Embedded Capital Gains in Post-1986 C Corporation Asset Holding Companies

There has been a substantial controversy regarding the appropriate treatment of embedded capital gains in determining the fair market value of interests of C corporations since the repeal of the so-called General Utilities doctrine by the Tax Reform Act of 1986 (“TRA”). The Internal Revenue Service has long held the position that embedded capital gains, or “trapped-in gains”, are speculative in nature. According to this argument, in the absence of a specific plan for the liquidation of a C corporation’s assets, it is inappropriate to consider the embedded capital gains tax liability that will be incurred upon liquidation of that corporation’s assets. We refer to this argument as the IRS Position.

Many business appraisers, on the other hand, have suggested that embedded capital gains must somehow be considered in valuations of post-1986 C Corporation asset holding companies. The crux of their argument is that rational investors would consider the risks and realities of acquiring interests in corporations with significant embedded gains in their overall investment decision-making processes, regardless of whether a liquidation is imminent, or even reasonably foreseeable, over a relevant investment time horizon. Some appraisers have called for a complete recognition of embedded tax liabilities in the valuation of C corporation asset holding companies. We refer to this argument as the Business Appraisers’ Position.

This article will test both positions and examine whether no consideration, a partial consideration, or full consideration of embedded tax liabilities makes sense in the context of the definition of fair market value.

In this article, we will:

- Define what embedded capital gains are in the context of C corporation holding companies.1

- Briefly review the impact of the repeal of the General Utilities doctrine on the valuation.

- Review the basic arguments of the IRS Position and the Business Appraisers’ Position that have typically been advanced regarding the treatment of embedded capital gains as a liability in the determination of the net asset value of C corporation holding companies.

- Consider two very recent court cases that have leaned strongly in the direction of the Business Appraisers’ Position, allowing active consideration of embedded capital gains taxes.

- Offer logical “proof” that rational investors must consider embedded gains in their investment decisions regarding the acquisition of interests of C corporations.

What are Embedded Capital Gains? What are the Questions?

The financial statements of most corporations are maintained on the historical cost basis of accounting. Assets are recorded at their original costs, and then, their bases are adjusted over time by depreciation, amortization, capital improvements, and disposals or other transactions that impact carrying value (basis). In the case of asset holding corporations, where assets subject to appreciation are likely to be found (e.g., land, buildings, investment securities, etc.), there can be a growing divergence between the historical “book values” of assets and their current market values with the passage of time.

To postulate a simple example, assume that ABC, Inc., a C corporation, owns a parcel of land with an original cost basis of $100 thousand. Currently, this land has an appraised fair market value of $1.0 million. Under current tax law (see below), the difference between the historical cost basis and the current market value, or $900 thousand (i.e., $1.0 million of fair market value less the $100 thousand cost basis), represents a capital gain that is “trapped-in” at the C corporation level. The gain is said to be a trapped-in (or “built-in”) gain because it will be incurred if the parcel of land is sold inside the corporation. Such embedded gains are also referred to as “inside gains,” indicating that the gain occurs inside the corporation, and must be dealt with before funds are available for shareholders, either via distribution or in liquidation.

Assume further that the corporation’s tax accountant has told us that the tax rate on the embedded capital gain is 40%. We can now quantify the embedded capital gain tax liability at $360 thousand (i.e., the $900 thousand embedded gain times the tax rate of 40%). The fundamental questions raised by the controversy outlined above are:

- Should the $360 thousand embedded tax liability in ABC be considered in the determination of the fair market value of interests in the stock of ABC? If it should not be considered, this will be a very short article.

- If the embedded tax liability should be considered in fair market value determinations regarding ABC, how should it be considered, and what is the economic rationale for its consideration from the viewpoint of hypothetical willing investors? These first two questions deal with existing embedded capital gains.

- There is a third question that appraisers have been reluctant to raise in the face of the controversy regarding the first two questions. We will ask it here as part of the formal economic analysis of embedded gains that has been missing for so long, both in business appraisal reports and in Tax Court decisions. What is the appropriate consideration of future capital gains (that will become embedded as assets appreciate) in the determination of the fair market value of interests of a C corporation asset holding entity today?

Things are Different After 1986

During the period from about 1935 until the Tax Reform Act of 1986, corporations generally did not recognize gains on certain distributions of appreciated assets to their shareholders or on certain liquidating sales of property. The policy was based on a doctrine established in General Utilities & Operating Co. v. Helvering, 296 U.S. 200 (1935). Under the so-called General Utilities doctrine, assets were allowed to leave corporate ownership and to take a stepped-up basis in the hands of shareholders without imposition of a corporate-level tax. Under the General Utilities rule, it was usually feasible to avoid paying tax on otherwise trapped-in capital gains by effecting appropriate distributions of the underlying assets. This doctrine was the law of the realm for some fifty years.

In the Tax Reform Act of 1986, the Congress repealed the General Utilities doctrine under the theory that it undermined the corporate income tax. C corporations and their shareholders have been dealing with the reality of the repeal of the General Utilities doctrine ever since.

Prior to 1986, business appraisers and investors were not overly concerned with the issue of embedded capital gains. The reason was straightforward: significant embedded capital gains tax liabilities were avoidable through generally available elections under the General Utilities doctrine (26 U.S.C. x 337(a)(1958)).

Since 1986, the Internal Revenue Service has cited numerous Tax Court cases that disallowed consideration of embedded capital gains tax liabilities in fair market value determinations.2 Virtually all the cases frequently cited by the IRS deal with pre-1986 valuation dates. To jump ahead a little, we quote the very recent Court of Appeals case of Eisenberg, which is discussed in more depth below:

Now that the TRA [Tax Reform Act of 1986] has effectively closed the option to avoid capital gains tax at the corporate level, reliance on these cases in the post-TRA environment should, in our view, no longer continue.3

So, things are different economically since 1986 with respect to the embedded capital gains issue. However, until recently, the IRS and the Tax Court have consistently argued (at least in substance) that they are not.

The IRS Position

The basic arguments by the IRS for not considering the valuation impact of embedded capital gains have been consistent and simple:

Unless a liquidation of the underlying assets is imminently contemplated, the consideration of embedded capital gains is “speculative.” If the gain is speculative, it should not be considered today.

The economic argument is that the gain might never be realized and the tax might never be paid because no liquidation is presently contemplated. Further, if the tax is ultimately paid, it might happen at such a distance in the future that its present value would be minimal. Therefore, according to the IRS Position, embedded capital gains should not be considered in fair market value determinations.4

Embedded capital gains can be avoided by having a C corporation make an S election. Under transition rules, if the gains are realized ten years or more following the S election, they are subject to only the pass-through, shareholder level personal tax.5

The arguments of the IRS Position are simple. Unfortunately, they do not follow the basic definition of fair market value (see below) and have incorrectly focused the attention of appraisers and the Tax Court on irrelevant issues.

The Business Appraisers’ Position

The basic argument for considering the embedded tax liability related to an embedded gain in a C corporation flows from common sense: If the tax cannot reasonably be avoided, it must be considered in valuation. After all, the components of a fair market value transaction include:

A willing buyer and a willing seller, both of whom are fully (or at least, reasonably) informed of the facts surrounding the subject investment, neither of whom is under compulsion to engage in a transaction, and both of whom have the financial capacity to engage in a transaction. Based on these components, the hypothetical willing buyer and seller engage in a (hypothetical) transaction.

Following the passage of the TRA of 1986, the analysts at Mercer Capital, like those at many other appraisal firms, made calculations and judgments that led to the inevitable conclusion that if a substantial embedded gain existed in a C corporation asset holding company, it should be considered explicitly in the valuation of interests in that company. After all, how could a rational investor ignore the reality of embedded capital gains? Unfortunately, appraisers have been, collectively, as guilty of failing to formalize their valuation logic as has the Internal Revenue Service (with the exceptions noted below).

What has followed since 1986 has been a cat-and-mouse game over the issue. Many appraisers have routinely considered embedded capital gains taxes as liabilities in the determination of net asset value of C corporation holding entities since 1986. Given the frequency of occurrence of the issue of embedded gains at our firm and with other appraisal firms, we can only assume that most cases (ours and others) are either ignored or resolved prior to disputes rising to the level of Tax Court litigation. Unfortunately, the common element of the various embedded tax cases that have previously been heard by the Tax Court is the paucity of economic evidence from appraisers mentioned in the decisions.

The Valuation Literature

Very little has been written on the issue of embedded gains. A recent search found only a limited treatment of the issue in the valuation literature. The various valuation texts are virtually silent with respect to hard positions on the issue.

Responding to TAM 9150001, John Gasiorowski wrote an article in Business Valuation Review in 1993 which concluded:

Investors have access to alternatives. Under the economic principles of anticipation and substitution, investors will pay less to acquire an interest in a real estate holding company organized as a C corporation than for an equivalent interest in an identical entity organized differently. Because corporate level taxes affect strategic outcomes, the impact of corporate taxes must be considered in the valuation.6

In Shannon Pratt’s Business Valuation Update, we find this brief position:7

In most (if not all) cases, I believe that the liability for trapped-in capital gains taxes should be reflected in the value of the stock or partnership that owns the assets. However, the IRS, the U.S. Tax Court and many family law courts have not, at least as yet, fully shared this view.

and….

Consensus is building among appraisers that the built-in capital gains tax should be recognized one way or another, either in the form of a balance sheet adjustment or some type of a discount.

In a 1996 article in Estate Planning, William Frazier advanced the position that the built-in capital gains taxes should be considered as a liability in the valuation of closely held corporations. In the context of a thoughtful article on the subject, which examined the issue in the context of the definition of fair market value, Frazier concluded:

Courts uniformly should abandon the ill-founded notion that the built-in corporate capital gains tax not be allowed as a reduction in the value of the equity of a closely held company when liquidation is only speculative. The premise for this policy has been undermined with the repeal of General Utilities. Observations from the marketplace, which should be the primary source of value determination, clearly show that the application of outdated legal precedents and the IRS viewpoint espoused in TAM 91500001 is out of step with economic reality, resulting in tax valuations that are unjustly burdensome. Failing to take into account capital gains taxes will result in the continuation of an ambiguous policy of determining value by a standard different from fair market value.8

And Steven Bolten wrote a brief article noting that at the first sign in early 1997 that the capital gains tax might be cut by up to half its then current rate, the financial markets reacted by lowering the discount to net asset values for closed end investment companies. Bolten concluded:

This observed decline in the discount to net asset value for the closed end investment companies, concomitant with the likely enactment of a capital gains tax cut, surely is evidence that the financial markets are, indeed, incorporating the trapped-in capital gains tax liability in valuations.9

The bottom line is that the IRS has argued loudly and consistently that embedded capital gains should be ignored in fair market value determinations. Appraisers, on the other hand have argued, albeit less loudly and less consistently, that embedded capital gains should be considered. And the Tax Court, at least until the issuance of Davis v. Commissioner, has either sided with the IRS or has avoided taking a clear stand on the issue.

Davis v. Commissioner10

Davis followed shortly on the heels of Estate of Pauline Welch, (T.C.M. 1998-167), which was issued in May 1998. In Welch, the Tax Court’s opinion followed the historical line of cases noted above, and disallowed consideration of the embedded capital gains liability in two closely held companies.11 In Davis, we find a case in which the Court specifically allowed consideration of the embedded capital gains tax in a C corporation asset holding company.

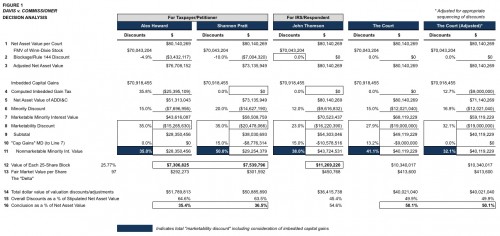

Davis will be reviewed extensively in many other forums. For our purposes, we can summarize the basic facts as follows:

Artemus D. Davis made two gifts of 25 shares of A.D.D. Investment and Cattle Company (“ADDI&C”), representing 25.8% (each) of the 97 shares outstanding as of November 1992, a distinctly post-General Utilities doctrine valuation date. The gift tax return was supported by an appraisal prepared by Alex W. Howard of Howard Frazier Barker Elliott, Inc.

ADDI&C owned a block of stock comprising approximately 1.3% of Winn-Dixie Stores, Inc., a large grocery chain whose shares trade on the New York Stock Exchange. The block had a market value of $70.0 million at the valuation date, and a cost basis of $338 thousand. Mr. Davis was a founder of Winn-Dixie, and ADDI&C was incorporated in 1947.

ADDI&C had a net asset value of $80.1 million at the valuation date. The total trapped-in capital gain in the company was $70.9 million, of which $69.7 million resulted from the Winn-Dixie block of stock. The embedded capital gains liability totaled $26.7 million (at the stipulated applicable rate of 37.63%), or about one-third of the net asset value.

In addition to the appraisal prepared by Mr. Howard, that was filed with the gift tax return, the taxpayer obtained a second appraisal prepared by Dr. Shannon P. Pratt of Willamette Management Associates. The Internal Revenue Service obtained an appraisal from Mr. John A. Thomson of Klaris, Thomson & Schroeder, Inc. All three appraisers are Accredited Senior Appraisers, having earned the ASA designation from the American Society of Appraisers (Mr. Pratt holds the FASA designation, Fellow of the American Society of Appraisers). All three appraisers prepared valuation reports and rebuttal reports that were reviewed by the Court.

While Davis will always be remembered as an embedded capital gains case, there were actually four distinct valuation issues dealt with by the appraisers and the Court, each of which had considerable economic impact. Unlike many other Tax Court cases, and particularly those dealing with embedded gains, the Court had credible valuation evidence from three qualified appraisers on each point. Without editorializing, the issues are summarized below.

Restricted Stock Issue. The Winn-Dixie shares were restricted under Rule 144 of the Securities and Exchange Act of 1934. Restrictions on the marketability of the block based on its size and trading restrictions needed to be considered. The taxpayer’s appraisers (Howard and Pratt) recommended discounts of 4.9% and 10%. Mr. Howard’s discount was based on the use of the Black-Scholes option pricing model, and Dr. Pratt’s was based on unquantified judgment. Mr. Thomson said that no restricted stock or blockage discount was appropriate because of the rising trend in Winn-Dixie’s shares. Based on its review of the record and the testimony of the experts, the Court did not allow any restricted stock or blockage discount for the Winn-Dixie shares.

Minority Interest Discount. There was little discussion in the case of the issue the minority interest discount. The recommendations of the appraisers were 15% (Howard), 20% (Pratt), and 12% (Thomson). The Court’s concluded minority interest discount was 15%.

Marketability Discount. All three appraisers recommended marketability discounts to the Court. Two of the appraisers, Dr. Pratt and Mr. Thomson, incorporated their consideration of the next issue, the embedded capital gains question, into their overall marketability discount analysis. Their reasoning was that such a large trapped-in liability would certainly impede the marketability of the subject shares. Excluding the specific consideration of embedded capital gains, Mr. Howard and Dr. Pratt relied on various restricted stock studies and pre-IPO studies, as well as their analysis of the various factors of the case. Mr. Thomson relied only on restricted stock studies and his analysis.12 The marketability discounts suggested by the experts were 35% (by Howard and Pratt) and 23% (by Thomson). The Court concluded that the appropriate marketability discount was $19.0 million, which translated into a marketability discount of 27.9%.

The Embedded Capital Gains Issue. The Court was presented with three different views of the treatment of embedded capital gains in Davis. Mr. Howard took the position that the tax on the embedded gain represented a present, economic liability. He therefore tax-effected the gain at estimated statutory rates and reduced net asset value by the full amount of the embedded liability.13 The IRS broke ranks with its appraiser and declared to the Court that there should be no consideration of embedded gains in the determination of fair market value as a matter of law. Dr. Pratt (for the taxpayer) and Mr. Thompson (for the IRS) advocated a middleground position (the IRS position). As noted earlier, they considered that the embedded tax liability would be an additional impediment to the marketability of the subject interests. And both suggested that the “extra” factor should add 15% to their otherwise determined marketability discounts, resulting in partial considerations of the embedded tax liability.

The Court was unconvinced by the IRS argument for no consideration of embedded gains liabilities as a matter of law. Mr. Howard was no less convincing to the Court with his argument that a full consideration of the embedded gain should be deducted from net asset value. Quoting from the decision on this point:

Petitioner adopts the view of petitioner’s expert Mr. Howard and argues that the full amount of such tax should reduce ADDI&C’s net asset value in making that determination. On the record before us, we reject petitioner’s position and Mr. Howard’s opinion. On that record, we find that, where no liquidation of ADDI&C or sale of its assets was planned or contemplated on the valuation date, the full amount of ADDI&C’s built-in capital gains tax may not be taken as a discount or adjustment in determining the fair market value on that date….even though we have found that as of that date it was unlikely that ADDI&C could have avoided all of ADDI&C’s built-in capital gains tax, and the record does not show that there was any other way as of that date by which ADDI&C could have avoided all of such tax. [emphasis added, citations omitted]

The Court apparently agreed with the manner in which Mr. Thomson and Dr. Pratt considered a partial treatment of the embedded gain as an incremental impediment to marketability. Both added 15% to their marketability discounts, which provided a range of dollar liabilities of $8.8 million (Pratt) to $10.6 million (Thomson).14 Within this range, the Court held that the appropriate consideration of the embedded gains tax liability was $9.0 million. Given that the total embedded gain was $26.7 million, the Court allowed a deduction to net asset value of some 34% of the embedded liability. The effective tax rate used by the Court on the embedded gain was therefore 12.7% (i.e., $9.0 million divided by the $70.9 million taxable gain inside ADDI&C).

Based on the record in Davis, the Court rejected both positions outlined at the beginning of this article, the full consideration of embedded capital gains liabilities advocated by many business appraisers (The Business Appraisers’ Position), and the absence of consideration advocated by the IRS (The IRS Position). It is not clear from the case as to how Pratt and Thomson arrived at their partial considerations of the embedded gain in ADDI&C. It is clear, however, that the Court was amenable to the consideration of economic arguments that attempted to simulate the thinking of hypothetical buyers of subject minority interests in ADDI&C common stock.

Davis stands, in our opinion, as a mandate by the Tax Court to appraisers to articulate their economic and valuation rationales for the consideration of the impact of embedded gains on hypothetical negotiations between hypothetical willing buyers and sellers.

Eisenberg v. Commissioner of Internal Revenue15

As this article was being finalized, we received a Second Circuit Court of Appeals decision regarding the appeal of the October 1997 Eisenberg decision of the Tax Court. Without going into details of the earlier case, we can summarize that Irene Eisenberg owned all the outstanding common stock of a C corporation that held a building in Brooklyn, New York. After stipulations of the fair market values of the building on three gifting dates and of a 25% minority interest discount, the sole issue for determination by the Tax Court was whether to consider a valuation adjustment for the embedded capital gains tax liability inside the corporation. The taxpayer argued for full consideration of the embedded liability, and the IRS argued for no consideration. The Tax Court held for no consideration citing the cases outlined above and the rationale regarding the speculative nature of any liquidation of the company.

After stating the issue of the appeal, the Court reviewed background cases on the embedded tax issue, as well as a brief history of the General Utilities doctrine and of its repeal by the Tax Reform Act of 1986. Brief quotes from the appellate decision trace the Court’s conclusion that rational purchasers of shares of post-1986 C corporations would consider the impact of embedded tax liabilities on the price they are willing to pay for interests in such corporations.

We quoted the Court’s position earlier disfavoring the consistent citing of pre-1986 valuation date cases by the IRS to support post-1986 valuation economics.

Regarding the recurring theme that embedded capital gains should not be considered because there is no plan of liquidation in place, and the resulting implications for hypothetical willing buyers, the Court indicated:

Fair market value is based on a hypothetical buyer and a willing seller, and in applying this willing buyer-willing seller rule, ‘the potential transaction is to be analyzed from the viewpoint of a hypothetical buyer whose only goal is to maximize his advantage…[C]ourts may not permit the positing of transactions which are unlikely and plainly contrary to the economic interest of a hypothetical buyer…’ [citing Estate of Curry v. United States, 706 F.2d 1424. Emphasis added]

In elaborating on this position:

Our concern in this case is not whether or when the donees will sell, distribute or liquidate the property at issue, but what a hypothetical buyer would take into account in computing fair market value of the stock. We believe it is common business practice and not mere speculation to conclude a hypothetical willing buyer, having reasonable knowledge of the relevant facts, would take some account of the tax consequences of contingent built-in capital gains on the sole asset of the Corporation at issue in making a sound valuation of the property. [emphasis added]

And reiterating the view of hypothetical buyers:

The issue is not what a hypothetical willing buyer plans to do with the property, but what considerations affect the fair market value of the property he considers buying.

In the concluding paragraph of its discussion, the Court stated:

We believe that an adjustment for potential capital gains tax liabilities should be taken into account in valuing the stock at issue in the closely held C corporation even though no liquidation or sale of the Corporation or its assets was planned at the time of the gift of the stock.16 [emphasis added]

If Davis stands as a mandate to business appraisers to become specific in their development of valuation adjustments relating to the embedded capital gains issue, Eisenberg is our clarion call.

Proof of the Business Appraisers’ Position

Buyers of appreciating properties, broadly defined, whether stocks, land, investment properties or other, generally have the option of acquiring desired investments in the normal markets for the properties. Negotiations occur between buyers and sellers for the properties and transactions are effected.

In the present article, we are discussing situations where appreciating properties are, for whatever historical reasons, residing inside C corporation holding companies. Post-1986, appreciation inside such corporations is subject to income taxation. Sellers desiring to obtain the market value of appreciated properties inside C corporation have two basic options:

Liquidate the asset(s) inside the corporation, pay any corporate tax on the appreciation of the assets upon their sale, and then either make substantial distributions of the net assets or engage in a liquidation of the corporation.

From the universe of potential buyers of the asset(s) inside the corporation, find a buyer who will purchase the C corporation’s stock as a vehicle to access the asset(s) who either has reasons to own the asset(s) inside a C corporation, or who will liquidate the corporation to gain access.

When analyzing the impact of embedded capital gains in C corporation holding entities, we must examine that impact in the context of the opportunities available to the selling shareholder(s) of those entities. We must also consider the realistic option that potential buyers of the stock of those entities must be assumed to have – that of acquiring similar assets directly, without incurring the problems and issues involved with embedded capital gains inside a C corporation.

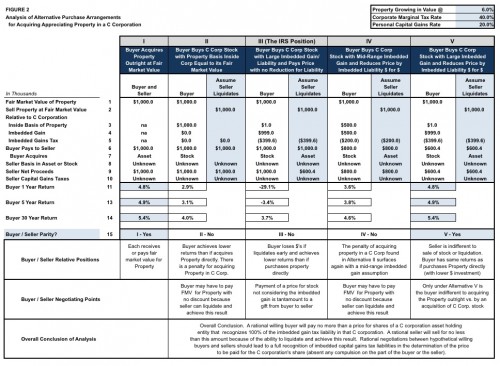

In Figure 2, we have attempted to analyze the impact of embedded capital gains in C corporation holding entities from the vantage point of hypothetical willing buyers and sellers. Through this analysis, we are seeking to reach conclusions regarding whether or how the issue of such embedded gains, and their associated embedded tax liabilities, would reasonably influence the negotiating positions of buyers and sellers of the stock.

In developing Figure 2, we prepared a series of spreadsheet models that attempt to simulate a series of transactions involving both buyers and sellers of C corporation holding entities containing appreciating property in the context of current tax law. Summary results of the modeling are found in Figure 2. The property involved has an assumed fair market value of $1.0 million, the corporate tax rate on embedded gains is assumed to be 40%, and the personal marginal tax rate is assumed to be 20%. In the example, the asset is assumed to be growing in value at a rate of 6% per year, and pays no dividends.17 A further assumption is that there are no costs involved in liquidating the C corporations other than the necessity to pay embedded capital gains taxes.18

Essentially, Figure 2 analyzed five alternative purchase options available to a buyer of appreciating assets, which relate to acquiring those assets through C corporation holding entities. The alternatives shown include:

The buyer acquires the property outright in the normal market for such property at its market value.

The buyer acquires C corporation stock where the basis of the property inside the corporation is equal to the property’s fair market value in its normal market.

The buyer acquires C corporation stock with a large embedded gain and embedded tax liability (i.e., with virtually a zero basis inside the corporation) and pays the seller a price for the shares that reflects no reduction for the embedded tax liability.

The buyer acquires C corporation stock with the basis of the property inside the corporation equal to 50% of the fair market value of the property (called a mid-range embedded gain in Figure 2). In this case, the buyer reduces the price paid for the stock by the amount of the embedded tax liability on a dollar-for-dollar basis.

The buyer acquires C corporation stock with a large embedded gain and embedded tax liability (as in Alternative III), and the price paid for the stock is again reduced by the full amount of the embedded tax liability.

Analysis of Figure 2 leads to the conclusion that rational buyers of C corporation holding entities with appreciated assets will negotiate to reduce the purchase price paid for the stock by the full amount of any embedded capital gains tax liabilities. The rationale for this conclusion can be summarized by the following points:

The buyer always has the presumed opportunity to acquire similar property in the open market. The rate of return from an investment in the property from this alternative should reasonably be used to evaluate options involving the acquisition of the same or similar property through the purchase of C corporation stock.

Under Alternative II, where there is no present embedded gain, there is an argument that the buyer should discount the price for the stock because the anticipated future capital gains and capital gains taxes at the corporate level will lower the expected holding period return for any reasonable holding period. The seller of the corporation, however, has the capability of liquidating the corporation and therefore will not likely negotiate a reduction for the future liabilities of the buyer. Further, the buyer, once having purchased the stock, has the option of liquidating the corporation to gain direct access to the asset without incurring future capital gains associated with the C corporation status.19

Alternative III is the analytical equivalent of the IRS Position (pre-Davis and pre-Eisenberg) with respect to embedded capital gains. In this alternative, there is a large embedded capital gain in the corporation (very much like that of the gain in ADDI&C in Davis discussed above). By ignoring the embedded capital gain and embedded tax liability in Alternative III, the buyer is placed at risk of loss of substantial principal if there is a necessary liquidation in the early years, or an unanticipated liquidation of the underlying property. For example, assume the property in Alternative III is Winn-Dixie stock. Assume further that the buyer pays $1.0 million for the stock, making no adjustment for the $400 thousand embedded tax liability in the C corporation. Finally, assume that the day after closing of the transaction, Safeway agrees to purchase 100% of Winn-Dixie’s stock for cash. The buyer has just turned a $1.0 million investment into $600 thousand, and would recognize a $400 thousand loss. The economic effect of Alternative III is that the buyer has made a gift of the amount of the embedded tax liability ($400 thousand) to the seller. This gift can be recognized in an early loss on liquidation or in the form of a permanently impaired rate of return in relationship to Alternative I, the outright purchase alternative. Rational buyers are not in the business of making gifts to sellers of properties.20

With Alternative IV, with a mid-range embedded gain of $500 thousand, the buyer of the C corporation’s stock encounters a permanent impairment of return in relationship to Alternative I, even though the stock’s purchase price is lowered by the full amount of the embedded tax liability. As in Alternative II, there is an argument for the buyer to negotiate for a further discount to account for capital gains on future appreciation; however, as in that alternative, the buyer has remedies, and the seller has the alternative of liquidating the corporation to avoid additional discounting.

Only in Alternative V, in which the corporation has a virtually zero basis in the property, is the buyer indifferent, from a rate of return perspective, with the outright purchase alternative of Alternative I. In this case, the buyer reduces the stock’s purchase price by the full amount of the embedded tax liability, and the discount from fair market value is sufficient to offset the combined impact of future corporate and personal taxes. As is visually apparent, the compound returns available from Alternative I, the outright purchase of the property, are identical with those from Alternative V.

The end result of this analysis is that there is not a single alternative in which rational buyers (i.e., hypothetical willing buyers) of appreciated properties in C corporations can reasonably be expected to negotiate for anything less than a full recognition of any embedded tax liability associated with the properties in the purchase price of the shares of those corporations. And rational sellers (i.e., hypothetical willing sellers) cannot reasonably expect to negotiate a more favorable treatment, because any non-recognition of embedded tax liabilities by a buyer translates directly into an avoidable cost or into lower expected returns than are otherwise available. Valuation and negotiating symmetry call for a full recognition of embedded tax liabilities by both buyers and sellers.

Conclusions

We can close with a few concluding observations:

- Nothing in the analysis supports any concept that the speculative nature of an expected holding period should call for a “sharing” of the embedded tax liability between sellers of C corporations and buyers of those corporations.

- Nothing in the analysis suggests that the lack of an imminent plan for the liquidation of a C corporation with embedded gains is any reason not to consider the existence of embedded tax liabilities directly in the purchase price of C corporation stock today.

- In the context of Davis, Mr. Howard’s treatment of the embedded tax liability of ADDI&C as a present liability in his appraisal is the most appropriate treatment of such embedded tax liabilities. We have validated the Business Appraisers’ Position.

- The partial treatment of the embedded liability by Dr. Pratt and Mr. Thomson, while a step in the right direction, falls considerably short of dealing with the true economic impact of the liability from the viewpoint of the hypothetical buyer of ADDI&C shares.

- This entire analysis has dealt with buyers of 100% of the stock of C corporation asset holding entities. If the analysis suggests that rational purchasers of control of the entities would require that the price of the stock reflect a reduction for the dollar amount of embedded tax liabilities, it is even more supportive of such consideration for hypothetical buyers of minority interests.

The Tax Court (in Davis) and the Second Circuit Court of Appeals (in Eisenberg) have recognized the economic reality of embedded capital gains tax liabilities and that such liabilities are appropriately considered in the determination of the fair market value of C corporation asset holding entities. However, appraisers who attempt to argue for a partial discount by citing Davis stand a good chance of losing their arguments based on differing facts or circumstances, or on the lack of economic justification for their positions. Appraisers are responsible for providing valuation and economic evidence to the Courts. The door is clearly open for the admission of such evidence regarding embedded capital gains tax liabilities in C corporation asset holding entities.

Endnotes

1 The treatment of embedded capital gains in operating companies or in tax pass-through entities is beyond the scope of this article, although many of the issues discussed are obviously applicable to C corporation operating companies that hold significant appreciated non-operating (or perhaps operating) assets. While the issue of embedded gains arises in valuations for many purposes, the following discussion is framed in the general context of gift and estate tax appraisals.

2 See Estate of Andrews v. Commissioner 79 T.C. 938, 942, 1982 WL 11197 (1982); Estate of Piper 72 T.C. 1062; Estate of Cruikshank , 9 T.C. 162 (1947); Estate of Luton v. Commissioner, T.C.M. 1994-539; Estate of Bennett v. Commissioner, T.C.M. 1993-34; Gallun v. Commissioner, 33 T.C.M. (CCH) 1316 (1974), and other cases often cited by the Internal Revenue Service in Tax Court cases, as well as argued in various settlement negotiations with taxpayers and their professional representatives.

3 Eisenberg v. Commissioner, 1998 WL 480814 (2nd Cir.).

4 Has anyone advocating the IRS Position ever made any pro forma present value of future tax liability calculations under reasonable assumptions regarding expected holding periods until liquidation, the growth rate in value of the assets in the interim, the tax consequences of liquidation and with the virtual certainty that the tax will ultimately be recognized reflected in the discount rate?

5 What rational buyer would subject himself to such exposure and pay hard dollars today against the chance of mitigating, for such a long period of time, the gain via an S election? This argument has nothing to do with fair market value or rational investment.

6 Gasiorowski, John R., “Is a Discount for Built-in Capital Gain Tax Justified?”, Business Valuation Review, June 1993, pp. 35-39.

7 Pratt, Shannon P., “Trapped-in capital gains affects real-world value,” Shannon Pratt’s Business Valuation Update, February 1996, pp. 33-34. Dr. Pratt is one of the experts in the Davis case which is discussed below.

8 Frazier, William H., “How Corporate-Level Capital Gains Taxes Affect Fair Market,” Estate Planning, June 1996, pp. 198-203. Mr. Frazier is a partner of Alex W. Howard, another of the experts in Davis.

9 Bolten, Steven E., “Financial Market Valuations Include Trapped-In Capital Gains Liabilities,” Business Valuation Review, June 1997, pp. 23-24.

10 Davis v. Commissioner, (T.C. June 30, 1998).

11 Interestingly, the taxpayer in Welch submitted valuation reports on the two companies prepared by Mercer Capital for another purpose entirely and as of a different valuation date without the knowledge of Mercer Capital. A discussion of Welch can be found in Mercer Capital’s newly initiated E-Law Newsletter, Volume 1, Issue #1, “How Easy it is for Appraisers to Misinterpret a Case!”

12 The restricted stock studies and pre-IPO studies cited by the experts in Davis are summarized in a recent book. See Mercer, Z. Christopher, Quantifying Marketability Discounts: Developing and Supporting Marketability Discounts in the Appraisal of Closely Held Business Interests (Peabody Publishing, LP: Memphis, Tennessee, 1997). Chapters 2, 3 and 12 deal with these studies at length.

13 The reasonableness of his position is affirmed below. This is the Business Appraisers’ Position stated at the outset of this article.

14 It is almost impossible not to editorialize. Both Pratt and Thomson agree that the embedded capital gain should be considered in the valuation of post-1986 C corporations. Thomson, to his credit, stuck to his valuation guns in the face of a client that undoubtedly pressured him not to consider any liability for embedded gains taxes. He gave partial treatment of the liability in the guise of a larger marketability discount. Given that the Tax Court had been so negative on opinions like that of Howard in the past, Pratt undoubtedly believed that a consideration as an incremental marketability discount was a way to introduce a legitimate valuation adjustment that the Court has disfavored as part of one that the Court has favored. Neither Pratt nor Thomson, however, provided any economic rationale for their selected 15% increases to their marketability discounts. As a result, there is no basis for using this case to justify a treatment of embedded gains tax liabilities in any other matter.

14 Eisenberg v. Commissioner of Internal Revenue, [(1998 WL 480814 (2nd Cir))]. This case represented an appeal to the United States Court of Appeals, Second Circuit, of a 1997 memorandum decision of the Tax Court: Irene Eisenberg v. Commissioner, T.C.M. 1997-483, October 27, 1997.

15 The Court did, in footnote 15, indicate that a full deduction of the tax liability from net asset value might not be considered, but concluded in footnote 16: “In any event, all of these circumstances should be determined as a matter of valuation for tax purposes.”

16 The results of the modeling are not sensitive to either the tax rates assumed or to the growth rate in value of the property.

17 This analysis could easily be adjusted for estimated costs of liquidation.

18 In this example, it might be useful to examine the specific costs of liquidation. This is also a case in point where consideration of embedded gains in operating companies with significant non-operating assets could depart from this argument. If it is not feasible to liquidate the corporation, a buyer might negotiate strongly for a further adjustment for future capital gains liabilities.

19 To carry this analysis a bit further, adoption of the IRS Position regarding the non-recognition of embedded capital gains tax liabilities is tantamount to asking a taxpayer to make a gift, in the form of higher gift or estate taxes today, to the U.S. Treasury. A rational taxpayer is just as unlikely to desire to make such a gift to the Treasury as a rational buyer is to making the gift to a seller facing the embedded obligation in a C corporation. This is particularly burdensome when the taxpayer will ultimately have to deal with the embedded capital gains tax in the corporation. In effect, the IRS position would require the taxpayer to pay an additional tax. While that might be good for revenues for the U.S. Treasury, the IRS Position has nothing to do with the concept of the fair market value of C corporation stocks.

First appeared in the 1998 November/December issue of Valuation Strategies.