Q1 2019 Asset Manager M&A Trends

On the Heels of a Record Year, Will Asset Manager M&A Trends Continue to be Strong in 2019?

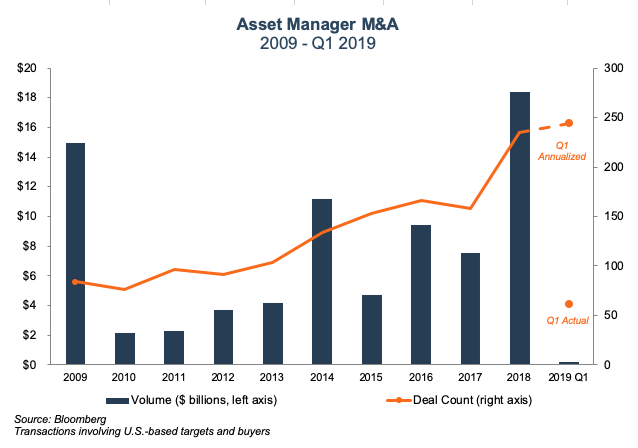

Last year marked the busiest year for asset manager M&A in the last decade, and the trend is poised to continue into 2019 as business fundamentals and consolidation pressures continue to drive deal activity.

Several trends which have driven the uptick in sector M&A in recent years have continued into 2019, including increasing activity by RIA aggregators and rising cost pressures. Total deal count during the first quarter of 2019 was flat compared to the same period in 2018, while deal count was up 35% for the twelve months ending March 31, 2019, compared to the comparative period ending March 31, 2018. Reported deal value during the first quarter of 2019 was down significantly, although the quarterly data tends to be lumpy and many deals have undisclosed pricing.

2018 marked the busiest year for asset manager M&A in the last decade, and the trend is poised to continue into 2019.

Consolidation has been a driver of many of the recent large deals, as exemplified by the largest deal of last year, Invesco’s (IVZ) acquisition of OppenheimerFunds. IVZ announced plans in the fourth quarter last year to acquire the OppenheimerFunds unit from MassMutual for $5.7 billion in one of the largest sector deals over the last decade. IVZ will tack on $250 billion in AUM as a result of the deal, pushing total AUM to $1.2 trillion and making the combined firm the 13th largest asset manager by AUM globally and the 6th largest by retail AUM in the US. The deal marks a major bet on active management for IVZ, as OppenheimerFunds’s products are concentrated in actively-managed specialized asset classes, including international equity, emerging market equities, and alternative income. Invesco CEO Martin Flanagan explained the rationale for scale during an earnings call in 2017:

“Since I’ve been in the industry, there’s been declarations of massive consolidation. I do think though, this time there are a set of factors in place that weren’t in place before, where scale does matter, largely driven by the cost coming out of the regulatory environments and the low rate environments in cyber and alike.” Martin Flanagan – President and CEO, Invesco Ltd. 1Q17 Earnings Call

RIA aggregators continued to be active acquirers in the space, with Mercer Advisors (no relation), and United Capital Advisors each acquiring multiple RIAs during 2018. The wealth management consolidator Focus Financial Partners (FOCS) has been active since its July IPO as well. So far in 2019, FOCS has announced 11 deals (including acquisitions by its partner firms). Just last week, Silvercrest Asset Management announced the acquisition of Cortina Asset Management, a $1.7 billion small cap growth equity manager based in Milwaukee, Wisconsin.

Consolidation Rationales

The underpinnings of the M&A trend we’ve seen in the sector include increasing compliance and technology costs, broadly declining fees, aging shareholder bases, and slowing organic growth for many active managers. While these pressures have been compressing margins for years, sector M&A has historically been muted, due in part to challenges specific to asset manager combinations, including the risks of cultural incompatibility and size impeding alpha generation. Nevertheless, the industry structure has a high degree of operating leverage, which suggests that scale could alleviate margin pressure as long as it doesn’t inhibit performance.

“Absolutely, this has been an elevated period of M&A activity in the industry and you should assume … we’re looking at all of the opportunities in the market.” Nathaniel Dalton, CEO, Affiliated Managers Group Inc – 2Q18 Earnings Call

“Increased size will enable us to continue to invest in areas that are critical to the long-term success of our platform, such as technology, operations, client service and investment support, and to leverage those investments across a broader base of assets.” David Craig Brown, CEO & Chairman, Victory Capital – 3Q18 Earnings Call

Consolidation pressures in the industry are largely the result of secular trends. On the revenue side, realized fees continue to decrease as funds flow from active to passive. On the cost side, an evolving regulatory environment threatens increasing technology and compliance costs. Over the past several years, these consolidation rationales have led to a significant uptick in the number of transactions as firms seek to realize economies of scale, enhance product offerings, and gain distribution leverage.

From the buyer’s perspective, minority interest deals ensure that management remains incented to continue to grow the business after the deal closes.

Another emerging trend that has been driving deal volume is the rise of minority interest deals by private equity or strategic buyers. These deals solve or mitigate many of the problems associated with acquisitions of what are normally “owner operated” businesses (at least for smaller RIAs). Minority interest deals allow sellers to monetize a portion of their firm ownership (often a significant portion of their net worth). From the buyer’s perspective, minority interest deals ensure that management remains incented to continue to grow the business after the deal closes.

Market Impact

Deal activity in 2018 was strong despite the volatile market conditions that emerged in the back half of the year. So far in 2019, equity markets have largely recovered and trended upwards. Publicly traded asset managers have lagged the broader market so far in 2019, suggesting that investor sentiment for the sector has waned after the volatility seen at year-end 2018.

M&A Outlook

With over 11,000 RIAs currently operating in the U.S., the industry is still very fragmented and ripe for consolidation. Given the uncertainty of asset flows in the sector, we expect firms to continue to seek bolt-on acquisitions that offer scale and known cost savings from back office efficiencies. Expanding distribution footprints and product offerings will also continue to be a key acquisition rationale as firms struggle with organic growth and margin compression. An aging ownership base is another impetus. The recent market volatility will also be a key consideration for both sellers and buyers in 2019.

RIA Valuation Insights

RIA Valuation Insights