The 1042 Rollover

Resurrected Interest in Tax Benefits for Selling Shareholders in ESOP Transactions

For many business owners, the investment in their company is their most significant asset. Shareholders of closely held businesses, particularly those on the crest of the baby boom wave, are rigorously searching for exit plans to diversify their portfolios and to plan for the next stage of life. It certainly helps if the exit plan is aligned with a compelling estate and tax strategy. In this era of challenging credit conditions and economic uncertainty, interest in Employee Stock Ownership Plans (“ESOPs”) is rising as sellers come to understand the varying opportunities related to transaction financing and to potential tax benefits accorded qualified sellers to ESOPs. One such potential benefit for selling shareholders is the 1042 rollover.

Internal Revenue Code Section 1042 provides beneficial tax treatment on shareholder gains when selling stock to an ESOP. Given certain conditions, capital gains tax can be deferred allowing the full transaction proceeds to be invested in Qualified Replacement Property (“QRP”). Long-term capital gains are recognized upon the liquidation of QRP securities at a future date after a required minimal holding period. If the QRP is not liquidated and becomes an asset of the seller’s estate, it enjoys a stepped up basis and avoids capital gains completely.

Summary Requirements

In order for the sale of stock to qualify for a 1042 rollover, several requirements must be met:

- The seller must have held the stock for at least three years;

- The ESOP must own at least 30% of the total stock immediately following the sale; and,

- The seller must reinvest the proceeds into “qualified replacement properties” within a 12 month period after the ESOP transaction.

Qualified replacement property is defined as stocks and bonds of United States operating companies. Government securities do not qualify as replacement properties for ESOPs. The seller must invest in these properties within a 15 month period beginning three months prior to the sale and ending 12 months after the sale. The money that is invested can come from sources other than the sale, as long as that amount does not exceed the proceeds. However, not all of the proceeds have to be reinvested. If the seller chooses to invest less than the sale price, then he or she will have to pay taxes on the amount not invested in QRP. In order to meet the 30% requirement, two or more sellers may combine their sales, provided that the sales are part of a single transaction. The sponsor Company must be a C Corporation for selling the shareholder to qualify for a 1042 rollover.

The shares sold to the ESOP can not be allocated to the ESOP accounts of the seller, the relatives of the seller (except for linear decedents receiving 5% of the stock and who are not treated as more-than-25% shareholder by attribution), or any more-than-25% shareholders.

1042 Rollover Benefits

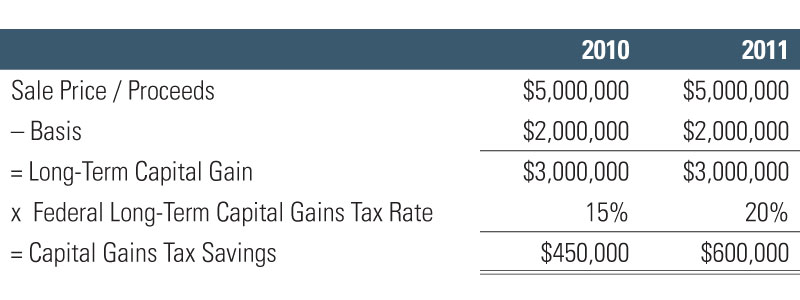

The current federal capital gains tax is 15%, but if no legislative action is taken, on January 1, 2011, the federal (long-term) capital gains tax will revert to 20%, making the 1042 rollover option more attractive and beneficial to business owners. If an owner with a $2,000,000 basis sells his or her shares for $5,000,000 and realizes a capital gain of $3,000,000, he or she would defer or save $450,000 in capital gains taxes under today’s tax structure. Given no legislative action and a 2011 reversion to previous capital gains rates of 20%, a seller would defer or save $600,000 in federal capital gains tax on the sale as shown below.

If legislative action is taken that results in an even higher capital gains tax rate, a 1042 rollover becomes even more attractive.

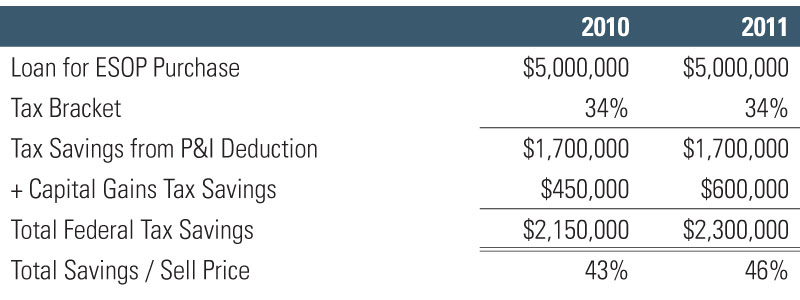

Leveraging the sale of stock to the ESOP can provide further financial benefit to the company and its shareholders. Sellers often use all or part of their replacement property as collateral for loans used to finance ESOP purchases. Financing costs are significantly lower for corporations that borrow to purchase owner’s stock for ESOPs than for conventional stock redemption because the corporations are able to deduct the principal and interest payments on the loan when used to purchase ESOP stock. If a corporation is in the 34% tax bracket and borrows $5,000,000 to purchase the ESOP stock, it would save $1,700,000 in federal income taxes. Combined with the $450,000 in savings with the current capital gains tax rate, the federal tax savings would be $2,150,000 or 43% of the selling price. If capital gains tax rates revert to the previous rate of 20%, the total federal tax savings would be $2,300,000 or 46% of the selling price.

S Corporations

Although S Corporations are allowed to have ESOPs, the 1042 rollover option is not available to the shareholders. In most cases, there is a 25% limit on tax-deductible contributions made by employers to ESOPs. C Corporations do not have to count interest payments on ESOP loans as part of the 25% limit, but S Corporations do. There is no required length of time during which a corporation must have C status to receive the benefits of the 1042 rollover, which means that an S Corporation can change its status and receive the differed tax benefits without delay. However, this change in status can have negative tax effects that would cancel out any benefits gained from the 1042 rollover status due to different accounting methods, so a change in status may not always be the best option.

ESOP Financing

Given the corporate development criterion of most strategic and financial buyers in the markets today, relatively few small-to-medium sized business owners can achieve an exit via a transaction with an external buyer. Throw in the difficulties of financing acquisitions and many shareholders of successful and sustainable businesses may be locked out of certain exit strategies. Increasingly, sellers to ESOPs are financing their own transactions. Before the financial crisis struck, many ESOPs sellers found that continuing business involvement and loan guarantees were required by ESOP lenders. The realization: seller financing in today’s market represents little incremental risk and time than in previous more favorable markets. True, many valuations may be lower than a few years back, but most good ESOP candidates have likely fared better than the markets as a whole. Absent the need for lump sum liquidity, and given a strong and early start to longer-term exit planning, seller-financed ESOPs may be a viable and preferable path for many closely held business owners.

What Goes Down Must Go Up

Confused? We’re alluding to taxes – in the context of a nation whose thirst for government spending had been both red and blue in the past ten years and shows little sign of being quenched. The likely result, relentless tax pressures even if significant belt tightening occurs. For those business owners committed to the long-term success of their businesses, concerned about the fate of their employees, and who have a desire for favorable tax treatment in the course of achieving succession and exit planning, the ESOP is a viable alternative. As taxes went down in previous years, so it seems they are going up. As ESOP formation waned in a previous market where external exit opportunities abound and have now collapsed, ESOP formation appears primed to go up. ESOPs represent one of the few exit plans that can be timed and entered into without a change of control. In an increasingly uncertain world, throw in a healthy dose of tax advantages for qualified sellers and it is hard not to view the ESOP with increased interest.

Mercer Capital has over 35 years of experience providing ESOP valuation services and is employee-owned, giving us a unique perspective. For more information or to discuss a valuation issue in confidence, give us a call at 901.685.2120.

Article originally appeared in the September/October 2010 issue of Value Matters(TM).