Use the Interim Time Between Now and the Future Sale of a Business to Wisely Prepare

Is business ownership a binary thing? Do we either own our businesses or not? The binary notion leads business owners to think either in terms of either the status quo or of an eventual sale of the business.

The truth is that between the two bookends of status quo and an eventual third-party sale are many possibilities for creating shareholder liquidity and diversification and facilitating both ownership and management transitions. We call this time “interim time.” The literal translation of “interim” from the original Latin means, “the time between.” Interim time, then, is the time between now, or the current status quo of a business, and an ultimate sale of that business. Let’s look at the bookends:

- Status Quo. First, let’s talk about the either. The status quo may be an excellent strategy. If sales and earnings are rising, existing owners can benefit from the growth and expected appreciation in value and maintain control of the business. However, the status quo, in many instances, does not provide liquidity and diversification opportunities for owners and places all execution risk on them. A decision to maintain the status quo for your business may not do much to advance necessary ownership and management transitions, as well. A decision to maintain the status quo should be based on conscious decision making and not on procrastination. And the status quo has an insidious side to it – unless you and the other owners do something, you will stay in the status quo for a long, long time; therefore, you have to question the status quo on an ongoing basis.

- Ultimate Third-Party Sale. Now, let’s talk about the or. If your business is continuing in a status quo mode, chances are you are not preparing it for an eventual sale. After all, it will happen someday, but not in the foreseeable future. Chances are also that you and the other owners may not be preparing yourselves for an eventual sale. And if you are maintaining a status quo status, you may not be able to influence the timing of an eventual sale. The ideal time to sell a business is when the markets are hot, when financing is readily available, when your business is tracking upward and has a good outlook, and when the owners are ready. In reality, what you can hope to achieve in a sale of your business is the best pricing available in the market at the time of the sale. If you remain in the status quo, you may not get to choose the timing of the eventual sale.If it seems like we are painting an eventual third party sale as an unfavorable outcome, we are not. It can result in an unfavorable outcome, however, if your business is not ready for sale at the given time and if you and your other owners are not ready, personally, for that eventual sale.

What to Do in the Interim Time

Managing illiquid, private wealth in private businesses is far more than running the businesses themselves. We all have to manage our businesses. Managing the wealth in our businesses requires a much more active role for business owners and often a different level of attention on the business itself.

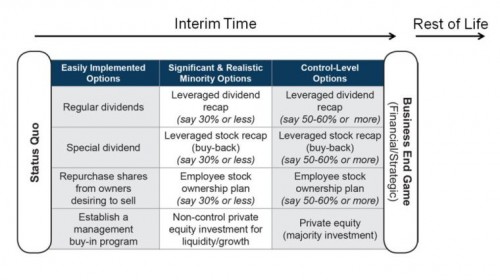

The status quo and an eventual third-party sale are, indeed, bookends. Consider the table.

If we are managing the wealth in our closely held and family businesses, we will be focused on creating liquidity opportunities over time and on achieving reasonable returns from our companies on a risk-adjusted basis. We will be using our companies as vehicles to generate liquid wealth and diversification opportunities over time.

The table shows the bookends of status quo and third-party sale options. In between are a number of options that owners of successful private companies can use to manage the wealth tied up in them and to create ongoing opportunities for liquidity and diversification.

At the far right, after the sale of a business, its owners must, in many cases, be prepared for the rest of their lives. So it is important to run a business in such a way that its owners develop liquidity and diversification to create options for the rest of their lives.

The table is certainly not all inclusive, but it does include some easily implementable options like establishing a dividend/distribution policy or making occasional share repurchases as owners need some liquidity or, for example, when an owner leaves the company. This purchase might be pursuant to the terms of a buy-sell agreement.

If your company has significant excess assets, it is probably a good idea to clean up your balance sheet and declare a special dividend. And it may be appropriate to have one or more key managers acquire small stakes in the company to facilitate alignment and future management transitions.

I call these options “easily implementable,” but they won’t happen unless someone does something.

The next category of options in the table above are termed “significant and realistic minority options.” They include relatively small leveraged dividend recapitalizations or share repurchases. The options also might include the creation of a 30% or less ESOP in appropriate circumstances. These transactions certainly won’t happen without someone doing something. They will likely require the assistance of outside expertise, and there will be certain transaction costs. Transaction costs should be considered in the context of investments.

The third category after the status quo is called “control level options.” For some successful private companies, it may be appropriate to engage in substantial transactions to create liquidity opportunities and to retain ownership in expected future growth and appreciation. Options here include:

- Leveraged share repurchases

- Leveraged dividend recapitalizations

- Employee Stock Ownership Plans

The final category is the bookend of third-party sale transactions. It should now be clear that there are options other than selling a business today, or simply maintaining the status quo, for managing the illiquid wealth in your private company.

Benefits of Focusing on Interim Time

The shareholder benefits of employing one or more of the above strategies over time include the following:

- Acceleration of cash returns, liquidity opportunities, and opportunities for diversification and creating liquidity independent of your company

- Ability for your owners to diversify their portfolios

- Optimization of your company’s capital structure with reasonable leverage

- Enhanced return on equity with reasonable leverage

- Enhanced earnings per share for some options

- Planned changes in ownership structure with shareholder redemptions, with remaining owners achieving pickups in their relative ownership of the company

- Enhanced performance and reduced business risk with focus on the business

Employing one or more of the above The One Percent Solution strategies is tantamount to using modern investment theory concepts and basic corporate finance tools in the management of illiquid private company wealth.

For more information or to discuss a valuation and transaction issue in confidence, please do not hesitate to contact us.