Recent Trends in Agricultural Production Lending

Although farm income is projected to decline for a second consecutive year in 2015, farmers and the broader agricultural industry have had a great run since the Great Recession. The agricultural lending industry? Not so much.

Call it one of the age old conundrums of being in the business of lending money – those to whom you feel most comfortable lending are the least likely to need your services. Such has been the case for several years in the broader agricultural economy. Sure, there have been some farmers and ranchers willing to take advantage of low interest rates to increase leverage and enjoy the associated higher returns on equity and a larger fixed asset base with more profit potential. However, the painful deleveraging associated with the Great Recession left no sector of the economy untouched. Agricultural producers were no exception, with many eschewing debt in favor of fiscal conservatism.

This conservatism among most farmers is contrasted with foreign investors seeking U.S. assets and institutional investors who drove land prices to record level in many areas by 2013. The prices paid implied these investors were oblivious to generating an acceptable return. Elevated land prices have led to concerns among some that lenders could be exposed should land prices fall sharply with a secondary impact on production-related collateral values in a replay of the 1980s bust in the farm sector following the inflation and borrowing binge that occurred during the 1970s.

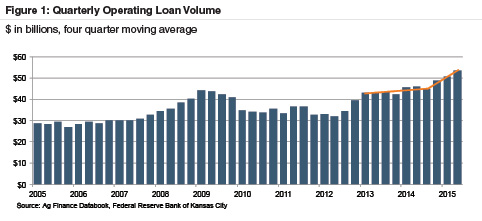

As for production-related lending, record yields and crop prices left many producers so flush with cash that borrowing needs declined. Data from the Federal Reserve Bank of Kansas City reveals a steadily declining trend in operating loan volumes at commercial banks over the 2009 to 2012 period (Figure 1). The second half of 2012 showed a rapid rise in loan volumes, but since then agricultural production loans have grown at a relatively slow pace – until recently, that is.

Volume Growth Picks Up Steam

A number of factors have finally reversed course, leading to a notable uptick in demand for financing and an expectation that ag production loan demand will remain strong in the near- term. While real estate agriculture loans also have increased, lending dollar volume in that area has been influenced by the substantial increase in farmland values in recent years. The discussion which follows focuses on production, or operating, lending.

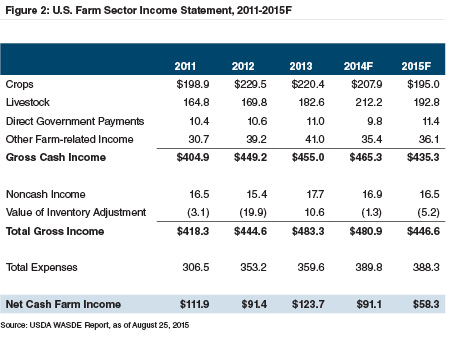

Several years of record crop yields and high commodity prices left farmers and ranchers with little need for operating loans. However, crop receipts are expected to decline by approximately 6% in 2015 and livestock receipts are expected to decline 9%. These declines will be modestly offset by an increase in direct government payments and other income. However, input expenses should remain stable, primarily reflecting higher costs for livestock purchases and labor offset by lower energy costs, leading to an expected 36% decline in net farm income. This decline comes on the heels of a 26% decline in 2014 (Figure 2).

Throughout 2014 producers had the luxury of strong balance sheets, allowing them to avoid significant operating debt despite the downturn in net income for that year. However, during 2015 the cash cushions built up during the commodity boom will begin to be depleted, leaving many producers with little choice but to finance short-term capital investment and input costs with borrowings.

Rates Hold Steady – For Now

The average effective interest rate on non-real estate bank loans to farmers declined from 5.6% in 2008 to 3.8% in 2014, but has shown two consecutive quarter over quarter increases (albeit modest) in the first half of 2015 and measured 4.1% in second quarter 2015. One possible explanation for this slight uptick is that as demand has picked up banks have regained the smallest amount of pricing power. Alternatively, it may be the case that the average borrower credit profile has deteriorated slightly as the industry comes off its highs from the recent commodity pricing boom.

Despite the low rates, ag production loans can be very attractive from an interest rate risk standpoint, as most of the loans renew annually allowing for more rapid adjustment when rates (finally) begin to rise. That said, oftentimes collateral used for non-real estate agricultural loans is less desirable, thus increasing the risk of the loan if it were to fail.

Producers Lock in Fixed Rates

There is an argument to be made that all of the factors affecting loan volume mentioned above are just noise, and producers are simply doing what mainstream America has been doing with residential mortgages for years – locking in these once-in-a-lifetime rates while they still can. The share of floating rate loans made by banks for non-real estate agricultural purposes fell to at least a 15-year low (60%) in the first quarter of 2015. Although it increased to 70.8% in the second quarter, that level remains well below the average exhibited since 2000.

Fixed rate loans are most commonly used for non-feeder livestock production and machinery and equipment, while floating rate loans are more common for shorter-term financing used for feeder livestock (typically sold to a feedlot within one year of age) and current operating and production expenses (including crop production).

Alternative Sources of Lending

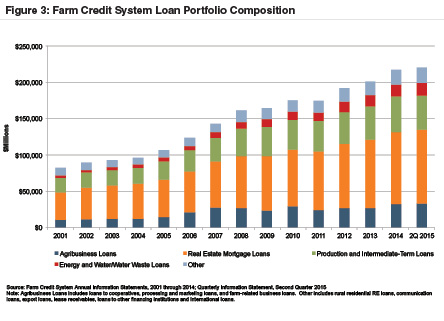

The amount of debt supporting the U.S. agricultural system is vast, and commercial banks are by no means the only player in town. The Farm Credit System (FCS), for example, funds approximately 39% of all U.S. farm business debt (according to the USDA) and commercial banks must compete with farm credit system banks for all types of agriculture and in all 50 states. While Call Report data compiled by the Federal Reserve Bank of Kansas City shows rapid recent growth in non-real estate ag lending at commercial banks, financial data from FCS paints a slightly different picture.

Figure 3 shows steady total FCS loan growth since 2001. However, loan growth in the first half of 2015 was nearly flat, and production and intermediate term loans actually declined relative to year-end 2014. FCS states this decline was driven by borrowers’ tax planning strategies at the end of 2014, resulting in significant repayments in early 2015, as well as a high level of seasonal pay-downs in the first quarter. It’s difficult to draw the conclusion, however, that this data indicates a shift in market share away from FCS toward commercial banks, given classification, measurement and timing differences. It’s worth noting that FCS relies primarily on the public debt markets for its balance sheet funding and these costs increased modestly in the first half of 2015 relative to the same period in 2014.

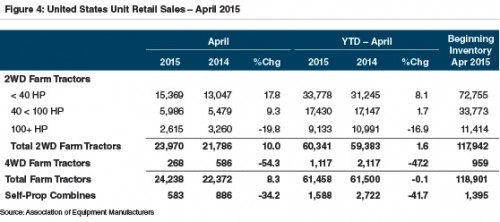

Another source of credit for the agricultural industry is financing provided by heavy equipment dealers and manufacturers. Equipment loan volume can be influenced by commodity cycles somewhat differently than for other operating loans. Producers generally prefer to invest in new equipment when times are good and net incomes are strong, electing to postpone larger capital purchases and make do with aging equipment in times of falling incomes. This effect has played out in the first part of 2015, with rather significant sales declines in what is normally an active period of highly seasonal buying patterns (Figure 4).

Implications for Asset Quality

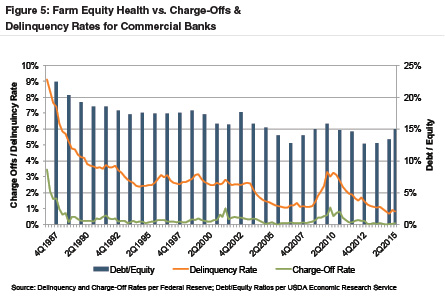

Since peaking in late 2009, delinquency and charge-off rates on ag production loans held by commercial banks have fallen consistently and dramatically, and for second quarter 2015 measured 0.81% and 0.09% (seasonally adjusted), respectively. Asset quality data from FCS exhibits a similar trend. As shown in Figure 5, delinquencies and charge-offs tend to be closely correlated with the health of farm balance sheets, which is not surprising.

We note an interesting trend since the end of 2012 in which this relationship appears to have broken down. Farm debt to equity ratios are increasing, while delinquencies and charge-offs continue to decline. Is this a harbinger of things to come? It’s probably too soon to tell, as the agriculture industry is highly susceptible to completely unpredictable events, such as weather patterns, and the health of the overall global economy (also not an easy prediction these days). One thing is certain, the trend is not sustainable indefinitely.

Another issue with the comparability of recent trends to previous points in the long-term historical agriculture cycle is the impact that the dramatic increase in land values has had on farm equity since 2009. A portion of the rise in debt to equity ratios in recent periods is not due to an increase in debt, but rather recent declines in land values (falling asset values will increase debt/equity ratios, all else equal). If land values continue to decline from their historical highs (which most reliable sources predict), and farm debt continues to increase (which all of the factors discussed above would indicate) then leverage ratios will be further strained in the coming quarters and years. Current charge-off rates are de minimis to the point where an increase in asset quality issues related to agricultural production loans will be easily absorbed by all but the most concentrated ag lenders. That said, it bears watching to see if these trends become more sustained and have deeper implications for both agricultural lending and the broader agricultural economy.