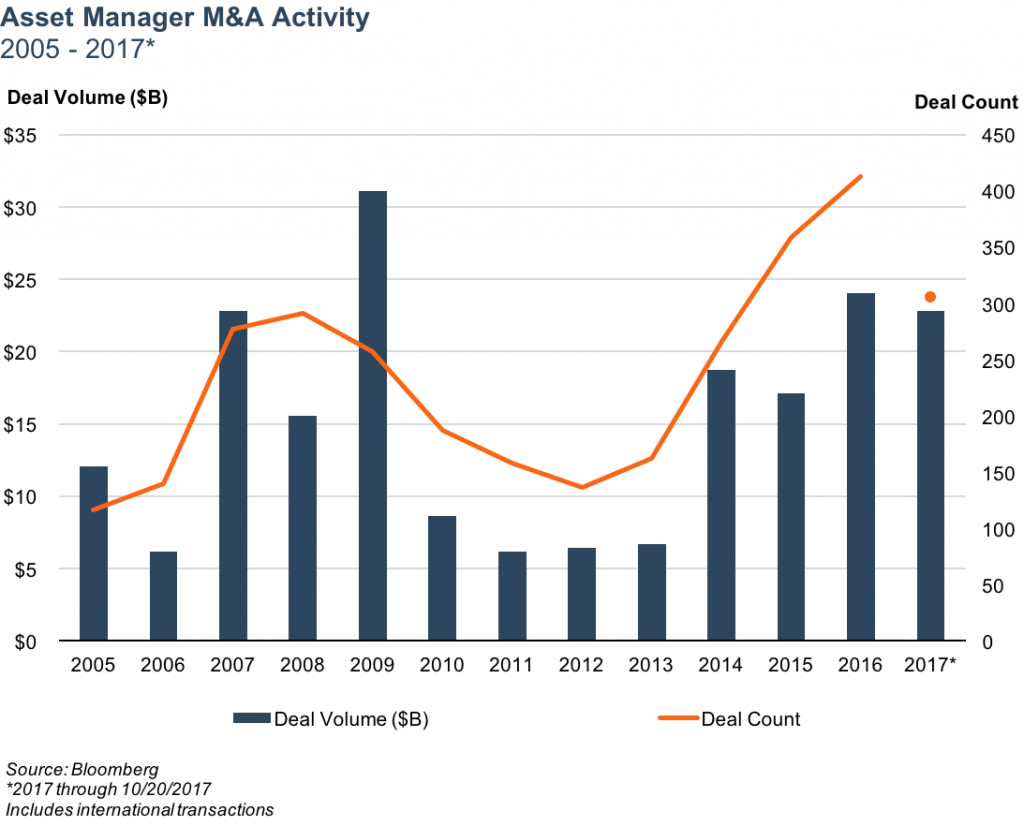

Consolidation pressures appear to have reached critical mass in the last several years, and M&A activity has picked up notably as a result. M&A activity in 2017, in particular, is on track to reach the highest level in terms of deal volume since 2009.

For publicly traded asset managers, at least, the market seems to view recent M&A activity favorably. Amundi has returned 46% year-to-date (as of October 20) after announcing the acquisition of Pioneer Investments last December. Aberdeen was up 15% through May 31 after agreeing to be acquired by Standard Life in March. KKR shares have risen 20% since April 19, when an investor group led by Stone Point Capital and KKR agreed to buy a majority stake in RIA aggregator Focus Financial Partners.

Recent increases in M&A activity come against a backdrop of a now eight-year-old bull market. Steady market gains, particularly in 2017, have more than offset the consistent and significant negative AUM outflows that many active managers have seen over the past several years. In 2016, for example, active mutual funds’ assets grew from $10.7 trillion to $11 trillion, despite $400 billion in net outflows according to data from Bloomberg. As a result, profitability has been steadily increasing despite industry headwinds that seem to rationalize consolidation.

It’s unclear whether this positive market movement has been a boon or a bane to M&A activity. On one hand, many asset managers may see rapid AUM gains from market movement as a case of easy come, easy go. In that case, better to sell sooner rather than later. And vice versa from a buyer’s perspective. On the other hand, as long as markets trend upwards, margin and fee pressures are easy to ignore. In that case, a protracted market downturn could lead to a shakeout for firms with cost structures that are not sustainable without the aid of a bull market.

We saw the effect a market downturn can have on M&A activity during 2009 when deal volume reached record levels as many distressed firms were sold. The M&A activity spurred by the 2009 downturn was short-lived, however. Deal volume was largely subdued between 2010 and 2013. The fallow period ended in 2014, and deal activity has accelerated since then while broad market indices have marched higher.

Conclusion

It seems likely that asset manager deal activity will continue to gain speed regardless of which way the markets are moving, although a market downturn could certainly expedite consolidation. Asset managers face secular trends that threaten lower revenue and higher costs. On the top line side, assets continue to flow into low fee passive funds at a good clip. On the cost side, an evolving regulatory environment threatens increasing compliance costs. Consolidation allows asset managers to spread compliance costs over a larger AUM base and increase distribution channels and product offerings, thereby combating revenue and cost pressure.

But if a protracted bear market does materialize, margins will face pressure not only from the evolving industry dynamics but also from evaporating AUM. A significant market downturn may highlight the consolidation pressures in the industry and catalyze a larger wave of M&A activity.

Mercer Capital’s RIA Valuation Insights Blog

The RIA Valuation Insights Blog presents a weekly update on issues important to the Asset Management Industry. Follow us on Twitter @RIA_Mercer.

RIA Valuation Insights

RIA Valuation Insights