Investment Manager Pricing Takes the Scenic Route

1963 Porsche 356 B Carrera 2 “Sunroof Coupe” (www.rmsothebys.com)

The predecessor of the venerable Porsche 911 series was the 356, a lightweight coupe with a rear-mounted horizontally-opposed four cylinder engine. It eventually became known as the Carrera, the Spanish word for race, after a pair of factory-entered 356s finished one-two in the 1954 La Carrera Pan-Americana, the long distance road race held in Mexico. Porsches such as the Carrera 2 pictured above were, above all, known for their agility, with sophisticated suspensions and four-wheel disc brakes to compensate for a lack of horsepower. The engineering worked, as the two-liter Porsches often beat Ferraris with more than twice the engine displacement. Sports car racing in the 1950s was rewarding to competing engineering approaches and technologies, and there are many such examples of victories born from rethinking conventional wisdom.

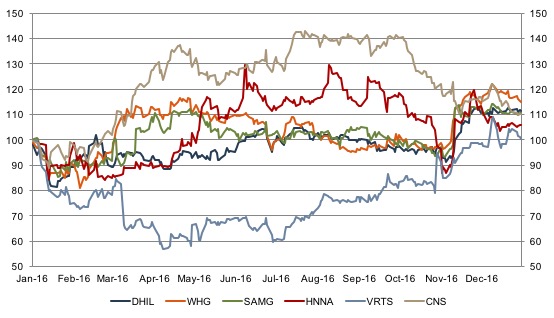

I was obsessing over these early sports car races last week while searching for a metaphor to describe the low correlation of smaller public asset managers in 2016. In what I can best describe as a wild ride to a close finish, at one point in July of 2016 Cohen & Steers (CNS) was up nearly 40% while Virtus Investment Partners (VRTS) was down over 30%. Seventy point divergences don’t happen very often, especially considering that, by Christmas of last year, the same spread narrowed to less than eight points. If you just look at 2016 stock performance for smaller RIAs, the chart is a hedge fund manager’s dream (assuming you’re a hedgie on the right side of the trade).

Taking the scenic route? Smaller public RIAs started and ended 2016 as a pack, but for about eight months performance was anything but similar.

The narrative as to how such a thing could happen is telling about the investment management industry. Thinking back to the dynamics in place this time last year, the RIA community, including these six companies, was mostly characterized by familiar themes: successful business models hitting the margin wall because of low rates, fee pressure, and AUM defections to passive strategies. Larger players with more diverse strategies were more able to trim expenses and stay a half step ahead of the game – at least for a while.

The story here seems to be one of asset flows. Virtus lost 15% of its AUM in 2015, and the hemorrhaging continued with the loss of a star emerging markets manager in March of 2016. VRTS saw net outflows in spite of favorable market conditions for several of its actively managed funds, and was only able to trim AUM losses by acquiring Ridgeworth Investments in December. The Ridgeworth acquisition will nearly double Virtus’s AUM, but it won’t come cheap and could leave the combined enterprise with more debt financing than investment management firms usually carry (Morgan Stanley and Barclays are said to have committed about 50% of enterprise value in loans). A downdraft in the market could make things very interesting for Virtus-Ridgeworth, even before the deal closes this summer. The market reacted favorably to an early fourth quarter announcement that VRTS was buying back 1.7 million shares of stock from the Bank of Montreal at modestly accretive pricing. This substantially increased EPS, which would have otherwise been hit hard by a 23% decrease in Q4 operating income.

Cohen & Steers, by contrast, was a story of good begetting better. Heading into 2016 with stable AUM, like much of the industry at the time, CNS saw a 22% increase in year over year AUM at September 30, with money coming in roughly equal amounts from client inflows and market activity. The Trump election stung CNS, however, which focuses on rate sensitive issues like preferred shares and REITs that lost valuation and client interest in the fourth quarter. The strong dollar isn’t helping CNS’s global real asset strategies, either – although that may bode well for their future if and when currency dynamics reverse course.

After the past decade of high asset correlation, the pricing diaspora of 2016 is surprising until you consider the huge differences in underlying AUM dynamics of these firms. Since those AUM trends drive profitability, they also drive market pricing. Despite the tightening of performance following the election, the divergence and convergence of valuation at VRTS and CNS in 2016 is a reminder to use caution when applying rules of thumb to activity metrics at RIAs, especially ones that focus on particular asset sectors.

Over time, however, there are market opportunities for most RIAs to finish strongly. Despite their very different paths through 2016, Virtus and Cohen & Steers finished the year with nearly identical valuations as a multiple of AUM, even if to investors they took the scenic route to get there. But life doesn’t have to be that complicated to be beautiful; I think we’d prefer enjoying the sights from behind the wheel of a vintage 356.

RIA Valuation Insights

RIA Valuation Insights