Jane Z. Astleford v. Commissioner

The case of Astleford v. Commissioner1 is noteworthy for a number of reasons. For instance, the Court’s ruling provides further support for applying tiered discounts in asset holding entities, and not only were the discounts tiered but they were also significant on each level applied, resulting in total blended discounts of approximately 55% with respect to certain assets. Additionally, in the determination of the appropriate lack of control (i.e., minority interest) discounts, the Court made use of data pertaining to both REITs that were publicly traded and RELPs that were traded on secondary markets. The Court also made use of studies cited in an expert’s report to justify discounts that were more than twice those applied by the expert.

Facts and Circumstances

After M.G. Astleford, a real estate investor, passed away in 1995, his wife, Jane Z. Astleford (Taxpayer), created the Astleford Family Limited Partnership (AFLP) in 1996. After transferring property to the AFLP, she gifted a 30% limited partnership (LP) interest to each of her three children (the 1996 AFLP interests), and retained a 10% general partnership (GP) interest. In 1997, Taxpayer transferred additional properties to the AFLP including a 50% GP interest in Pine Bend Development Co. (Pine Bend). As a result of this transfer, Taxpayer’s GP interest in AFLP increased significantly. In order to return Taxpayer’s GP interest to 10% of AFLP, Taxpayer gifted to each of the three children additional LP interests (the 1997 AFLP interests) necessary to return the ownership structure to the initial 30/30/30/10 allocation.

The Court outlined three general issues to be addressed in its ruling:

- The value of 1,187 acres of Minnesota farmland

- Whether a particular interest in a general partnership held by the AFLP should be valued as a partnership interest or an assignee interest, and

- The lack of control and lack of marketability discounts that should apply to the limited and GP interests.

This article will summarize the first two issues briefly, and then address the third issue, which deals with valuation discounts, in greater detail.

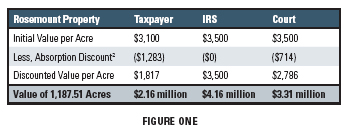

Issue #1 – Determine the value of 1,187 acres of Minnesota farmland (Rosemount Property)

The Taxpayer’s expert and the IRS expert each used a market approach by reviewing sales of similar properties.

According to the Court, the IRS expert was “particularly credible, highly experienced and possessed a unique knowledge of farm property located in the county in which the subject property was located.” The court used his initial value of $3,500 per acre.

However, the IRS appraiser did not apply an absorption discount to this value. The Court determined that an absorption discount was appropriate, but not to the extent applied by the Taxpayer’s appraiser. Using present value mechanics and making assumptions with respect to the holding period, discount rate, and appreciation rates, the Court applied an effective absorption discount of about 20%. The discounted price per acre was $2,786.

Issue #2 – Determine whether 50% GP interest in Pine Bend (held by the FLP) should be valued as a GP interest or an assignee interest

The Taxpayer’s appraiser argued that it should be valued as an assignee interest. As such, he discounted the interest because under Minnesota law a holder of an assignee interest would have an interest only in the profits of the partnership and would have no influence on management.

The IRS appraiser argued that the “substance over form doctrine” should apply, and therefore, the interest should be valued as a GP interest.

The court adopted the “substance over form doctrine” and rejected the Taxpayer’s argument; however, as discussed below, the Court applied a combined lack of control and lack of marketability discount of 30% to the Pine Bend interest, consistent with the Taxpayer’s appraiser’s methodology.

Issue #3 – Determine the lack of control and the lack of marketability discounts that should apply to the limited and GP interests

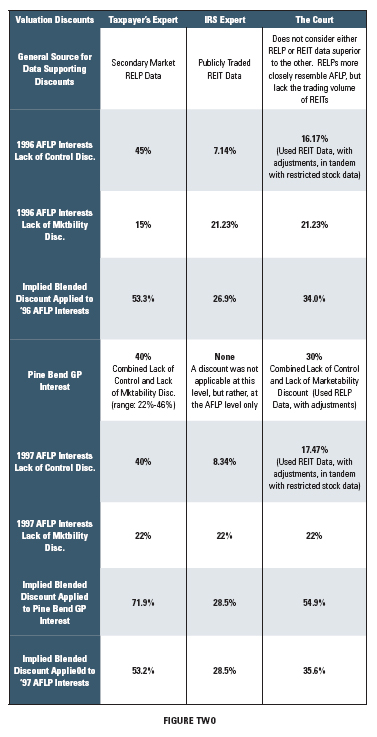

Figure Two summarizes the discounts applied by the Taxpayer, the IRS, and the Court.

Lack of Control Discounts Applied to AFLP Interests

The Taxpayer. The Taxpayer’s expert relied upon RELP secondary market data to determine that the lack of control discounts applicable to the 1996 and 1997 gifts of AFLP Interests were 45% and 40%, respectively. The RELP data, which reflected a group of four selected RELPs, provided a range of discounts of 40% to 47%. It is unclear how the Taxpayer’s expert determined that the lack of control discount applicable to the 1996 interests was greater than that applicable to the 1997 interests.

The Court noted that two of the four selected RELPs were more leveraged than AFLP. In addition, AFLP’s distribution yield of 10% was greater than the 6.7% average yield of the RELP group. The Court considered these two factors to be indicative of a lack of control discount less than that reflected in the RELP pricing. Due to these differences, among others, the Court concluded that the RELPs selected were “too dissimilar to AFLP to warrant the amount of reliance [the Taxpayer’s] expert placed on them” and the discounts for lack of control were excessive.

The IRS. The IRS expert relied upon REIT data to derive discounts for lack of control. The REIT data, which included approximately 75 REITs, indicated that the selected group traded at a median premium of 0.1% in 1996 and a median discount of 1.2% in 1997.

The Court explained that REIT prices are “in part affected by two factors, one positive (the liquidity premium) and one negative (lack of control).” The Court went on to say that liquidity premiums should be reversed out of the trading prices so as to determine the embedded discount for lack of control.3

The IRS expert used a regression analysis to determine that REITs traded at a liquidity premium of 7.79% relative to closely held partnership interests. Based upon this liquidity premium and the 1996 REIT group median premium of 0.1% and the 1997 REIT group median discount of 1.2%, the IRS expert calculated discounts for lack of control of 7.14% and 8.34% in 1996 and 1997, respectively.4

The Court. The Court ultimately decided to use the REIT data presented by the IRS expert to determine the appropriate lack of control discount, but the Court deemed the 7.79% liquidity premium offered by the IRS expert to be “unreasonably low.” Accordingly, the Court sought to calculate a more reasonable liquidity premium by calculating the difference in “average discounts observed in the private placements of registered and unregistered stock.” The Court considered any such difference as representative of “pure liquidity concerns.” Using this methodology, the Court referenced two studies cited by the IRS expert which indicated that a general premium for liquidity in publicly traded assets was on the order of 16.27%. Based upon this observed premium and the REIT group premium of 0.1% in 1996 and discount of 1.2% premium in 1997, the Court concluded that the discounts for lack of control in 1996 and 1997 should be 16.17% and 17.47%, respectively.5

Lack of Marketability Discounts Applied to AFLP Interests

Little explanation was provided with respect to the marketability discounts applicable to the gifts of AFLP interests.

The following relates to the 1996 AFLP interests:

[The Taxpayer’s] expert estimated a discount of 15%, and [the IRS] expert estimated a discount of 21.23%. We perceive no reason not to use [the IRS’s] higher marketability discount of 21.23% without further discussion, which we do.

The following relates to the 1997 AFLP interests:

Because both parties advocate a lack of marketability discount of approximately 22%, we apply a lack of marketability discount of 22%.

Combined Lack of Control and Lack of Marketability Discounts Applied to Pine Bend GP Interest

The Taxpayer’s expert relied upon data regarding 17 RELPs to determine a range of discounts of 22% to 46%, and he then selected a 40% discount without fully explaining the selection of that measure over the midpoint of the range or some other measure. The IRS appraiser did not apply any discount, as he claimed that any such discounts should be applied at the AFLP level only.

The Court rejected the position of each appraiser and performed its own analysis of RELP data. The Court concluded that a 30% combined discount for lack of control and lack of marketability was appropriate at the Pine Bend level, providing further support for applying tiered discounts in asset holding entities.

Summary and Conclusions

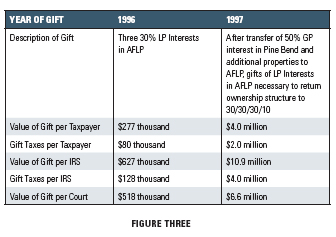

Figure Three summarizes the valuation conclusions reached by the Taxpayer’s expert, the IRS’s expert, and the Court.

As shown, the Court’s opinion fell within the range defined by the conclusions of the experts representing the Taxpayer and the IRS, with a slight overall bias towards the Taxpayer’s expert.

Observations

The Court’s application of an absorption discount appears to be well-grounded in present value mechanics using seemingly reasonable assumptions. Further, the general application of valuation discounts to not only the FLP interests but also the GP interest held by the FLP seems to be supported by valuation theory. However, the Court’s reliance on RELP and REIT data to determine the lack of control discount to be applied to AFLP interests is questionable.

In general, the price-to-NAV ratios observed in the REIT and RELP marketplace often reflect a numerator (price) which is current and a denominator (NAV) which is more dated. A REIT’s NAV may be determined once per year (usually at year-end) while market prices are determined by trading activity throughout the year. Under this system, some properties held by a REIT may experience rapid and unexpected appreciation in June, but NAV would still reflect the appraised values as of the preceding December, resulting in an understated NAV measure, all else equal. In this case, the price-to-NAV ratio may indicate the REIT is trading at a substantial premium to NAV due to the understated measure used in the denominator.

More meaningful valuation discounts may be derived using investment classes that have NAV measures which are updated throughout the year. One example is closed-end funds. In our experience, closed-end funds (equities and bonds) frequently trade at a discount to NAV between 0% and 15%. These discounts may be interpreted to represent a discount for lack of control.

Finally, the Court relied upon two studies (cited in the IRS expert’s report) in the determination of a liquidity premium. We note that these studies make use of equity market data (registered and unregistered stock information). The Court selects the liquidity premium implied in the equity markets and applies it to a FLP holding real estate. In a sense, the Court seems to have assumed there is only one liquidity premium for all asset classes in the marketplace. The Court uses this liquidity premium in tandem with the price-to-NAV ratios of REITs to calculate the resulting discount for lack of control for the AFLP interests. Intuitively, there appears to be a disconnect between REIT market pricing and the premiums paid for registered versus unregistered equity interests.

Endnotes

1 Jane Z. Astleford v. Commissioner, T.C. Memo 2008-128, filed May 5, 2008

2 The Court’s absorption discount was based upon assumed market absorption over a four-year period, a discount rate of 10%, appreciation of 7% per annum, sales expenses of 7.25%, and property taxes of 60 bp. Taxpayer’s expert made similar assumptions, but applied a discount rate of 25% (rather than 10%).

3 With respect to REIT data, discounts and premiums are based upon the ratio of price to NAV.

4 The relevant formula is: (1 + Liquidity Prem.) x (1 – LOC Discount) = (1 + Disc. or Prem. to NAV). Using 1997 as an example: (1.0779) x (1 – LOC Discount) = 0.988. (1 – LOC Discount) = 0.9166. Lack of Control Discount = 8.34%.

5 For 1996: 16.27% – 0.1% = 16.17%. For 1997: 16.27% + 1.2% = 17.47%.

Reprinted from Mercer Capital’s Value Added™, Vol. 20, No. 2, 2008