An Example of Structuring Earn-outs for RIAs

With an order book of over 400 thousand units, Tesla started delivering the Model 3 last month (photo tesla.com)

Risk is enigmatic to investing. While we might all desire clairvoyance, it would only work if we were the sole investors who could see the future perfectly. If everyone’s forecasts were proven accurate, assets would all be priced at something akin to the risk-free rate, with no premium return attached. Uncertainty creates opportunity for investors, because opportunity is always a two-way street.

Pricing uncertainty is another matter altogether. Not everyone “believes” in CAPM, or at least maybe not the concept of beta, but most agree that the equity risk premium exists to reconcile the degree of unlikelihood for the performance of a given asset with the value of that asset. In an ideal world, a reasonable cash flow projection and a reasonable cost of capital will yield a reasonable indication of value.

In the real world, there can be genuinely differing opinions of what the future holds. Some think the future is all about batteries, with considerably stronger environmental regulations on the horizon (at least in Europe) not to mention the relative simplicity of battery power. This sentiment bid Tesla’s share price to a larger market capitalization than Ford. Others have equally questioned the wisdom of this, noting the reluctance of consumers, and many governments, to phase out the use of fossil fuels in transportation. Naysayers note that Tesla’s 400 thousand plus pre-orders for the Model 3 pale in comparison to, say, the over 16 million Ford F150 pickup trucks sold over the past 20 years. What would break that trend now?

In the vacuum sealed world of fair market value, we can reconcile discordant outlooks with different cash flow projections. The differing projections can then be yoked together into one conclusion of value by weighing them relative to probability. The discount rate used in the different projection models captures some of the risk inherent in the cash flow, and the probability weights capture the remainder of the uncertainty. In a real world transaction, however, buyers want to be paid based on their expectations if proven right, and sellers also want to be paid if outcomes comport with their projections. With no clear way to consider the relative likelihood of each party’s expectations, no one transaction price will facilitate a transaction. Risk and opportunity can often be reconciled by contract, however, by way of contingent consideration.

RIA Transaction Example

Consider the example of a depository institution, Hypothetical Savings Bank, or HSB. HSB has a substantial lending platform, but it also has a trust department that operates as something of an afterthought. HSB’s senior executives consider options for closing or somehow spinning off the trust operation, but because of customer overlap, lengthy trust officer tenure with the bank, and concerns by major shareholders who need fiduciary services, HSB instead hopes to bolster the profitability of trust operations by acquiring a RIA.

Following a search, HSB settles on Typical Wealth Management, or TWM. TWM has 35 advisors and combined discretionary assets under management of $2.6 billion (an average of $75 million per advisor). TWM has a fifteen-year track record of consistent growth, but with the founding generation nearing retirement age, the firm needs a new home for its clients and advisors.

The Seller’s Perspective

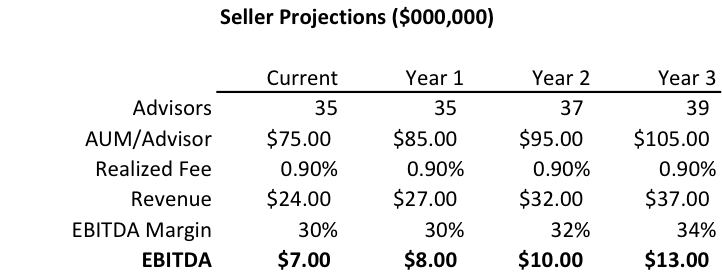

TWM’s founders are motivated, but not compelled, to sell the firm. TWM generates 90 basis points of realized fees per dollar of AUM and a 30% EBITDA margin. Even after paying executives and advisors, TWM makes $7MM of EBITDA per year, and the founders know that profitability has significant financial value to HSB, in addition to providing strategic cover to shore up the trust department.

Further, Typical Wealth Management has experienced considerable growth in recent years, and believes it can credibly extend that growth into the future, adding advisors, clients, and taking advantage of the upward drift in financial markets to improve revenue and enhance margins.

Given what it represents to be very conservative projections, and which don’t take into account any cross selling from the bank or potential fee enhancements (TWM believes it charges below-market fees to some clients), the seller wants 12x run rate EBITDA, or about $85 million, noting that this is only about 10x forward EBITDA, and less than 7x EBITDA three years hence.

The Buyer’s Perspective

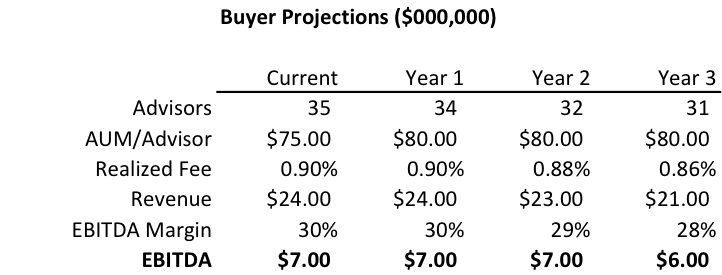

The bankers at HSB don’t really understand wealth management, but they know banks rarely double profitability in three years and suspect they’ll have a tough time convincing their board to pay top dollar for something without tangible book value.

Bank culture and investment management frequently do not mix well, and they worry whether or not TWM’s clients will stay on if the senior staff starts to retire. Further, they wonder if TWM’s fee schedule is sustainable in an era of ETFs and robo-advisors. They create a much less sanguine projection to model their possible downside.

Based on this, HSB management wants to offer about $40 million for Typical, which is about six times run rate EBITDA. This pricing gives the seller some credit for the recurring nature of the revenue stream, but doesn’t pay for growth that may or may not happen following a change of control transaction.

The Compromise

With a bid/ask spread of $45 million, the advisors for both buyer and seller know that a deal isn’t possible unless one or both parties is willing to move off of their expectations significantly (unlikely) or a mechanism is devised to reward the seller in the event of excellent performance and protect the buyer if performance is lackluster. Even though the buyer is cautious about overpaying, they eventually agree to a stronger multiple on current performance and offer $50 million up front for TWM. The rest of the payment, if any, will come from an earn-out. Contingent consideration of as much as $30 million is negotiated with the following features:

- TWM will be rebranded as Hypothetical Wealth Management, but the enterprise will be run as a separate division of the bank during the term of the earn-out. This division will not pay any overhead charge to the bank, except as specifically designated for marketing projects through the bank that are managed by the senior principals of the wealth management division. As a consequence, the sellers will be able to maintain control over their performance and their overhead structure during the term of the earn-out.

- The earn-out period is negotiated to last three years. Both buyer and seller agree that, in a three year period, the value delivered to the seller will become evident.

- Buyer and seller agree to modest credits if, for example, the RIA recommends a client develop a fiduciary relationship with the bank’s trust department, or if the bank’s trust department refers a wealth management prospect to the RIA. Nevertheless, in order to keep matters simple during the term of the earn-out, both parties agree to manage their operations separately while the bank determines whether or not the wealth management division can continue to market and grow as an extension of the bank’s brand.

- To keep performance tracking straightforward, HSB negotiates to pay five times the high-water mark for any annual EBITDA generated by TWM during a three year earn-out period in excess of the $7 million run-rate established during the negotiation. It is an unusual earn-out arrangement, but the seller is compensated if by steady marketing appeal or strong market returns, AUM is significantly enhanced after the transaction. The buyer is protected, at least somewhat, from the potentially temporary nature of any upswing in profitability by paying a lower multiple for the increase than might normally be paid for an RIA. As long as management of Typical can produce at least $6 million more in EBITDA in any one of the three years following the transaction date, the buyer will pay the full earn-out. Any lesser increase in EBITDA is to be pro-rated and paid based on the same 5x multiple.

- The earn-out agreement is executed in conjunction with a purchase agreement, operating agreement, and non-competition / non-solicitation agreements which specify compensation practices, reporting structures, and other elements to govern post-transaction behavior between the bank and the wealth manager. These various agreements are done to minimize misunderstandings and ensure that both buyer and sellers are enthusiastic participants in the joint success of the enterprise.

As the earn-out is negotiated, buyer and seller run scenarios of likely performance paths for Typical after the transaction to see what the payout structure will look like per the agreement. This enables both parties to value the deal based on a variety of outcomes and decide whether pricing and terms are truly satisfactory.

Structuring Earn-Outs Is the Key to a Successful Transaction

My very limited understanding of neuroscience has led me to a cursory knowledge of the shortfalls of human decision making. As much as we might like to believe we think analytically, we mostly act on impulse, responding emotionally to our environment faster than we can reason.

This capacity kept us alive when rapid escape from a predator was a more reliable reaction than stopping to think about what was happening. This same brain function causes sellers to focus too much on the headline number offered in a deal negotiation and not enough on the terms surrounding the price.

In RIA transactions, those terms frequently include large earn-out payments based on performance outlooks that are highly unlikely, or that at least should be discounted significantly. As a rule, buyers get more protection from contingent consideration than sellers, and frequently have more experience offering earn-outs than sellers have living with them. Seller beware!

If you’re considering an offer for your firm that includes earn-out consideration, think about having some independent analysis done on the offer to see what it might ultimately be worth to you. If you’re working the buy-side, prepare to spend lots of time fine-tuning the earn-out agreement – you won’t get credit if things go well for the seller, but you will get blamed if it doesn’t.

RIA Valuation Insights

RIA Valuation Insights