Resolving Buy-Sell Disputes

On Being a Jointly Retained Appraiser

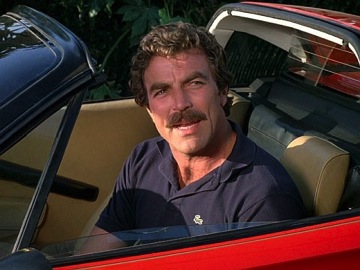

Ferrari 308 GTS (a quattrovalvole model c. 1984) | Photo Credit: Rent A Classic Car

Detective shows are usually good for automotive product placement, and the 1980s television series, Magnum, P.I., was no exception. It didn’t hurt that the show’s main character, Thomas Magnum, solved crimes in tropical settings throughout Hawaii, necessitating a requisite number of bikini-clad women sipping Mai Tai’s in every episode. But the show’s most memorable character was probably Magnum’s car, a Ferrari 308. The 308 wasn’t the fastest Ferrari of all time; the 3.0 liter eight cylinder motor didn’t muster much more than 200 horsepower. It was small enough to have great handling (the seat had to be modified to fit Tom Selleck’s 6’4″ frame), it had a targa top, and at full throttle it sounded like Barry White eating wasps. With a car like that, a do-gooder role mysteriously funded by an anonymous millionaire, and a very-casual-Friday-everyday dress code, one thing was certain: Tom Selleck had a good job.

The closest we get to detective work at Mercer Capital is when we’re jointly retained to resolve a shareholder disagreement over a buy-out. Whether we’ve been court-appointed or mutually chosen by the parties to do the project, we’ve done enough of these over the years to learn that the process matters as much as the outcome.

As a consequence, we’ve developed some fairly strict procedures for engagements involving buy-sell fights. The backstories for most shareholder disputes in the investment management industry have common themes: long-time partner ends up at odds, usually for economic reasons, with the rest of the ownership and is more or less forced out. There are usually lots of negative emotions on both sides, mistrust, and even impaired careers. The necessity of the buyout is obvious: the ex-partner wants to be paid so he or she can move on, and the remaining partners don’t want to share the spoils of ownership (distributions) with their ex any longer than necessary.

As the jointly retained appraiser, we’re often in the awkward position of serving as judge and jury on the valuation, without the usual protections afforded by a judge or jury (like unlimited indemnification or an armed bailiff). So, like a private detective, we’re left on our own to design and conduct an investigation to reach a reasonable outcome. If the process is sufficiently robust and fair, the two parties may not like the result, but they’ll have to accept it. Doing so involves focus on a few key issues.

Working in a Glass House

There is no substitute for transparency. We generally require that all information requested by and shared with us be shared with both parties. We also copy all parties on our communications and request that they do the same. When we conduct interviews with the parties as part of our normal due diligence, we open those meetings to both parties. Typically, the parties agree to not attend each others’ interviews so that they’ll feel free to speak to us more openly, and inevitably this leads to accusations at some point of our being lied to “in closed door meetings.” In reality, no one is blind to the motivations of the parties in a buy-sell dispute, and we usually hear some level of hyperbole from both sides.

Separating Fact from Opinion

Like any valuation engagement, we start with an information request to get the basic facts of the situation: financial statements, regulatory filings, organization charts, strategic plans, etc. Then we interview the parties, and (frequently) get very different interpretations of those facts. It is not unusual for both sides to have very earnest, if diametrically opposed, opinions of why the facts are the way they are. Squaring those interpretations against what we can discern to be the reality of the situation is part of our job.

The Value of Client Review

In a normal valuation matter, we prepare a draft report for client review to make sure we understand key elements of the enterprise being valued. In the case of a shareholder dispute, this review process is more structured. We usually have both parties review our work product independently of each other and give a written review that is distributed to us and the opposing party. Then we allow the parties to comment (also in writing) on each other’s review. Our expectation is that knowledge of this cross-review process will dissuade the parties from misconstruing issues in their initial comments on our draft. That doesn’t always work, but at least we have the benefit of both perspectives before we issue a final report.

Economic Independence

A client in one of these matters told us that he had heard jointly retained appraisers tended to favor the firm over the ex-partner (he was an ex-partner). I haven’t heard the same thing, but it’s easy to be accused of bias. One of the ways we guard against this is by structuring the engagement such that it is clear our payment is not contingent on the outcome. We start the engagement with a retainer that is applied against the final billing and stipulate that bills be paid current before we release a draft report or a final report. This assures both parties that we’re not in anyone’s back pocket and that we have the economic freedom to express the opinion of value we think is appropriate.

No Man Can Serve Two Masters…

Suffice it to say, we’ve learned a lot of this the hard way. It’s no fun to be the punching bag between former partners who no longer want to have anything to do with each other, and business divorces are among the most fractious engagements we find ourselves in. But it doesn’t help matters for us to offer to make someone else’s problem our problem. Our kind of detective work involves sticking to a disciplined process that is respectful of the facts and allows both parties to openly participate. Unfortunately, it doesn’t involve much intrigue, car chases, or hair gel – which probably explains why so few television series are about finance.

RIA Valuation Insights

RIA Valuation Insights