Dividend Recaps Can Unlock Value

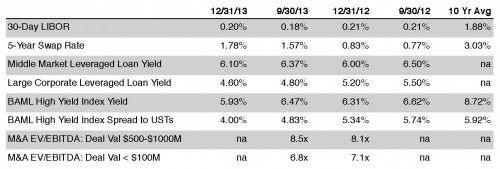

When announcing its decision to initiate the taper process with a reduction of $10 billion in monthly bond purchases on December 18, 2013, the Federal Reserve emphasized “forward guidance” that the fed funds target rate will remain unchanged at 0% to 0.25% for an extended period. As a result, capital markets may remain well bid with below average volatility and credit spreads that remain relatively tight in a very low rate environment.

One permutation of the Fed’s policy is that adding leverage to corporate balance sheets is inexpensive even though the ethos post-crisis is de-leveraging among consumers and corporations. It is especially inexpensive if borrowing is obtained via a bank revolver with a multi-year commitment and 30-day LIBOR as the base rate. According to Thomson Reuters, leveraged loan issuance (debt > 4.0x EBITDA) was $1.14 trillion in 2013, up from $664 billion in 2012. About two-thirds of the issuances were attributable to refinancing activity vs. one-third of “new money” issuances.

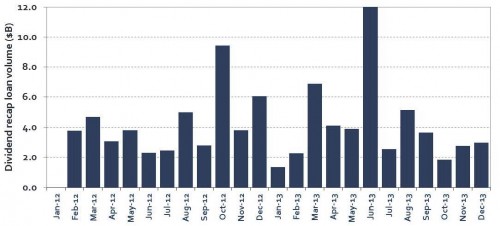

Private equity investors have taken note and have been the primary force behind an increase in dividend recaps that gained traction in 2012 as firms borrowed from banks and the corporate bond market to fund large distributions. As shown in Figure 1, the trend has continued in 2013, though it has slowed the past few months. Dividend recapitalizations totaled $50 billion in 2013 compared to $47 billion in the 2012. It may be that the pick-up in IPOs and perhaps a hoped for increase in M&A by private equity investors has led to a little bit lower dividend recap activity lately.

Figure 1

Dividend recaps can be an attractive transaction for a board to undertake to unlock value, especially since multiples for many industries have recovered to pre-crisis levels while borrowing rates are very low and most banks are anxious to lend. In addition, dividend recaps allow privately held businesses to convert “paper” wealth to liquid wealth and thereby facilitate diversification.

Dividend recaps raise solvency and possibly fairness issues if an alternative transaction was under consideration. In a future edition of the Transaction Advisor we will take a look at solvency specific issues. Nevertheless, given the implications of a recap transaction a financial advisor’s views should be solicited as part of a board’s duty to its shareholders to make an informed decision.

Figure 2