Trust Banks’ Performance and the Role of Technology

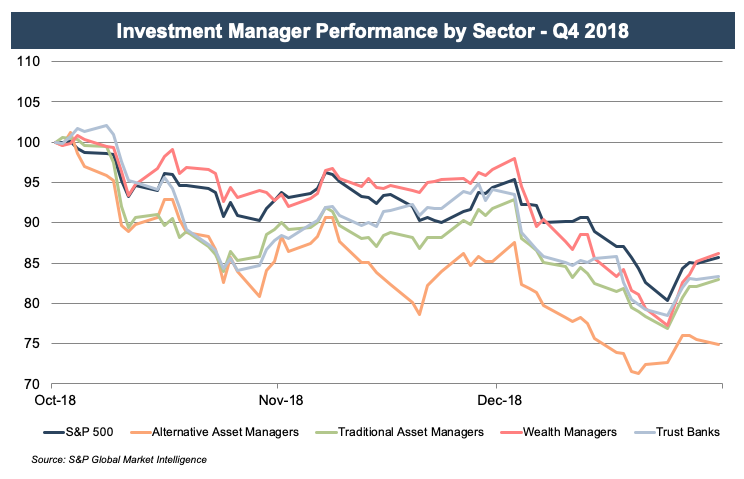

Trust banks have generally lagged the broader indices since the financial crisis of 2008 and 2009. Against a bearish backdrop for the industry, all three trust bank stocks declined in the last few months of the year with falling client asset balances and rising labor costs.

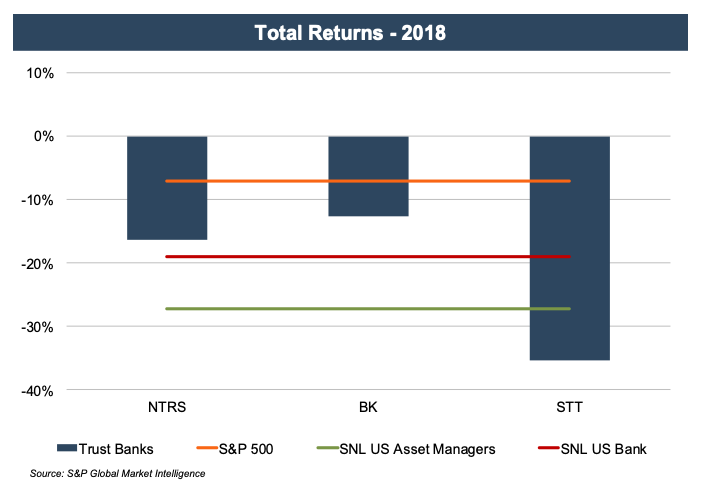

Rough year for trust bank stocks, especially State Street

Northern Trust and BNY Mellon performed more in line with the market and traditional banks while State Street’s underperformance is largely attributable to investor skepticism surrounding its purchase of Charles River Systems last summer.

Customers Demand Improved Technology Offerings

As noted during a Conversation with Jay Hooley and Ron O’Hanley at State Street, the industry is going through a “time of unprecedented change.” Investment firms are devoting more time and resources to keep up with the most recent technological offerings and improve the overall client experience. These dynamics are especially true for trust banks where increased regulation has encouraged advancement in data management.

IT investment is outlined as a clear priority for success. BNY Mellon invested $2.4 billion in IT last year and plans to spend another $2.7 billion going forward to develop their operating platform. Northern Trust utilizes technology in order to provide momentum to its growth strategies and cut costs “to take advantage of new technologies such as robotics to slim down its permanent workforce.”

Another example of trust banks’ directing resources to technological development is State Street’s recent acquisition of Charles River Systems for $2.6 billion. Charles River is a financial data firm that runs a software platform used by more than 300 asset management firms. According to Ron O’Hanley, President and CEO of State Street, “This acquisition represents not only a significant investment in our future but also the recognition that the ability to assist clients in managing their data needs and extract insights from their data is increasingly the most important differentiator for our industry.”

Investors disagreed as STT’s share price declined sharply after the announcement (pessimism surrounding the acquisition) as the 38% increase in total assets under custody from the acquisition will not be met with proportional increases in revenue. At the moment, investors are questioning if State Street’s focus on data management in addition to asset management will, in fact, create shareholder value in the long run.

Is Pricing Indicative of Performance in a Down Market?

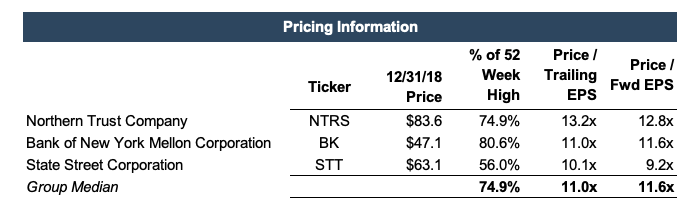

Trust bank trailing and forward multiples have fallen in line with the broader market.

A quick glance at year-end pricing shows the group valued at 9-13x (forward and trailing, respectively) earnings, down from 14-16x at year-end 2017 as the outlook on future cash flows has stalled with the recent market correction.

Despite trust banks’ underperformance during 2018, investment management fees increased year-over-year (as of the third quarter, the most recent information available). Servicing fees varied by company. State Street saw a decline in serving fees due to what it explains as “client transitions and challenging industry conditions.” BNY Mellon’s fees were relatively flat and Northern Trust saw an increase in servicing fees partially due to the UBS fund administrator acquisition which closed in late 2017. But, as a whole, trust banks saw improved net interest margins due to higher U.S. market interest rates and increases in trading services with the recent uptick in volatility.

Are Investors Too Bearish on State Street?

State Street’s stock price has been hammered even more than the industry as a whole. State Street’s ETF business has historically helped it outperform peers. However, legacy contracts have disabled them from cutting fees in order to remain competitive. State Street has begun restructuring its ETF business, but it will take time to regain its market position. Despite these challenges, State Street’s share of the U.S. ETF industry was at an all-time low by July of this year. Despite the recent struggles with its ETF business and the market’s perception of the Charles River acquisition, State Street ($34 trillion in AUCA) is still on track to surpass BNY Mellon ($34.5T AUCA) as the largest custody bank by in terms of assets under custody/administration.

Trust Companies are Bullish on Technology

Trust Companies are relying on technology to ease some of the pressure from their customers on cost. More barriers to entry have developed in the industry as regulators have made it harder to obtain approval to operate as a custody bank. This stricter regulation has forced these companies to adopt technological platforms which, if done properly, can provide a valuable service to its customers.

Mercer Capital assists RIA clients with valuation and related consulting services for a variety of purposes. In addition to our corporate valuation services, Mercer Capital provides transaction advisory and litigation support services to the investment management industry. We have relevant experience working with independent trust companies, wealth management firms, traditional and alternative asset managers, and broker-dealers to provide timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

RIA Valuation Insights

RIA Valuation Insights