Your Business Will Change Hands: Important Valuation Concepts to Understand

In this article, we provide a broad overview of business value and why understanding basic valuation concepts is critical for business owners. Why is this valuation knowledge important? Because businesses change hands much more frequently than one might think. In fact, every business changes hands at least every generation, even if control is maintained by a single family unit.

Business Press Focuses on Public Companies

According to statistics about business size from the U.S. Census Bureau, there are about six million businesses with payrolls (meaning these businesses employ people) in the United States.[1] A little more than three and a half million U.S. businesses have sales of less than $500 thousand. Without any disrespect, these businesses are often referred to as “mom and pop” operations because their basic function is to provide jobs for the owner(s) and sometimes a few other people.

About two million businesses have annual sales between $500 thousand and $10 million.[2] This segment of the business community is generally given credit for the majority of job growth. Only about 200 thousand businesses have annual sales exceeding $10 million.[3]

At the top of the business pyramid are public companies. Of these, as of 2012, only about four thousand have active public markets for their shares with regular stock pricing and volume information available.[4] Because of their size and visibility, this relatively small group of public companies gets the lion’s share of coverage in the business press. As a result, most of the popular business press coverage of valuation issues relates to public companies.

Most Companies are Privately Owned

But most of the businesses in corporate America are closely held, or private corporations. This means that most of the business owners in corporate America are not in public companies, but in generally smaller entities owned by a single, or a small number of shareholders. Therefore, it’s important for these business owners and their advisors to have an understanding of the nature of value in these businesses.

Private Businesses Change Hands Frequently

Most business owners, and, quite often, their advisors, have inaccurate conceptions of the value of their businesses. This is not surprising, because there is no such thing as “the value” of any business. Value changes, often rapidly, over time. Yet it is important for business owners to have current and reasonable estimates of the values of their businesses for numerous reasons, including ownership transfer.

There are many reasons for ownership transfer, including:

- The death of the primary owner. At this point, it is clear that control of a business will pass to someone else.

- The departure of a key employee. This departure may trigger the necessity to sell a business if he or she takes away the key contacts or critical energy that keep things going and growing

- The owner gets “tired” and decides to sell. This is an unbelievably frequent reason why business ownership transfers. Unfortunately, if a business owner waits until he or she is tired, they are already on the down side of the value curve. Tired owners almost unavoidably transmit their “tiredness” to employees and customers in many subtle and not so subtle ways. In the process, their businesses lose a vital life force critical for ongoing growth and success.

- An unexpected offer. Occasionally, a business owner will receive an unexpected offer to purchase the business and will, quite suddenly, sell out to take advantage of the situation.

- Business reversals occur. Perhaps a company fails to adapt to a changing market, competition arises from unexpected quarters, or an accident or bad luck generates substantial losses. Sometimes the affected businesses never recover, and at other times, a forced sale results.

- A divorce. Divorces involving family-owned or closely held businesses occur. Wild card divorce settlements or emotional changes resulting from a divorce can also create the necessity or desire to sell.

- Life-changing experiences. Business owners sometimes encounter life-changing experiences, such as heart attacks, cancer, close calls in accidents, the death of a parent, spouse or friend, or other. The shock of such experiences sometimes fosters a strong desire to “do things differently with the rest of my life.” Business transfers can be the eventual result of these life-changing experiences.

- Gift and estate tax planning. Gift and estate tax planning by business owners is a normal means of business transfer. The absence of proper gift/estate tax planning can also precipitate the forced sale of a business if a business owner’s estate lacks the liquidity to handle estate taxes, or if a failure to plan for orderly and qualified management succession cripples the business when the owner is no longer there.

- The second generation is not up to the task. There is ample proof that most businesses never survive to the second generation. Unfortunately, family businesses which do make it past the founder’s death sometimes never survive the ascendancy of the second generation of management and have to be sold.

- Normal lifetime planning. Finally, businesses sell as the result of normal lifetime planning by their owners who plan for and execute the sale of their businesses (or transfer them through gifts) on their own timetables and terms.

The Business Transfer Matrix

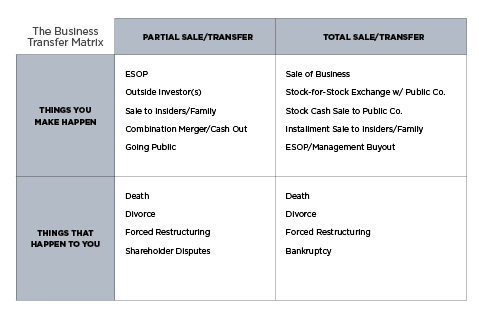

If you don’t believe that businesses change hands, examine the Business Transfer Matrix in Figure 1.

When a business changes hands, there will be either a partial transfer of ownership (in the form of gifts, sales to employees, going public, etc.) or a total transfer of ownership (through outright sale or death).

The Business Transfer Matrix also indicates that ownership transfers are either voluntarily or involuntary because we do not always control the timing or circumstances of sale.

The Common Thread Behind Most Business Transfers

Unfortunately, most business owners don’t plan for the eventual transfer of their business. In our experience, most business sale or transfer decisions are made fairly quickly. In many cases, business owners never seriously contemplate the sale of their businesses until the occurrence of some precipitating event, and shortly thereafter, a transfer takes place.

The logical inference is that many, if not most, business sales occur under less than optimal circumstances.

The only way business owners can benefit is to constantly do the right things to build and preserve value in their businesses, whether or not they have ever entertained a single thought about eventual sale.

In other words, owners should operate their businesses under the presumption that it may someday (maybe tomorrow) be necessary or appropriate to sell. When the day comes, business owners will be ready – not starting to get ready and already behind the eight ball.

What a Business Owner Thinks About the Value of Their Business Ultimately Doesn’t Matter

It is a hard truth for many business owners to learn that what they think regarding the value of their business doesn’t matter. The value of any business is ultimately a function of what someone else with capacity (i.e., the ability to buy) thinks of its future earning power or cash generation ability.

For other transactions with gift or estate tax implications or with legal implications for minority shareholders, what a business owner thinks still doesn’t matter. What then becomes important is the value a qualified, independent business appraiser or the court concludes it is worth. In so doing, the appraiser or the court will simulate the arms’ length negotiation process of hypothetical willing buyers and sellers through the application of selected valuation methodologies.

Theoretically, the value of a business today is the present value of all its future earnings or cash flows discounted to the present at an appropriate discount rate. To determine a business’s worth, determine two things: 1) What someone else (with capacity) thinks the company’s earnings really are; and 2) what multiple they will pay. Simplistically, we are saying:

Hypothetical (or real) buyers of capacity will make reasonably appropriate adjustments to the company’s earnings stream in their earning power assessments. In addition, they will incorporate their expectations of future growth in earning power into their selected multiples (price/earnings ratios). Or they will make a specific forecast of earnings into the future and discount the future cash flows to the present.

A Conceptual Viewpoint of the Value of Companies

Now let’s talk a bit about the value of companies from a conceptual viewpoint by beginning with a familiar term and its definition: Fair Market Value.

A hypothetical willing buyer and a hypothetical willing seller, both of whom are fully or at least reasonably informed about the investment, neither of whom are acting under any compulsion, and both having the financial capacity to engage in a transaction engage in a hypothetical transaction

That may not sound like the real world, but it is the way that appraisers attempt to simulate what might happen in the real world in actual transactions in their appraisals.

And it is the way that business owners state in agreements – quite often in buy-sell agreements, put agreements, and other contractual relationships – that value will be determined.

Just so everything is crystal clear, this concept of fair market value can be considered on several levels.

How is Value Determined?

The basic value equation is also known as the Gordon Model:

As mentioned previously, value is also presented as:

The multiple is calculated as follows:

Another multiple:

A company’s price/sales ratio is a function of the margin, say pre-tax earnings, and the appropriate multiple. If companies in the industry tend to sell in the range of 50 cents per dollar of revenue, that might be because the typical pre-tax margin is around 10% and the pre-tax multiple is about 5x.

The multiples of sales that people talk about obviously come from somewhere. Now we know where they come from.

If Value = Earning x Multiple, what about Earnings?

There are three ways to increase Earnings:

- Increase Total Revenue and hold Total Costs constant

- Hold Total Revenue constant and decrease Total Costs

- Increase Total Revenue and decrease Total Costs

At the margin, if a business increases its costs at a slightly slower rate than its revenues increase, its margins will increase and there will be a multiplicative impact on earnings growth.

If a company’s margins aren’t where they need to be, a business owner should begin a conscious effort each period to hold cost increases to something under revenue increases. If this is done, single digit revenue growth can be turned into double digit earnings growth – at least until margins normalize. We call this “margin magic.” In the process, the business owner will have begun to optimize the value of the business.

Therefore, the multiple can be characterized as:

- 1 / (Risk – Growth)

- Multiple = f (controllable, noncontrollable factors) [risk, and growth]

- Value = f (expected cash flow, risk, and expected growth)

Six Different Ways to Look at a Business

Along the road to building the value of a business it is necessary, and indeed, appropriate, to look at the business in a variety of ways. Each provides unique perspective and insight into how a business owner is proceeding along the path to being ready for sale.

So, how does a business owner look at their business? And how can advisers to owners help owners look at their businesses? There are at least six ways and they are important, regardless of the size of the business.

- At a point in time. The balance sheet and the current period (month or quarter) provide one reference point. If that is the only reference point, however, one never has any real perspective on what is happening to the business.

- Relative to itself over time. Businesses exhibit trends in performance that can only be discerned and understood if examined over a period of time, often years.

- Relative to peer groups. Many industries have associations or consulting groups that publish industry statistics. These statistics provide a basis for comparing performance relative to companies like the subject company.

- Relative to budget or plan. Every company of any size should have a budget for the current year. The act of creating a budget forces management to make commitments about expected performance in light of a company’s position at the beginning of a year and its outlook in the context of its local economy, industry and/or the national economy. Setting a budget creates a commitment to achieve, which is critical to achievement. Most financial performance packages compare actual to budget for the current year.

- Relative to your unique potential. Every company has prospects for “potential performance” if things go right and if management performs. If a company has grown at 5% per year in sales and earnings for the last five years, that sounds good on its face. But what if the industry niche has been growing at 10% during that period?

- Relative to regulatory expectations or requirements. Increasingly, companies in many industries are subject to regulations that impact the way business can be done or its profitability.

Why is it important to look at a company in these ways? Together, these six ways of looking at a company provide a unique way for business owners and key managers to continuously reassess and adjust their performance to achieve optimal results.

The Magic Ingredient: Time

At Mercer Capital, we have provided over 8,000 valuation opinions for companies throughout the nation. Many of our client companies (which have ranged from a few hundred thousand dollars to multiple billions of dollars in value) are enormously successful enterprises.

Our successful client companies have one thing in common – they achieved their success by conscientiously working to build value over time. Success rarely comes instantly. For most companies, it comes slowly, and then only in spurts.

Successful companies manage to grow through their spurts, and then to hang on until internal and external circumstances are ripe for another spurt. In this pattern, they slowly build enterprises of substantial value.

Conclusion

We noted earlier that value is, theoretically, equal to the product of a company’s believable earning power and a realistic multiple applied to that earning power. Business owners need to focus on both earnings and the multiple to maximize value. They also need to understand that it can take a long time to build businesses of substantial value. However, having done so, even modest growth rates bring substantial dollar growth in value.

If you have questions about the value of your business or would like to discuss opportunities for ownership transition, please contact us.

ENDNOTES

[1] Statistics about Business Size (including Small Business) from the U.S. Census Bureau 2007. About three quarters of all U.S. business firms have no payroll. Most are self-employed persons operating unincorporated businesses, and may or may not be the owner’s principal source of income. Because nonemployers account for only about 3.4 percent of business receipts, they are not included in most business statistics, for example, most reports from the Economic Census.

[2] Ibid.

[3] Ibid.

[4] “Investors face a shrinking stock supply,” Matt Krantz, Karl Gelles and Sam Ward, USA TODAY.