How ESOPs Work

ESOPs are a recognized exit planning tool for business owners, as well as a vehicle for employees to own stock in their employer company. However, most business owners and their advisors are unfamiliar with how an ESOP works. The mechanics of an ESOP can vary somewhat, but there is a basic common functionality to all ESOPs. Below, we discuss the mechanics of leveraged and non-leveraged ESOPs.

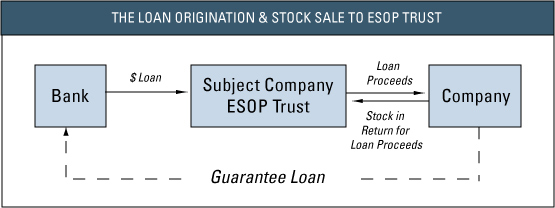

Most ESOPs are leveraged and involve bank financed purchases of either newly issued shares, or more often, the stock of a selling shareholder. The Company funds its ESOP via annual contributions as a qualified retirement plan and the plan effectively uses those funds to repay the debt used for the purchase.

Leveraged ESOPs tend to be more complicated than non-leveraged ESOPs. A leveraged ESOP can be used to inject capital into the Company through the acquisition of newly issued shares of stock. Figure 1 illustrates how the initial leveraged ESOP transaction typically works.

Subsequent to the initial transaction, the Company makes annual tax deductible contributions to the ESOP, which in turn repays the loan. Stock is allocated to the participants’ accounts — just as it is in a non-leveraged ESOP — enabling employees to collect stock or cash when they retire or leave the Company. ESOP participants have accounts within the ESOP to which stock is allocated. Typically, the participant’s stock is acquired by contributions from the Company — the employees do not buy the stock with payroll deductions or make any personal contribution to acquire the stock. An exception to this norm could involve roll-overs of participant’s funds from alternative qualified plans sponsored by the Company. Plan participants generally accumulate account balances and begin a vesting process as defined in the plan. Contributions, either in cash or stock, accumulate in the ESOP until an employee quits, dies, is terminated, or retires. Distributions may be made in a lump sum or installments and may be immediate or deferred. The typical annual flow of funds for a leveraged ESOP is illustrated in Figure 2.

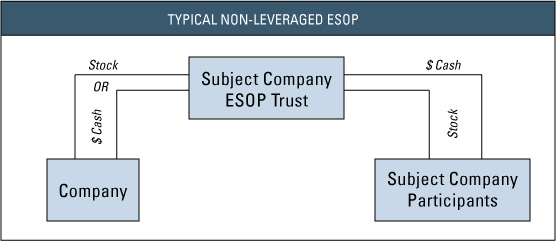

Although non-leveraged ESOPs have certain tax advantages to selling shareholders, they generally tend to be an employee benefit, a vehicle to create new equity, or a way for management to acquire existing shares. The Company establishes an ESOP and either makes annual contributions of cash, which are used to acquire shares of the Company’s stock, or makes annual contributions in stock. These contributions are tax deductible for the Company. As in a leveraged ESOP, the employee/participant vests according to a schedule defined in the plan document, and stock accumulates in the account until the employee/participant leaves the Company or retires. At that time the participant has the right to receive stock equivalent in value of his or her vested interest. Typically, ESOP documents contain a provision called a “put” option, which requires the plan or the Company to purchase the stock from the employee after distribution if there is no public market for it, thus enhancing the liquidity of the shares. Figure 3 illustrates a non-leveraged ESOP.

As ESOP participants roll out of the plan at termination or retirement, the ESOP or the Company purchases the employee’s plan shares based on the terms specified in the plan document. Plan design and administration are crucial to a successful ESOP experience and require the participation of specialized financial and legal advisors.

As with all qualified retirement plans, there are rules and requirements pertaining to annual contribution limits, vesting, share allocation, plan administration, and other functional aspects which are beyond the scope of this overview.

Sellers of stock to an ESOP may enjoy certain tax benefits related to their sale proceeds, and the Company (the sponsor) may enjoy tax benefits related to its contributions to the ESOP. Thus, ESOPs are often postured by business advisors as a tax advantaged exit strategy. Please refer to other articles on Mercer Capital’s website or contact me or Tim Lee for more information.

Mercer Capital is itself an employee-owned firm. We value scores of ESOPs annually and provide fairness opinions and other valuation services on a regular basis to many other plans. To discuss a valuation issues in confidence, give me a call at 901.322.9716.

Reprinted from Mercer Capital’s Value Matters (TM) 2009-03, published March 31, 2009.