Mercer Capital Study Finds Community Banks Dominated by Recession in 2008

As the world hoped to return to normalcy after a turbulent 2007, 2008 proved to be a worse year for bankers. A credit crunch and housing collapse maintained the downward pressure on stock prices that began in 2007. 2008 saw the closure of 25 banks nationwide, and the overall banking industry has struggled with deteriorating asset quality and liquidity concerns. In order to gauge the impact of the 2008 financial institution market trends on smaller institutions, Mercer Capital conducted a study of two asset size based bank indices: banks with assets between $500 million and $1 billion (referred to hereafter as the “Small Community Bank Group”) and banks with assets between $1 billion and $5 billion (the “Large Community Bank Group”).

The banking industry made headlines throughout the second half of 2008. The struggles of Freddie Mac and Fannie Mae necessitated nationalization of the two government-sponsored enterprises, and the failures of IndyMac Bank and Washington Mutual Bank fueled the erosion of confidence in the banking industry. Furthermore, the acquisitions of Merrill Lynch by Bank of America and Wachovia by Wells Fargo signaled consolidation in the banking industry in order to survive the economic uncertainty.

In an attempt to provide assistance to the banking industry, the government developed several programs to improve banks’ asset quality and capital positions. Under the Emergency Economic Stimulus Act of 2008, the Troubled Asset Relief Program (“TARP”) was developed with the intention of cleaning up the balance sheets of banks by removing troubled assets from the books. Because pricing the troubled assets was difficult given economic uncertainty, the initial structure of the TARP was abandoned shortly after the program was established. Instead, the Capital Purchase Program under the TARP attempted to provide stability for financial institutions by providing capital injections.

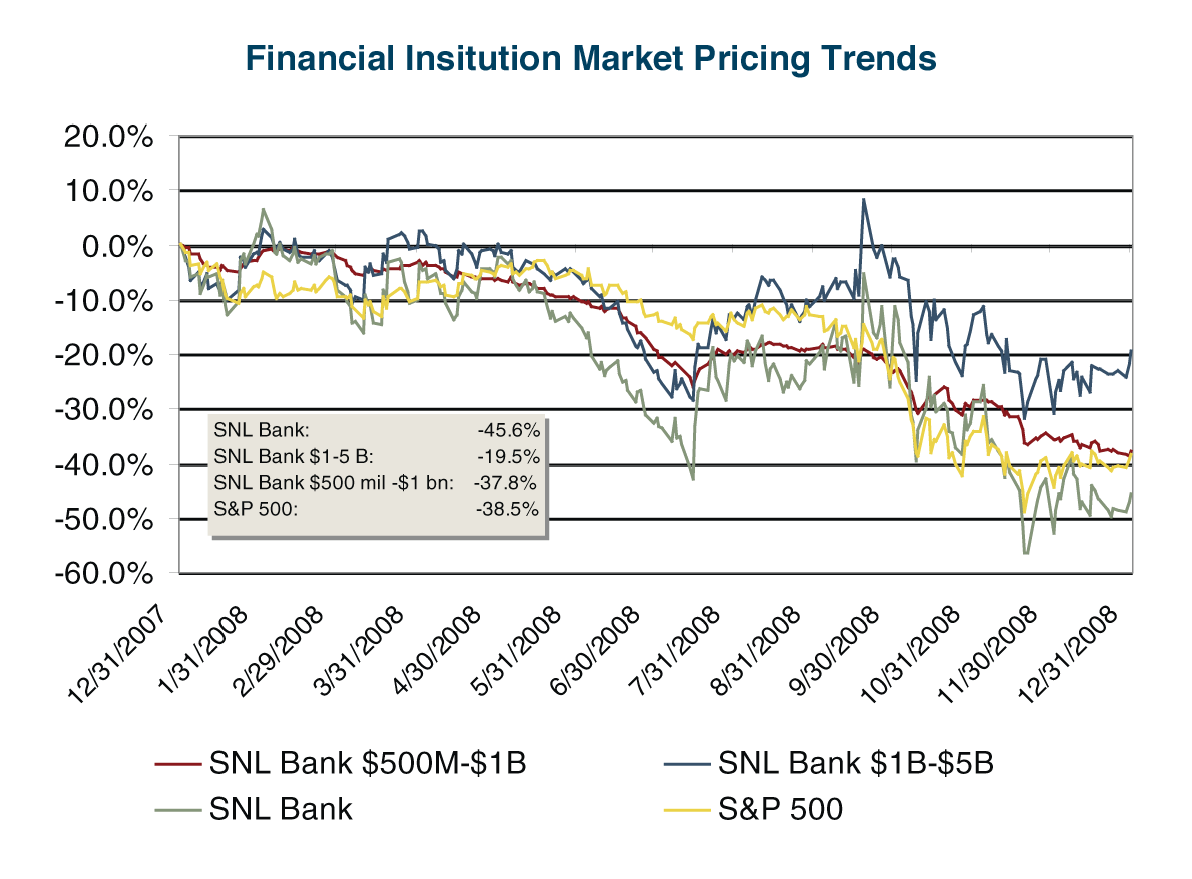

Figure One depicts market pricing trends of financial institutions during 2008. As shown, the Large Community Bank Group saw a price decline of 19.5%, outperforming the overall market, as measured by the performance of the S&P 500, as well as the banking industry, as measured by the SNL Bank Index. For comparison purposes, the SNL Bank Index saw a 45.6% decline in price due primarily to the decline in value of a number of large institutions, and the S&P 500 saw a 38.5% decline in 2008. The Small Community Bank Group observed a decline of 37.8%, reflecting their poorest performance in the last decade.

In order to attempt to isolate the driving trends behind the market performance of these institutions in 2008, we stratified the banks in each group based on TARP participation, asset quality metrics, loan portfolio concentrations, and location. Banks with unavailable financial data were excluded from our stratification, and the resulting analysis included 160 banks in the Large Community Bank Group and 84 banks in the Small Community Bank Group. The following discussion summarizes our findings.

- TARP Participation. As TARP regulations continue to unfold, our study revealed several interesting trends in bank stock pricing among participants in the program. More banks in the Large Community Bank Group elected to participate in the TARP program than the Small Community Bank Group (58.8% compared to 42.9%). For the Large Community Bank Group, participating banks saw a median price decline of 31.9% compared to declines of 34.8% for banks that opted not to apply and 17.5% for banks that declined the funds after being approved. Banks that applied but had not been approved at the time of our analysis saw a median price decline of 76.3%. For the Small Community Bank Group, participating banks also had a larger decline (44.9%) than those that were approved but had not accepted the funds (23.3% decline) as well as banks that opted not to apply (29.4% decline). Banks that applied but had not yet been approved for TARP experienced a 64.3% decline in the median price.

- Asset Quality. 2008 highlighted the importance of strong asset quality in a weak economy. In the Large Community Bank Group, banks with strong asset quality (non-performing assets measuring less than 2.00% of leans plus OREO) experienced a median price decline of 3.9%. On the other hand, those with weak asset quality (non-performing assets measuring greater than 2.00% of leans plus OREO) experienced a median price decline of 51.5% over the same period. In the Small Community Bank Group, banks with strong asset quality (31.1% decline) outperformed those with weak credit quality (51.3% decline). Although most banks experienced stock declines, asset quality did affect the banks’ stock performance relative to the banking industry. For the Large Community Bank Group, 60% of banks with weak asset quality were outperformed by the SNL Bank index, compared to 14% of banks with strong asset quality. The Small Community Bank Group exhibited similar results, as 59% of banks with weak asset quality underperformed the SNL Bank index while only 13% of banks with strong asset quality were outperformed by the SNL Bank index.

- Construction and Development Loans. With aversion to risk among the most pressing issues in 2008, banks increased their standards for loans among the economic turmoil as loan losses continued to rise. The deterioration of the housing market continued to generate problems for construction and development (C&D) loans, in particular. The number of banks with high C&D concentrations (more than 40% of the loan portfolio) is limited due to data constraints as well as changes in loan portfolio composition during 2008 and meaningful comparisons were available only for the larger community banks. Six banks in the Large Community Bank Group were identified as having high C&D concentrations. The median price decline for these banks was 75.6%, compared to 29.8% for those banks with lower C&D loan concentrations.

- Commercial Real Estate Loans. Much like C&D loans, commercial real estate loans continued to generate high loan losses due to spreading real estate problems. Again, data for banks with high CRE concentrations is limited and meaningful comparisons were available only for the larger community banks. Of the Larger Community Bank Group, nine of the banks considered in this analysis reported commercial real estate loans comprising more than 50% of their entire loan portfolios. These banks experienced a median price decline of 49.9%, compared to the 30.2% decline for banks with lower CRE concentrations.

- Location. Location proved to be less important in 2008 than in 2007 as the economy as a whole was affected with the gloom of a recession. Although the hardships could be felt nationwide, the identified high-risk locations (California, Colorado, Florida, Georgia, Michigan, and Nevada) continued to experience higher declines in stock prices than the broader asset-size groups. For the larger banks, those in high-risk locations had a 49.1% decline as compared to a 34.3% decline for banks overall within the asset size group. For the smaller banks, those in high-risk locations experienced a 61.2% decline in price compared to the median price decline of 42.3% for all banks within the asset size group.Looking forward, 2009 could prove to be another difficult year for banks. Within the first four months of 2009, 29 banks failed, exceeding the number of bank failures during the full fiscal year 2008. As evidenced by early 2009 data, market pricing for financial institutions has declined further and exhibited greater volatility due to significant uncertainty regarding banks’ solvency and the government’s efforts to support financial institutions and the credit markets. By March 6, 2009 the SNL Bank Index hit a low, with a 59.6% decline from the beginning of the year. By April 30, the SNL Bank Index had increased 91.1% from March 6, exhibiting a total decline of 22.8% from the beginning of the year.

Given market volatility and uncertainty about the effects of new regulations and government support, investors have limited confidence in the overall market. The government is continually amending the TARP regulations and has begun performing stress tests on some of the largest financial institutions to examine banks’ ability to cope with various changes in the economy and try to improve capital positions. As the events of 2009 unfold in accordance with government programs and regulations as well as continued consolidation, the banking industry hopes for improved performance in the second half of 2009.

Reprinted from Mercer Capital’s Bank Watch, Special Edition, May 19, 2009.