The Estate of Charlotte Dean Temple

The Estate of Charlotte Dean Temple in United States District Court (No. 9:03 CV 165(TH) was adjudicated on March 10, 2006. This was a civil action for recovery of federal gift taxes and related interest. Plaintiff Arthur Temple (“Temple”) individually and as executor of the estate of his wife, Charlotte Dean Temple paid gift taxes on various gifts during the period 1997 – 1998 which upon audit were deemed to be undervalued. Temple paid the assessments and filed claims for a refund.

There were four entities at issue in this case: Ladera Land, Ltd (“Ladera Land”); Boggy Slough West, LLC (“Boggy Slough”); Temple Investments, LP; and Temple Partners, LP (collectively the “Temple Partnerships”). All four entities were asset holding entities: one LLC and three partnerships, all appropriately valued based on the underlying net asset value approach. As the Court saw it, “A critical factor in this case is determining the appropriate diminution in value between a hypothetical willing buyer and a hypothetical willing seller.” In other words, the key analytical factors in dispute were the prospects for a minority interest discount and a marketability discount.

Ladera Land

For an analysis of the appropriate discounts for Ladera Land, Temple engaged the services of appraiser Nancy M. Czaplinski. Net asset values do not appear to have been in dispute. Czaplinski utilized the net asset value approach to this entity, although the Court chided her for discussing the appraisal only with Temple’s attorney, and not with any principals of the entity.

Minority Interest Discount

Czaplinski selected a 25% minority interest discount, based on “the inverse of the premium for control”, which in turn was derived from Mergerstat data. Czaplinski testified in court that the Mergerstat data is a study of operating companies but that she classified Ladera Land as a holding company.

Marketability Discount

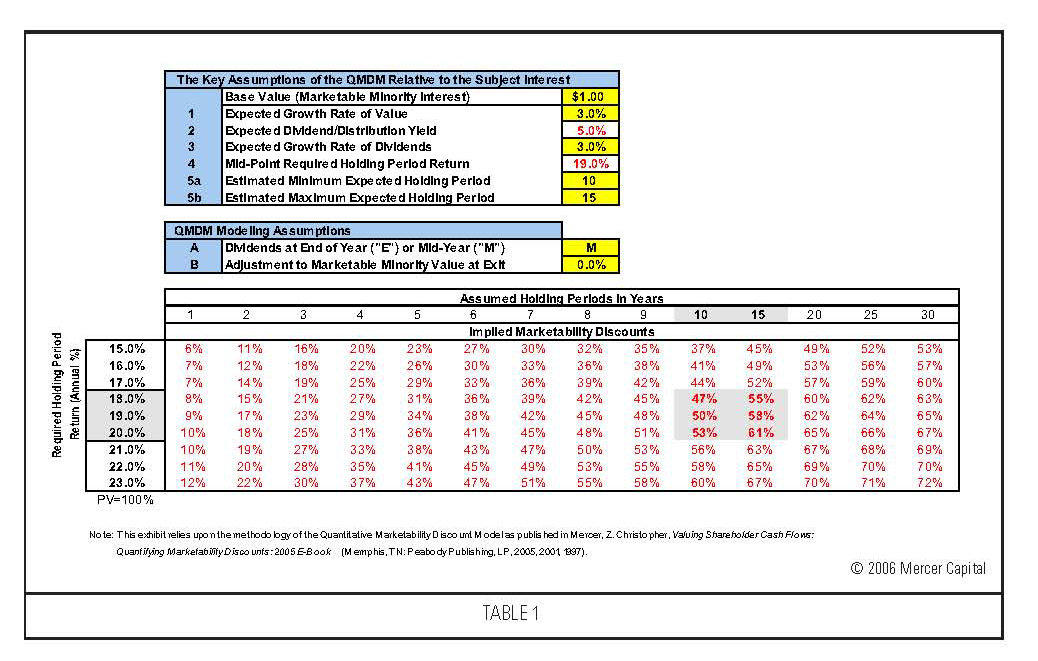

Czaplinski utilized the Quantitative Marketability Discount Model (QMDM) to assess the lack of marketability discount for Ladera Land. She assumed the following input items to implement the QMDM: 1) the holding period of a Ladera Land partnership interest is between 10 and 15 years; 2) the minority investor requires a holding period return on investment of 18-20%; 3) Ladera Land’s distribution yield is 5%; and 4) the expected appreciation of Ladera Land’s real property is 3%. These parameters provide a range of marketability discounts from 47% to 61%, as shown in Table 1.

The Court was unconvinced on several assumptions, but not on the applicability of the model. The 5% yield assumption was made without talking to anyone at Ladera Land, and the entity was not making distributions (although the assumption of a 5% yield would tend to reduce, rather than increase, the marketability discount). The expected property appreciation at 3% was based on conversations at Czaplinski’s own firm, not based on real estate appraisals. The Court did not understand the concept of the prospective holding period, saying “…the Court finds that it is inappropriate to assume a particular holding period for the hypothetical buyer” since there is no holding period requirement for the partnership interest.

It is on this last point that the Court missed the mark. As securities analysts, we make investment decisions in the marketplace every day, based on prospective holding periods. Life insurance policies are priced based on actuarial tables which clearly imply a holding period; corporate bonds are often priced at “yield-to-maturity” which thereby captures the current distribution yield as well as the implicit gain from a discount from par to maturity at par value. If you don’t hold it until maturity, you don’t get that full yield. Tax law recognizes holding period distinctions in the segregation of short-term gains from long-term gains. Common stock investors manage stock portfolios according to business, product cycle or interest rate cycle moves, with an investment time horizon in mind that dictates the relative mix of the portfolio.

In the case of closely held common stock, the analyst must make a reasonable assumption with regard to a prospective holding period; i.e., not necessarily until the termination of the partnership, but until that future date when some liquidity event occurs that may feasibly convert a security interest into cash. During that interim period, the investment has a security interest growing at some internal growth rate and possibly distributing some cash along the way. But a longer time horizon (holding period) implies a larger marketability discount, other things being equal.

The Court’s Conclusion

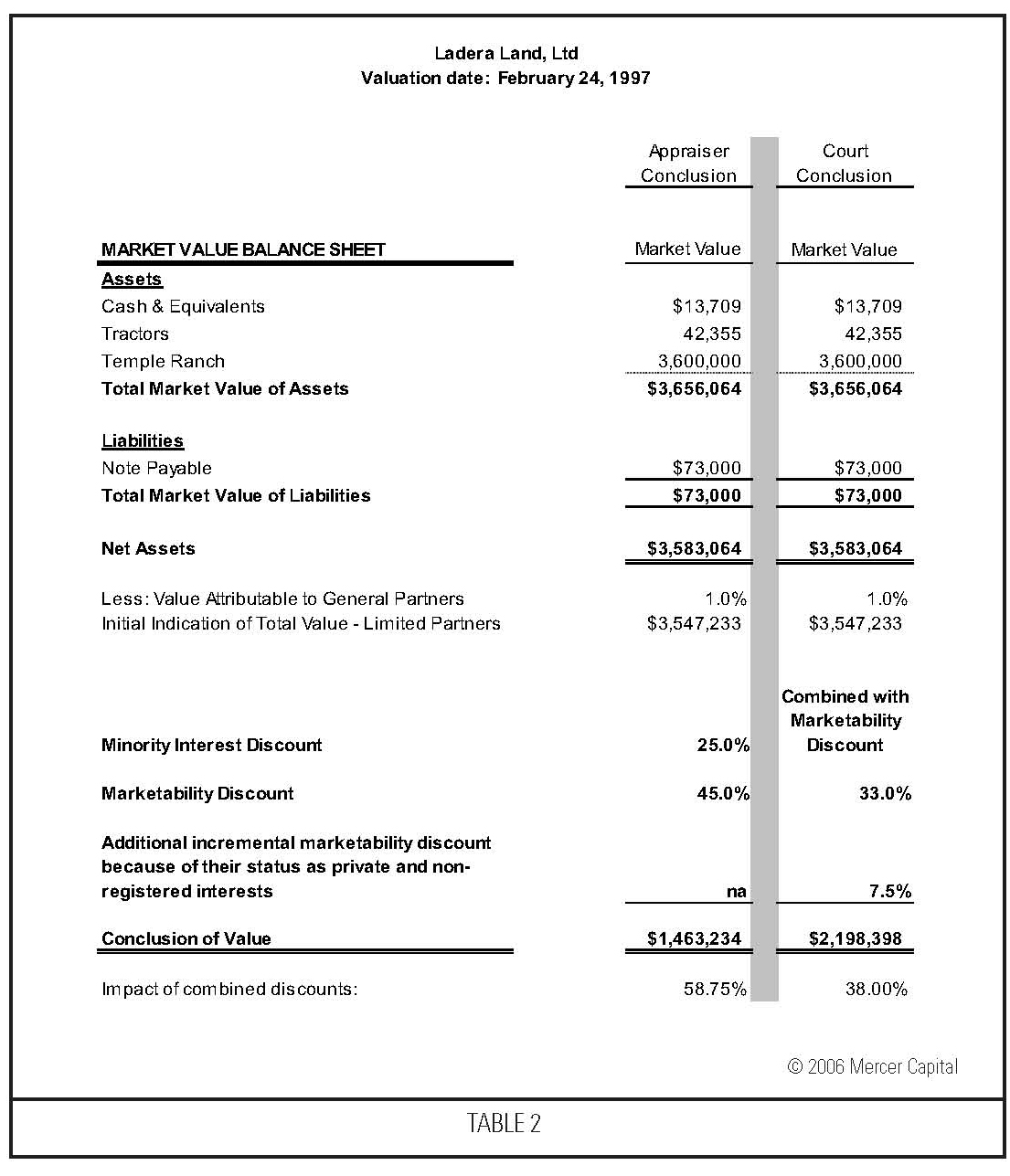

Lacking specific testimony at the valuation date with regard to alternative minority interest discounts, the Court did not specify a minority discount. Rather, it combined the minority and marketability discounts into a single 33% discount for the limited partnership interests, and combined that with an “additional incremental marketability discount because of their status as private and non-registered interests.” It is unclear how private and unregistered interests are distinguished from those impacted by the 33% marketability discount. Clearly, the Court was getting beyond its grasp in the application of this separate, ill-defined discount. The overall result is shown in Table 2.

Boggy Slough West, LLC

For an analysis of the appropriate discounts for Boggy Slough, Temple also employed Czaplinski, who utilized the same assumptions as in Ladera Land, also without discussing the appraisal with management. She concluded a 25% minority interest discount and a 45% marketability discount, again utilizing the QMDM. The Court echoed its concern over the assumptions in the QMDM, but had additional testimony from another expert, William J. Lyon, who testified about the difficulties in partitioning the underlying properties. Based on this additional input, the Court concluded that “Lyon’s valuations support Czaplinski’s calculations”, at least in the gift of larger interest. For four smaller gifts to grandchildren, the Court defaulted to its 38% overall discount as shown in Table 3.

Temple Partnerships

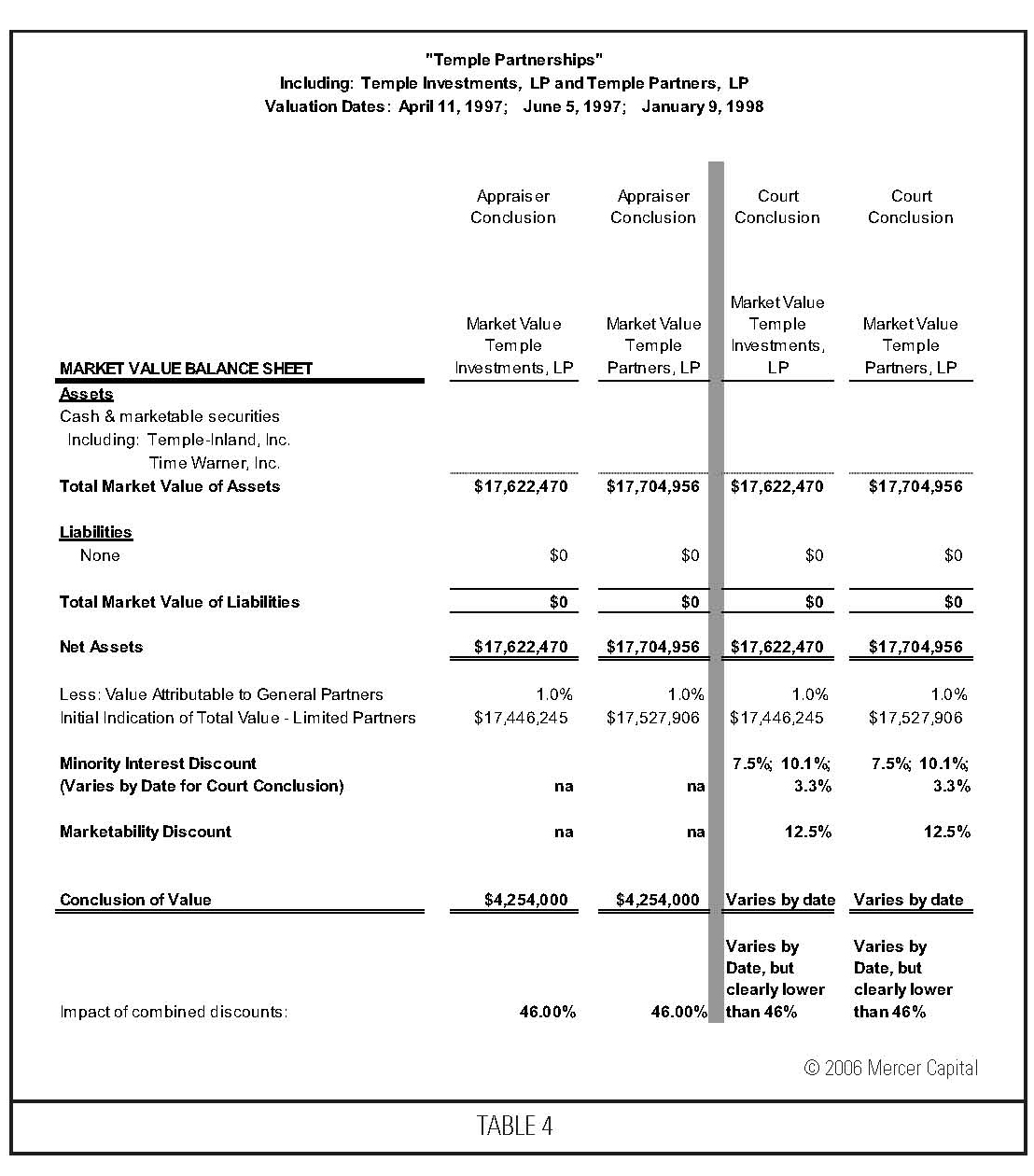

The Temple Partnerships include Temple Investments, LP and Temple Partners, LP, both asset holding partnerships owning marketable securities in public companies. For the assessment of appropriate discounts for these entities, Temple engaged Mr. Charles Elliott, and the government expert was Mr. Frances Burns. Details in the case write-up are sketchy with regard to the minority and marketability discounts, however, the Court favored the Burns approach.

Minority Discount

Burns relied on a published weekly list of closed end funds, which showed discounts or premiums to net asset value. He did not exclude any funds, and calculated the mean discount at the three valuation dates, showing that the discount varied by date: 7.5%, 10.1% and 3.3%. Elliott had excluded some funds without explanation. The Court concluded that “Burns properly examined transactions involving closed end funds” and the minority interests corresponded to the published mean discounts to net asset value. “This method was used by the Tax Court in Peracchio v. Commissioner, 86 T.C.M. (CCH) 412 (2003). The Court observed that this was ‘an approach we have previously followed in the context of investment partnerships … and we shall do so again here.’ “

Marketability Discount

The QMDM was not utilized for the Temple Partnerships by either appraiser. In the determination of the marketability discount, Burns considered and relied upon seven factors: 1) restricted stock studies; 2) academic research; 3) the costs of going public; 4) secondary market transactions; 5) asset liquidity; 6) partnership interest transferability; and 7) whether distributions were made. By contrast, Elliott used restricted stock sales but did not analyze them as fully as Burns. Rather than taking restricted stock sales and explaining its relation to the gifted interests, Elliott simply listed the studies and picked a discount based on the range of numbers in the studies. The Court concluded: “The better method is to analyze the data from the restricted stock studies and relate it to the gifted interests in some manner, as Burns did.” The Court accepted the 12.5% marketability discount derived by Burns. The summary results are shown in Table 4.

Summary Comments

Minority Interest Discount

The Court here and with reference to prior cases has concluded that minority interest discounts (for investment companies) based on transactions involving closed end funds is an acceptable method. They focused on the mean as the statistical measure of central tendency. The median can also be useful, since it is not as distorted by extreme data at either end of the spectrum. The concept on both data bases is identical.

Marketability Discount

The Court is still struggling with this issue, and as jurists, cannot be expected to have a complete grasp of investment analysis. In the Temple case, they defaulted to the restricted stock studies, although concluding that the better approach was to “analyze the data” from the restricted stock studies to ensure applicability to the subject case. The Court appeared to be moving away from restricted stock studies in Peracchio, although it is clear overall that the Court is seeking more relevant analysis that it can apply directly to the facts and circumstances of a particular case.

At Mercer Capital, we have carefully reviewed the restricted stock studies and concluded that the dissection of academic studies into homogeneous sub-groups that can be applied with confidence to a particular case is not a helpful approach. The determination of a marketability discount is an investment decision, not an academic one, and it is necessarily based on investment facts and assumptions. These facts and assumptions include: competing rates of return for alternative investments; the growth rate of the underlying asset during the holding period; the expected dividend yield; the growth rate of the dividend; and yes, an expected holding period until some prospective liquidity event. As appraisers, we must deal with incomplete information all the time and base our analysis on the facts as we know them and on assumptions that are reasonable and defensible.

The QMDM fulfills the Court’s demand for analysis, and provides a framework for making a reasonable investment decision that can be applied to the facts and circumstances of a particular case. Facts are a key part of this, but so are the assumptions, some of which can be based on relevant market data and some of which must be based on a discussion with management. Again, in the end, it’s an investment decision, not an academic one. In the Temple case, the Court did not dismiss the QMDM, it just had a problem with the appraiser’s assumptions; and it missed the important perspective of the holding period as a necessary component of any investment decision.

At Mercer Capital, we have used the QMDM to assess the prospects for a marketability discount for over 10 years. It forces us as securities analysts to consider the facts and circumstances of an individual case and make an informed investment decision. Please give us a call if we may help you in your investment decision process.