Profitability, Growth and Valuation

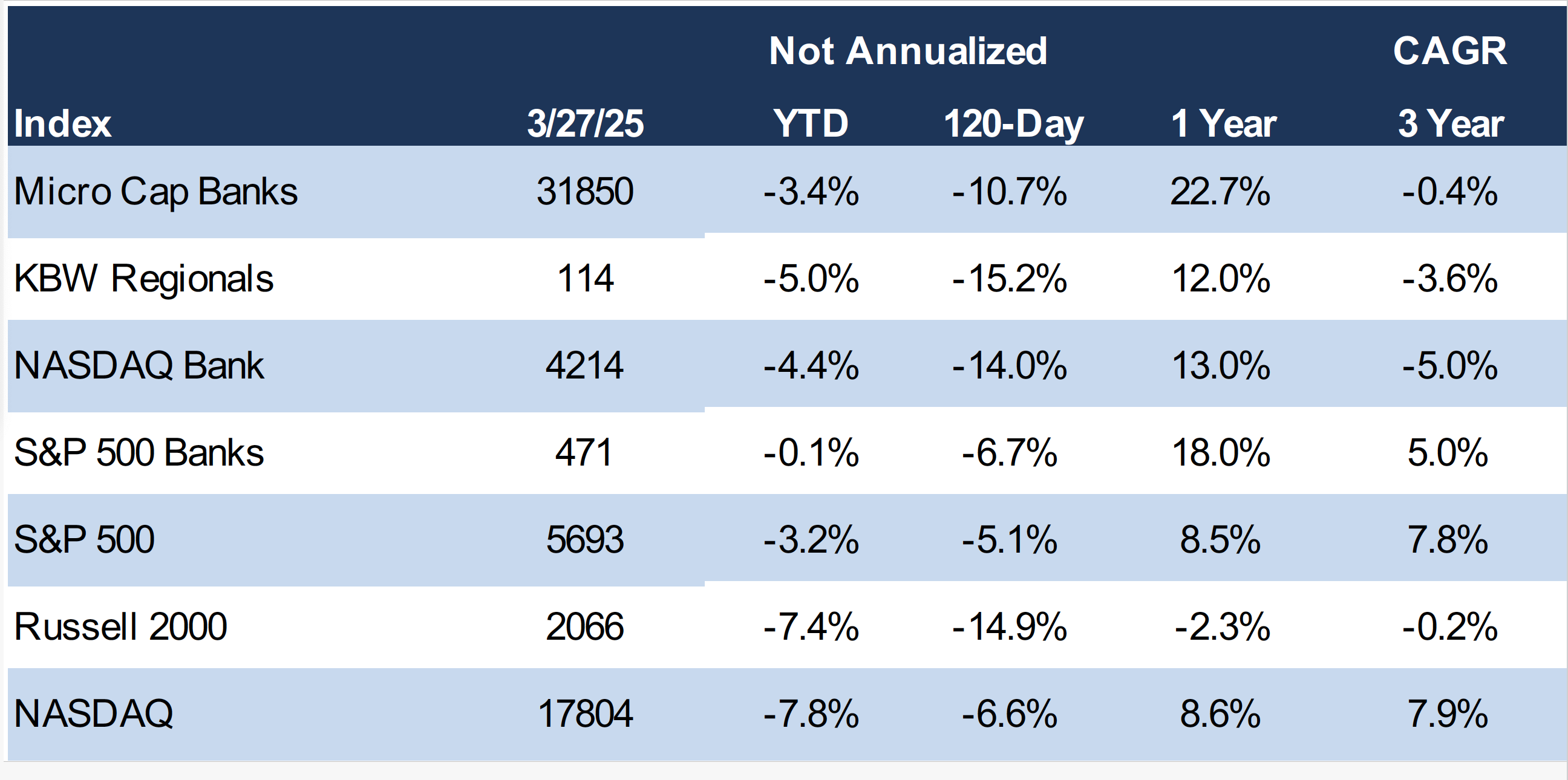

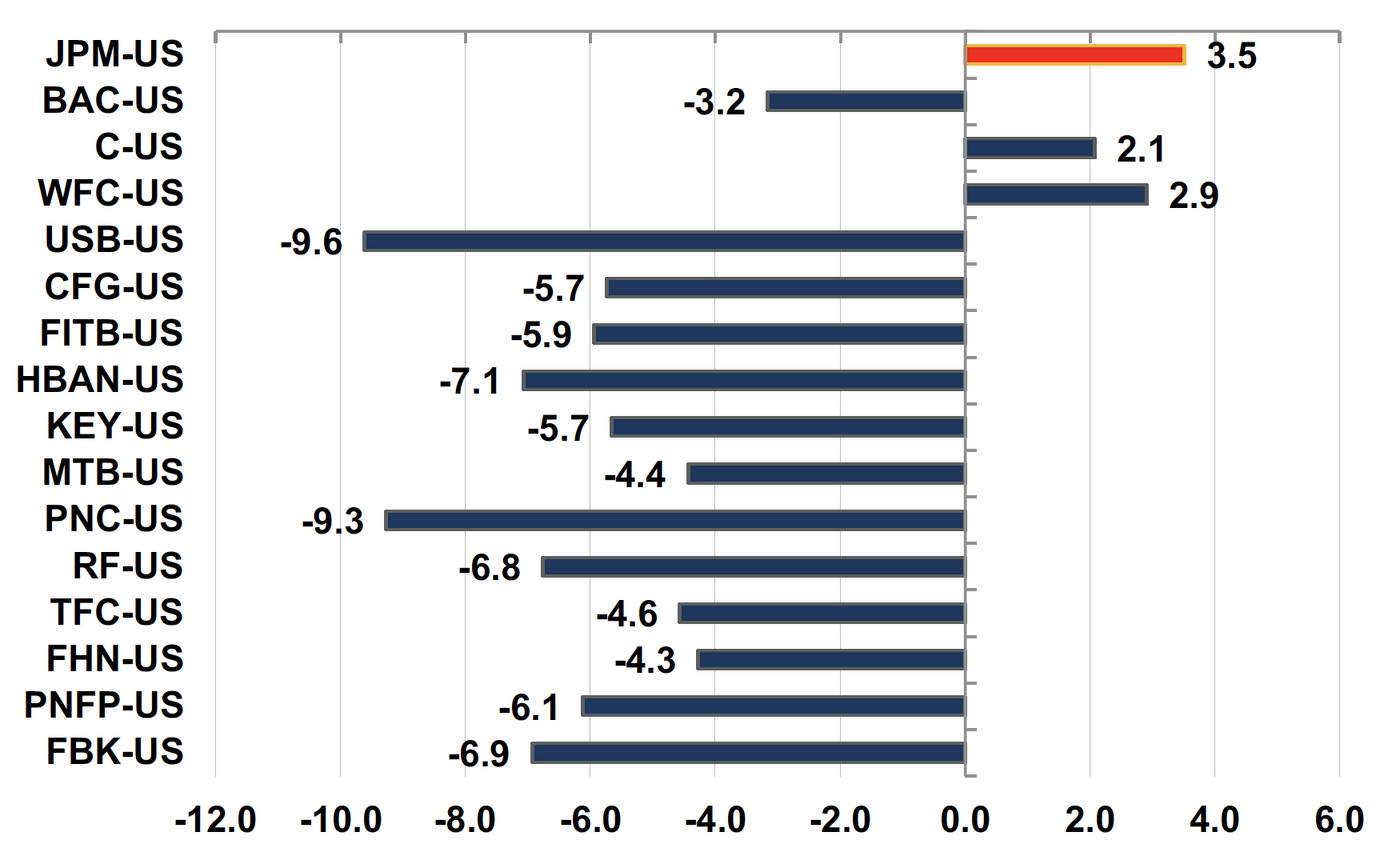

After a great run in 2024, community and regional bank stocks are on pace to post modest losses in the first quarter of 2025. As of March 27, the KBW Regional Bank Index is down 5% compared to flat for the S&P 500 Bank Index. Both indices are market cap weighted. The outsized weighting of mega-cap JPMorgan (NYSE:JPM) and to a lesser extent Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC), all three of which have risen year-to-date, accounts for much of the differential.

The outperformance of the three likely reflect several factors: a) the importance of the steady bid large cap companies have from passive flows into the market—especially for ~$700 billion market cap JPMorgan; b) reasonably good trading results for JPM and Citi; c) possibly misplaced enthusiasm by investors regarding Citi management’s ability to cut overhead to produce a competitive ROE; and d) the prospect of the lifting of WFC’s consent order that has capped the bank’s assets at $2 trillion for seven years.

The performance story is more nuanced, however. Bank stocks peaked around December 1 last year after a big run that occurred from mid-year through November. As shown in Figure 1, regional banks are down about 15% since late November compared to 7% for the larger banks as investors perhaps overreacted to Fed rate cuts and the impact of the national election on the sector. The regulatory environment will be more industry friendly, but ultimately stocks will follow (and anticipate changes in) earnings.

Figure 1:: Banks vs. the Market

Stocks ebb and flow and tend to overshoot to the upside and downside when a significant event occurs. Likewise, industry valuations will expand and contract in anticipation of changes in interest rates, growth rates, and profitability.

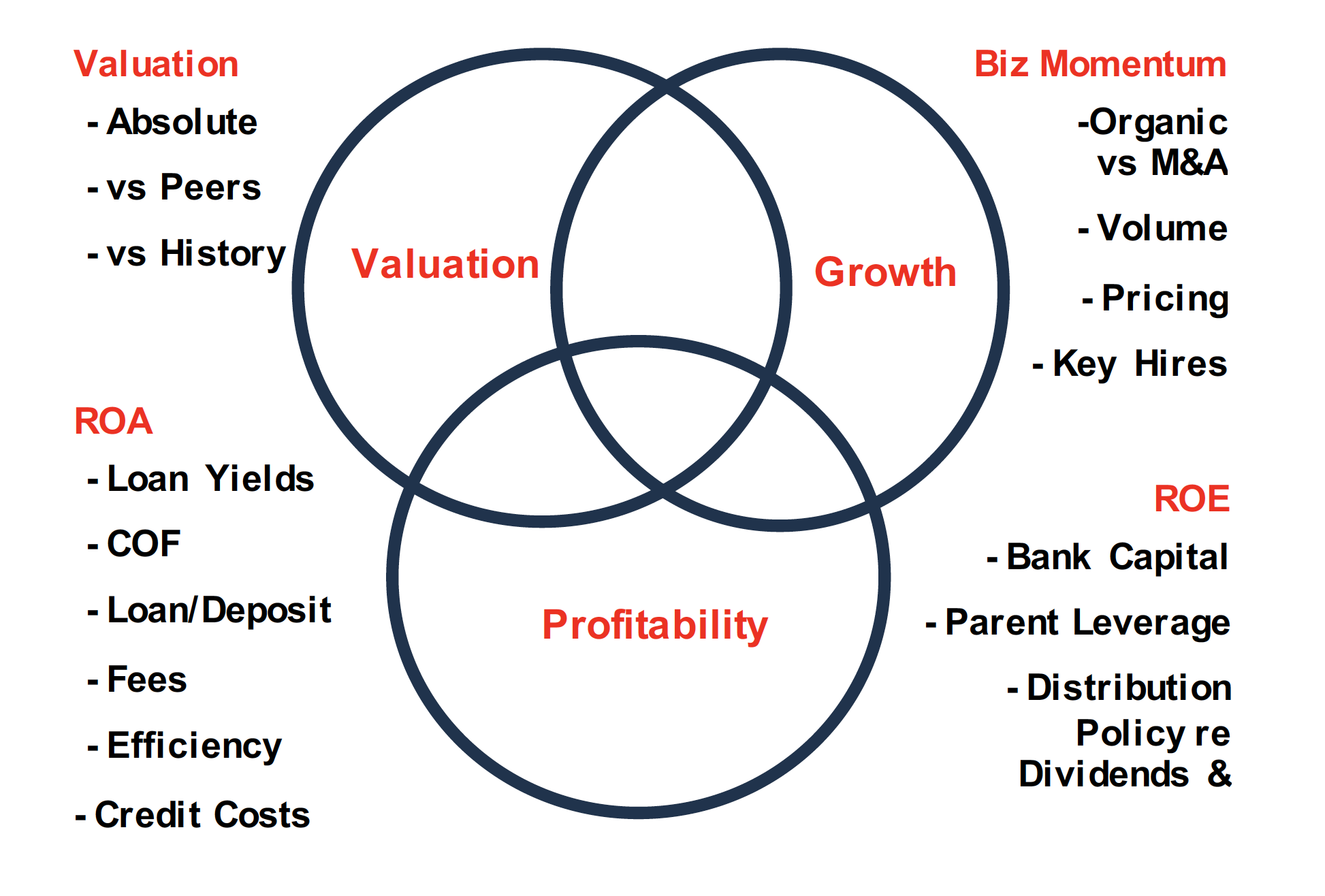

Figure 2 (on the next page) provides a good framework for thinking about the sector and individual banks. I copied it from a mounted picture in a conference room of a Boston-based asset manager in the winter of 2002 when I was taking a bank around to see institutional investors. At the time the U.S. had emerged from a shallow recession, but the gloom around the collapse of tech stocks and the S&P 500 (both would bottom in the fall) weighed on the investing landscape even though banks emerged from the recession largely unscathed.

The three pillars the firm used to evaluate individual investments were: profitability, growth and valuation. The three were presented as concentric circles with some overlap, meaning nothing ever lines up perfectly. Usually, if growth and profitability are attractive the valuation is not; or profitability and the valuation may be attractive, but the growth prospects are absent.

Figure 2:: Stock Selection Framework

Occasionally, a stock would be identified where all three virtues existed, which usually entailed small companies with limited coverage from Wall Street. However, it is impossible to build a portfolio with perfect stocks if such a stock even exists. There are always a range of outcomes.

Margin of safety is an important concept for investing. We have no idea if the current downdraft in bank stocks reflects a completely normal pullback after a big run or is signaling an emerging earnings issue due to credit, a lower multiple environment due to stagflation or some combination thereof.

A review of each of the pillars would indicate the banking environment is fine; it could be better but that is usually the case. ROA for the industry per the FDIC rose 3bps to 1.12% in 2024, while the pretax ROA for community banks (many banks with less than $10 billion of assets are S-corps) eased 8bps to 1.14%.

Asset quality metrics are okay, but directionally problem loans and credit costs have been grinding higher from the post-COVID lows. Further, credit metrics for subprime and near prime consumers are problematic. Limited expansion of NIMs for many banks that is expected in 2025 after two years of contraction may be absorbed by higher credit costs. If so, the high single digit EPS growth the Street forecasts for many banks (vs core 2024 results x-bond portfolio restructurings) may not occur.

Figure 3:: YTD Performance of Selected Bank Stocks

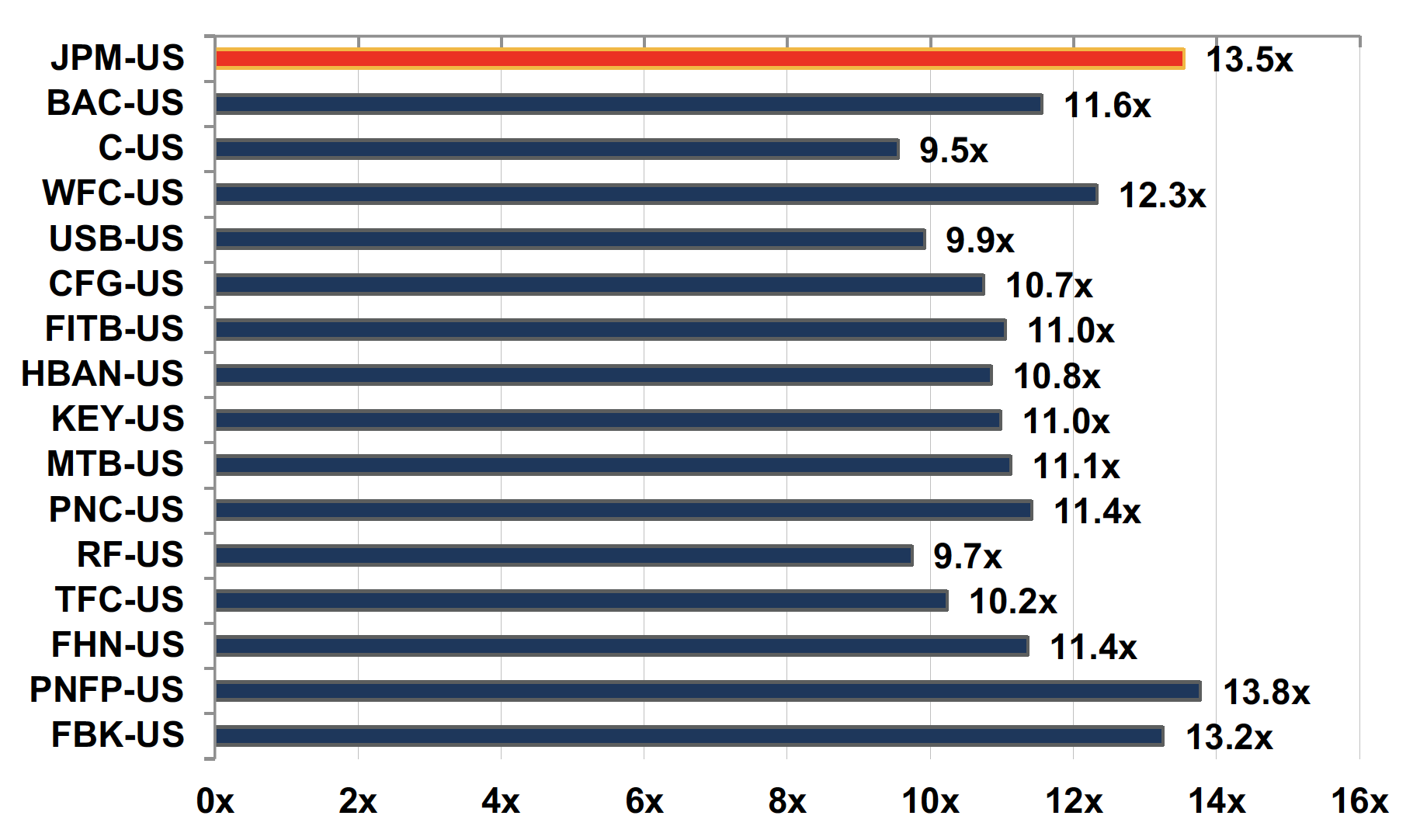

Figure 4:: P/E 2025 Consensus EPS

However, valuations are modestly cheap to history with banks trading in the vicinity of 10x to 12x consensus 2025 estimates. Absent a material reduction in earnings expectations, valuation provides a margin of safety but is not a catalyst for the stocks.