Koons v. Commissioner

It appears that Mr. Koons’ careful estate planning, involving a significant sale and redemption transaction of business operations to provide liquidity and flexibility in his later years, was disrupted by an untimely death. While estate planning professionals can hardly advise against a premature passing, the disruption here highlights the importance of starting early with business valuation input to help avoid a complex confluence of strategic transactions within a narrow time frame.

Key Issues

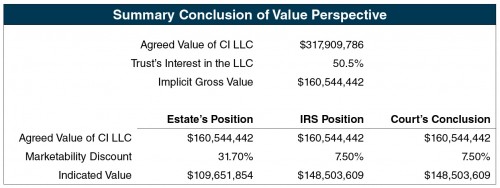

The Court rejected the Estate’s claim seeking a 31.7% marketability discount applied to a Revocable Trust’s ownership interest in a family-owned Limited Liability Company. The Estate’s expert calculated a marketability discount through a regression analysis. It was his opinion that a substantial risk existed that the Trust’s contemplated redemptions of Member Interests, contracted for as part of a planned redemption, might not be consummated. The contemplated redemptions would place the Trust in a voting control position.

The Court agreed with the IRS expert’s conclusion that the referenced redemption offers were binding contracts and were expected to be consummated. The lower risk implicit in the likelihood of a transaction, in context with the implicit voting control position, resulted in the IRS marketability discount of 7.5%, which was accepted by the Court.

The Court also held that claimed interest expense in the amount of $71,419,497 on a $10,750,000 loan from CI LLC to the John F. Koons III Revocable Trust is not deductible to the Estate as an essential expense. The Trust had borrowed the $10.75 million from the LLC in order to pay estate taxes.

Background

John Koons III (the “decedent” or “Koons”) died on March 3, 2005. At issue before the court was the value of his interest in his Revocable Trust (the “Trust’), as well as the deductibility of claimed interest expense on a loan which was incurred by the Trust to make payments on the estate tax liability.

In 1934, the father of John Koons III began buying shares in the Burger Brewing Co., which owned and operated a Cincinnati brewery. The decedent also purchased shares and later became the company’s president and CEO. Under Koons’ leadership, the company began bottling and distributing Pepsi soft drink products in the 1960s. In the 1970s the company stopped brewing beer altogether, and changed its name to Central Investment Corp. (“CIC”). Diversifying its business further, it expanded into the business of selling food and drinks from vending machines.

In 1997, CIC was in a dispute with PepsiCo about whether CIC had the exclusive right to sell Pepsi fountain syrup directly to restaurants, movie theatres, and other customers in its territory. Litigation ensued, and PepsiCo eventually suggested that the lawsuit could be settled if CIC exited the Pepsi system. CIC negotiated with PepsiAmericas, Inc., (“PAS”), the nation’s second largest Pepsi-Cola bottling company. Negotiations were expanded to include the sale of CIC’s vending-machine business.

In preparation for the sale of its soft drink and vending machine business, Central Investment LLC (“CI LLC”) was set up in August 2004 as a wholly owned subsidiary of CIC, to receive all the non-soft-drink and non-vending-machine assets. Koons and his children owned the same percentage in the newly-formed CI LLC as they did in CIC. However, the children were required to approve the sale transaction. Further, their interests in CI LLC were subject to redemption agreements within 90 days of the PAS transaction.

The PAS sale transaction was effected on January 12, 2005.

On February 27, 2005 (approximately four days before the valuation date), the last of the four children signed her letter offering to redeem their respective interests in CI LLC. Mr. Koons died on March 3, 2005. Mr. Koons had already transferred his interests in CI LLC to his Revocable Trust. At his death, the Revocable Trust had a total 50.50% interest in CI LLC, which included a 46.94% voting interest and a 51.59% nonvoting interest. The net asset value of CI LLC at the date of death was $317,909,786.

The children’s redemptions scheduled as part of the sale transaction took place on April 30, 2005 (approximately two months after the valuation date). With redemptions complete, the Trust (by then a Trust Under Will) owned a 70.42% voting interest and a 71.07% nonvoting interest in CI LLC.

On February 28, 2006 (approximately one year after the valuation date), the Trust borrowed $10.75 million from CI LLC to facilitate payments for Estate Tax liabilities. The Trust received a promissory note in the amount of $10,750,000 at 9.5% annual interest, with the principal and interest due in 14 equal installments of approximately $5.9 million each between August 31, 2024 and February 28, 2031. The terms of the loan prohibited prepayment. The total interest component of the 14 installments was $71,419,497. The proceeds of the loan would be used to make a payment toward the estate and gift tax liabilities.

Commentary

The parties agreed that the value of the Revocable Trust’s interest in CI LLC was less than the pro rata asset value. The parties also agreed that the difference was due to the lack of marketability of the interest in CI LLC as compared to the marketability of CI LLC’s assets. However, the parties disagreed on the magnitude of the marketability discount.

With Regard to the Marketability Discount

The Estate’s expert considered the Trust’s ownership interest in CI LLC as it existed on the date of death, i.e., a total 50.50% interest (comprised of a 46.94% voting interest and a 51.59% nonvoting interest). He developed a marketability discount through a regression analysis, and concluded that a 31.7% marketability discount was appropriate considering, among other factors, substantial risk existed that the redemptions of the children’s interests might not be consummated. Of course, the redemption of the children’s interests were accomplished soon after the valuation date, which resulted in the Trust owning a 70.42% voting interest and a 71.07% nonvoting interest in CI LLC.

The IRS expert believed that the redemptions of the interests of the four children would occur, and such redemptions would increase the voting power of the Trust’s interest to 70.42%. In determining a marketability discount, he considered the following characteristics of the Trust’s total 50.50% interest in CI LLC:

- There was only a small risk that the redemptions would not be completed;

- There were obligations imposed on CI LLC by the stock-purchase agreement, including those related to potential environmental, health, and safety liabilities;

- It was reasonable to expect that CI LLC would make cash distributions;

- There were transferability restrictions in the operating agreement;

- The owner of the Trust’s interest would have had the ability to force CI LLC to distribute most of its assets once the redemptions were closed;

- Most of CI LLC’s assets were liquid.

The IRS expert opined that a 5 -10% marketability discount was warranted. Within the 5 -10% range, he thought that 7.5% would reflect a reasonable compromise between a buyer and a seller.

The Court analyzed the two approaches to the marketability discount, highlighting that a key difference was the assumption of whether or not those scheduled redemptions would occur. The Court agreed with the IRS expert’s assumption, applying a 7.5% marketability discount, based on the following points:

- The redemption offers were binding contracts by the time Mr. Koons died on March 3, 2005;

- CI LLC had made written offers to each of the children to redeem their interests in CI LLC on December 21, 2004;

- Each of the four children had signed an offer letter by February 27, 2005;

- Once signed, the offer letters required the children to sell their interests in CI LLC to CI LLC.

With Regard to the Interest Expense Deduction

To raise money to pay for the Estate tax liabilities, the Trust borrowed $10.75 million from CI LLC in 2006. Because the installments were deferred for over 18 years, the interest component of the installments was high: it totaled $71,419,497.

According to the Court, administration expense deductions against the gross estate are limited by regulation to such expenses as are actually and necessarily incurred in the administration of the decedent’s estate, such as the collection of assets, payment of debts, and distribution of property to persons entitled to it. Expenditures not essential to the proper settlement of the estate, but incurred for the individual benefit of the heirs, legatees, or devisees, may not be taken as deductions.

The Court concluded it was not necessary for the Trust to borrow the $10.75 million from CI LLC in order to pay the federal tax liabilities:

- When it borrowed the money on February 28, 2006, the Trust had a 70.42% voting control over CI LLC, and CI LLC had over $200 Million in highly liquid assets.

The Trust had the power to force CI LLC and its Board of Managers to make a pro rata distribution to its members, including the Trust itself. - The Trust’s ability to force CI LLC to distribute assets made it unnecessary for the Trust to borrow from CI LLC.

- Lending money to the Trust did not avoid the necessity of making distributions altogether; it merely postponed the necessity. Furthermore, the Estate must remain active long enough for the loan to be repaid.

- The loan repayments are due 18 to 25 years after the death of Mr. Koons. Keeping the Estate open that long hinders the “proper settlement” of the Estate.

Since the loan was not necessary to the administration of the Estate, the projected interest to be paid under the loan is not a deductible administration expense of the Estate.

What’s Important

It appears that Mr. Koons’ careful estate planning, involving a significant sale and redemption transaction of business operations to provide liquidity and flexibility in his later years, was disrupted by an untimely death. The consideration of a loan component extending the life of the estate for many years beyond the date of death was an over-reach, and possibly could have been addressed after the redemption transaction. Furthermore, that redemption transaction clearly put the Trust in a voting control position. The IRS and the Court considered that contractual obligation to be a driving factor, thereby limiting the marketability discount. That controlling interest position would also likely have been addressed in a future estate planning strategy.

While estate planning professionals can hardly advise against a premature passing, the disruption here highlights the importance of starting early with business valuation input to help avoid a complex confluence of strategic transactions within a narrow time frame.