The State of Wealth Management Entering 2026

The wealth management industry delivered another year of growth in 2025, supported by favorable equity market performance amid periods of market volatility. Within the publicly traded RIA universe, outcomes varied across investment manager models and asset exposures.

Performance across the wealth management industry continued to track broader equity markets in 2025, reflecting the close relationship between market conditions and Assets Under Management (AUM). After recovering from market downturns in early 2025, publicly traded RIAs posted solid gains to close the year, with firms over $250 billion in AUM up 9.8% year-over-year and firms under $250 billion in AUM up 10.7% year-over-year, though both groups underperformed the broader market as the S&P 500 rose 17.9% over the same period. This reflects a continuation of the growth trend seen in 2024 and 2023, following the market pullback in 2022. In contrast, alternative asset managers declined 9.5% during the year, lagging both traditional wealth managers and the broader market.

Another notable development in 2025 was a shift in Federal Reserve policy later in the year. After maintaining its target rate through the majority of the year, the Fed began lowering interest rates in September, implementing three quarter-point cuts by year-end. These actions followed improving inflation trends and reflected a recalibration of policy expectations as the year progressed.

Looking ahead to 2026, market expectations suggest the Federal Reserve may implement additional interest rate cuts if inflation continues to moderate and economic conditions remain stable. As in prior periods, interest rate policy will remain an important factor shaping market conditions for the wealth management industry.

Artificial intelligence continues to gain traction across the RIA industry, though adoption remains uneven as firms balance exploration with oversight. Findings from Schwab’s 2025 Independent Advisor Outlook Study indicate that many advisors are engaging with AI tools, but most firms are still in the early stages of establishing formal structures around their use. As a result, AI adoption to date has largely been incremental rather than fully integrated.

While interest in AI is widespread, firms appear focused on learning and experimentation rather than immediate, large-scale deployment. For many RIAs, the emphasis has been on understanding potential applications and risks before committing significant resources, particularly given regulatory, compliance, and data security considerations.

Source: September 2025 Schwab Advisor Services Independent Advisor Outlook Study

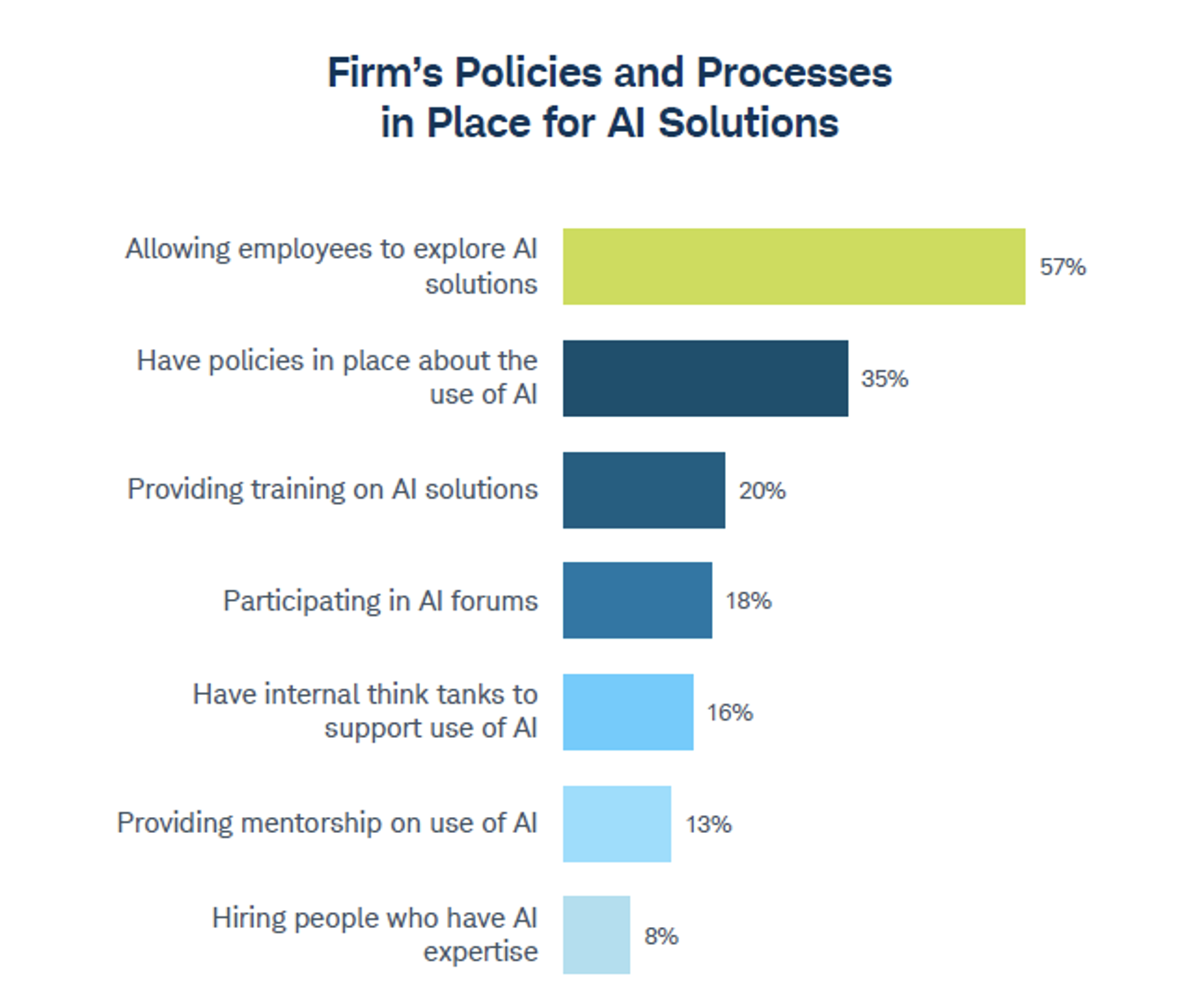

Current approaches to AI governance and process development highlight a clear contrast between experimentation and formalization. While 57% of firms allow employees to actively explore AI solutions, only 35% report having formal policies in place governing AI use, and 20% have begun providing training. This pattern suggests that the majority of firms are creating room to experiment and learn before AI becomes a more embedded part of day-to-day operations.

As RIAs continue to invest in technology, the composition and purpose of their technology infrastructure has become an increasingly important strategic consideration. Decisions around how systems are integrated, how new tools are adopted, and how technology supports growth and client service are shaping how firms operate and scale.

In this context, a firm’s technology stack refers to the collection of core systems and specialized tools used to support portfolio management, trading, reporting, compliance, client communication, and other operational functions. Rather than relying on a single all-in-one platform or assembling a patchwork of standalone solutions, many RIAs are gravitating toward a hybrid approach to their tech stacks. This model combines a stable, integrated core system with select specialized tools, allowing firms to balance efficiency with flexibility as needs evolve.

Source: September 2025 Schwab Advisor Services Independent Advisor Outlook Study

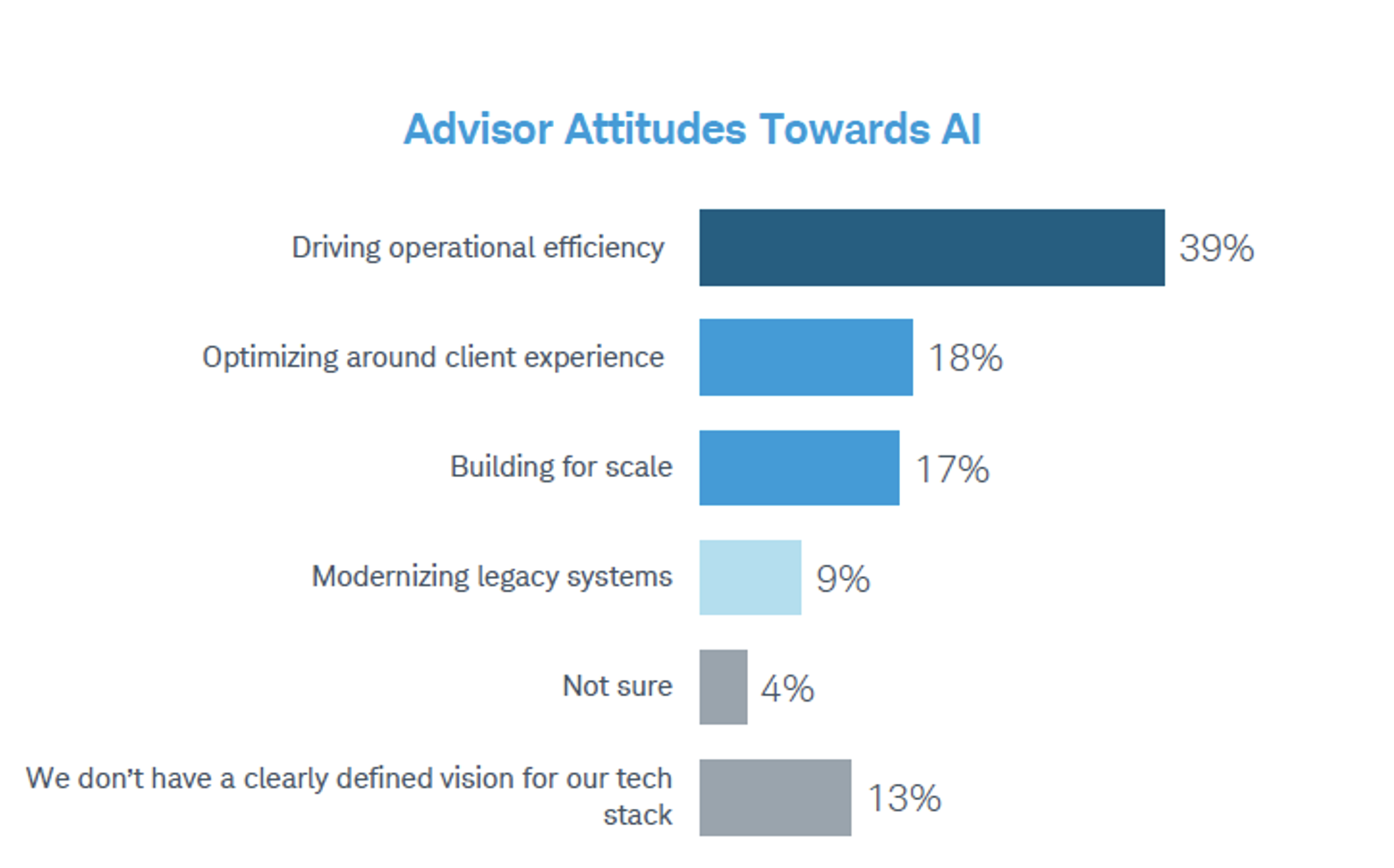

Advisor priorities around investments in technology point toward practical outcomes. Improving operational efficiency ranks as the leading objective, cited by 39% of firms, followed by efforts to enhance the client experience (18%) and build infrastructure that can support scale (17%). Fewer firms are focused primarily on modernizing legacy systems (9%), and 13% report that they do not yet have a clearly defined vision for their technology stack, underscoring the range of maturity levels across the industry.

As the wealth management industry moves into 2026, technology strategy and the use of AI will continue to influence how RIAs operate and scale. Firms that take a disciplined approach to building their technology stacks and incorporating new capabilities will be better positioned to adapt as industry conditions continue to evolve.

About Mercer Capital

We are a valuation firm that is organized according to industry specialization. Our Investment Management Team provides valuation, transaction, litigation, and consulting services to a client base consisting of asset managers, wealth managers, independent trust companies, broker-dealers, PE firms and alternative managers, and related investment consultancies.

RIA Valuation Insights

RIA Valuation Insights