Labor Shortage in Trucking Sector

Driver Shortage

The trucking industry is wedged between a rock and a hard place when it comes to driver recruitment. Trucking companies are simultaneously exploring self-driving technology, while still convincing new entrants to the labor market that commercial driving is a career choice that will pay off. Punctuating the less-than-glamorous work and lifestyle conditions of the occupation, those entering the labor force realize that the career path could be upended in the near-term by the economic cycle and disrupted in the long term by the impending evolution of autonomous transportation. With several companies (like Tesla) beginning deployment of self-driving trucks, and numerous others deep in development of the technology, young workers may fear choosing a vocation that trucking companies are actively planning to automate.

Rob Sandlin, CEO of Patriot Transportation, emphasized these challenges in the company’s third quarter earnings call, “Management spends a good deal of time dealing with these issues surrounding driver shortage, including advertising, recruiting, compensation, dispatcher training and productivity among others.” With the tightening of the labor market, companies have found new ways to attract talent including investments in newer and more reliable assets, in-house training programs, incentive bonuses, and, of course, a simple increase in wages.

Executives at many of the largest trucking companies dedicated time in their third quarter investor calls and presentations to this issue. PAM identified several unique recruitment initiatives in its November corporate presentation. The company is taking advantage of temporary visitor qualifications through the B1 Visa program to increase labor capacity. This program allows commercial drivers with Mexican residence temporary entry to the United States for truck delivery. Additionally, the company’s new driver-friendly initiatives promote lifestyle and career improvements. Its “Driver Life-Cycle” program provides dedicated driver experience with a path towards ownership through a lease-to-own set up.

Patriot mentioned significant changes to its recruitment efforts, as well. “In the latter part of fiscal 2018, we implemented a significant change to our hiring process, we added [a] driver advocate position and introduced productivity-based driver pay, all in an effort to attract and retain drivers. We are encouraged by the increased number of drivers hired and in training since these implementations, and we’ll continue to monitor our progress for any needed adjustments to our plan.”

Mechanic Shortage

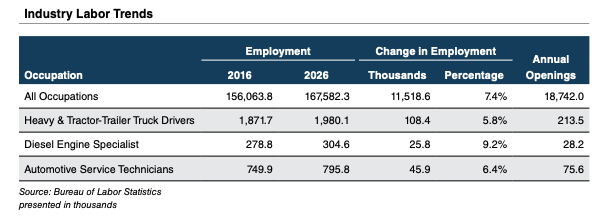

The driver shortage (which is estimated to reach 108,000 by 2026) has sparked major shifts in the way hiring and training are conducted in the industry. While this shortage will hurt shippers until autonomous technology is fully developed, the long-term problem may actually lie in another labor pool: service technicians.

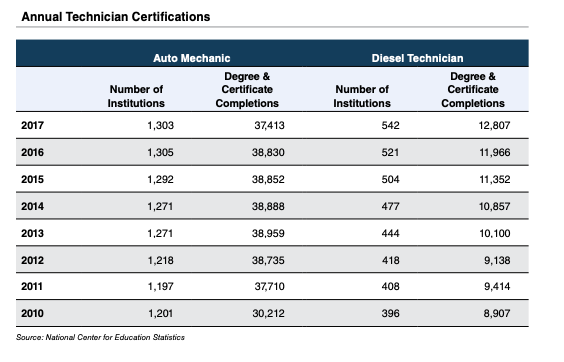

As new truck designs increase the level of technology on board, those who service them will have to develop more tech-focused expertise. Additional sensors, predictive technology, and, of course, autonomy will evolve the role of the truck mechanic as they start spending more time with computers than wrenches. While technical colleges and certificate programs continue to produce a skilled workforce, the supply of service technicians has not kept pace with the increasing demand.

Trucking companies have had to adapt to the shifting labor force trends and find new ways to fulfill maintenance needs. Like driver scarcity, mechanic shortages have caused companies to seek alternatives to traditional labor sourcing, from outsourcing labor needs to developing training programs.

Overall, employment in the transportation and warehousing industry grew 3.5% from October 2017 to October 2018, adding more than 183,700 jobs. Nearly 37,000 of these jobs were in the trucking industry, which experienced a 2.5% increase in employment over the prior year. The transportation industries are adding jobs faster than the overall non-farm economy, which experienced a more modest 1.7% increase in employment.

Despite labor pressures in the industry, economic activity and transportation demand remain strong. While executives will continue to monitor driver and mechanic shortages, the outlook for trucking in 2019 appears optimistic. John Roberts III, CEO of J.B. Hunt, summed up the industry sentiment well on the company’s third quarter earnings call.

Just final comment on the people side of things. Driver hiring has been a challenge. It’s been a challenge in the past. It presented us with the challenge like we have never seen before this year. In fact, our unseated need number got as high as [it’s] ever been. In about the last 60 days, we’ve seen that number come down a little bit through a number of internal efforts. And I think overall pay in the industry is starting to catch up a little bit. And so I think more people are becoming interested. But we’re making progress there and feel confident we’ll continue to get through that. Good year, some challenges, and frankly, we’re looking forward to heading into 2019.

Originally published in the Value Focus: Transportation & Logistics, Fourth Quarter 2018.