Correlation of Value | Appraisal Review Practice Aid for ESOP Trustees

This article first appeared as a whitepaper in a series of reports titled Appraisal Review Practice Aid for ESOP Trustees. To view or download the original report as a PDF, click here.

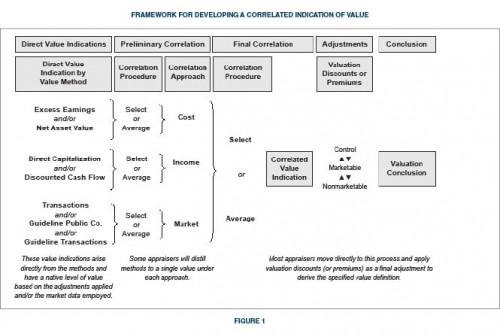

The correlated indication of value is a value that is arrived at through some reasonable, well-articulated, replicable, and credible process of selection, averaging or otherwise, of the total valuation evidence generated from the valuation methodologies employed. Correlating a valuation conclusion that subsumes all the information, processes, analyses, and market evidence in a valuation engagement is no simple task. The term used by some appraisers for the resulting valuation distillation is “correlated indication of value.” For valuations in which the value methodology directly results in the value definition specified in the engagement, the correlated indication of value may represent the final conclusion of value. For cases in which the value definition differs from the direct results of valuation methodology, the correlated indication of value is typically adjusted by valuation discounts or premiums (typically the former) to develop the value definition specified in the engagement. Figure 1 depicts the typical correlation framework. There are numerous variations and potential interjecting steps and adjustments.

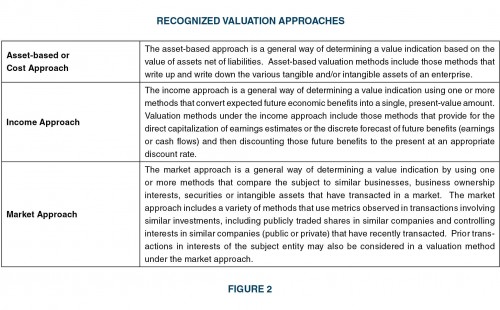

In operation, developing a correlated indication of value may appear reasonably straightforward (sometimes it is), but the considerations in the process can reach back to the smallest of details and considerations in the underlying valuation methodologies. A brief review of the global valuation approaches provides a good review for the subsequent observations. Figure 2 presents the three valuation approaches.

Global Considerations in the Correlation Process

The following provide some global considerations used by many appraisers to navigate the correlation process (which is not to say all are best practices).These points are not listed in any order of significance because the priority of consideration changes with every appraisal.

Nature and Industry of the Subject Business

- Manufacturing, distribution, retail, service, professional, contracting, etc. Differing business models have differing value drivers and differing financial infrastructures.Some methods will be the primary or sole path to value for some types of businesses.

- The relative asset-intensity of a business may influence the selection of valuation methods. Manufacturing concerns make capital investments differently than do professional service firms; the methods weighed should reflect this basic reality.

- All businesses have resources at risk in the marketplace and should by logical extension rely on earnings (cash flow) as the core driver of value. In other words, the capitalized cash flow of the subject company should at least validate the value of underlying net asset value. In a very real sense, the value of capitalized cash flow defines the value of underlying net assets, based on risk, return, and growth parameters. Yet many businesses, at different points in their life cycles, are more appropriately valued based on (or with partial reliance on) underlying net assets. It is the job of the appraiser to determine the driver(s) of value in general and on a given valuation date and to utilize that perspective in fashioning a conclusion.

- Although all firms employ assets to generate profits, some are better at it than others. The store of value in hard assets can serve to sustain value (or soften downturns) for many types of businesses, particularly in times when profits are low or non-existent. For businesses lacking significant hard assets (and other balance sheet resources), a lack of earnings or cash flow, when coupled with poor business prospects, likely means a lack of value.

- Businesses that hold assets are typically valued using the appraised values of the underlying assets and/or on asset values that can be readily evidenced from an active, observable market. In such cases, a singular method such as the net asset value method may be employed. Additional analysis based on income and market methods may be used to support valuation discounts that are applied to the direct asset-based value indication.

- Most closely held businesses are too small or narrow in focus to be valued using the market approach. Accordingly, many (most) appraisals do not employ the guideline public company method. In similar fashion, other market methods may not apply either.

Stage of Business Maturity and Development

- Mature businesses with established performance may be valued using methods that are not appropriate for early stage businesses or businesses in decline.

- Start-ups or liquidating business should be valued using methods that capture the eventual or ultimate expected economic norms or outcomes for the business.In such cases, there is little correlation required because only one method may be used.

Position in Industry or Economic Cycle

- Businesses that display periodic down cycles may be valued with more weight placed on balance sheet indications of value, particularly when projected performance is uncertain or lacking all together.However, income methods showing little to no value may be weighted as a proxy for lack of control issues (also known as minority interest discount), to capture appraiser concerns regarding the economic obsolescence of assets, or to capture anticipated financial losses for the period of time until a return to profitability or stabilized performance is can be expected to be achieved.The weighting of low-to-no value income methods serves to effectively discount the asset-based method in many valuations.

- Businesses performing at historic average levels and/or with continuing expectations for stability will likely be valued using income methods or with market methods that focus on earnings and cash flow.

- Businesses in high or low cycles may be valued using discrete projection methods that adjust the business up or down over time toward a steady state of performance that is more in keeping with proven history or is better aligned with industry performance and/or expectations.

Nature of Underlying Adjustments in the Valuation Methods

- All valuation methods require underlying adjustments. Asset-based methods follow a mark-to-market discipline. Income methods may be adjusted for unusual expenses. Projections may be more or less believable in the context of history and external market expectations. Market methods may rely on market evidence that is not directly comparable or is unreliable due to an economic or industry shock.

- The point is that many valuations include methodologies and results that are more or less speculative than other methods. This can be acute when a business is at a peak or trough in its cycle.

- Under the ubiquitous standard of fair market value, appraisers must take into account the balance of considerations from both the hypothetical buyer’s and hypothetical seller’s perspectives.

Standard and Level of Value (The Value Definition)

- An appraisal performed using the controlling interest level of value may rely more heavily on the higher value indications than on the lower value indications. This kind of consideration may serve as a proxy for the highest and best use or operation of the underlying business assets.It can also lead to error and/or alleged bias.

- Conversely, a minority interest value definition may influence the consideration of lower value indications or indications from methods that are believed more reflective of the expectations of investors who lack the prerogatives to bring about the changes or choices that might otherwise increase the indicated value.This too, can lead to error and/or alleged bias.

- Some appraisals are performed for specific purposes using a standard of value other than fair market value. In such cases, certain methodologies may be dictated and others prohibited. Fair value under FASB reporting requirements may require considerations and perspectives very different than under fair market value. Fair value (yes, a different “fair value”) under operation of law (either by statute or judicial guidance) can vary from state to state and from issue to issue.Dissenter’s rights, marital dissolution, securities fraud, and other matters in which an appraisal is developed for expert consulting or expert witness purposes may require unique valuation considerations and often include specific instruction from legal counsel concerning what “counts” in the calculations and how.In matters requiring a very specific set of defining elements, the value definition must be top of mind when developing or reviewing the work product, which is often a scope of report other than the typical appraisal opinion.

The Quality and Availability of Subject Financial Data

- The lack of proper financial reporting does not provide license for an appraiser to resort to obtuse measures such as total assets or gross sales as a foundation for establishing value.

- Some situations may require consideration of broad financial measures and/or somewhat remote market evidence as a basis for speculating on value when the quality of net worth and /or the visibility of cash flow are obscured. Such situations may require the valuation to be qualified as falling short of a formal appraisal opinion under most professional standards.

- In other cases, an appraiser simply has to operate with the available information.

These considerations are based on experience, observations of public and private markets over time, and a dose of informed judgment; differences, both semantic and substantive, can exist from one appraiser to the next. One could ask: When should a valuation not reflect balanced consideration of all approaches and methods? The right answer is – never. It is always helpful to assess the value indications from all approaches and methods in the context of one another. However, consideration and direct reliance are different things. In many cases, there is simply not ample information, market evidence, or cause to develop values under each approach.

Appraisers owe the users of their reports a credible explanation of where reliance was placed and in what proportion. There are times when financial information and valuation evidence suggest that brevity is the high road and that too much analysis along lines that are ultimately not relied upon in the valuation is confusing or misleading. Appraisers simply must use the judgments extended them by the appraisal standards to present a complete picture of the relevant methodological landscape. However, appraisers and their audiences benefit from the use of a core set of processes and considerations for deriving and displaying the correlation of value.

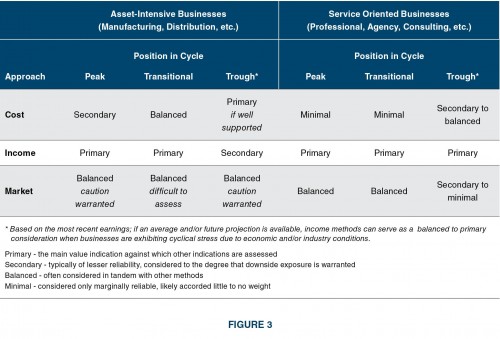

The table in Figure 3 is provided for perspective. We note that the valuation of most business enterprises is ultimately driven by the economic returns generated on the assets that comprise the business. As such, the income approach is the primary indicator of value in most business appraisals where the business is a going concern and not simply a fund of underlying net assets. Unfortunately, the income approach can be difficult to model in certain circumstances such as a recession.

For ESOP appraisals, the above perspectives can be shift based on the comfort and confidence of the appraiser/trustee in the company’s ability to maintain a sustainable ESOP benefit. Repurchase obligations ultimately require cash flow. Depending on the overall design and management of the ESOP plan, appraisers and trustees are cautioned when relying on asset-based value indications without taking into consideration the ability of the company to sustain the asset base when cash flows fall short of servicing the ESOP’s needs, let alone the needs of the business. ESOP companies that experience a decline in business activity and which have little prospects of recovering to past performance levels (or worse, remaining a going concern) should likely include consideration of a liquidation premise. The liquidation premise is often developed and studied using an asset value perspective, adjusted for the time-value and liquidation consequences that could befall the assets as they are sold. Such a premise need not be a death sentence for the ESOP or the Company, but may relevant to consider during a time of reorganization for the sponsor company.

When businesses are displaying significant volatility and/or a fundamental change in business posture (particularly on the downside), appraisers and trustees are encouraged to communicate about the underlying methodology and the potential need to redefine the level and premise of value for the appraisal. Such changes could materially rebalance the consideration of the underlying approaches and methods toward the conclusion.

Correlation Examples

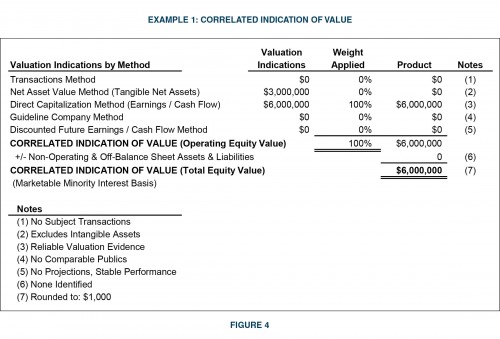

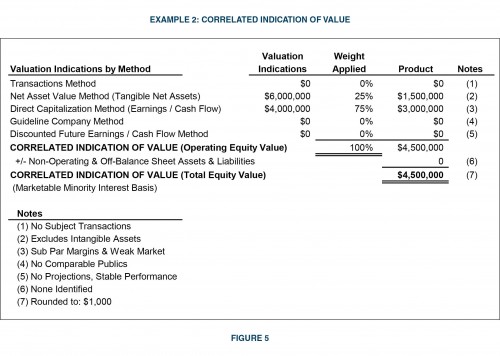

Following are some typical examples of a correlated indication of value. We have provided differing examples based on varying scenarios. The numerical values and weights are for demonstration purposes; the weights applied are not based on any rigid formula and will vary for each appraisal based on the totality of underlying factors for each appraisal.

Example 1 in Figure 4. Small to medium service business; stable market, consistent performance and expectations; valuation definition is FMV minority interest, correlated value before discount for lack of marketability.

Example 2 in Figure 5. Small distribution business; challenging market conditions and sub-par expectations; company owns real property and other fungible assets; valuation definition is FMV minority interest, correlated value before discount for lack of marketability.

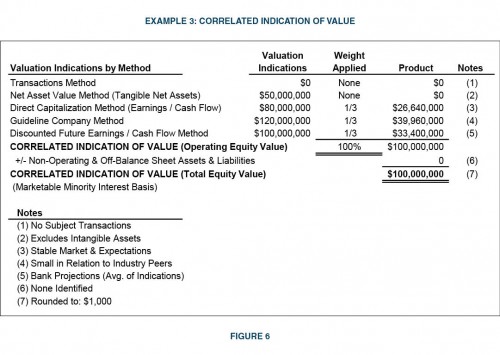

Example 3 in Figure 6. Large producer of value-added capital assets; stable markets and expectations; advanced financial management and capital resources; value definition is FMV minority interest, correlated value before discount for lack of marketability.

In Figure 6, we can see that the income approach was allocated two-thirds of overall weighting. Looking deeper, if the GPCM exclusively considered cash flow calculations (say net earnings and EBITDA), then income measures were effectively weighted 100 percent in the overall valuation; the only difference being the specificity of the market evidence used to value the income and cash flows.

For cases in which the GPCM is used, there may be reasons that some calculations should receive greater underlying consideration than others (say capitalized book value rather than EBITDA). This may simply be a variation of the same theme of shifting weights between asset-based and income-based methods to address issues related to business and economic cycles.

Variations on these examples are almost endless. There are often circumstances in which value indications vary greatly and require thoughtful explanation about why a value that appears at one end of a spectrum was exclusively weighted.

In some cases, a simple average might be appropriate but appraisers should be cautious when averaging a potentially non-meaningful indication with a meaningful indication.

Rarely does the averaging of an unreliable indication make the end result correct unless additional explanation and support are provided about how the resulting correlation relates to the most meaningful valuation evidence.

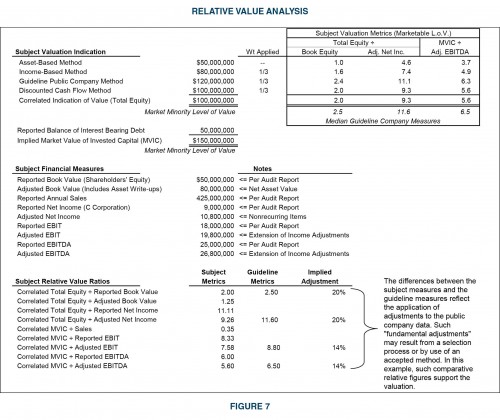

Accordingly, a relative value analysis, as in Figure 7, may be a useful tool in helping explain how each indication relates to other indications. Let us expand on the third example with some additional information to see how the various indications compare to each other. Such a comparison could be used in an iterative fashion to reach a final weighting scenario as well as to provide support for the conclusions reached in the report. Note that the relevant comparisons are being made at the marketable minority interest level of value.

At the marketable minority interest level of value, the subject’s relative value measures can be directly compared to the relative value measures of the guideline public companies.

Relative value assessments that compare subject valuation results to peer valuation evidence must be performed using an appropriate and comparative level of value for both the subject and the peer.

Section 5 of Revenue Ruling 59-60 addresses the weight to be accorded to various factors in an appraisal. In the context of an operating company appraisal, judgment is required to reconcile what may be diverging indications of value among the various valuation approaches (or even methods within a single approach or method).

Although averaging widely diverging indications of value from various valuation methods may be appropriate in a particular valuation, appraisers should assess why such large differences exist. Do indications from the market approach suggest that assumptions made in methods within the income approach be revisited? Or do the results from an income approach shed light on the appropriate fundamental adjustment (or selection of guideline companies)?

Within the market approach, indications of value can vary widely, depending on the financial measure capitalized. The appraiser may glean hints with respect to the weight to a particular indication by considering why such differences occur. Differences between indications derived from capitalized net income and EBIT are a function of the financing mix.

Differences between indications derived from EBIT and EBITDA may reveal varying degrees of asset intensity. Capitalized revenue measures provide a view of “normalized” margins – are the margins of the subject company likely to improve or deteriorate? Finally, capitalizing measures of physical volume (number of subscribers or units sold, for example) could reveal unit-pricing disparities between the subject and the selected guideline companies.

There can be no fixed formula for weighing indications of value from various valuation methods. Responsible appraisers, recognizing this, should apply common sense and informed judgment in developing a correlated indication of value.

Conclusion

Given the potential diversity of valuation evidence and methodology in most business appraisals, a well-reasoned and adequately documented process is required to support the initial and final valuation conclusions derived in a business valuation. In this publication we provided insight on the functional processes and analytical considerations underlying the determination of a correlated indication of value. Additionally, we discussed methods and perspectives that can be used to justify the underlying methodology and valuation evidence relied upon while providing relative value observations to support the reasonableness of a valuation conclusion.