Estate of Michael J. Jackson v. Commissioner – Key Takeaways

It is imperative for estate planners to engage valuation analysts that perform the proper procedures and follow best practices when performing valuations for gift and estate planning purposes. It is necessary to have a well-supported valuation because these reports are scrutinized by the IRS and may end up going to court. The recent decision by the U.S. Tax Court in Estate of Michael J. Jackson v. Commissioner provides several lessons and reminders for valuation analysts, and those that engage valuation analysts, to keep in mind when performing valuations for gift and estate planning purposes.

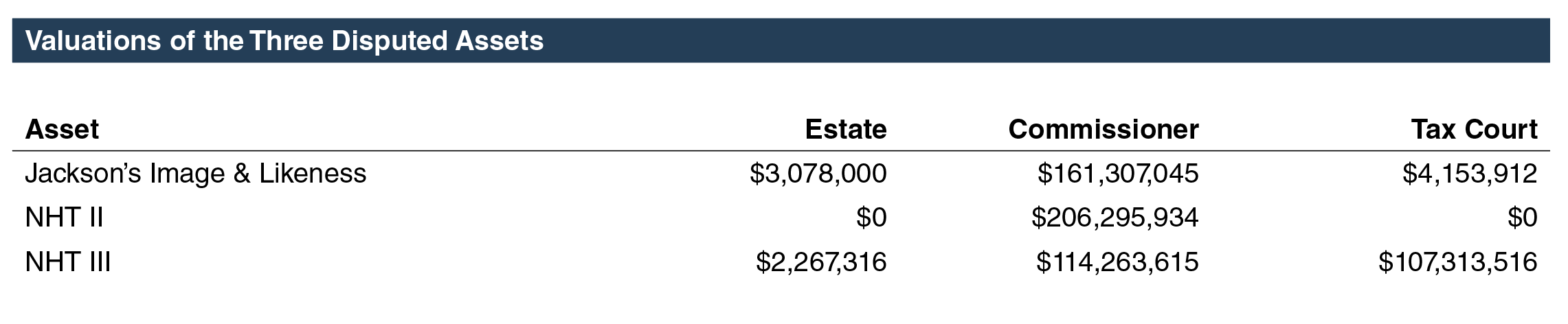

Michael Jackson, the “King of Pop,” passed away on June 25, 2009. His Estate (the “Estate”) filed its 2009 Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, listing the value of Jackson’s assets. After auditing the Estate’s tax return, the Commissioner of the Internal Revenue Service (the “Commissioner”) issued a notice of deficiency that concluded that the Estate had underpaid Jackson’s estate tax by a little more than $500 million. Because the valuation of some assets were considered to be so far off, the Commissioner also levied penalties totaling nearly $200 million on the Estate. The IRS and the Estate settled the values of several assets outside of court. The case involved three contested assets of Michael Jackson’s estate:

- Jackson’s Image and Likeness

- Jackson’s interest in New Horizon Trust II (“NHT II”) which held Jackson’s interest in Sony/ATV Music Publishing, LLC, a music-publishing company

- Jackson’s interest in New Horizon Trust III (“NHT III”) which contained Majic Music, a music-publishing catalog

We discuss the key topics that the Tax Court ruled on and addressed that inform valuation analysts in the preparation of quality valuation reports.

Known or Knowable

It is important that valuation analysts only rely on information that was known or knowable at the valuation date.

In the decision, the Tax Court rejects the analysis of experts on several occasions for using information that was “unforeseeable at the time of Jackson’s death.” The Tax Court goes on to state that “foreseeability can’t be subject to hindsight.”

It can be difficult to distinguish and depend on only the information known or knowable at the valuation date especially when a significant amount of time has passed between the current date and the valuation date. Therefore, a careful examination of all sources of information is necessary to be sure that it can be relied upon in the analysis.

As can be seen from the Tax Court’s opinion, valuation analysts and experts can undermine their credibility by relying on information that was not known or knowable at the valuation date.

Tax Affecting S Corporations

The Tax Court, in this specific case, did not accept the tax affecting of S Corporations: “The Estate’s own experts used inconsistent tax rates. They failed to explain persuasively the assumption that a C corporation would be the buyer of the assets at issue. They failed to persuasively explain why many of the new pass-through entities that have arisen recently wouldn’t be suitable purchasers. And they were met with expert testimony from the Commissioner’s side that was, at least on this very particular point, persuasive in light of our precedent. This all leads us to find that tax affecting is inappropriate on the specific facts of this case.” The Tax Court did, however, leave room for the possibility of tax affecting being appropriate by stating, “we do not hold that tax affecting is never called for.”

At Mercer Capital, we tax affect the earnings of S corporations and other pass-through entities. Given that this issue continues to be a point of contention, it is imperative that valuation analysts provide a thorough analysis and clear explanation for why tax affecting is appropriate for S corporations and other tax pass-through entities.

Developing Projected Cash Flows

In the valuation of NHT II, the Court found it more reasonable to use the projections of Sony/ATV in the development of a forecast used in the income approach rather than relying on historical financial performance to inform the projection. The Tax Court based its decision on the fact that “the music-publishing industry was (and has remained) in a state of considerable uncertainty created by a long series of seismic technological changes. We think that projections of future cashflow, if made by businessmen with an incentive to get it right, are more likely to reflect reasonable estimates of the short-to-medium-term effects of these wild changes in the industry that even experts, much less judges, are unlikely to intuit correctly.”

This decision makes it clear that valuation analysts need to fully understand the industry in which the company operates and develop a forecast that is most reasonable given the information available as of the valuation date.

In cases where analysts have access to a projection developed by management, valuation analysts should have a clear, well-reasoned rationale for not relying on the forecast should they decide not to use it in the analysis. However, valuation analysts should not blindly accept management’s forecasts as truth but should perform proper due diligence to assess the reasonability of the forecast and clearly articulate any deviations from management’s forecast.

Other Topics Addressed

A few other topics of note are addressed throughout the decision that can help valuation analysts provide reliable valuation analyses.

On more than one occasion, the Tax Court sided with the expert that provided a compelling explanation for the use of a certain assumption rather than arbitrarily using an assumption without explanation. The Tax Court also sided with one expert simply because they provided a clear citation for their source when another expert did not. The Tax Court also called out the inconsistency of an expert in their report and testimony. These topics addressed by the Tax Court demonstrate that consistently explaining and citing the sources of assumptions and key elements of the valuation analysis help to produce a supportable valuation

analysis.

Finally, the expert for the Commissioner seriously damaged their credibility in the eyes of the Tax Court when the expert was caught in a couple lies during the trial. The Tax Court found that the expert “did undermine his own credibility in being so parsimonious with the truth about these things he didn’t even benefit from being untruthful about, as well as not answering questions directly throughout his testimony. This affects our fact finding throughout.”

Takeaways & Conclusion

The table below presents the valuation conclusions of the Estate, Commissioner, and the Tax Court at trial. This decision has shown that it is critical for valuation analysts to present quality valuation reports that are clear, supported, and follow accepted best practices.

At Mercer Capital, estate planners can be confident that we follow the proper procedures, standards, and best practices when performing our valuations for gift and estate planning. Mercer Capital has substantial experience providing valuations for gift and estate planning as well as expert witness testimony in support of our reports. Please do not hesitate to contact one of our professionals to discuss how Mercer Capital may be able to help your estate planning needs.