The Level of Value: Why Estate Planners Need to Understand This Critical Valuation Element of a Buy Sell Agreement

We have preached for several years here at Mercer Capital that all businesses with more than one shareholder should have a current, well-written buy-sell agreement.

Business appraisers retained pursuant to the operation of buy-sell agreements are normally bound to prepare their valuations in accordance with the kind of value described or defined within the agreements. For clients with valuation processes as part of their agreements, it is imperative for estate planners to understand the six defining valuation elements of a valuation process agreement (as outlined in the book Buy-Sell Agreements for Closely Held and Family Business Owners).

This article deals with one of those defining elements – the level of value. Keep in mind that there is no such thing as “the value” of a closely held business. Confusion over an appraiser’s basis of value, either by appraisers or by users of appraisal reports, can lead to the placing of inappropriately high or low values for a buy-sell agreement transaction. Therefore, it is essential that business appraisers and the parties using appraisals are aware of the correct basis (level) of value. Properly specifying the intended level of value provides a platform for appropriate and consistent valuation methodologies in deriving the conclusion of value.

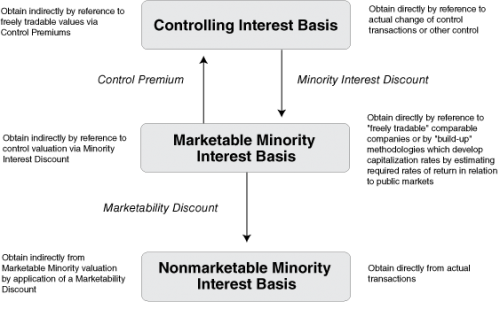

The levels of value chart is an economic and financial model used by appraisers to describe the underlying financial behavior of individual owners and businesses in the process of buying and selling businesses and business interests. It summarizes a hierarchy of detailed facts and circumstances that characterize transactions involving particular business interests in specific situations. The model generally describes and organizes the valuation relationships that emerge from observing many thousands of individual transactions.

Understandably, business owners are often confused by or are totally unaware of the various levels of value. Business owners tend to think of value in terms of an “enterprise” basis or perhaps a “sale” basis. Valuation professionals look more at terminology like “controlling interest” basis or “minority interest.”

The Levels of Value Charts

The levels of value chart has been an established model since the early 1990s. The original chart showed three levels, as indicated in Figure 1.

Figure 1: Traditional Levels of Value

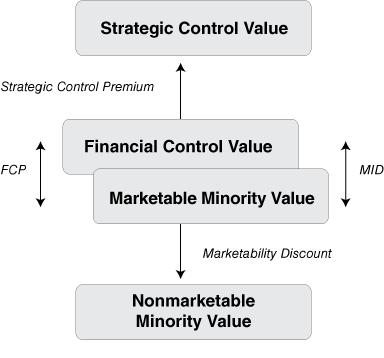

In current thinking, there are four conceptual levels of value as shown in Figure 2.

- Strategic control value refers to the value of an enterprise as a whole, incorporating strategic features that may motivate particular buyers and capturing the expected business and financial synergies that may result from its acquisition. Higher expected cash flows relative to financial buyers may enable strategic (or synergistic) purchasers to pay premiums, often called strategic control premiums, relative to financial control values. Strategic buyers may also increase the price they will pay based on the use of their own, presumably lower, cost of capital.

- Financial control value refers to the value of an enterprise, excluding any synergies that may accrue to a strategic buyer. This level of value is viewed from the perspective of a financial buyer, who may expect to benefit from improving the enterprise’s cash flow but not through any synergies that may be available to a strategic buyer.

Many business appraisers believe that the marketable minority and the financial control levels of value are, if not synonymous, essentially the same.

One way of describing the financial control value is that buyers are willing to pay for the expected cash flows of enterprises and will pay no more than the marketable minority value. However, they may believe they can run a company better and if the competitive bidding situation requires that they share a portion of potential improvements with the seller, these two levels can diverge somewhat.

- FCP is the financial control premium. The financial control premium is shown, conceptually, to be nil, or at least very small in Figure 2.

- MID is the minority interest discount. The minority interest discount is also shown to be conceptually nil or very small. This is consistent with the discount being the conceptual inverse of the financial control premium, which is itself nil or very small.

Figure 2: Updated Levels of Value

Recently, with the large influx of capital into private equity groups and hedge funds, competitive pressure for deals has caused some financial buyers to compete with strategic buyers. To do so, they must lower their expected rates of return, since strategic or synergistic cash flow benefits are not generally available to them.

Business appraisers look in part to the transaction markets for pricing guidelines when developing valuations at the strategic and financial control levels of value.

- Marketable minority value refers to the value of a minority interest, lacking control, but enjoying the benefit of liquidity as if it were freely tradable in an active market. This level of value is also described as the “as-if-freely-traded” level of value.

Minority investors in actively traded public companies cannot exercise control over companies. However, they can exercise control over whether they hold shares or sell them. In selling, they obtain the current share price, which is their pro rata share of the public market’s pricing of the companies.

Business appraisers look to similar publicly traded companies, in part, to develop valuations at the marketable minority level of value.

- Nonmarketable minority value refers to the value of a minority interest, lacking both control and market liquidity. Value at this level is determined based on the expected future enterprise cash flows that are available to minority shareholders, discounted to the present at an appropriate discount rate over the expected holding period of the investment. The nonmarketable minority level of value is derived indirectly by applying a marketability discount directly to marketable minority indications of value, or directly, by determining the present value of expected cash flows to minority interests.

The selection of the level of value, in conjunction with the standard of value, begins to specify a valuation or appraisal assignment of a particular business or business interest. Without looking at any numbers, it is clear that the strategic control level of value is higher (more valuable on a per-share or pro rata basis) than is the nonmarketable minority level of value.

In any multiple appraiser valuation process, if one appraiser believes that the appropriate level of value is strategic control and the other believes that the nonmarketable minority level of value is appropriate, the disparity in their conclusions will be wide. That is why business owners have to agree on these two important elements that help to specify the appraisals that will be performed based on their buy-sell agreements.

Practical Thoughts on the Levels of Value

Where there is a lack of understanding about valuation concepts, confusion will reign. Recall the old expression: “A picture is worth a thousand words.” Here’s a word picture and then a visual picture.

The Word Picture

Assume that a buy-sell agreement was triggered and the company was required to acquire a shareholder’s shares per its terms. Unfortunately, the agreement had vague and confusing language regarding the level of value.

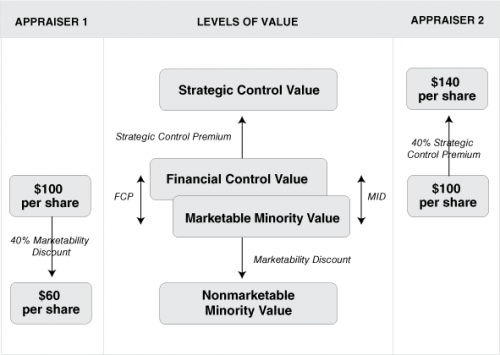

The company retained a well-qualified business appraiser, as did the shareholder. Under the terms of the agreement, each was required to provide a valuation.

- The company’s appraiser interpreted the level of value as the nonmarketable minority level of value, citing specific language in the agreement to support her conclusion. In developing her opinion, she concluded that the financial control/marketable minority level of value was $100 per share. A marketability discount of 40% was applied and the interest was valued at $60 per share.

- The shareholder’s appraiser interpreted the level of value as the strategic control level of value, citing specific language in the agreement in support of his conclusion. He also concluded that the financial control/marketable minority level of value was $100 per share. A control premium of 40% was applied and the interest was valued at $140 per share.

The Visual Picture

The conclusions of value at each level of value are shown in Figure 3. Note that there is exact agreement on value at the financial control/marketable minority level.

Figure 3: Levels of Value in Action

Note the dramatic difference in concluded values after reaching their respective final values – $60 per share versus $140 per share.

The parties now have two appraisals. They are quite similar in many respects, but widely different in their respective conclusions of value. The visual picture raises several questions for consideration:

- How could this have happened?

- How will the mandatory third appraiser reconcile the (irreconcilable) differences in concluded values?

- Could this happen to you?

Suggestions for Specifying the Desired Level of Value

So, what level of value should be indicated in your client’s buy-sell agreement? There can be many reasons to select from any of the available levels of value, though we do observe that the financial control/marketable minority level of value should work as the most “fair” solution in many situations.

While the specific level of value decision will depend on specific circumstances, it is imperative for the owners of businesses drafting a buy-sell agreement to reach agreement on which level of value is desired. After coming to such agreement, the document should specifically refer to the appropriate level of value to eliminate any questions that appraisers, who are be retained at future trigger events, might have. It would be even more helpful to include a diagram of a levels of value chart in the agreement along with this reference.

If you follow this advice, the parties to the buy-sell agreement should get the kind of valuation they and their fellow owners agreed on and minimize the potential for disagreements after the buy-sell agreement gets triggered.

Concluding Thoughts

Mercer Capital is the leading provider of buy-sell agreement valuation services in the nation.

We bring analytical resources and over 30 years of experience working with private and public companies to the business valuation issues surrounding buy-sell agreements. We act as the named appraiser in numerous buy-sell agreements, provide annual or recurring valuations, provide expert witness services when a buy-sell agreement dispute arises, and review buy-sell agreements to identify any areas of confusion concerning valuation provisions.

Contact us to discuss a buy-sell agreement issue in confidence.

About the Author

Key Contacts

Insights

-

Services

Buy-Sell Agreements

-

Books

Buy-Sell Agreements for Closely Held and Family Business Owners

-

Books , Products

The Buy-Sell Agreement Review Checklist

-

Articles , Buy-Sell Agreements

Recommended Valuation Process for Buy-Sell Agreements: Single Appraiser – Select Now, Value Now