Q2 2019 Macro Overview

Uncertainties Engulf Global Oil Amid Political Tensions

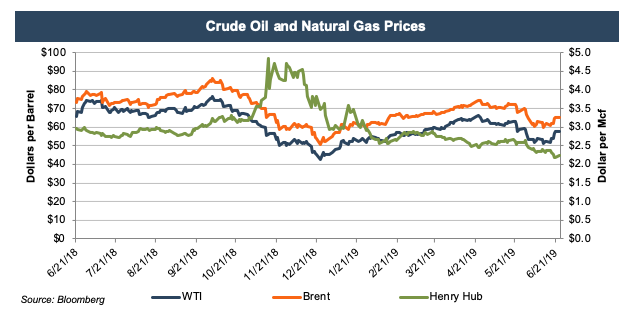

Brent crude prices began the quarter around $69 per barrel and peaked at nearly $75 in late-April before declining to just below $60 on June 12, 2019. Prices have since increased to $65, with WTI continuing to trail by about $8 per barrel. In this post, we will assess global supply and demand factors that have caused these price fluctuations.

Global Supply

Originally founded by Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela in 1960, OPEC now stands at 14 members, after Qatar terminated its membership at the beginning of the year. OPEC is still a significant organization when assessing global supply, but it has undergone considerable changes. While OPEC only has 14 statutory members, an alliance known as OPEC+ has added 10 non-OPEC member countries headlined by Russia and including Mexico and Kazakhstan. This group agreed in December 2018 to a production decline with the goal of balancing global inventories and stabilizing the oil market (read: raising prices). With churn in its members and inclusion of allies in its production cuts, people may not know exactly who OPEC+ is, but the oil cartel’s mission remains clear (even if oil and cartel are not the O or C in the group’s amorphous acronym).

OPEC+ has thus far been successful in reducing output, though for countries like Iran and Venezuela, decreased output hasn’t necessarily been intentional. In May, OPEC members produced 29.9 million barrels per day (b/d), the lowest for any month since July 2014. It remains to be seen if these production cuts set to expire this month will remain intact, and if so, for how long. Saudi Arabia’s energy minister Khalid al-Falih expressed absolute confidence that an agreement would be reached to extend the oil production cuts after “very constructive discussions” with Russian energy minister Alexander Novak. Falih also said,

Our intent is to make sure that we continue to work together closely, not just bilaterally, but with all other members of the OPEC+ coalition – and that the good work we have done over the last two and a half years continues to the second half of 2019, maintaining supply constraints to bring balance to the global inventories of oil.

The bilateral comment is telling. In April, the planned meeting was cancelled to reportedly have more time to analyze market data. However, the second delay, though only for a week, has shown heightened tensions, as decisions have increasingly been driven by Saudi Arabia and Russia, who combine for over 40% of OPEC+ oil production. Falih said all but one OPEC member nation has agreed to delay the group’s meeting until after the G20 summit, and the holdup figures to be Iran, who has been increasingly perturbed by its diminishing influence. Production cuts rely on all members to stick to their word, as each individual country would be economically incentivized to increase production to reap the benefits sown by those who withhold production.

Iran

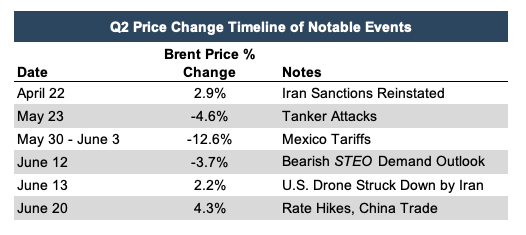

Alongside voluntary declines from Saudi Arabia and Russia, Iran has been one of the key reasons for lower production recently. In April, the U.S. reinstated its sanctions on importers of Iranian oil. The sanctions were initially implemented to ramp up “maximum pressure” on Iran as oil is a significant revenue source for the Iranian government. The U.S. is pressuring Iran to curtail its nuclear program and return to the negotiating table on a nuclear deal.

Waivers were granted last November to allow countries time to find other sources of supply and three of these countries (Greece, Italy, and Taiwan) have done so as they no longer import any oil from Iran. China and India are the largest importers of Iranian oil whose waivers have been rescinded, which should ramp up pressure on Iran and could have spill-over effects on trade discussions as China expressed displeasure with the U.S.’s decision to reinstate sanctions.

Alongside voluntary declines from Saudi Arabia and Russia, Iran has been one of the key reasons for lower production recently.

These sanctions are not the only concerns related to Iran. The recent crude price rebound following its 5-month low is due in part to Iran shooting down a U.S. drone, raising already heightened tensions. This comes after attacks in May on two tankers near the Strait of Hormuz, which the U.S. blames on Iran. The Strait of Hormuz, described by the EIA as the world’s most important oil choke point, separates UAE, Oman, and Iran and a significant amount of world oil supply passes through this relatively narrow shipping route.

The White House has put out two statements in the past few days, seeking to set the record straight and with Saudi Arabia, UAE, and the UK jointly condemn these attacks. The situation remains fluid and volatile and continues to threaten the flow of oil, as President Trump began the week by announcing new sanctions on Iran.

Rising U.S. Production

Production cuts from OPEC+ (intentional or not) have been able to raise prices since the lows seen at the end of 2018, and the U.S. has been one of the prime benefactors. The U.S. has been able to increase its global market share, increasing production to fill the void left by OPEC+ production. Additionally, any elevated prices caused by these production cuts have also increased top line revenues for American producers, a fact not lost on OPEC.

According to the EIA’s latest Short Term Energy Outlook (“STEO”), U.S crude oil production increased 17% in 2018, peaking at an all-time rate of 10.96 million b/d. This was capped by a December that saw 11.96 million b/d, the highest monthly level on record, despite crude prices sliding considerably in the fourth quarter. The EIA expects this growth to continue with production reaching 13.3 million b/d on average by 2020.

Slowing Global Demand

According to the STEO, the EIA is projecting lower crude prices for 2019 due to uncertainty about global oil demand growth. In late May, President Trump announced the potential for tariffs on Mexico, which would have particularly negative impacts on the energy industry as the U.S. exports more fuels to Mexico than any other country. Easing continental trade concerns, Mexico became the first country to ratify the USMCA (new NAFTA), though approval has yet to come from Canada or the U.S., and there is no timetable for its passage.

Concerns about the U.S.-China trade relations picked up in the second quarter as increased tariffs have been threatened by both sides.

Concerns about the U.S.-China trade relations have also picked up in the second quarter as increased tariffs have been threatened by both sides. Expected industrial activity, as measured by the manufacturing Purchasing Managers’ Index (PMI) declined across several countries in May, and the U.S. PMI fell to its lowest level since 2009. These contribute to concerns that future economic growth could be lower than expected, which would, in turn, curb oil demand. However, there was optimism on June 20, related in part to hopes that U.S.-Chinese relations would improve when President Trump meets with President Xi at the G20 Summit.

Interest Rates

Optimism on June 20 wasn’t restricted to trade with China as the Federal Reserve also met the prior day. The Fed Funds rate has been increased 9 times since December 2015 to a target range of 2.25%-2.50%. However, it has become increasingly clear that the next change is more likely to be up than down. For the first time in Jerome Powell’s tenure as Fed Chairman, a dissent was cast, which advocated for a rate cut. James Bullard, President of the Federal Reserve Bank of St. Louis, said cutting rates now “would provide insurance against further declines in expected inflation and a slowing economy subject to elevated downside risks. Even if a sharper-than-expected slowdown does not materialize, a rate cut would help promote a more rapid return of inflation and inflation expectations to target.”

In theory, interest rate hikes tend to be negative for risk assets such as equities and commodities such as energy. Conversely, a rate decrease should make holding these products more attractive and raise the price. More important, however, is the overall message it sends to the economy. If the Fed were to cut rates, even if it cited its inflation target as the reason (and not a global economic slowdown), this would be viewed by the market as a bearish signal, likely sending equities and crude oil prices downward.

Conclusion

With the G20 Summit occurring June 28 and 29, we’ll close the quarter with a more informed outlook on global demand going forward. OPEC and OPEC+ meetings are expected to occur July 1 and 2, so we’ll have to wait until the beginning of the third quarter for a decision on increased, steady, or reduced production cuts on the supply side. Even with an announcement at the beginning of the quarter, it will take more time to determine how this production will be further impacted by individual country circumstances, particularly from Iran. In the meantime, the U.S. will likely continue its production to capitalize on the shortfall, even if global demand slows or is already slowing. While interest rate hikes or cuts will likely continue to play a role in market sentiment, it is unlikely we see a change on this front in the near-term.

At Mercer Capital, we stay current with our analysis of the energy industry both on a region-by-region basis within the U.S. as well as around the globe. This is crucial in a global commodity environment where supply, demand, and geopolitical factors have various impacts on prices. We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and internationally. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights