ESOPs: The Basics and the Benefits

An ESOP is an employee benefit plan designed with enough flexibility to be used to motivate employees through equity ownership. Therefore, according to theory, ESOPs implicitly enhance productivity and profitability and create a market for stock. This enhances shareholder liquidity and provides a vehicle for the transfer of ownership, which can assist in the transition from an owner/management group to an employee-owned management team.

Although ESOPs have been in use for a number of years – and with each new tax law undergo some changes – their basic structure and benefits have stood the test of time. ESOPs deserve to be examined and considered for potential application. Here is a brief and basic description of ESOPs, a simplified overview of the two types of ESOPs and a summary of the benefits of employee ownership to employees, shareholders and employers.

An ESOP Defined

An ESOP is an employee benefit plan which qualifies for certain tax-favored advantages under the Internal Revenue Code (“Code”). In order to take advantage of these tax benefits, it must comply with various participation, vesting, distribution, reporting and disclosure requirements set forth by the Code. These requirements are designed to protect the interests of the employee owner. ESOPs are also subject to the regulations set forth in the Employee Retirement and Income Security Act of 1974 (“ERISA”) which essentially created a formal legal status for ESOPs and must meet the employee benefit plan requirements of the Department of Labor.

How An ESOP Works

A company establishes an employee stock ownership trust and makes yearly contributions to the trust. These contributions are either in new or treasury stock, cash to buy existing shareholder stock or pay-down debt used to acquire company stock. Regardless of the form, the contributions are tax-deductible.

Employees or ESOP participants have accounts within the ESOP to which stock is allocated. Typically, the participant’s stock is acquired by contributions from the company – the employees do not buy the stock with payroll deductions or make any personal contribution to acquire the stock. Plan participants generally accumulate account balances and begin the vesting process after one year of full time service. Contributions, either in cash or stock, accumulate in the ESOP until an employee quits, dies, is terminated, or retires. Distributions may be made in a lump sum or installments and may be immediate or deferred.

ESOPs are of two varieties: leveraged and non-leveraged. Each of the ESOPs has different characteristics.

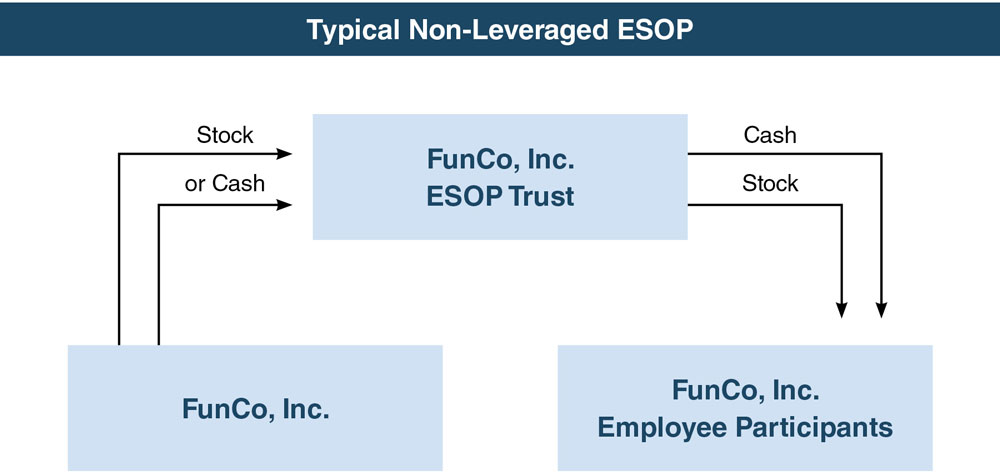

Non-Leveraged ESOPs

FunCo, Inc. establishes an ESOP and makes annual contributions of cash, which are used to acquire shares of the company’s stock, or makes annual contributions in stock. These contributions are tax deductible for the company. As shares are allocated to participants’ accounts based on a value determined by an independent appraisal, employees begin to acquire an equity ownership in the business.

The employee/participant begins to vest according to a schedule incorporated into the ESOP document, and stock accumulates in the account until the employee/participant leaves the company or retires. At that time, the participant has the right to receive stock equivalent in value to his or her vested interest. Typically, ESOP documents contain a provision called a “put” option, which require the Plan or the company to purchase the stock from the employee after distribution if there is no public market for it, thus enhancing the liquidity of the shares.

Non-leveraged ESOPs, although they have certain tax advantages, generally tend to be an employee benefit, a vehicle to create new equity, or a way for management to acquire existing shares.

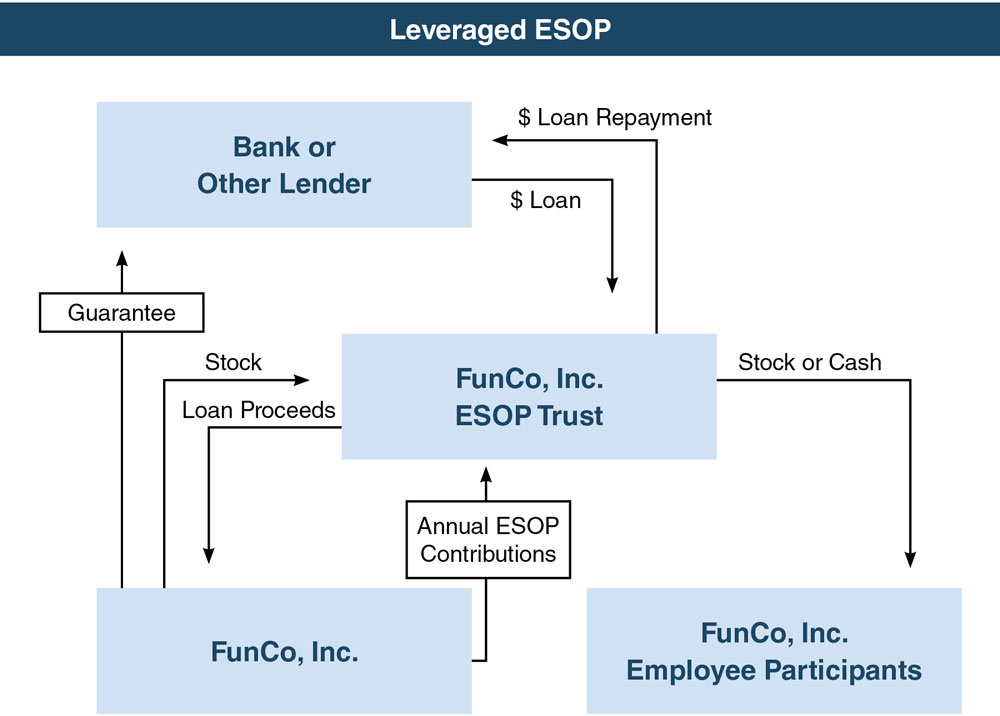

Leveraged ESOPs

Leveraged ESOPs tend to be more complicated than non-leveraged ESOPs. However, they provide a company with tax-advantages by which it can generate capital or acquire outstanding stock. A leveraged ESOP may be used to inject capital into the company through the acquisition of newly issued shares of stock.

FunCo establishes an ESOP. A bank or other lending institution lends money to the ESOP which acquires company stock. The company makes annual tax deductible contributions to the ESOP, which in turn repays the loan. Stock is allocated to the participants’ accounts – just as it is in a non-leveraged ESOP – enabling employees to collect stock or cash when they retire or leave the company.

Benefits Of An ESOP

The advantages and benefits of an ESOP are numerous and varied depending on whether you are the employee/participant, an existing shareholder, or an employer.

The Benefits To Employees

An ESOP can provide an employee with significant retirement assets if the employee is employed by the company for a significant period of time and the employer stock has appreciated over the years to retirement. The ESOP is generally designed to benefit employees who remain with the employer the longest and contribute most to the employer’s success. Since stock is allocated to each employee’s account based on a contribution by the company, the employee bears no cost for this benefit.

Employees are not taxed on amounts contributed by the employer to the ESOP, or income earned in that account, until they actually receive distributions. Even then, “rollovers” into an IRA or special averaging methods involved in the income calculation can reduce or defer the income tax consequences of distribution.

When the employee’s participation in the ESOP ends, they are entitled to their share of the “vested” benefit according to a schedule incorporated into the ESOP document. Distributions may be made in stock or cash. However, a “put” option, which requires the Plan or the company to acquire stock distributed to participants, may provide cash for their shares. This is especially valuable to participants in privately held companies where there is no market for the company stock.

The Benefits To Shareholders

An ESOP can create a market for the stock of a privately held company. The ESOP provides a ready, current market for the stock of outside shareholders providing liquidity not otherwise available. This feature may be used by participants, beneficiaries, major shareholders or estates of deceased shareholders.

The ESOP leveraging provides a way for a selling shareholder to receive cash, rather than incur the risk of a deferred payment arrangement.

Subject to certain conditions and regulations, the Code makes provision for special tax incentives for certain sales of stock to an ESOP. This would enable a shareholder of a closely held company to sell stock to an ESOP, reinvest the proceeds in other qualified securities and defer taxation on any gain resulting from the sale.

The Benefits To The Employer

An ESOP is mandated by law to invest contributions primarily in employer stock. It is also the only qualified employee benefit plan which is permitted to borrow funds on employer credit in order to acquire employer stock. These differences provide significant flexibility for a company using an ESOP as a corporate finance tool and make possible the accomplishment of corporate objectives not available through other methods.

As a corporate finance technique, the ESOP can be used to raise new equity to refinance outstanding debt or to acquire assets, or outstanding stock, through leveraging with third party lenders. Since contributions to an ESOP are fully tax-deductible, an employer can fund both the principal and the interest payments on an ESOP’s debt service obligations with pre-tax dollars. Dividends which are used to repay a loan may also be deductible.

Another major benefit to both employer and shareholder is the positive impact that results when employees have an equity ownership in the company. This results in improved productivity, profitability and overall corporate performance.

Conclusion

An ESOP is an attractive employee benefit and corporate financing tool; its structure can range from simple to very complex. Its feasibility should be considered by competent lawyers, accountants, and administrators to ensure tax deductibility compliance with the Internal Revenue Service regulations and to meet the employee benefit plan requirements of the Department of Labor.

Reprinted from Mercer Capital’s Bizval.com – Vol. 9, No. 2, 2000.