The Market Approach | Appraisal Review Practice Aid for ESOP Trustees

This article first appeared as a whitepaper in a series of reports titled Appraisal Review Practice Aid for ESOP Trustees. To view or download the original report as a PDF, click here.

The market approach is a general way of determining the value of a business, business ownership interest, security, or intangible asset by using one or more methods that compare the subject to similar businesses, business ownership interests, securities, or intangible assets that have been sold.

Functionally, market methodologies are similar to direct capitalization income methods in that a benefit (or performance) measure of the subject business is converted to value by a capitalization factor. It is the specificity of the data supporting the capitalization factor that differentiates market methodology from income methodology. In general, income methodologies rely on indirect, broad market rates of return on capital (Ibbotson, et al.) and on various data sets and trends to establish growth rates. For cases in which there is more direct information from a comparable market, such information is used in a market approach to develop a value for the subject entity. These comparable markets offer evidence of either direct- or relative-value metrics based on transaction activity among investors. Such markets can be described as direct—in that a similar ownership interest or security in the same subject entity has transacted—or as indirect—in that a group of publicly traded securities of similar companies can be observed and/or that transactions of entire entities can be observed.

The market approach includes numerous methods, which are generally named according to the nature of the direct or relative-value market data. Naming conventions for certain market methods differ among valuation practitioners but most fall into three categories: (1) the transaction method, (2) the guideline public company method, and (3) the guideline transactions method. As with market data sets used in income methodology, the appropriateness of the data (i.e., its comparability and overall strength of relevance) is the primary concern. Market evidence may require adjustment to address a variety of issues before it can be used to value the subject interest. These adjustments differ based on which of the various market methods is employed as well as on the nature of the transactions observed. The following provides an overview of the primary elements of comparability and adjustments under the three primary categories of market methodology.

Valuation Methods Under The Market Approach

The market approach includes a variety of valuation methods under which pricing metrics are drawn from transactions of interests in companies that are comparable to the subject company. The three primary valuation methods under the market approach are summarized below.

- Transactions Method — derives value using pricing metrics of historical or contemporaneous transactions of interests in the subject company.

- Guideline Public Company Method — derives value using transaction information drawn from publicly traded securities of companies in the same or similar lines of business as the subject company.

- Guideline Transactions Method — derives value using pricing metrics of mergers and acquisitions involving controlling interests of companies (public and private) in the same or similar lines of business as the subject company.

The comparability and reliability of observed transactions is the central concern. The three core market methodologies yield differing types of valuation information for a given ownership interest or entity. Based on the market in which the observed transaction(s) occurred, there can be differing relative valuations. The transaction method may yield valuation information at various levels of value (control or minority). The guideline public company method generally yields valuation information at the marketable minority interest level of value. The guideline transactions method generally yields valuation information based on the controlling interest level of value. Accordingly, the value definition used for an appraisal may suggest which single method or combination of methods might directly apply in the appraisal process. Rarely is a guideline transactions method employed in a valuation calling for the minority interest level of value. Conversely, observed transactions in minority ownership interests of the subject entity may not provide appropriate valuation information for valuations in which the engagement calls for use of the controlling interest level of value.

Although market methods can result in valuations at varying levels of value, each of which may differ from the level of value defined for a given appraisal, there can be useful information in transaction activity even if such activity implies a valuation that is not directly equivalent to the value definition specified in the appraisal engagement. Frequently, there are circumstances in which the appraiser may observe activity that provides indirect support for the valuation or that can be reconciled to the value definition called for in the appraisal report.

As with income methods, the valuations developed using market methodology can result in a value indication for the equity of the subject or for the assets (invested capital) of the subject. In the latter case, the market value of debt is subtracted to derive the equity value of the subject. Appraisers may elect to use market methods that result in direct value indications that differ from the value definition called for in the appraisal engagement. In such cases, valuation discounts and premiums are usually applied to adjust the value indication to the specified level of value defined for the engagement.

Rules of Thumb

A valuation rule of thumb relates an operational or financial measure of a company to a measure of value. Most metrics are operational in nature (based on some unit of business activity or volume) or are financial (representing a multiplier to capitalize revenue, cash flow or some other financial benefit stream). There is rule-of-thumb valuation innuendo in almost every industry. In some cases, such information provides useful insight into the mentality and predisposition of what an owner of a business or business interest believes their holding is worth. This is particularly true of industries whose participants adhere to a relatively narrow range of norms in operating, financial, and/or physical composition.

A rule of thumb value indication is typically a controlling interest level of value. In some cases, rules of thumb reflect a strategic value as opposed to a financial controlling interest value. Appraisers using or referring to rules of thumb must be aware, to the degree possible, of the origin of the rule of thumb in order to assess whether it captures synergies or other premium benefits (or expected profitability) available only to specific strategic investors. Because most rules of thumb have their genesis within a given industry or trade group, strategic elements are often included. Accordingly, ESOP valuations using the fair market value standard may result in conclusions lower than the common industry rules of thumb. However, industry rules of thumb may also coincide with fair market value if the hypothetical investor is closely aligned with likely market participants in the industry or market.

Most rules of thumb relate to the total enterprise value of assets as opposed to the total equity value of a business. Hence, the determination of equity value requires the subtraction of debt from the total enterprise value. As with the private transaction databases, rules of thumb generally require adjustment for certain types of assets and liabilities that are not typically part of transactions. Cash balances, certain liabilities, working capital, real estate, and other balance sheet amounts may be treated separately from core business assets.

Rules of thumb can be highly misleading as most subject companies differ from the stereotypical company in the stereotypical market with a steady-state cycle of performance. Even when such normalcy appears evident, there are marketplace and economic factors that result in valuations that deviate from the central point of a suggested range. Some valuation texts refer to the use of a rule of thumb as a valuation method. Likewise, there are proprietary transaction databases that, when viewed across multiple industries over extended periods of time, are promulgated to represent meaningful information in the valuation of small business enterprises. Appraisers have the task of determining whether or not such data rise to an acceptable level of reliability and/or relevance. In most cases, we see such data as constituting a rule of thumb, and, therefore, subject to healthy scrutiny and devil’s advocacy.

Many small- to middle-market companies (enterprise valuations of $5 to $500 million) have enjoyed increased access to capital funding alternatives and exit strategies in recent years. The rise of private equity buyout firms and the general increase in knowledge among business owners has influenced evolution in rules of thumb. Historically simplistic references to unit revenue measures have evolved and been reconciled to financial measures.

For example, an old-guard rule of thumb in the beverage distribution industry was based on annual volume of cases sold. A distributor of a given type or brand of product might generally assume or expect a certain business value based on annual case-volume activity. However, changes in product mix caused by evolving consumer preferences over time rendered these rules less reliable in explaining the value of a given distributor whose margin was below or in excess of norms. Eventually, the industry vernacular became more focused on gross profit, which better characterizes profit by taking into account the mix and pricing of product offerings. However, operating expense structures of distributors vary to the extent that gross profit is often inadequate in explaining value differentials in transactions. In the current environment, rules of thumb have taken the next step by reconciling to financial measures (such as a multiple of cash flow). Any rule of thumb based on an industry metric (i.e., tons, cases, etc.), can be reconciled to a financial equivalency. Doing so facilitates easier value comparisons and provides a financial basis for reconciling the concluded value in an appraisal to a broad industry rule of thumb.

Consistent with the business valuation standards issued by the professional organizations, we do not suggest using a rule of thumb as a stand-alone valuation method under the market approach. However, when valuing a subject entity or interest using a controlling interest level of value, we do encourage appraisers and reviewers to be aware of any rule of thumb that may characterize value in the subject’s industry. In most cases, an indirect reference to a rule of thumb can provide support for a value conclusion developed under more conventional and financially sound methods. If a conclusion deviates from a rule of thumb, it can be useful for the appraiser to explain why.

Transactions Method

The transactions method is a market approach that develops an indication of value based upon consideration of observed transactions in the ownership interests of the subject entity. Transactions should be scrutinized to determine if they have occurred at arm’s length, with a reasonable degree of frequency, and within a reasonable period of time relative to the valuation date. Inferences about current value can sometimes be drawn, even if there is only a limited market for the ownership interests and relatively few transactions occur.

The timeliness of a transaction is important. However, time itself is not the only parameter that determines whether a transaction is reliable for use in a given appraisal. If internal and/or external business conditions or other factors have changed or evolved in a significant way from the time of the observed transaction to the date of the valuation, then use of the transaction may be unreliable. This could also be true for a transaction occurring in close proximity to the valuation date. While a dated transaction may be unreliable in absolute value terms, the implied relative value of the transaction may be useful to examine (such as price to book or enterprise value to cash flow). Arguably, any transaction that has occurred in reasonable proximity to the valuation date should be disclosed and distilled even if it is not directly considered toward the valuation. In such a case, the appraiser may need to explicitly qualify why a transaction is not being given direct weight in the valuation. In select cases where entity and market performance have remained stable over time, transactions that are somewhat dated may provide meaningful direct or indirect support to the appraisal. Transactions occurring subsequent to the valuation date should not be considered unless the facts and circumstances of such activity were known or reasonably knowable as of the valuation date and there is (was) a high likelihood of the transaction closing.

There are many corporate and shareholder events in the ordinary course of business that may produce meaningful transaction data. Shareholder redemptions, capital raising, transactions among the ownership group, recapitalizations, buy-sell trigger events, equity compensation grants, business acquisitions, dispositions, and other events are not unusual, particularly in larger entities or in entities with large and/or active ownership groups. It is important that any transaction used to develop an indication of value for the entity, or more directly for the subject interest, be considered in the proper context (in terms of value definition) of other valuation methods developed in the appraisal. Frequently, transactions must be adjusted using estimated (and reasonable) discounts or premiums to derive a meaningful base of comparison to the subject interest.

Guideline Public Company Method

The Guideline Public Company Method (GPCM) involves the use of valuation metrics from publicly traded companies that are deemed suitably comparable to the subject entity. Direct comparability is difficult to achieve in many situations, as most public companies are larger and more diverse than the subject, closely held entities in most business appraisals. However, the threshold for direct comparability need not be so inflexible that public companies with similar business characteristics are disqualified from providing guidance in the valuation of the subject company. In some cases, public companies may not be reliable for direct valuation purposes but may yield information helpful in ascertaining norms for capital structure assumptions and growth rate analysis.

There are relatively few industries in which direct comparability is readily achieved, and most of those present challenges by the sheer scalar differences between the public operators and most private enterprises. The selection of, adjustment of, and application of public company valuation data can be a complicated process involving significant appraiser skill and experience. Absent proper execution, the GPCM can render valuation indications that differ significantly from other methods and thus lead to confusing and/or flawed appraisal results.

Guideline companies are most often publicly traded companies in the same or similar industry as the valuation subject and/or that provide a reasonable basis for comparison to the subject company due to similarities in operational processes, supply and demand factors, and/or financial composition.

Investors in the public stock markets often study the P/E ratio of a security for purposes of assessing the merits of the investment. The P/E ratio of a stock is utilized in a common variation of the GPCM whereby a guideline public P/E ratio is used to capitalize the subject company’s net income. Other variations include the use of valuation metrics to capitalize pre-tax income, numerous versions of cash flow, book value, revenues, or other performance measures of the valuation subject.

Investors in the public securities markets are said to be transacting minority investments (non-controlling) in the issuer’s security, and such investors enjoy the benefit of regulated exchanges and mandatory information disclosures by the issuer. Regular filings by publicly traded companies allow investors to assess the valuation of the security in relation to an almost endless array of operational and financial performance measures for the public company. Guideline company valuation metrics produce marketable minority interest valuation indications. The term “as- if- freely- traded” is often used to describe value indications under the GPCM. Guideline companies are used to develop valuation indications under the presumption that a similar market exists for the subject company and the guideline companies.

Ideal guideline companies are in the same business as the company being valued. However, if there is insufficient transaction evidence in the same business, it may be necessary to consider companies with an underlying similarity of relevant investment characteristics such as markets, products, growth, cyclical variability, and other salient factors.

Although a guideline group may provide some indication of how the public markets value the subject company’s shares, there are limitations to the method. For example, it is virtually impossible to find identical guideline companies. In addition, analysts must assume that all relevant information about a company is embedded in its market price. A guideline group can sometimes provide useful valuation benchmarks, but it is ultimately left to the analyst to derive an appropriate capitalization factor for a subject company based upon a thorough comparison of the selected group of guideline companies to the subject company.

Variations of the Guideline Public Company Method

The GPCM can be used to develop value indications for both invested (or enterprise) capital and equity capital. There are numerous sub-methods for performing both types of valuations. The nature of the denominator in a guideline valuation metric or ratio determines the nature of the value indication. Consistent with the rules governing proper income method execution (namely, matching the discount rate to the proper measure of the subject’s earnings or cash flows), the benefit stream of the valuation subject should be capitalized by the appropriate guideline valuation metric. Performance measures and benefits streams have one primary differentiating feature – they are either before debt-service costs or after. The performance or benefit measures that capture cash flows before the payment of debt costs (i.e., interest expense) are used to develop value indications for the invested capital (i.e., total assets) of the guideline companies and, therefore, result in the same valuation for the appraisal subject. The performance measures that capture cash flow after debt service are used to develop value indications for equity capital. As with any approach or method that results in a direct valuation of invested capital, debt is subtracted to arrive at the value of equity. Although it is true that a valuation metric can relate a pre-debt cash flow to equity value (and vice versa an after-debt cash flow to invested capital), we view this as a likely source of valuation error and would discourage such methodology unless there is a convincing reason to do so. We would likely disregard the use of the GPCM if such mixing of benefit streams and capitalization factors were the only calculations developed (e.g., price-to-sales or priceto-EBITDA, etc.).

Appraisers have the task of developing guideline company cash-flow measures and value metrics in a fashion consistent with the cash flows and valuation math used for the valuation subject. Mismatching the guideline valuation metric with the wrong benefit measure of the subject is a common mistake. Appraisers are encouraged not to take valuation multiples for a given public company or group of companies from a published or electronic data source unless the underlying definition and/or development of the metric is adequately detailed. There can be subtle but meaningful variations in how an appraiser tabulates a benefit measure, such as EBITDA, versus how it was tabulated in the cited source material.

Appraisers must also be mindful of understanding the implications of developing guideline company valuation metrics using financial information and pricing data from periods that are reasonably consistent with the benefit measures of the valuation subject. Public market stock pricing conventions follow a rolling four-quarter or 12-month norm. Often, the acronym LTM (last twelve months) or TTM (trailing twelve month) is used to denote that a given cash flow or earnings measure was tabulated using the most recent annualized performance measure of the public company. That is, a given P/E ratio or MVIC/EBITDA ratio is based on the market capitalization as of a defined date and the most up-to-date, 12 month earnings or cash flow measure of the public company.

Although it is not absolute that timing of the data used in developing a guideline valuation metric must be applied to the subject’s benefit measure from the same period, it is recommended that this be the base convention in most business valuations. Due to performance fluctuations and the timing of the business cycle (among other things) from the valuation subject to a given peer guideline company group, some appraisers may use average pricing metrics spanning several years for the guideline companies against a similar average of cash flows or earnings for the valuation subject. This type of execution seemingly parallels common disciplines used in various income methods in which an ongoing, average expression of earnings and cash flow is capitalized by a factor whose underlying discount rate and growth rate were derived from data observed over some historical time frame.

We urge caution when not following consistency of timing regarding pricing measures and/or benefit streams from subject to peer. For example, when a multi-year average of subject earnings is capitalized using the median LTM P/E ratio from a guideline group, the valuation of the subject can be characterized as being adjusted for fundamentals resulting in a valuation that is higher or lower than would be the case had the LTM P/E ratio been applied to the LTM earnings of the subject. This type of fundamental adjustment is but one of many implicit or indirect adjustments that an appraiser can capture under the GPCM. These adjustments need not be construed as flawed as long as there is adequate purpose and explanation for why such a discipline was employed and perhaps even a calculation of the impact on the valuation indication versus a valuation using the typical timing conventions (i.e., guideline LTM to subject LTM).

For valuations in which the GPCM is employed, the guideline data may serve an additional purpose. A properly developed appraisal opinion may have numerous value indications under the cost, income, and market approaches. Value indications from various methods are typically correlated with, or weighted toward an overall valuation conclusion that attempts to reflect the entirety of process and consideration captured in the valuation. Some appraisers have long practiced providing a relative value analysis at the end of their valuation reports that educates the reader on numerous observations of relative value. In such a fashion, the appraiser can present the valuation conclusions from perspectives that extend beyond the direct methodology employed. Accordingly, the appraiser may effectively assert that the conclusions directly developed are consistent with alternative or additional valuation methods that had would support the conclusions reached had such alternative or additional valuation methods been employed.

The relative value analysis is often used to articulate the sanity and appropriateness of the conclusions based on comparing various valuation ratios to broad-market norms, market transactions, or public market pricing for similar (guideline) companies. Relating the valuation conclusion to the reported book value of equity, to the adjusted value of tangible equity, to various measures of cash flow, etc. is an often used technique to support the valuation and to provide a basis for explaining why the conclusion reflects or differs from various peer measurements. In some cases, a guideline company group may have been identified but not used directly. Regardless, when such market evidence is reasonably observable, comparing the data and reconciling it against the valuation conclusions can be a useful and informational exercise.

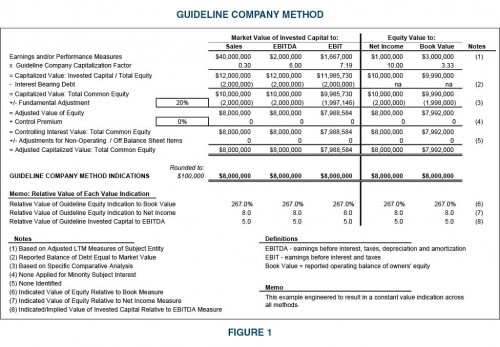

For example, consider a valuation in which equal weights were applied to the cost approach (e.g., net asset value method) and the income approach (e.g., direct capitalization of earnings), resulting in a correlated equity value of $8,000,000 (marketable minority interest level of value). The subject has $2,000,000 of debt, implying a market value of invested capital (MVIC or TEV) of $10,000,000. Assume the subject entity has a debt-free net cash flow of $1,000,000, EBIT of $1,667,000, and EBITDA of $2,000,000. The resulting MVIC ratios to EBIT and to EBITDA are approximately 6.0x and 5.0x, respectively. If market data were identified but not directly employed, it may be that the valuation conclusion can be compared and reconciled to the market data. All such comparisons must be assessed using the same level of value for both the guideline peer data and the subject company.

The table in Figure 1 presents an example of a multi-method execution of the GPCM. Some of the valuation metrics result in a valuation for equity and some for invested capital. In the example, it is by design that each indication of value is the same. Valuation indications from varying methods within the GPCM will vary, and, in some cases, the variations can be significant. We note that capitalized revenue and capitalized book value will often yield different valuation indications than capitalized earnings or cash flow. In such cases, the appraiser must develop and/or select from those methods and indications believed to be reliable for the appraisal assignment and the definition of value called for therein.

Several caveats and considerations are required to properly execute a GPCM.

- There is a fundamental adjustment of 20% applied to each equity value indication developed under each method. A following section of this publication will provide an overview of how fundamental adjustments for guideline data can be developed.

- There is a line item for the market values of non-operating assets (and liabilities). Appraisers should apply adjustments to the earnings and other performance measures to eliminate the effects of non-operating assets because the values of such assets are typically captured on the back end of the analysis in order to develop the final indications of value. Failure to adjust the performance measures can result in double counting errors.

- There is a line item providing for the potential application of a control premium. Such a premium applies only when the engagement definition calls for the controlling interest level of value. The consideration of a control premium at this stage serves as a proxy for other adjustments not otherwise captured in previous adjustments or reflected in the guideline multiples or applied as a subsequent treatment after a correlation of the GPCM with other methods employed in the appraisal. We caution that blind application of published control premiums is a frequent source of flawed, over-stated valuation. Published control premiums are consequential measures of investor expectations for efficiencies and other value pick-ups from the reported transactions. They reflect expectations of post-deal operating and strategic economies. In the context of appropriately adjusted performance measures and other valuation inputs, most financial control premiums for small private companies are quite modest to nil. This can be particularly true in ESOP situations where the entity is remaining an independent going concern and will not benefit from postmerger efficiencies and synergies embedded in most market-based transactions.

- A memo section in the example displays what each value indication implies on a relative basis by way of comparison of each value method to the subject’s book value, net income, and EBITDA. In this fashion, appraisers and users of valuations can assess how a valuation indication using one valuation metric relates to another.

When multiple indications of value are developed using the GPCM, the appraiser may elect to average the indications into a singular expression of value or may elect to carry individual value indications from the GPCM into a broader exercise to correlate the overall conclusion of value from all methods developed using the three core approaches to value. We believe both of these presentations to be appropriate, but we caution that appraisers and report users should be aware of the total consideration applied to each methods and approach.

Identifying Guideline Companies

The initial stage generally includes the identification of relevant subject company characteristics to serve as a basis for a public company or transaction search. These characteristics include (among other things):

- The subject entity’s portfolio of products and/or services

- The subject entity’s vertical and/or horizontal integration in its respective industry

- The subject entity’s market share in the industry or in subsets of geography or by customer type, and so forth (to whom and where are the subject’s products and services sold?)

- The subject entity’s operational and organizational structure

The characteristics outlined in this list can be used to identify codes under the Standard Industrial Classification (SIC) and North American Industrial Classification Systems (NAICS – used in the United States, Mexico, and Canada). These codes can be used to identify transacting companies and public companies with common economic activities to the valuation subject. Appraisers may need to augment such global screenings with key word searches or perform parallel searches of other SIC or NAICS codes that represent businesses with substantially similar business attributes. Screening of electronic and web-based resources is a virtual standard in valuation practice today. Such resources often include industry data and noteworthy public and private participants. Additional criterion used for selecting and narrowing selections include consideration of the subject’s and the guideline companies’ financial performance and composition, the nature of the assets, the supporting capital structure, trends in absolute and relative performance via size and margin considerations, and consideration of internal and external factors that drive or influence business activity.

Choice of Valuation Metric

The valuation metrics applied in a given appraisal should be commonly accepted and recognized as relevant to the subject’s industry (earnings, EBITDA, book, etc.) and should be reflective of business cycle or other relevant issues affecting the subject, its industry, and its guideline peer group. For example, guideline capitalized net income is a common valuation norm for many financial institutions and service companies, while capitalized EBITDA is a more recognized valuation norm for asset-intensive business such as manufacturers. In many valuation engagements, the value of an entity in relation to its book value can be important.

The reliance of securities markets on various types of valuation information can shift during economic and industry cycles. Businesses that typically have higher valuations during economic expansions may be valued with higher reliance on capitalized cash flow or earnings, while valuations in recessionary periods or down cycles may place greater reliance on asset-based valuation methods. The point is that valuations performed from one time to another or for one purpose to another may require differing degrees of reliance on and consideration of the GPCM as a whole, as well as differing degrees of reliance on and consideration of varied indications of value underlying the GPCM. A rigid average of underlying methods in the GPCM as well on other methods and approaches in an appraisal may constitute little more than a rule-of-thumb or formulaic approach to value and can lead to flawed valuation results.

The Fundamental Adjustment

Under both the guideline public company method and the guideline transactions method, it is necessary to adjust the market evidence observed in transactions of comparable companies for fundamental differences between the subject company and the guideline companies.

Adjusting Guideline Valuation Metrics for Use in Business Valuation

What is a fundamental adjustment? The term “fundamental adjustment” is not a universal term, but it is a universal treatment applied explicitly or implicitly in virtually every GPCM and guideline transaction method (GTM). Where market-value evidence is observed, screened, and modified for use in the GPCM or GTM, one can be virtually assured that some adjustment has been applied to the data. The adjustment of market-value evidence, whether it is through selection criterion, central tendency observations, or otherwise is what we refer to as a fundamental adjustment. Labels and terms aside, we acknowledge the need for an explanation of how an appraiser adjusts market-value evidence used in the appraisal process. The obfuscation of or failure to consider such adjustment is a common feature of and/or source of error in many appraisals.

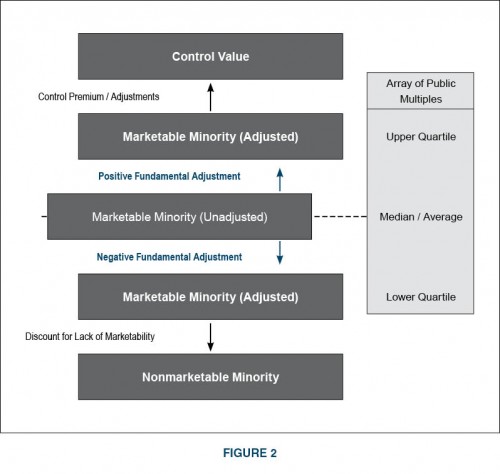

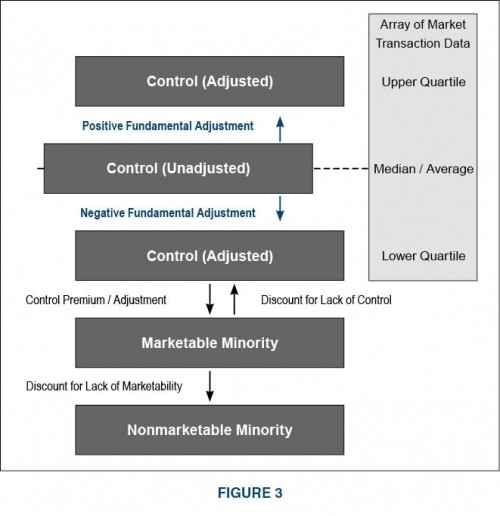

Figures 2 and 3 provide perspective concerning the conceptual framework of market-value evidence and its adjustment for use in business valuations. Figure 2 relates to the marketable minority level of value that by default is the typical level of value arising from the GPCM. We note that the financial and strategic control levels of value may differ from guideline to subject using the same concepts discussed here.

The necessity for fundamental adjustments is frequently overlooked. These adjustments are required to reconcile differences between the subject company and the selected group of guideline companies (or transactions as the case may be). Fundamental adjustments are generally applied as discounts to the observed market-value evidence (reflecting a typically smaller and riskier valuation subject versus larger public companies that populate a guideline company group), but they can also represent premiums in relationship to the base market-value evidence.

Core comparative considerations between the valuation subject and the guideline companies include the following:

- Size. Publicly traded guideline companies are often larger and more diversified than the valuation subject. Diversification and scale regarding geographic footprint, customer concentration, supply inputs, and other common risk factors typically favor guideline public companies and acquirers in transactions. All things being equal, this would imply a lower valuation multiple for a relatively smaller subject entity.

- Growth. The growth expectations of guideline companies may be materially different than the growth expectations for the subject company. All things being equal and using the basic representative equation of valuation and the underlying elements of a valuation multiple, higher growth translates to higher valuation multiples and vice versa.

- Access to and Composition of Financing. The ability to obtain financing and negotiate favorable terms can facilitate future growth and provide superior returns on investment. The capital structures and financing power of large public companies can reduce the cost of capital and provide greater operational and strategic flexibility. Such factors translate to higher valuation multiples than may be reasonable for smaller companies lacking such resources.

- Financial/Operating Strength. Guideline companies may be better capitalized and have greater depth in their respective management teams.

The underlying need for fundamental adjustments arises because of differences in the risk profile and growth prospects of the valuation subject in relation to the companies whose trading and transaction data are used in a valuation. By process, the adjustments are developed (through explicit analyses or otherwise) by substituting the risk and growth attributes captured in the guideline data with the risk and growth attributes of the valuation subject. In this fashion, the appraiser attempts to answer the question – how would the market-value evidence differ if the guideline companies and/or the transaction participants had the same risk profile and growth prospects as the valuation subject? This question provides the genesis for understanding a quantitative method for assessing the magnitude of a fundamental adjustment. There are numerous variations of quantitative adjustment and most are predicated on the principle of substitution.

Quantitative Process for Assessing a Fundamental Adjustment

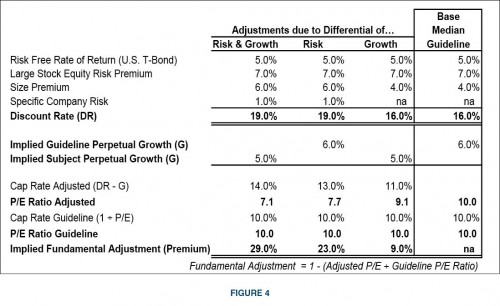

As a preface to the following example, readers are reminded of the build-up and ACAPM methods for developing the required rate of return on equity capital. These CAPM-based disciplines provide the basis for disaggregating the P/E ratios of public companies in a fashion that facilitates the process for substituting the subject risk profile and growth of the subject and determining the effect on the P/E ratio. Such quantification may suggest the magnitude of an appropriate fundamental adjustment. The following assumptions and conditions are used in the example. The figures and assumptions in this example are purely for demonstration purposes.

- Ten public companies were identified as guideline public companies. The median P/E ratio of the group was 10x. The reciprocal of this P/E ratio equals a capitalization rate of 10%.

- The median equity market capitalization of the 10 guideline companies would place the hypothetical guideline company near the bottom of 9th decile of public companies according to the Morningstar/ Ibbotson SBBI Yearbook. The 9th decile companies reflected an implied size premium on the order of 4.0% in excess of returns on the S&P500 index (large cap stocks). The median beta was 1.0, implying equal volatility to the S&P500.

- Financial composition and performance of the subject company were reasonably consistent with the guideline company. The elements of risk were primarily related to differences in firm size.

- Stock analysts following the guideline companies were projecting annual earnings growth of approximately 10% for the next five years. Long-term industry prospects suggested annual earnings growth on the order of 4%. The guideline growth rate expectations equate to a perpetual earning growth rate of approximately 6%. The implied required rate of return for the hypothetical median guideline company is 16%. This measure of return minus the perpetual growth rate of 6% equals the observed capitalization rate of 10%.

- The subject company was mature and displayed recent earnings growth of 10%, near-term growth expectations were expected to decline by 1% each year and level out at a long-term growth rate similar to the overall industry (4%). The subject growth rate expectations equate to a perpetual earning growth rate of approximately 5%.

- At the valuation date, the risk-free rate of return on long-term U.S. Treasury bonds was 5%. The assumed large stock equity premium was assumed to be 7%. The size premium deemed appropriate for the subject company was 6%, and firm-specific risk was assumed to be 1%.

- The table in Figure 4 depicts the changes in the median guideline P/E ratio via the sequential and combined substitution of subject growth and risk into the build-up process. The differences between the resulting adjusted capitalization factors and the median guideline P/E ratio represents the fundamental adjustment.

The risk differential (combined size- and firm-specific) suggests the median guideline P/E ratio be reduced by 23% solely based on the valuation subject’s risk. The growth differential suggests the median guideline P/E ratio be reduced by 9% based solely on the valuation subject’s risk. Considering risk and growth differentials, the median guideline P/E ratio would be reduced by 29%. In operation, this adjustment would be applicable to pricing metrics that result directly in value indications for total equity or could be applied to the resulting equity value derived after subtracting debt from value indications for invested capital. Using the foregoing example, we might see an appraiser use a fundamental adjustment of 15% to 25%. Every situation is unique, and the exact quantified result of this technique is not the absolute adjustment that need apply.

Fundamental Adjustments in Disguise

The following bullet points highlight some of the possible implicit adjustments we see applied to market-value evidence. These points are random in fashion and are designed to spark the necessary analytical curiosity required to scrutinize valuation methods under the market approach.

- Most appraisers, even those who have never employed the term “fundamental adjustment,” have employed the same concept in appraisals. In fact, any appraiser who has selected guideline company multiples other than the median (or perhaps, the average), whether above or below, has implicitly applied the concept of the fundamental adjustment. Based on comparisons between private companies and guideline groups of companies, appraisers often select multiples above or below the measures of central tendency for the public groups.

- Analysts routinely add a small stock premium to the base, CAPM-determined market premium based on historical rate of return data. In addition, analysts routinely estimate a specific company risk premium for private enterprises, which is added to the other components of the ACAPM or build-up discount rate. Implicitly, analysts adjust public market return data (from Ibbotson or other sources) used to develop public company return expectations to account for risks related to size and other factors. In other words, they are making fundamental adjustments in the development of discount rates.

- What are the differences between the subject company and the guideline companies, and how does one incorporate them into the analysis? If all of the guideline companies were identical to one another and the subject company was identical to the guideline companies, then subject value would be equal to the values of the guideline companies. Because this is never the case, the analyst has to identify the important differences and determine what adjustments are required to arrive at a reasonable estimate of value for the subject.

- The actual value measure applied to the subject may be anywhere within (or sometimes even outside) the range of value measures developed from the market data. Where each measure should fall will depend on the quantitative and qualitative analysis of the subject company relative to analysis of the companies that comprise the market transaction data. Valuation pricing multiples are influenced by the same forces that influence capitalization rates, the two most important of which are: (1) risk and (2) expected growth in the operating variable being capitalized.

- Therefore, in order for the analyst to make an intelligent estimate of what multiple is appropriate for the subject company relative to the multiples observed for the guideline companies, the analyst must make some judgments about the relative risk and growth prospects of the subject compared with the guideline companies.

- The analyst should be aware that a search criterion could represent the beginning of a fundamental adjustment in the eyes of potential users of a report. The analyst can unwittingly (or overtly) apply a fundamental adjustment before the mathematical process even begins.

- As with any discount or premium, a fundamental adjustment has limited meaning unless the base against which the adjustment is applied is clearly defined. Define such base in error, through either commission or omission, and the selection and adjustment of public company valuation metrics may be faulty.

- Use of generic methodology in lieu of an emphasis on relevant metrics can be construed as a fundamental adjustment.

- Ultimately, as a result of weighing alternative valuation methods to the ultimate valuation conclusion, the valuation may reflect a significant discount to public company multiples and potentially a higher (or lower as the case may be) fundamental adjustment than explicitly articulated (or implicitly captured) under the guideline method.

Conclusion

As with many tools in the valuation, there are variations of this process. Some appraisers may elect to quantify adjustments for application to differing valuation metrics so as to take into consideration specific differences in profit margins or capital structure. Fundamental adjustments can be small or large and can be positive or negative. Appropriate quantification techniques can be useful tools in augmenting qualitative-based adjustments. Fundamental adjustments can be explicit in nature or implicit and disguised in numerous ways. Ultimately, it is the appraiser’s responsibility to select and reasonably adjust market-value evidence for use in the GPCM or the GTM.

Guideline Transactions Method

The transactions method and the GPCM follow a generally recognized (more or less) set of procedures and practices. The guideline transaction method (GTM) is inherently different in its requirements due to potential idiosyncrasies in the underlying data.

The largely private purveyors of market-value evidence used in the GTM provide varying degrees of data from varying markets. Transaction events are generally classified by industry, facilitating SIC- and NAICS-enabled screening. However, transaction consideration and various valuation ratios may follow differing definitions. Certain adjustments are required to add or subtract values associated with excluded assets or to compensate for the effect of specialized transaction consideration and other deal terms in order for an appraiser to develop an appropriate valuation of the subject.

The required adjustments and considerations vary from one data source to the next. Such adjustment items may include employment contracts, non-compete agreements, contingency payments, seller financing terms, working capital, real estate, specialized expressions of cash flow and other transaction attributes. Care must be taken to ensure that the methodology results in value indications that are consistent with the value definition required in the appraisal description. Appraisers and report users are cautioned that data sources should be reviewed to understand what kind of valuation is captured in the transaction data (typically it is the market value of invested capital) and how that data needs to be adjusted to derive the intended subject valuation (equity value in most valuation engagements). Confusion in the proper use of transaction data bases has fueled a veritable professional niche of publications intended to instruct appraisers on the proper use of market-value evidence from the various databases. This suggests that transaction observations be supported by sufficient (perhaps significant) underlying financial detail.

In operation, the GTM is similar to direct capitalization income methods and to the GPCM in that a specified subject performance measure is capitalized by a capitalization factor that is derived from observable market-value evidence (transactions). As with other guideline data processes, capitalization factors are typically drawn from numerous transactions implying some average valuation metric or ratio. Adjustments to reconcile fundamental differences between subject and guideline follow similar considerations as discussed in the GPCM. Differing valuation metrics may be used to describe transaction values based on the nature and industry of buyers and sellers in the cited transactions. As with income methods and other market methods, consistency between performance measures and capitalization multiples is required.

Valuations using transaction data result in a controlling interest valuation indication. As such, the GTM may not be employed (or useful) in a valuation intended to develop a minority interest level of value. Alternatively, a controlling interest value can be adjusted by valuation discounts to derive alternative levels of value. Market transactions are used to develop valuation indications under the presumption that a similar market exists for the subject company.

As with the guideline public company method, ideal guideline transactions involve companies which that are in the same business as the company being valued. However, if there is insufficient transaction evidence in the same business, it may be necessary to consider companies with an underlying similarity of relevant investment characteristics such as markets, products, growth, cyclical variability, and other salient factors.

One or a combination of data sources are typically employed in the GTM. Additionally, there are countless other potential sources of information that are reported by specialized industry trade groups, investments banking concerns, industry consultants, and other market participants. Information may also be gleaned from the corporate development activities of publicly traded buyers and sellers because such data may be reported in SEC filings. There is a wealth of potential information from diverse providers of financial and market market-based information including (among others) SNL Securities, Thomson Reuters, and Bloomberg.

Virtually every caveat and caution discussed for the GPCM and the transaction method extend to the GTM (and then some). Appraisers are challenged with adequate documentation of transactions, proper application of the data, and proper adjustment of the results. Many appraisers include citation of transaction data in their reports but may elect to use such data as a supporting element to an appraisal conclusion derived from alternative methodologies. Direct use of transaction data is often reserved for situations in which adequate transaction volume can be observed, the transactions occurred within a reasonable timeframe of the valuation data, and the transaction participants’ data and deals can be reasonably adjusted and reconciled to the valuation subject.