M&A in the Eagle Ford Shale

Over the last twelve months, the Eagle Ford Shale region has experienced steady growth and healthy transaction activity.

According to the Society of Petroleum Engineers, crude production from the south Texas play climbed steadily throughout the year and continued to achieve its highest marks ever. New, upstart independents came back to the region, including one led by the former head of Occidental Petroleum, as investors looked beyond the neighboring Permian Basin with its crowded top-tier acreage and pipelines. And operators began joining forces to increase the scale of their operations, headlined by Chesapeake Energy’s merger with Wildhorse Resource Development.

The region’s strengths, such as its low cycle times, high oil cuts and Louisiana Light Sweet crude and Brent oil pricing, has facilitated free cash flow and made the area attractive to both investors and operators.

As long as entry costs and well costs remain reasonable, the Eagle Ford Shale has strong potential for continued economic growth.

Recent Transactions in the Eagle Ford Region

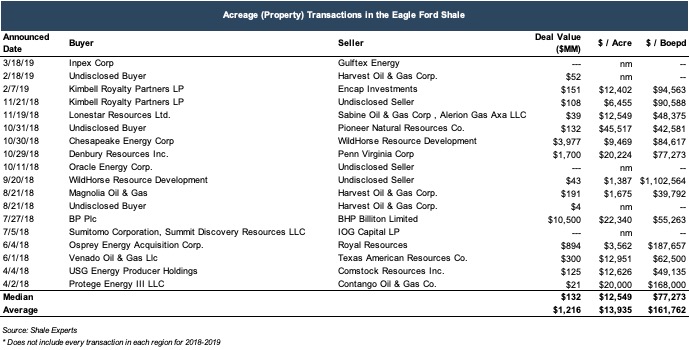

Details of recent transactions in the Eagle Ford Shale, including some comparative valuation metrics are shown below.

Chesapeake Closes Acquisition of WildHorse for Nearly $4 Billion

Chesapeake has made several major transactions over the last nine months. In the middle of 2018, the company sold its entire stake in the Utica Shale, and experts speculated that the company would put the sales proceeds towards an acquisition in the Eagle Ford or Powder Basin area.

Following the deal, Chesapeake is now the top acreage holder in the Eagle Ford with approximately 655,000 nets acres, pro forma.

Chesapeake closed a deal with Houston-based WildHorse Resource Development with a transaction value of $3.977 billion. The consideration for the transaction consisted of either 5.989 shares of Chesapeake common stock or a combination of 5.336 shares of Chesapeake common stock and $3 cash, in exchange for each share of WildHorse common stock. Chesapeake intended to finance the cash portion of the WildHorse acquisition, which was expected to be between $275 million and $400 million, through its revolving credit facility.

In a statement, Chesapeake’s CEO, Doug Lawler said: “In 2018, Chesapeake Energy continued to build upon our track record of consistent business delivery and transformational progress through both financial and operating improvements. The addition of the WildHorse assets to our high-quality, diverse portfolio, combined with our operating expertise and experience, provides another oil growth engine with significant oil inventory for years to come and gives us tremendous flexibility and optionality to help achieve our strategic goals.”

Following the deal, Chesapeake is now the top acreage holder in the Eagle Ford with approximately 655,000 nets acres, pro forma.

Trends and Outlook

Investor Returns and Free Cash Flow

One of the most attractive features of the Eagle Ford region for the last year has been the returns. The Eagle Ford generates solid economics and cash flow, which operators use to fund exploration projects both nearby and elsewhere. Portions of the Eagle Ford generate some of the best economics in shale, and the region is forecasted to generate stable production into the 2020s.

Coupled with the fact that the Eagle Ford is one of the lowest costing basins in the U.S., reliable production and capital efficiency in a mid-life stage play has been translating to free cash flow, something investors have been vocal about trying to obtain from the oil and gas industry as a whole for quite some time.

Portions of the Eagle Ford generate some of the best economics in shale, and the region is forecasted to generate stable production into the 2020s.

Todd Abbott, VP of Resource Plays South for Marathon Oil Corp., recently said at the DUG Eagle Ford conference in San Antonio that Marathon is seeing “fantastic” returns with reliable production, capital efficiency, and free cash flow.

At the same conference, Stephen Chazen, chairman, president and CEO of Magnolia Oil & Gas, noted “General investors want reasonable growth, earnings per share, and free cash flow.” The recently formed small independent company generated free cash flow in excess of capital on acquisition spending and ended 2018 with $136 million of cash on the balance sheet, an increase of approximately $100 million compared to the end of the third quarter.

These kinds of results show that the region has been a cash flow generator for the year and has been a main driver for most of the recent and anticipated transaction activity, especially companies under $1 billion in market capitalization.

Anticipated Large Operator Divestitures in 2019

In recent reports from Shale Experts, several larger operators in the Eagle Ford area are potential candidates for divestiture. Following Q4 2018 earnings calls, five operators have indicated that they are open to selling all or parts of their Eagle Ford assets in 2019. Collectively, the net acreage under consideration totals to over 100,000 net acres.

Below are four of the company responses to Shale Experts’ questions regarding where Eagle Ford assets fit into their portfolios:

- Encana Corp. – After purchasing Newfield, Encana now considers the Eagle Ford as non-core.

- Pioneer Natural Resources – They have been actively selling pieces of their Eagle Ford asset since 2018.

- Matador Resources – Matador will outspend cash flow this year, and therefore an Eagle Ford asset sale might help plug that gap.

- Earthstone Energy – Earthstone is trying to convert itself into a Permian-only player. Reports from Shale Experts expect they will be looking to offload their Eagle Ford assets in the near-term.

In addition to the reports above, Norway’s Equinor announced plans to explore the sale of its Eagle Ford assets as well.

Equinor has an ownership interest in the Eagle Ford Shale formation located in south Texas through a joint venture with Repsol. Through transactions in 2013 and 2015, Equinor obtained full operatorship in the joint venture and increased its working interest to 63%.

The company’s net acreage position in Eagle Ford at the end of 2018 was approximately 71,000 net acres and production of 43,000 boe/d.

In a recent interview, Al Cook, the company’s head of strategy, said that Equinor is looking to add to its large position in Appalachia in an attempt to chase natural gas-rich acreage. This move is consistent with trends we identified last quarter in our transaction analysis of the Marcellus-Utica region.

Any divestiture of assets by these operators would pose an interesting opportunity, especially for aforementioned smaller operators to acquire acreage and capitalize on the cash flow generating ability of the region to facilitate growth and increase returns.

We have assisted many clients with various valuation needs in the upstream oil and gas industry in North America and around the world. In addition to our corporate valuation services, Mercer Capital provides investment banking and transaction advisory services to a broad range of public and private companies and financial institutions. We have relevant experience working with companies in the oil and gas space and can leverage our historical valuation and investment banking experience to help you navigate a critical transaction, providing timely, accurate and reliable results. Contact a Mercer Capital professional to discuss your needs in confidence.

Energy Valuation Insights

Energy Valuation Insights