The Rise of FreightTech

To the lay person, transportation may seem like the farthest end of the spectrum from the technology industry – telephone orders and paper shipment tracking. But those in the know understand just how tech-enabled the industry has become. Advancements in machine learning, artificial intelligence, and predictive technology could have the power to disrupt the way goods are transported, stored, and tracked. And investors are clearly willing to take bets on that.

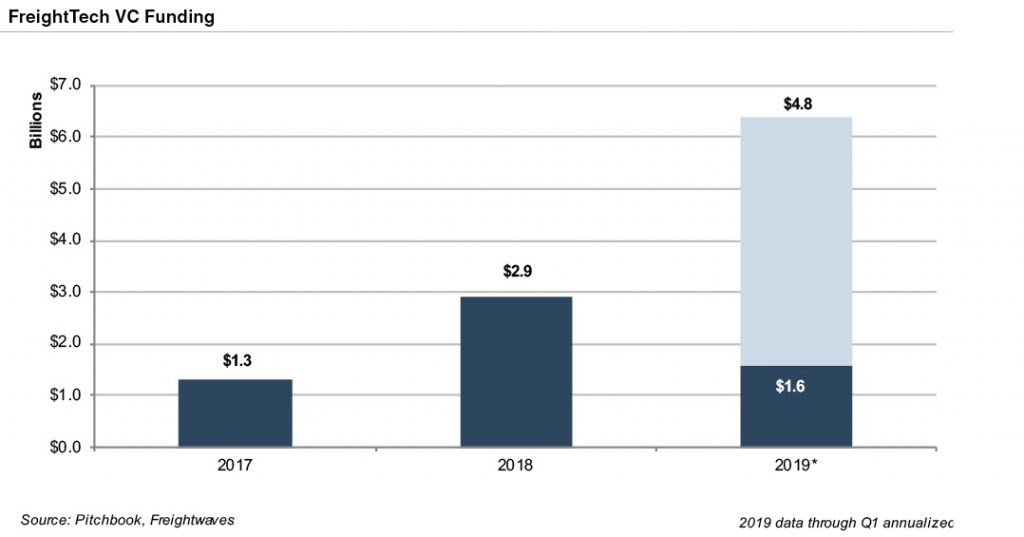

Over the past few years, FreightTech has emerged as its own category of technology. The level of excitement in the space grew in 2018 as global venture capital investment increased to $2.9 billion from $1.3 billion the prior year. FreightTech is on track for another year of exponential growth in 2019, with $1.6B of funding raised in the first quarter alone.

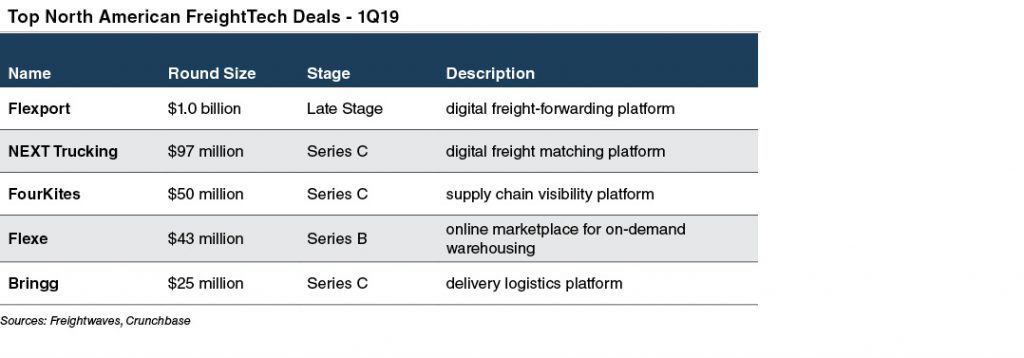

The willingness of industry participants to adopt logistics technology is evident as well. Corporate players and major OEMs have spun up innovation departments, startup accelerators, and investment arms in order to find and fund new technology. However, it’s not only the companies that directly benefit from this technology that are investing capital in the space. Technology players recognize the potential for returns on transportation investments, too. Alphabet’s venture capital arm, Capital G, led a $185 million investment in Convoy, a tech-enabled freight matching startup, at the end of 2018. The Series C round valued Convoy at $1.0 billion and brought the company’s total capital raise to $265 million. Softbank Vision Fund, known for making big bets on disruptive technology, got in on the game too. The fund invested $1.0 billion in Flexport, a digital platform for freight forwarding and logistics, at the start of the year. The investment valued the company at $3.2 billion.

The table below shows the five largest North American FreightTech investments in the first quarter of 2019 by round size.

Investment in FreightTech has not only grown in terms of aggregate investment, but the average size of deal rounds has increased as well, mirroring the trends in the overall venture capital landscape. According to Morningstar, the average round size for a Series B round in the FreightTech industry increased 78% from $24.5 million in 2014 to $43.6 million in 2017.

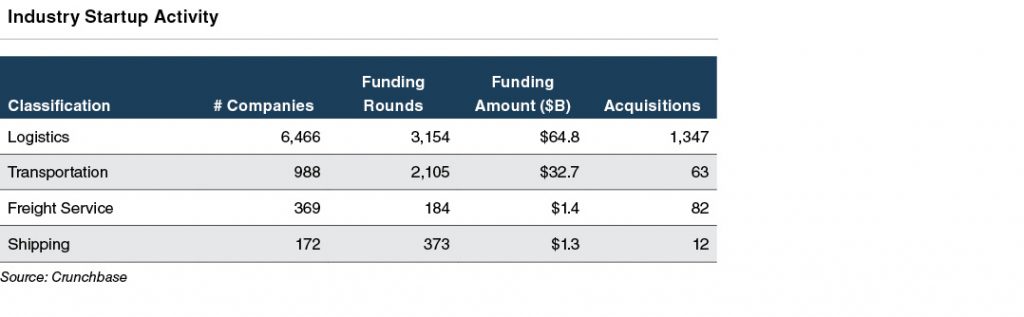

The classification of transportation and logistics startups differs, but it is clear that there is growing innovation in many different facets of the industry. It is evident that technological change in the freight transportation industry is about far more than just digitizing processes that once involved paper or fax machines. The application of advanced data and analytics to the transportation and logistics industry has the potential to change the global movement of freight.

Originally published in the Value Focus: Transportation & Logistics, First Quarter 2019.