Neiman Marcus: A Restructuring Case Study

Mercer Capital is a national valuation and financial/transaction advisory firm. The Neiman Marcus Chapter 11 bankruptcy filing raises multiple valuation questions:

-

Fraudulent conveyance (asset stripping) and solvency related to pre-filing asset distributions

-

Liquidation vs going concern value

-

Value of the company once it emerges from Chapter 11

-

Allocation of enterprise value to secured and unsecured creditors

-

Fresh start accounting

Neiman Marcus Group, Inc. (“Neiman Marcus” or “Company”) is a Dallas, Texas-based holding company that operates four retail brands: Neiman Marcus, Bergdorf Goodman, Last Call (clearance centers), and Horchow (home furnishings). Unlike other department store chains, such as JCPenney and Macys that cater to the mass market, Neiman Marcus’s target market is the top 2% of U.S. earners.

Among the notable developments over the last 15 years were two private equity transactions that burdened the Company with a significant debt load and one well-timed acquisition. The debt and acquisition figured prominently in the May 7, 2020 bankruptcy filing in which the company sought to reorganize under Chapter 11 with the backing of most creditors.

Iconic Luxury Retailer to Indebted Morass

History

The iconic Neiman Marcus department store was established in 1907 in Dallas. Over the ensuing decades, the Company prospered as oil wealth in Texas fueled demand for luxury goods. Neiman Marcus merged with Broadway-Hale Stores (later rechristened Carter Hawley Hale Stores, Inc.) in the late 1960s. Additional stores were opened outside of Texas in Atlanta, South Florida, and other wealthy enclaves around the U.S. except for New York where Bergdorf Goodman (acquired in the 1970s) operated two stores.

In 1987, Neiman Marcus along with Bergdorf Goodman was partially spun out as a public company with the remaining shares spun in 1999.

In 2005, the Company was acquired via a $5 billion LBO that was engineered by Texas Pacific Group and Warburg Pincus. Once the economy rebounded sufficiently from the Great Financial Crisis, the PE-owners reportedly sought to exit via an IPO in 2013. However, the IPO never occurred. Instead, the Company was acquired for $6 billion by Ares Management and the Canada Pension Plan Investment Board (“CPPIB”).

In 2014 Neiman Marcus acquired MyTheresa, a German luxury e-commerce retailer with annual revenues of $130 million, for $182 million of cash consideration. During 2018, the entity that held the shares of MyTheresa (MyT Holding Co.) was transferred via a series of dividends to the Neiman Marcus holding company directly controlled by Ares and CPPIB and thereby placed the interest out of the reach of Company creditors.

Neiman Marcus filed an S-1 in 2015 in anticipation of becoming a public company again; however, the registration statement was withdrawn due to weak investor demand.

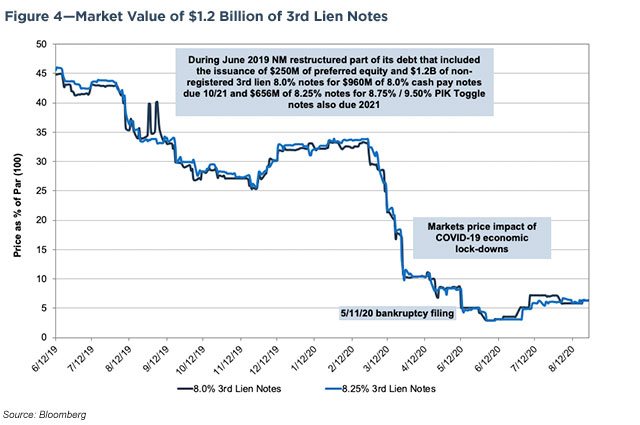

Although Neiman Marcus’ common shares had not been publicly traded since 2005, the Company filed with the SEC because its debt was registered. During June 2019, the Company deregistered upon an exchange of new notes and preferred equity for the registered notes. S&P described the restructuring as a selective default because debt investors received less than promised with the original securities.

Review of Financials

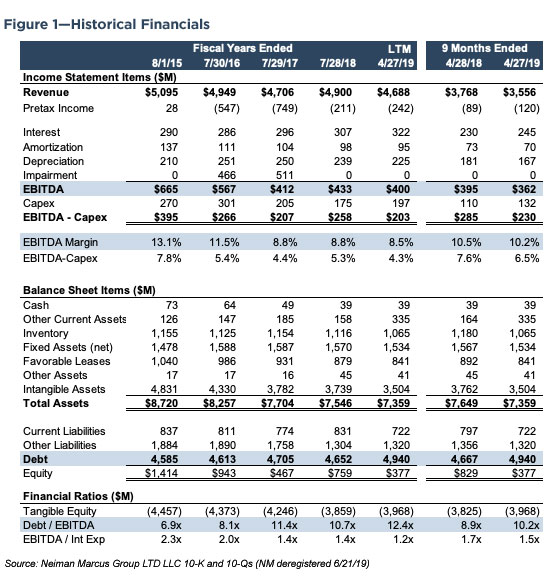

Figure 1 below presents a recent summary of the company’s financial performance and position one year prior to the bankruptcy filing. Of note is the extremely high debt burden that equated to 12.4x earnings before interest taxes, depreciation, and amortization (“EBITDA”) for the last twelve months (“LTM”) ended April 27, 2019. Although definitions vary by industry, federal banking regulators consider a company to be “highly levered” if debt exceeds EBITDA by 6x.

Moody’s downgraded the Company’s corporate credit rating to B3 from B2 in October 2013 with the acquisition by Ares and CPPIB. Moody’s also established an initial rating of Caa2 for unsecured notes issued to partially finance the acquisition. By the time the notes were deregistered, Moody’s had reduced the corporate rating to Caa3 and the notes to Ca.

Moody’s defines Caa as obligations that “are judged to be of poor standing and are subject to very high credit risk,” and Ca as obligations that are “highly speculative and are likely in, or very near, default, with some prospect of recovery in principal and interest.”

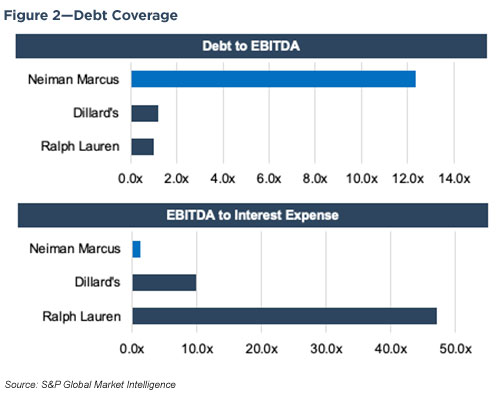

Neiman Marcus has struggled with a high debt load since the first LBO in 2005, which has been magnified by the disruptive impact that online retailing has had on department stores. EBITDA declined from $665 million in FY2015 to $400 million in the LTM period ended April 27, 2019; the EBITDA margin declined by over a third from 13.1% to 8.5%, over the same time. By April 2019, debt equated to 12.4x LTM EBITDA and covered interest expense by 1.2x.

By way of reference, the debt/EBITDA and EBITDA/interest ratios for Ralph Lauren (NYSE: RL) for the fiscal year ended March 30, 2019, were 1.0x and 47.1x, while the respective ratios for Dillard’s (NYSE: DDS) were 1.2x and 9.9x for the fiscal year ended February 2, 2019.

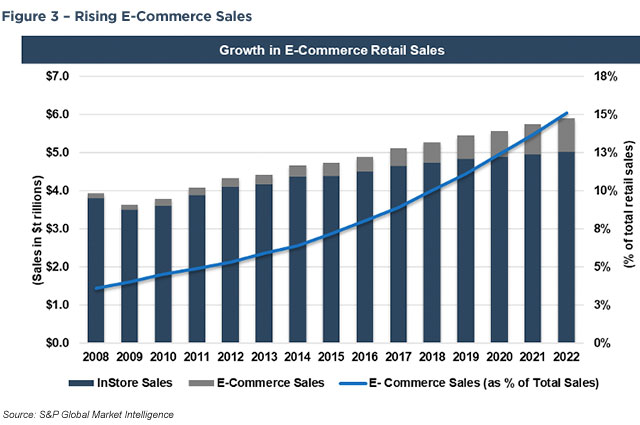

At the time of bankruptcy, Neiman Marcus generated about one-third of its sales (about $1.5 billion) online. MyTheresa generated approximately $500 million of this up from $238 million in 1Q17 when certain subsidiaries that held MyTheresa were designated “unrestricted subsidiaries” by the Company. While MyTheresa’s sales increased, the legacy department store business declined as the Company struggled to connect with younger affluent customers who favored online start-up boutiques and had little inclination to shop in a department store.

As shown in the chart below, ecommerce sales as a portion of total retail sales have doubled over the last five years to about 12% in 2019. The move to work from home (“WFH”) and social distancing practices born of COVID-19 in early 2020 have accelerated the trend such that the pre-COVID-19 projection of e-commerce sales rising to 15% by 2020 will likely prove to be significantly conservative.

Bankruptcy Filing

Neiman Marcus filed on May 7, 2020 for chapter 11 bankruptcy protection. The COVID-19 induced shutdown of the economy was the final nail in the coffin, which forced major furloughs and the closing of its stores in accordance with various local shelter-in-place regulations. Other recent retail bankruptcies include Lord & Taylor, Men’s Warehouse, Ann Taylor, Brooks Brothers, Lucky Brands, J. Crew with many more expected to file.

The initial plan called for creditors to convert $4 billion of $5 billion of debt into equity. The plan does not provide for mass store closures or asset sales, although the Last Call clearance stores will close.

As noted, the bankruptcy filing follows a restructuring in June 2019 that entailed:

- An exchange of all but $137 million of $960 million of 8.0% cash pay and $656 million of 8.75%/9.50% PIK Toggle unsecured notes for $1.2 billion of (i) 8.0% and 8.75% third lien Company notes and (ii) $250 million of Series A preferred equity in MyT Holding Co., a US-based entity that holds the German corporate entity that operates MyTheresa;

- The issuance of $550 million of new second-lien 6% cash pay/8.0% PIK notes due 2024 with a limited senior secured claim of $200 million from MyT Holding Co. and other MyT affiliates;

- A partial paydown of the first-lien term loan facility at par with the proceeds of the second lien notes; and

- An exchange for the remaining $2.2 billion first-lien credit facility with a new facility and an extension of the maturity to October 2023.

The restructuring did not (apparently) materially impact the Company’s $900 million asset-based credit facility of which $455 million was drawn as of April 2019; or the first lien $125 million debentures due in 2028.

As shown in Figure 4, market participants assigned little value to the $1.2 billion of third lien notes that were trading for around 8% of par when the bankruptcy filing occurred and 6% of par in late August 2020.

The binding Restructuring Support Agreement (“RSA”), dated May 7, 2020, included commitments from holders of 99% of the Company’s term loans, 100% of the second line notes, 70% of the third line notes, and 78% of the residual unsecured debentures to equitize their debt. Also, certain creditors agreed to backstop $675 million in debtor-in-possession (“DIP”) financing and to provide $750 million of exit financing which would be used to refinance the DIP facility and provide incremental liquidity.

DIP financing is often critical to maintain operations during the bankruptcy process when the company has little cash on hand. DIP financing is typically secured by the assets of the company and can rank above the payment rights of existing secured lenders. DIPs often take the form of an asset-based loan, where the amount a company borrows is based on the liquidation value of the inventory, assuring that if the company is unable to restructure, the loan can be repaid from the liquidation of the retailer’s assets.

Bankruptcy Path: Chapter 7 vs. Chapter 11

Federal law governs the bankruptcy process. Broadly, a company will either reorganize under Chapter 11 or liquidate under Chapter 7.

A Chapter 7 filing typically is made when a business has an exceedingly large debt combined with underlying operations that have deteriorated such that a reorganized business has little value. Under Chapter 7, the company stops all operations. A U.S. bankruptcy court will appoint a trustee to oversee the liquidation of assets with the proceeds used to pay creditors after legal and administrative costs are covered. Unresolved debts are then “discharged”, and the corporate entity is dissolved.

Under Chapter 11, the business continues to operate, often with the same management and board who will exert some control over the process as “debtor in possession” operators. Once a Chapter 11 filing occurs, the debtor must obtain approval from the bankruptcy court for most decisions related to asset sales, financings, and the like.

Most public companies and substantive private ones such as Neiman Marcus file under Chapter 11. If successful, the company emerges with a manageable debt load and new owners. If unsuccessful, then creditors will move to have the petition dismissed or convert to Chapter 7 to liquidate.

Most Chapter 11 filings are voluntary, but sometimes creditors can force an involuntary filing. Normally, a debtor has four months after filing to propose a reorganization plan. Once the exclusivity period ends creditors can propose a competing plan.

Usually, the debtor continues to operate the business; however, sometimes the bankruptcy court will appoint a trustee to oversee the business if the court finds cause to do so related to fraud, perceived mismanagement and other forms of malfeasance.

The U.S. Trustee, the bankruptcy arm of the Justice Department, will appoint one or more committees to represent the interests of the creditors and stockholders in working with the company to develop a plan of reorganization. The trustee usually appoints the following:

- The “official committee of unsecured creditors”

- Other creditors committee representing a distinct class of creditors such as secured creditors or subordinated bond holders; and

- Stockholders committee.

Once an agreement is reached it must be confirmed by the court in accordance with the Bankruptcy Code before it can be implemented. Even if creditors (and sometimes stockholders) vote to reject the plan, the court can disregard the vote and confirm the plan if it believes the parties are treated fairly.

Neiman Marcus pursued a “prepackaged” or “prepack” Chapter 11 in which the company obtained support of over two-thirds of its creditors to reorganize before filing. Under the plan, the Company would eliminate about $4 billion of $5.5 billion of debt. The creditors also committed a $675 million DIP facility that will be replaced with a $750 million facility once the plan is confirmed by the court.

The Role of Valuation in Bankruptcy

Valuation issues are interwound in bankruptcy proceedings, especially in Chapter 11 filings when a company seeks to reorganize. Creditors and the debtor will hire legal and financial advisors to develop a reorganization plan that maximizes value and produces a reorganized company that has a reasonable likelihood of producing sufficient cash flows to cover its obligations.

There are typically three valuation considerations for companies restructuring through Chapter 11 Bankruptcy.

- Companies must prove that a Chapter 11 Restructuring is in the “best interest” of its stakeholders;

- A cash flow test must prove that post-reorganization the debtor will be able to fund obligations; and,

- “Fresh Start Accounting” must be adopted in which the balance sheet is restated to fair value.

Sometimes as is the case with Neiman Marcus there is a fourth valuation-related issue that deals with certain transactions that may render a company insolvent.

Fraudulent Conveyance

A side story to Neiman Marcus relates to the 2018 transaction in which the shares of MyTheresa were transferred in 2018 to bankruptcy-remote affiliates of PE owners Ares and CPPIB. Under U.S. bankruptcy law, transferring assets from an insolvent company is a fraudulent transaction.

During 2017, Neiman Marcus publicly declared the subsidiaries that held the shares were “unrestricted subsidiaries.” Once the distribution occurred in September 2018, creditors litigated the transaction. All but one (Marble Ridge) settled in 2019 as part of the previously described debt restructuring.

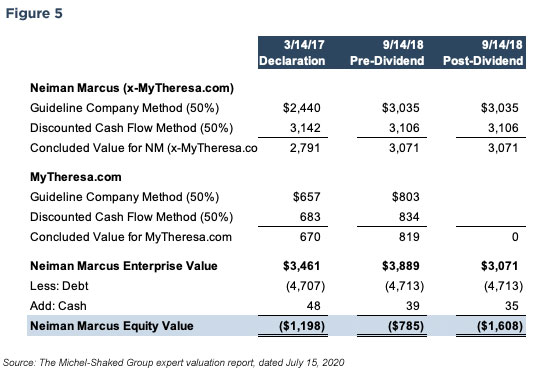

Since the bankruptcy filing occurred, the unsecured creditors commissioned a valuation expert to review the transaction to determine whether Neiman Marcus was solvent as of the declaration date, immediately prior to the distribution and after the distribution. As shown in Figure 5, the creditors’ expert derived a negative equity value on all dates. If the court accepted the position, then presumably Ares and CPPIB would be liable for fraudulent conveyance.

At the time the distribution occurred, Neiman Marcus put forth an enterprise valuation of $7 billion and relied upon the opinion of two national law firms that it was within its rights to execute the transaction. Since filing, the PE owners have commissioned one or more valuation experts whose opinion has not been disclosed.

On July 31, 2020, the committee of unsecured creditors and the Company reached a settlement related to the fraudulent conveyance claims arising from the MyTheresa transaction. Ares and CPPIB agreed to contribute 140 million MyTheresa Series B preferred shares, which represent 56% of the B class shares, to a trust for the benefit of the unsecured creditors. The Company also agreed to contribute $10 million cash to the trust. A range of value for the series B shares of $0 to $275 million was assigned in a revised disclosure statement filed with the bankruptcy court.

Marble Ridge, which served on the committee, did not view the settlement as sufficient as was the case in 2019 when it did not participate in the note exchange as part of the 2018 litigation settlement.

During August, it became known that Marble Ridge founder Dan Kamensky pressured investment bank Jeffrey’s not to make a bid for the shares that were to be placed in a trust because it planned to bid, too (reportedly 20 cents per share compared to 30 cents or higher by Jeffrey’s). The anti-competitive action was alleged to have cost creditors upwards of $50 million. Marble Ridge subsequently resigned from the creditors committee and announced plans to close the fund. Kamensky was arrested on September 7th and charged with securities fraud, extortion, wire fraud, extortion, and obstruction of justice, according to the U.S. Attorney’s Office for the Southern District of New York.

Best Interest Test

A best interest test must show that the reorganization value is higher than the liquidation value of the company, to ensure that the creditors in Chapter 11 receive at least as much under the restructuring plan as they would in a Chapter 7 liquidation.

In the case of Neiman Marcus, the liquidation vs. reorganization valuation analysis was a formality because most unsecured creditors and the Company agreed to a prepackaged plan subject to resolution of such items as the MyTheresa shares. Nonetheless, we summarize both for illustration purposes.

Liquidation Analysis

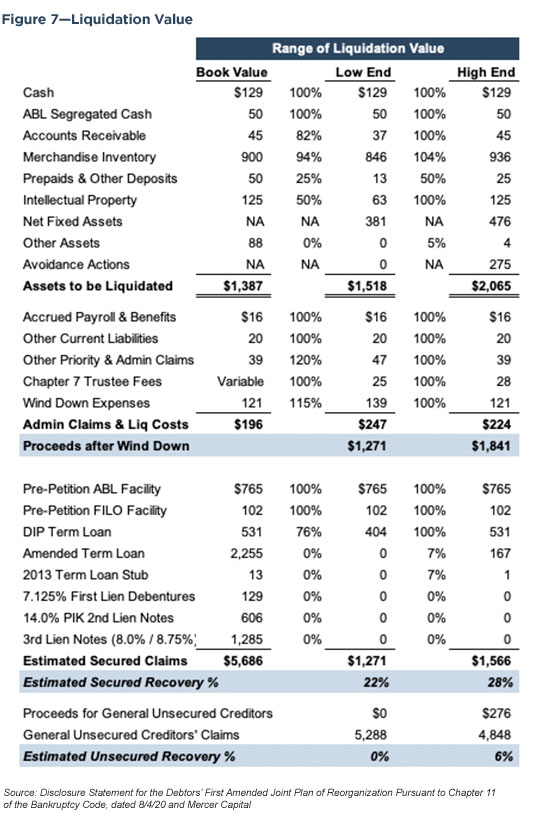

A rough calculation of Neiman Marcus’ liquidation value is included below, based on balance sheet data from April 2019 as these are the most current figures available.

Substantial value in a liquidation analysis depends upon what an investor would be willing to pay for the rights to the Neiman Marcus name as well as its customer lists and proprietary IP code. The recovery ratio applied to Neiman Marcus’ inventory is higher than expected recovery ratios across the broader apparel industry since much of Neiman’s inventory is designer goods. Nonetheless, the analysis implies creditors would face a significant haircut in a Chapter 7 liquidation scenario.

Reorganization (Going Concern) Analysis

The reorganization value represents the value of the company once it has emerged as a going concern from Chapter 11 bankruptcy. Typically, the analysis will develop a range of value based upon (i) Discounted Cash Flow (“DCF”) Method; (ii) Guideline Public Company Method; and (iii) Guideline Transaction Method.

Both guideline methods develop public company and M&A “comps” to derive representative multiples to apply to the subject company’s earnings and cash flow. Market participants tend to focus on enterprise value (market value of equity and debt net of cash) in relation to EBITDA. Secondary multiples include enterprise value in relation to EBIT, EBIT less ongoing Capex, and revenues.

As it relates to Neiman Marcus, we note that Lazard Freres & Co. (“Lazard”) as financial advisor focused on adjusted EBITDA for the LTM period ended February 1, 2020 and the projected 12 months ended February 1, 2022. In doing so, Lazard looked past 2020 and 2021 as excessively abnormal years due to the COVID19 induced recession. Our observation is that this treatment (for now) is largely consistent with how many market participants are treating various earning power measures in industries that were severely impacted by the downturn.

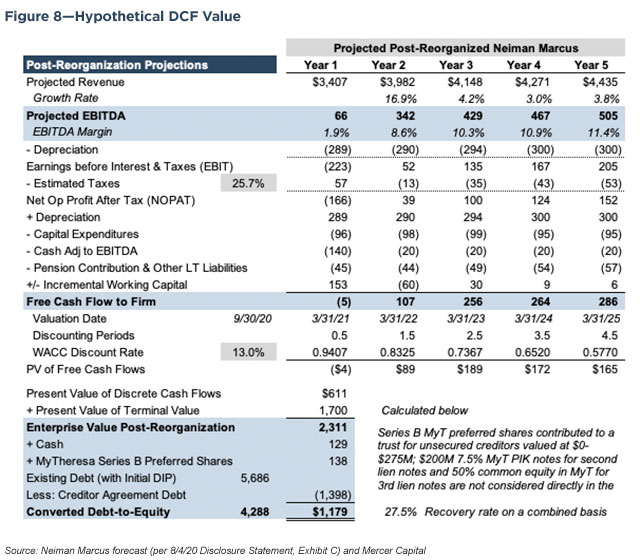

A DCF analysis for Neiman Marcus that assumes the Company emerges from bankruptcy in the fall of 2020 will incorporate the impact of the adverse economy as reflected in presumably subpar operating performance in the first year or two of the projections. More generally, the DCF method involves three key inputs: the forecast of expected future cash flows, terminal value, and discount rate.

- Forecast of Expected Future Cash Flows: Valuation practitioners typically develop cash flow forecasts for specific periods of time, ranging anywhere from three to ten years, or as many periods as necessary until a stable cash flow stream can be realized. Key elements of the forecast include projected revenue growth, gross margins, operating costs, and working capital and capital expenditure requirements. Data from other publicly traded companies within similar lines of business can serve as good reference points for the evaluation of each element in the forecast.

- Terminal Value: The terminal value represents all cash flow values outside of the discrete forecast period. This value is calculated through capitalizing cash-flow at the end of the forecast period, based on expectations of long-term cash flow growth rate and discount rate. Alternatively, a terminal value can be determined through the application of projected or current market multiples.

- Discount Rate: The discount rate is essential in estimating the present value of forecasted cash flows. A proper discount rate is developed from assumptions about costs of equity and debt capital, and capital structure of the new entity. For costs of equity capital, a build-up method is used with long-term risk-free rate, equity premia, and other industry/company-specific factors as inputs. Cost of debt capital and new capital structure can be based on benchmark rates or comparable corporations. The discount rate should reflect the financial risks that come with the projected cash flows of the restructured entity.

The sum of the present values of all forecasted cash flows indicates the enterprise value of the emerging company for a set of forecast assumptions. Reorganization value is the total sum of expected business enterprise value and proceeds from the sale or disposal of assets during the reorganization.

Cash Flow Test

The second valuation hurdle Neiman Marcus will have to jump is a cash flow test. The cash flow test determines the feasibility of the reorganization plan and the solvency of future operations. Since a discounted cash flow analysis is typically used to determine reorganization value, the projected cash flows from this analysis are compared to future interest and principal payments due.

Additionally, the cash flow test details the impact of cash flows on the balance sheet of the restructured entity, entailing modeling changes in the asset base and in the debt obligations of and equity interests in the company. Therefore, the DCF valuation and cash flow tests go together because the amount of debt that is converted to equity creates cash flow capacity to service the remaining debt. If the cash flow model suggests solvent operations for the foreseeable future, the reorganization plan is typically considered viable.

Fresh-Start Accounting

When emerging from bankruptcy in the case of going concern, fresh-start accounting could be required to allot a portion of the reorganization value to specific intangible assets. The fair value measurement of these assets requires the use of multi-period excess earnings method or other techniques of purchase price allocations.

Conclusion

Neiman Marcus plans to eliminate about $4 billion of over $5 billion of debt and $200 million of annual interest expense in a reorganization plan that was approved by U.S. bankruptcy judge David Jones in early September. The plan will transfer the bulk of ownership to the first lien creditors, including PIMCO, Davidson Kempner Capital Management and Sixth Street Partners. PIMCO will be the largest shareholder with three of seven board seats.

Other creditors will receive, in effect, a few pennies to upwards of one-third of what they were owed depending in part on the value of MyTheresa Class B preferred shares that were contributed to a trust for the benefit of unsecured creditors. Also, the Company’s term loan lenders, second lien and third lien note holders waived their right to assert deficiency claims and thereby eliminated upwards of $3.3 billion of additional claims in the general unsecured claims pool (now limited to $340 to $435 million).

Lazard estimated the value of the reorganized Company upon exit from bankruptcy to approximate $2.0 billion to $2.5 billion on an enterprise basis with the equity valued at $800 million to $1.3 billion.

Creditors and the Company negotiated a plan that has presumably maximized (or nearly so) value to each creditor class based upon the priority of their claims. We are not privy to the analysis each class produced and how their views of the analyses, relative negotiating strength and the like drove the settlement.

Ultimately, the performance of the reorganized Neiman Marcus will determine the eventual amount recovered by creditors to the extent shares are not sold immediately. Some creditors would be expected to sell the shares immediately, while others who have flexibility to hold equity interests and have a favorable view of the reorganized company’s prospects may wait to potentially realize a greater recovery.

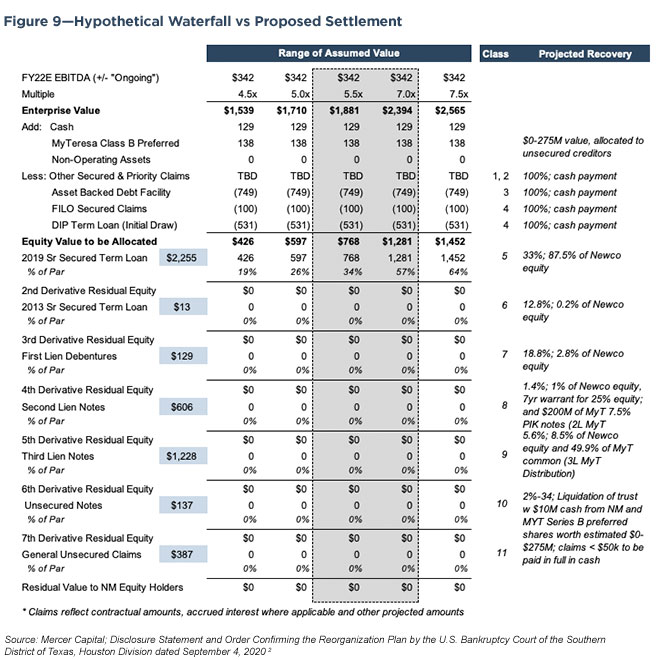

In Figure 9 we have constructed a waterfall analysis which we compare with the actual settlement. We assume a range of enterprise values based upon multiples of projected FY22 EBITDA, or $342 million, and compare the residual equity after each claimant class is settled to provide perspective on the creditors’ recovery.

This waterfall implies that class 5 through 7 debt, which for our purposes here is more or less pari passu, should receive the bulk if not all of the equity given $2.4 billion of debt owed to the three classes. Because ~10% of the equity was allocated to subordinated creditors, the senior lenders may have been willing to cede some ownership in order to reach a settlement more quickly.

Per the settlement, ~90% of the equity was allocated to the 2019 senior secured term loan (~$2.3 billion; 87.5%), 2013 residual senior secured loan ($13 million) and first lien debentures ($129 million; 2.8%).

Recovery for the 2019 senior secured creditors was estimated in the Disclosure Statement to approximate 33% compared to about 19% for the first lien debentures.

Interests in MyTheresa also impacted projected recoveries for the junior and unsecured creditors, a byproduct of the litigation to settle the fraudulent conveyance claims related to the 2018 transaction.

The second lien noteholders ($606 million) would obtain (i) 1.0% equity interest; (ii) seven-year warrants to purchase up to 25% of the reorganized equity at an agreed upon strike price; (iii) participation rights in the exit loan and associated fees; and (iv) an economic interest in MyTheresa in the form of $200 million of 7.5% PIK notes.

The disclosure statement indicates the recovery equates to less than 2% of what is owed to the second lien note holders, which appears to exclude whatever value is attributable to the PIK notes because 1% of the Newco equity would equate to $800 thousand to $1.3 million of value based upon a range of equity value of $800 million to $1.3 billion.1

The third lien noteholders ($1.3 billion) would obtain (i) 8.5% equity interest; (ii) participation rights in the exit loan and associated fees; and (iii) a 50% economic and 49.9% voting interest in the common equity of MyTheresa.

The disclosure statement indicates the recovery to be 5.6% of the claim, which also appears to exclude the value of the MyTheresa common shares if the equity interest is equal to $68 million to $110 million based upon an aggregate equity value of $800 million to $1.3 billion.

The issuance of $200 million of PIK notes and transfer of 50% of the common equity interest in MyTheresa to the second and third lien noteholders appears to be a result of the 2019 debt restructuring and settlement of the 2018 litigation surrounding the 2018 transfer of MyTheresa to the parent company and out of the reach of creditors.

The final wrinkle in the disputed MyTheresa saga involved an agreement reached in late July 2020 in which Ares and CPPIB agreed to allocate 140 million (56%) MyTheresa Series B preferred shares to a trust established for unsecured creditors. Neiman Marcus as debtor also agreed to contribute $10 million cash to the trust.

At the time the settlement was announced in late July, the value attributed to the preferred shares was $162 million; however, the August 3 Disclosure Statement assigned a range of value of $0 to $275 million. Marble Ridge reportedly had planned to bid 20 cents per share to provide certain unsecured creditors (e.g. unpaid vendors) immediate liquidity before the fracas with Jeffrey’s occurred.

Neiman Marcus emerged from Chapter 11 by September 30, 2020 in a streamlined process via the prepackaged negotiations that will leave the Company with significantly less debt in its capital structure. As outlined in this article, valuation is an important factor in the bankruptcy process.

1 The issuance of $200 million of PIK notes and transfer of 50% of the common equity interest in MyTheresa to the second and third lien noteholders appears to be a result of the 2019 debt restructuring and settlement of the 2018 litigation surrounding the 2018 transfer of MyTheresa to the parent company and out of the reach of creditors.

2 The projected 1.4% recovery rate for the second lien notes apparently excludes the MyTheresa PIK notes, while the projected 5.6% recovery rate for the third lien notes likewise appears to exclude the 50% common equity interest in MyTheresa.