Not All MOEs Are Created Equal

In the December 2020 BankWatch, we provided our M&A outlook for 2021 and touched on themes that we believed would drive deal activity for the year. Our view was that the need to reduce costs in the face of revenue pressure would create urgency for banks to engage in M&A and lead to increased deal activity, given that credit quality remained stable and the economy avoided a double-dip recession.

Specifically, we noted that these drivers may cause mergers of equals (“MOEs”) to see more interest. Indeed, four of the largest bank deals in 2020 were structured as MOEs or quasi-MOEs (low premium transactions), and we believed the trend would only gain more traction as economic clarity emerged.

Thus far in 2021, against the backdrop of economic reopening, stable asset quality, and favorable bank stock performance, deal activity in the industry has picked up, and MOEs remain a hot topic. S&P Global Market Intelligence reported 53 U.S. bank deals year-to date through April 30, compared to 43 during the same period in 2020. The pace increased notably in April as 19 deals were announced in the month, including two large MOEs. BancorpSouth (BXS) announced a merger with Cadence (CADE) on April 12, and Webster (WBS) announced a deal with Sterling Bancorp (STL) one week later on April 19.

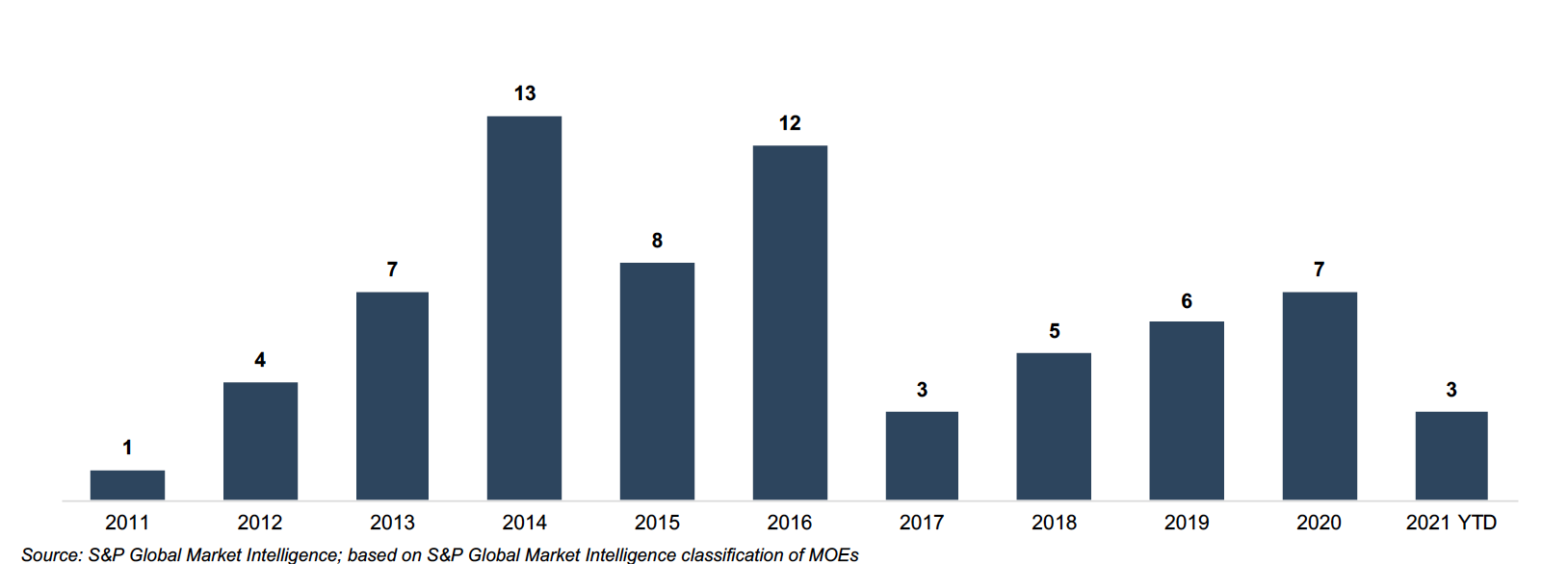

U.S. Bank MOEs by Year

# of Announced Deal

Bank MOEs are not a new concept, but they have occurred more frequently over the past several years, with the most notable being the BB&T – SunTrust combination to form Truist Financial (TFC). The BB&T-SunTrust combination has been reasonably well received, while it is perhaps early to judge some of the more recent deals. These types of transactions certainly have their merits and can appear strategically and financially compelling. However, MOEs involve a number of risks that should not be overlooked. For management teams considering an MOE, it is important to assess both the benefits and potential risks of such a deal.

CLICK HERE TO ENLARGE THE CHART ABOVE

BENEFITS

Reduce Costs

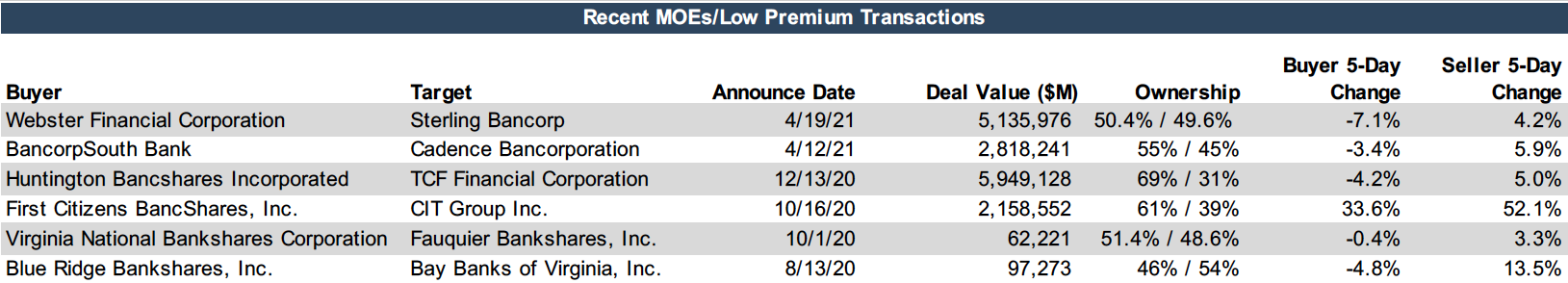

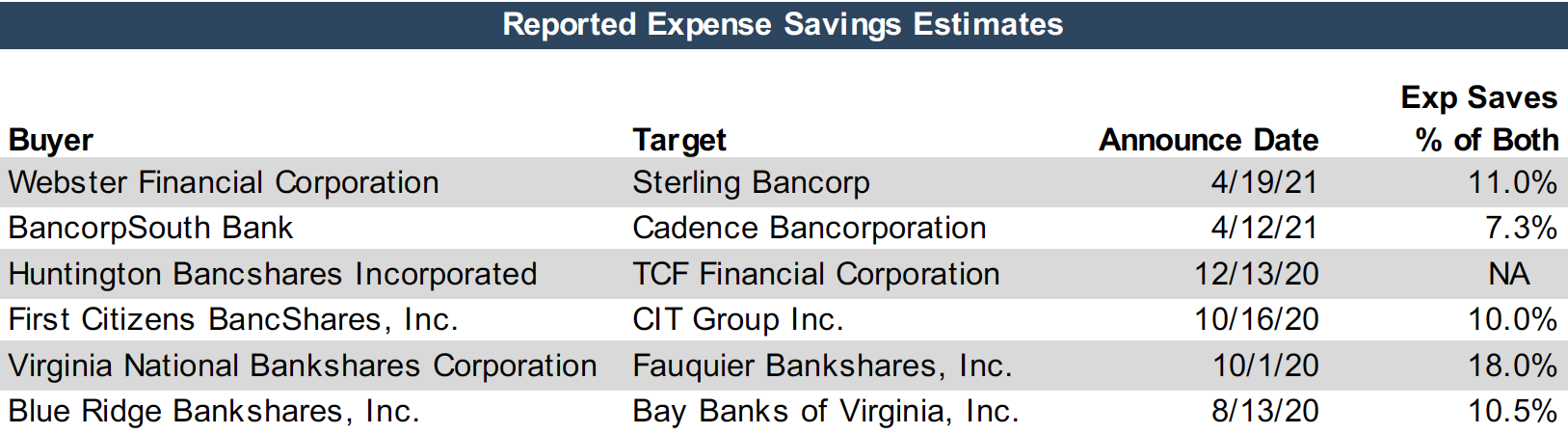

Perhaps the most apparent benefit is the opportunity to reduce costs and improve operational efficiency. This is especially valuable in the current environment as revenue growth opportunities are limited. Reported estimates for cost savings in recent MOEs have been on the order of 10% to 15% of the combined expense base. These savings are often achieved by consolidating back office and administrative functions and/or right-sizing the branch network. With the increased adoption of digital banking, branch networks have become less central to banks’ business models and can be a drag on efficiency. MOEs provide management teams an opportunity to re-evaluate their banks’ physical distribution systems and reap the benefits of optimizing the branch network.

CLICK HERE TO ENLARGE THE CHART ABOVE

Invest in Technology

The savings from efficiencies and branch consolidation can be invested in upgrading the bank’s technological capabilities. Almost all recent merger press releases include some type of statement indicating management’s intent to invest in the pro forma bank’s digital capabilities. While the specifics of such investments are often not disclosed, it is clear that management teams view the ability to invest in technology as a key piece of the rationale for merging. By gaining scale, banks can dedicate the necessary resources to develop sophisticated financial technology solutions.

Expand Footprint

With a challenging loan growth outlook, many banks are considering entering new markets with favorable demographic characteristics. Unlike a de novo strategy or a series of small acquisitions, an MOE provides an opportunity to quickly establish a sizeable presence in a desired market. In merging with Cadence, BancorpSouth will in a single transaction more than double its deposit base in Texas where it previously had been acquiring smaller banks, with three sub-$500 million asset bank acquisitions since 2018. As banks look to position themselves for growth, MOEs are a potentially attractive option to gain meaningful exposure to new markets.

Diversify Revenue Stream

A merger offers opportunities to diversify the revenue stream by either gaining new lending expertise or entering a new fee income line of business. The more retail-focused First Citizens Bancshares will significantly diversify its lending profile when it completes its combination with the commercial-oriented CIT Group, announced in October of last year. Similarly, IberiaBank diversified its revenue stream by combining with First Horizon which has a sizeable fixed income operation. As revenue growth remains challenging, management teams should consider if a transaction might better position their bank for the current environment.

RISKS

While an MOE can offer benefits on a larger scale, it also presents risks on a larger scale. The risks detailed below largely apply to all mergers and are amplified in the case of an MOE.

Culture

Culture is often the arbiter between success and failure for an MOE. Each of the subsequent risks detailed in this section could be considered a derivative of culture. If two banks with conflicting management philosophies combine, the result is predictable. The 1994 (admittedly before my time) combination of Society Corporation and KeyCorp was considered a struggle for several years as Society was a centralized, commercial-lending powerhouse while KeyCorp was a decentralized, retail-focused operation. Potential merger partners need to honestly assess cultural similarities and differences and evaluate the proposed post-merger management structure before moving forward.

It is also important that merging banks be on the same page regarding post-merger ambitions. If one views the merger as “fattening itself up” for a future acquirer while the other desires to remain independent, they will likely diverge in their approach to other strategic decisions. When executives or board members frequently clash, the pro forma entity will struggle.

Staff Retention

There is usually some level of employee fallout with an acquisition, but if enough key employees leave or are poached by competitors, the bank’s post-merger performance will suffer. This is an especially important consideration when acquiring a bank in a new market or with a unique lending niche. If employees with strong ties to the communities in a new market leave for a competitor, it will be difficult to gain traction in that market. Likewise, a new lending specialty or business line can fail if those with the knowledge and experience to run it do not stick around for long.

Execution/Integration

Acquiring a bank of the same or similar size requires a tremendous amount of effort. Loan and deposit systems must be consolidated, customers from the acquired bank must be onboarded to the new bank’s platforms, and branding must be updated across the franchise. If the acquirer’s management team has little experience with acquisitions, successfully integrating with a large partner may prove difficult. When considering an MOE, the acquiring bank must assess what tasks will be necessary to combine the operations of the two organizations and achieve the projected cost savings. Management teams must consider whether their organization has the expertise to do that or, if not, what external resources would be needed.

Credit

Credit quality issues from an acquired loan portfolio can come back to bite a bank years after the acquisition. Merger partners need to be sure they have performed thorough due diligence on each bank’s loan portfolio and are comfortable with the risk profile. While recent credit quality concerns in the industry have not materialized and greater economic clarity has emerged, would-be acquirers need not be lulled to sleep by the current credit backdrop. The past year has shown that the future is unpredictable, and that forecasts are not always correct.

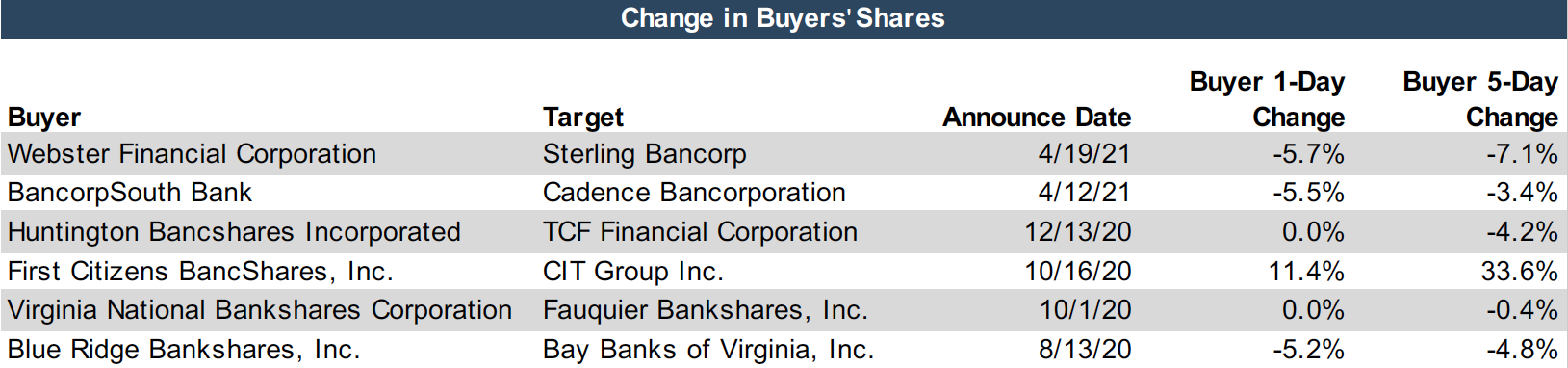

CLICK HERE TO ENLARGE THE CHART ABOVE

Adverse Market Reaction

In recent MOEs and low premium transactions, acquirers’ shares have faced an adverse reaction from investors with declines of 5% to 7% in the days following announcement. First Citizens is an exception as its shares were up 34% five days after announcing its acquisition of CIT, which largely reflects the favorable price paid (44% of tangible book value). While it is not uncommon for buyers’ shares to decline following the announcement of an acquisition, these drops could reflect the market’s concerns around the heightened execution and integration risk of an MOE. It is early to judge whether the deals will create value in the long run or if the market’s initial reaction was justified.

CONCLUSION

We believe M&A will continue at a strong pace in the coming months as the economy continues to reopen and banks dust off previously shelved pre-Covid deals. We also expect MOEs will continue to garner more interest due to the aforementioned benefits. Management teams may be more willing to negotiate now than before on price, management roles, board composition, branding, etc. A balanced consideration of the benefits and risks of an MOE is imperative for making the optimal decision. Mercer Capital has significant experience in advising banks as buyers and sellers in transactions, including MOEs.