An Overview of Personal Goodwill

In the world of FASB, goodwill is not delineated into personal goodwill and corporate or enterprise goodwill. However, in the tax world, this distinction can be of critical importance and can create significant savings to a taxpayer involved in the sale of a C corporation business.

Many sellers prefer that a transaction be structured as a stock sale, rather than an asset sale, thereby avoiding a built-in gains issue and its related tax liability. Buyers want to do the opposite for a variety of reasons. When a C corporation’s assets are sold, the shareholders must realize the gain and face the issue of double taxation whereby the gain is taxed at the corporate level, and taxed again at the individual level when proceeds are distributed to the shareholders. Proceeds that can be allocated to the sale of a personal asset, such as personal goodwill, avoid the double taxation issue.

The Internal Revenue Service defines goodwill as “the value of a trade or business based on expected continued customer patronage due to its name, reputation, or any other factor.”1 Recent Tax Court decisions have recognized a distinction between the goodwill of a business itself and the goodwill attributable to the owners/professionals of that business. This second type is typically referred to as personal (or professional) goodwill (a term used interchangeably in tax cases).

Personal goodwill differs from enterprise goodwill in that personal goodwill represents the value stemming from an individual’s personal service to that business, and is an asset owned by the individual, not the business itself. This value would encompass an individual’s professional reputation, personal relationships with customers or suppliers, technical expertise, or other distinctly personal abilities which provide economic benefit to a business. This economic benefit is in excess of any normal return earned on other tangible or intangible assets of the company.

In Martin Ice Cream Co. v. Commissioner (“Martin”)2, the Tax Court ruled that intangible assets embodied in the shareholder’s personal relationships with key suppliers and customers were not assets of the shareholder’s corporation because there was no employment contract or non-competition agreement between the shareholder and the corporation. In this case, the shareholder/owner, Arnold Strassberg, had developed personal relationships with his customers over a period of approximately 25 years. During this time, Mr. Strassberg was instrumental in the design of new ice cream packaging and marketing techniques. In 1974, the founder of Haagen-Dazs (a large ice cream manufacturer) asked Mr. Strassberg “to use his ice cream marketing expertise and relationships with supermarket owners and managers to introduce Haagen-Dazs ice cream products into supermarkets.”3

The underlying question in the Martin case involved the tax treatment of a 1988 split-off of Mr. Strassberg’s portion of the business from the rest of the company. Arnold Strassberg had an oral agreement to distribute Haagen-Dazs products, and his portion of the business focused on the large supermarket customers, with whom he had developed personal relationships throughout his career. Arnold Strassberg’s son Martin, the other shareholder of Martin Ice Cream Co. (“MIC”), preferred instead to focus on the small store business. Strassberg Ice Cream Distributors, Inc. (“SIC”), a subsidiary entirely related to Arnold Strassberg’s side of the business that serviced the large supermarkets, was split-off from the rest of the company. Arnold Strassberg became the sole shareholder of SIC, and the assets of SIC were subsequently sold to Haagen-Dazs.4

The Tax Court held that Arnold Strassberg’s oral agreement for distribution with Haagen-Dazs and his personal relationships with customers were never corporate assets of MIC, and therefore could not have been transferred to SIC in the split-off. Prior to the sale to Haagen-Dazs, Arnold Strassberg was the sole owner of those intangible assets because he had never entered into an employment or non-competition agreement. The Tax Court concluded,

“Accordingly, neither any transfer of rights in those assets to SIC or other disposition to Haagen-Dazs is attributed to petitioner [Martin Ice Cream Co.]”5

While the Martin case does not provide specific methodology for valuing personal goodwill, it does lend guidance to the issue of identification of personal goodwill apart from corporate goodwill. Following the Tax Court’s approach, the process of recognizing personal goodwill would consider the following issues:

- Do personal relationship exist between customers or suppliers and the owner/manager of the business?

- Do these relationships (customer or supplier) persist in the absence of formal contractual obligations?

- Does the owner/manager’s personal reputation and/or perception in the industry provide an intangible benefit to his business?

- Are the practices of the owner/manager innovative or distinguishable in his or her industry, such that the owner/manager is regarded as having added value to that particular industry?

- With respect to the above factors, is the owner/manager currently under any employment agreement or covenant not to compete with the business?

The existence of personal goodwill apart from corporate goodwill was also recognized in Norwalk v. Commissioner (“Norwalk”).6 The Norwalk case centered on the tax implications of the liquidation and distribution of assets of an accounting firm (C corporation). The two shareholders of the firm elected to terminate the company and to distribute its assets because the business was not profitable. The IRS maintained that the firm had realized a gain on the liquidation of its goodwill, and that the shareholders had realized a capital gain from the distribution of goodwill from their accounting firm to them. Although the shareholders had employment agreements with the firm prior to its dissolution, these agreements expired at the time of the liquidation.7

The Tax Court found that the liquidation was not taxable because the employment agreements with the shareholders had expired. With no enforceable contract in place to restrict the activities of the accountants, any personal goodwill of the shareholders was not an asset belonging to the corporation. Therefore the distribution of the client base to the shareholders did not result in a taxable event to either the firm or the shareholders.

Citing MacDonald v. Commissioner8, the Tax Court in Norwalk stated:

“We find no authority which holds that an individual’s personal ability is part of the assets of a corporation by which he is employed where, as in the instant case, the corporation does not have a right by contract or otherwise to the future services of the individual.”9

Although both Norwalk and Martin clearly recognize the concept of personal goodwill, neither provides a definitive answer as to its quantification. Because personal goodwill is considered to be the value of the services of a particular individual to a firm, the issue often arises in the context of professional practices. With respect to professional practices, Lopez v. Lopez10 suggests several factors that should be considered in the valuation of professional (personal) goodwill:

- The age and health of the individual;

- The individual’s demonstrated earning power;

- The individual’s reputation in the community for judgment, skill, and knowledge;

- The individual’s comparative professional success

- The nature and duration of the professional’s practice as a sole proprietor or as a contributing member of a partnership or professional corporation.

Should a seller be contemplating an asset sale of his or her C Corporation, and there is an embedded gain involved, the possibility of allocating a portion of the purchase price to personal goodwill should be considered. However, the idea must have a basis in reality. The best case scenario is when the shareholder/manager has an excellent professional reputation and close contact with customers and suppliers.

While the transaction price, including any intangible assets, is often negotiated between the buyer and seller, it is highly recommended that a professional appraisal be obtained to allocate the appropriate portion of the transaction to personal goodwill.

Endnotes

1 IRS Publication 535: Business Expenses, Ch. 9, Cat. No. 15065Z

2 Martin Ice Cream Co. v. Commissioner, 110 T.C. 189 (1998).

3 Ibid.

4 Ibid.

5 Ibid

6 Norwalk v. Commissioner, T.C. Memo 1998-279.

7 Ibid.

8 MacDonald v. Commissioner, T.C. 720,727 (1944).

9 Norwalk v. Commissioner, T.C. Memo 1998-279.

10 In re Marriage of Lopez, 113 Cal. Rptr. 58 (38 Cal. App. 3d 1044 (1974).

Experience and the Test of Reason

The Tax Court opinion regarding the Estate of Thompson vs. the Internal Revenue Service (T.C. Memo 2004-174) is remarkable in that the full opinion is essentially a business valuation analysis. The 54 page decision report includes approximately 18 pages of background and industry set-up work describing the Company and its industry, and an additional 36 pages of business appraisal analysis. As a review appraisal, the Court’s due diligence is limited to the information provided to it by the respective experts.

The subject company, Thomas Publishing Company (TPC) is a private, closely held corporation located in New York City , and is engaged in the production and sale of industrial and manufacturing business guides and directories, including the Thomas Register. The decedent owned 487,440 shares of TPC voting common stock (20.57%) at the date of her death, May 2, 1998 .

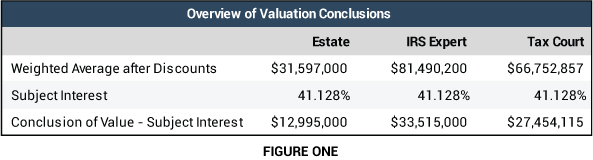

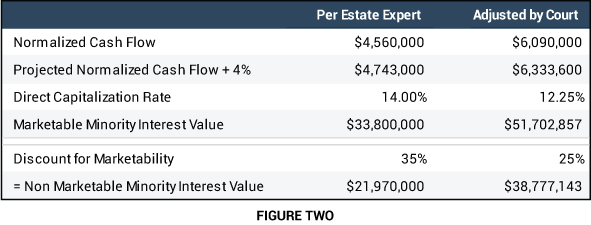

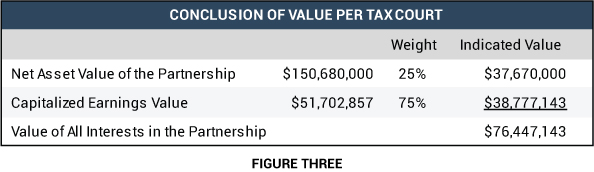

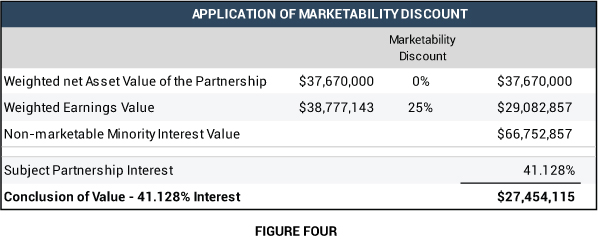

The decision describes the disparity between the parties’ valuation as “startling.” That startling disparity and the analyses presented by the respective experts encouraged the Court to perform its own analysis based on information derived from the testimony, as well as its own valuation perspective. This is summarized in the following table:

The sole testamentary beneficiary of the decedent’s shares was also the Co-Executor of the Estate. In the fall of 1998, the Executors hired an Alaskan lawyer to appraise and to prepare a valuation report for the Estate’s 20.57% interest. The Executors had learned about the Alaskan lawyer from a family contact who had met him on a fishing trip. The acknowledged reason for hiring the Alaskan lawyer was to have the IRS audit conducted not by the IRS New York City office, but by the IRS Alaska office where the lawyer believed he would be able to obtain for the Estate a more favorable valuation of the Estate’s TPC stock. The lawyer in Alaska hired an Alaskan accountant to assist him in the valuation. Specific analytical assumptions and related discounts were equally bizarre in the Estate’s analysis, discussed below.

The IRS expert submitted an initial report and then had to revise it since the centerpiece of his valuation was a discounted cash flow (DCF) model, and his initial model started with net cash flow of $13,069,000, which turned out to be incorrect. The correct net cash flow figure was only $1,398,000, which should have had a major downward impact on his value, but didn’t. When the revised numbers didn’t come close to supporting his initial analysis he substituted something called “liquidation value” for his terminal value, but provided what the Court easily determined to be a predetermined answer.

The Court admitted the experts’ reports into evidence, but found them both “to be deficient and unpersuasive in calculating the fair market value of TPC as an entity and in calculating the fair market value of the estate’s 20-percent interest therein.” The Court stated that the lawyer and accountant from Alaska both had relatively little valuation experience. The lawyer “appears to have attended limited appraisal courses, other than a few courses while working for respondent many years ago.” The Court was also concerned about the lawyer being engaged to handle the anticipated audit, an inherent conflict of interest. The accountant “belongs to no professional organizations or associations relating to his appraisal or valuation work.” With regard to the Estate’s experts, “we regard those reports and testimony of the estate’s experts to be only marginally credible.” Moreover, they “were barely qualified to value a highly successful and well-established New York City-based company with annual income in the millions of dollars.”

The Court rejected the IRS expert’s discounted cash flow analysis, since significant errors were made, and the expert’s numerous recalculations were suspect, not sufficiently explained and not persuasive.

The Court pursued its own analysis, generally following a capitalization of earnings approach, summarized below. Our summary comments follow.

- Specific Company risk related to Internet technology and management risk perceived by the Estate, but was totally discarded by the Court based on their perception of the Company’s ability to handle the new media;

- Neither the Estate nor the Court discussed the concept of the growth rate in developing the capitalization rate. It is unclear if they fully understood that you must subtract the growth rate from the discount rate to derive the capitalization rate;

- Sustainable net income was calculated by the Estate after a pretax adjustment of $10 million per year against historical earnings for new technology expenditures related to the Internet. The Court accepted this, but it appears large in context with historical results (at 43% of historical reported pretax income);

- The Court determined $68 million in non-operating assets (more than half of total value) based on balance sheet information disclosing $68 million in short term liquid investments. This is a substantial oversight on the part of the Estate’s expert.

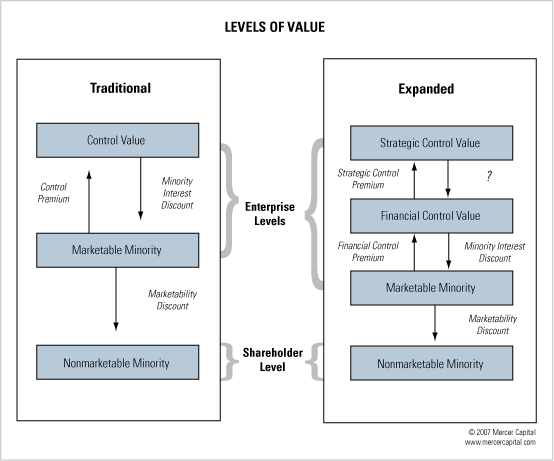

Minority and Marketability Discounts

The Estate’s experts’ 40% minority interest discount was based primarily on their reading of general valuation texts, and their 45% lack of marketability discount was based on several factors, but the Estate’s experts “provided no credible explanation for why they used 40-percent and 45-percent minority interest and lack of marketability discounts, as distinguished from some other numbers.” In general the Estate “based their discounts on general studies and not on the facts of this case … without any credible substantive discussion of how the facts of this case support such particular discounts.” The discounts taken by experts and the Court are shown below. Our summary comments follow.

- The Court either ignored, or was unaware of, the fact that the “build-up” capitalization rate was developed using data from Ibbotson Associates, which itself is derived from minority interest pricing in the public marketplace. Accordingly, no minority interest discount is called for from this perspective (and none was taken by the IRS expert for that reason).

- The Court disagreed with the 45% marketability discount used by the Estate’s expert, since it was based on “general studies and not on the facts of this case,” but applied a 30% marketability discount without any clear quantification methodology. They highlighted this point by saying, “Indeed, but for the fact that respondent’s expert allowed a 30-percent discount for lack of marketability, we might have been inclined to reduce this discount.”

Both Experts Rejected

The Tax Court believed that the Estate’s experts were too inexperienced, accommodating and biased in favor of the Estate. They demonstrated no experience related to the business of the subject company. There was no credible explanation regarding the selection of discounts and how they fit the facts of the case. They had relatively little valuation experience, attended only limited appraisal courses, and belonged to no professional organizations or associations relating to appraisal or valuation work.

The Tax Court perceived that the IRS expert selected his comparable companies in a “casual manner,” that he made significant errors in his calculations and analysis, and made questionable and inadequately explained adjustments in his discounted cash flow analysis which were inconsistent with the methodology utilized in his original report.

The Mercer Capital Advantage

At Mercer Capital we have over a century of combined experience among our valuation and M&A professionals. We consider our ongoing training and education vital to our business, and our professional staff has either achieved or is pursuing one or more of the following credentials: ASA, CFA, ABV, CPA and CBA. We support those organizations and their continuing education requirements, supplemented by our internal training effort. We have published over a hundred business valuation articles over the last decade, plus several comprehensive textbooks, including: Valuing Financial Institutions, Quantifying Marketability Discounts, Valuation for Impairment Testing, and Business Valuation, An Integrated Theory.

Mercer Capital professionals operate in an intellectually challenging environment where diversity of opinion and perspective is expected and encouraged. We provide approximately 400 business valuation reports each year which are subject to multi-level internal review to help ensure conceptual validity, technical accuracy and document the test of reason. To discuss an appraisal assignment in confidence, please give us a call.

Fundamental Adjustments To Market Capitalization Rates

We have previously discussed the concepts of normalizing adjustments and control adjustments to the income statement. Developing an understanding of these important adjustments that are made to the income stream is crucial in the process of conducting an appraisal – and why and when certain adjustments are appropriate or not. We learned, for example, that not making normalizing adjustments in minority interest appraisals is inconsistent with the Integrated Theory.

We now need to consider a third category of valuation adjustments, fundamental adjustments. This term is used to describe a category of adjustments employed by appraisers in the application of the guideline company method. I first posed the question about the necessity for fundamental adjustments in the 1989 ACAPM article.[1] In Valuing Financial Institutions published in 1992, we framed the issue as follows:

Business and bank appraisers face a difficult task in developing capitalization rates in situations where they are unable to identify a comparable group of public companies to use as a foundation. The ACAPM model provides some assistance in this regard.

But the analyst sometimes faces an equally imponderable task in assessing where, relative to a public comparable group, to “price” the earnings of a valuation subject. The analytical question is straightforward: How can the analyst justify a significant discount to the P/E multiples derived from public comparables even when it seems obvious that the subject should command a considerably lower multiple?

While a public company comparable group provides an objective basis for comparing a subject company’s results, either with measures of the group average (such as the mean or median) or with regard to the performance of specific companies in the group, appraisers often end up applying what amounts to a large judgmental discount to the comparable group average (e.g., …”on the order of 50 percent based on our detailed analysis”) to obtain a correct (i.e., more reasonable and realistic) valuation multiple to be applied to the subject company.[2]

Interestingly, both in the ACAPM article and in Valuing Financial Institutions, we referred to fundamental adjustments as fundamental discounts. Along the way, however, we learned that private companies can compare both favorably and unfavorably with groups of guideline companies, so we began using the term fundamental adjustments.

The GRAPES of Value Reviewed

A brief review of the GRAPES of Value is appropriate as we begin to address the concept of fundamental adjustments.[3] We begin with “A” (alternative investment world) because of its direct correlation with the guideline company method. While the examples in the following discussion apply to the guideline (public company) method, the considerations raised are applicable to guideline transactions involving entire companies, to guideline transactions involving restricted shares of public companies, or any other relevant comparisons of private enterprises with market transactions.

A – The world of value is an alternative investment world. We value private enterprises and interests in private enterprises in relationship to alternative investments. In using the guideline company method, we look, for example, at groups of similar (or comparable) publicly traded companies to develop valuation metrics for application to private enterprises.

G – The world of value is a growth world. Investors purchase equity securities with the expectation that the underlying enterprises will grow and that their investments will grow in value. This suggests that it would be important, when comparing private enterprises with groups of guideline public companies, to examine the underlying growth prospects for each.

R – The world of value is a world in which risk is both charged for and rewarded. This would suggest that in making comparisons with guideline companies, appraisers should account for differences in the relative riskiness of subject enterprises and the guideline groups.

P – The world of value is a present value world. To the extent that one investment is riskier than another, the impact of that greater risk dampens the present value of expected future cash flows, and therefore, value.

E – The world of value is an expectational world. If it is important to understand the growth prospects of both guideline public companies and private enterprises with which they are being compared, it is also important to examine the impact on value of differences in expectations.

S – The world of value is a sane and rational world. While pockets of seeming irrationality may always exist in the public markets, on balance, the markets operate on a rational basis. It is often incumbent on the analyst to decipher the underlying rationale reflected in market transactions.

The seventh principle in the GRAPES of value is knowledge, which is the basket within which appraisers can hold their symbolic grapes. This review frames the following discussion of fundamental adjustments employed when developing valuation metrics (multiples) for private enterprises based on comparisons with public companies (or other guideline transactions).

A Conceptual Overview of Fundamental Adjustments

In Chapter 3 of The Integrated Theory, we illustrated that the levels of value can be shown conceptually using the Gordon Model. The symbolic representation of the markets’ valuation of a public company was described as:

Conceptually, when we examine price/earnings multiples from guideline public companies, we are seeing the result of the capitalization of expected future cash flows or earnings based on each company’s r and expected g. Using the market approach, analysts often examine market multiples directly and do not attempt to derive either r or g specifically. There is an implicit assumption that reported public company earnings are normalized. In some cases, the analyst may actually make normalizing adjustments to individual public companies before calculating earnings multiples.

When valuing a private company, its normalized cash flows are capitalized based on the appropriate discount rate for that private enterprise (R) and its expected growth in core earnings (G). Conceptually, we define the value of a private enterprise as:

The normalized cash flows of the private company (i.e., the result of adjusting for unusual or nonrecurring items and items like excess owner compensation) are capitalized at the appropriate rate for the enterprise based on its risk profile and growth expectations. This construct works well with direct capitalization (income methods) if the analyst appropriately assesses risk and growth expectations, either with a single period capitalization of earnings or using the discounted cash flow method. In other words, if the discount rate (built-up using the Adjusted Capital Asset Pricing Model) and expected growth of cash flows are appropriately estimated, reasonable valuation indications can be developed.

Risk Differentials Cause Fundamental Adjustments

However, when comparisons are made between a subject private company and public guideline companies, the objective is to compare a subject private company in appropriate ways to ascertain the appropriate discount rate or capitalization rate. Conceptually, this analysis must allow for the following range of comparisons of discount rates.

Quite often, it is the case that the subject private company is riskier than the public companies with which it is being compared. For example, it may be smaller, have key person risks, customer concentrations, or other risks not present in most or all of the selected guideline companies. Skeptical readers might suggest that the selected guideline companies were not sufficiently comparable to the private enterprise for use. However, by common practice, and judicial and client expectation, if there are publicly traded companies somewhat similar to the subject, even if somewhat larger, they will need to be considered for their valuation implications.

As discussed at length in Chapter 6 of The Integrated Theory (1st Edition) regarding the Adjusted Capital Asset Pricing Model, it is common practice when using income methods to “build up” a discount rate. Analysts routinely add a small stock premium to the base, CAPM-determined market premium to account for the greater riskiness of small companies relative to large capitalization stocks, or specify a more refined size premium based on historical rate of return data. In addition, analysts routinely estimate a specific company risk premium for private enterprises, which is added to the other components of the ACAPM or build-up discount rate.

Implicitly, analysts adjust public market return data (from Ibbotson Associates or other sources) used to develop public company return expectations to account for risks related to size and other factors. In other words, they are making fundamental adjustments in the development of discount rates. In so doing, analysts develop credible valuation indications for the subject enterprises.

Now, consider making direct comparisons between a subject enterprise and valuation metrics obtained from a guideline public group. Assume that the subject enterprise is riskier than the public companies used for comparison. Other things being equal (like expected growth in earnings), the direct application of guideline public multiples to the subject private enterprise would result in an overvaluation of the private enterprise.

Why? Because the cash flows are normalized to public equivalent basis and growth expectations are comparable. However, the lower r from the public group was applied to the normalized cash flows of the private enterprise – and the higher (relative) risk of the private enterprise was not captured.

Expected Growth Differentials Cause Fundamental Adjustments

Now, consider that the growth expectations for the subject private enterprise may be the same, greater than, or less than the growth expectations embedded in the public company multiples.

Quite often (indeed, more often), it is the case that the realistic growth expectations for the subject private enterprise are less than the growth expectations embedded in public market pricing. Familiarity with public markets is crucial when examining relative growth expectations between private and public companies.

- For private companies, examination of historical growth may provide the best evidence relating to future growth expectations, although “hockey stick” projections are seen quite often in private company appraisals. The question in such cases is: “How realistic are the forecasted results in light of history and what is happening at the private enterprise?”

- For a public company, examination of historical growth may provide little indication of the expectations for future growth embedded in its stock price. “Hope springs (almost) eternal” in the public markets, and analysts’ estimates of future growth may be considerably higher than an examination of past results would indicate.

In direct capitalization methods, analysts typically make estimates of expected future growth to convert their ACAPM or build-up discount rates into capitalization rates. Growth expectations are normally based on historical analysis and realistic expectations for future growth of earnings or cash flows. Based on personal experience, discussions with hundreds of appraisers and reviews of hundreds of appraisal reports, it is fair to say that the typical Ge, or expected growth is less than 10%. When discrete earnings forecasts are made, this observation is also true when direct capitalizations are used to develop terminal value indications.

However, the effective, long-term Ge embedded in the pricing of public companies is often 10% or a bit more. Appraisers who recognize this fact (when true) and who use lower expected growth in income methods implicitly reflect fundamental adjustments in the resulting indications of value.

Other things being equal (like risk), if valuation metrics from guideline public companies are applied directly to cash flows of private enterprises in cases where the growth expectations for the public companies exceed those of subject private enterprises, overvaluation will result. (The opposite result would be true if the private company’s growth expectations exceeded those of the publics.) Therefore, analysts should consider whether a fundamental adjustment is appropriate relative to guideline company multiples, or overvaluation (or undervaluation) will result.

Why? Because the cash flows are normalized to public equivalent basis and risks are comparable in this example. However, the higher Ge from the public group was applied to the normalized cash flows of the private enterprise – and more future cash flow than is realistically available is capitalized.

Fundamental Adjustments by Another Name

Most appraisers, even those who have never employed the term fundamental adjustment have employed the same concept in appraisals. In fact, any appraiser who has selected guideline company multiples other than the median (or perhaps, the average), whether above or below, has implicitly applied the concept of the fundamental adjustment. Based on comparisons between private companies and guideline groups of companies, appraisers often select multiples above or below the measures of central tendency for the public groups. In so doing, they are no less applying the concept of the fundamental adjustment than others who make explicit determinations of the adjustments.

The Literature Regarding Fundamental Adjustments

As previously discussed, we introduced the concept of fundamental adjustments in the 1989 ACAPM article and in Valuing Financial Institutions in 1992. I have also discussed the concept in many speeches over the years since then. The third edition of Valuing a Business contained a brief, conceptual discussion of the concept, although the term fundamental adjustment was not used. The Pratt/Reilly/Schweihs text provides an example illustrating how to adjust for differences in expected growth and risk.

We will continue with the example where the guideline company indicated price/cash flow multiple is 8, resulting in a capitalization rate for cash flow of 12.5 percent. Let us assume the comparative risk analysis leads us to conclude the discount rate for the subject company would be five percentage points higher than for the guideline companies, which would bring the capitalization rate to 17.5 percent (12.5 + 5.0 = 17.5). On the other hand, let us assume our smaller, riskier company had two percentage points higher infinitely sustainable long-term growth prospects than the guideline companies. This offsetting factor would bring the capitalization rate back town to 15.5 percent (17.5 – 2.0 = 15.5). This, then, equates to a valuation multiple of 6.5 (1 / 15.5 = 6.5).[4]

Given that the adjusted valuation multiple above is 6.5x and the beginning guideline multiple is 8.0x, the Pratt/Reilly/Schweihs analysis implies that a fundamental discount of 19% is appropriate in their example. Unfortunately, this analysis does not appear in the fourth edition of Valuing a Business.

Richard Goeldner, ASA has also focused on the concept of fundamental adjustments. His material on this subject includes the following:

- Goeldner, “Bridging the Gap Between Public and Private Market Multiples,” Business Valuation Review, September 1998. Goeldner cites the 1989 ACAPM article and Valuing Financial Institutions and provides an algebraic and graphic analysis of equity-based fundamental adjustments.

- Goeldner, “Adjusting Market Multiples of Public Guideline Companies for the Closely Held Business,” a paper presented at the 18th Annual Advanced Business Valuation Conference of the American Society of Appraisers, October 1999. In this paper, Goeldner made an initial attempt to address the fundamental adjustment in the context of total capital appraisals.

There is need for more investigation, thought, and analysis regarding fundamental adjustments in the application of the guideline company method. However, it should be clear that the concept exists and that consideration of fundamental adjustments is an integral part of the guideline company method.

Conclusion

We can summarize the discussion of fundamental adjustments with the following observations.

- Fundamental adjustments are used to account for observed differences between subject private companies and the guideline companies with which they are being compared.

- The need for fundamental adjustments arises because of differences in size, risk profile, performance, or growth expectations.

- Fundamental adjustments can be positive or negative.

- Fundamental adjustments are applicable to marketable minority multiples when using the guideline company method.

- Fundamental adjustments may be applicable to controlling interest guideline multiples.

- Fundamental adjustments can be sizeable. Appraisers need to develop methods and techniques for identifying the need for, and then justifying, the application of fundamental adjustments in the appraisal process.

- A failure to consider fundamental differences between valuation subjects and selected guideline groups of companies can result in material undervaluation or overvaluation.

- Appraisers who make selections of multiples within the range (or outside the range) of guideline company multiples – which includes virtually every appraiser based on queries at dozens of conferences – are embracing the concept of the fundamental adjustment.

In conclusion, we hope that the methods presented here will assist appraisers as they attempt to quantify and to justify fundamental adjustments relative to guideline company multiples. Finally, we hope that this discussion of fundamental adjustments will prompt further consideration and reflection on this issue by others in the appraisal profession.

[Note to Readers: Not included in this brief article, the chapter also provides practical examples of applying fundamental adjustments using a quantitative methodology and consciously selecting valuation parameters other than the median (or average) of a guideline company group for application to private company earnings or cash flows.]

…………………………………………………

[1] Z. Christopher Mercer, “The Adjusted Capital Asset Pricing Model for Developing Capitalization Rates: An Extension of Previous ‘Build-Up’ Methodologies Based Upon the Capital Asset Pricing Model,” Business Valuation Review, Vol. 8, No. 4 (1989): pp. 147-156. In that article, I used the term fundamental discount.

[2] Z. Christopher Mercer, “Minority Interest Valuation Methodologies,” Valuing Financial Institutions (Homewood, IL: Business One Irwin, 1992), p. 235. Now available as an e-book. See www.mercercapital.com.

[3] For a further discussion of the “Grapes of Value,” see Chapter 2 of Valuing Enterprise and Shareholder Cash Flows: The Integrated Theory of Business Valuation.

[4] Shannon P. Pratt, Robert F. Reilly, and Robert P. Schweihs, Valuing a Business: The Analysis and Appraisal of Closely Held Companies, 3rd ed. (Chicago, IL: Irwin Professional Publishing, 1996), pp. 225-226.

Reprinted from Mercer Capital’s Value Matters™ 2004-11, December 14, 2004.

Normalizing Adjustments to the Income Statement

Normalizing adjustments adjust the income statement of a private company to show the prospective purchaser the return from normal operations of the business and reveal a “public equivalent” income stream. If such adjustments were not made, something other than a freely traded value indication of value would be developed by capitalizing the derived earnings stream. For appraisers using benchmark analysis, this would be disastrous, since the restricted stock studies were based on freely traded stock prices.1

Keep in mind the integration of levels of value in the integrated theory of business valuation. In creating a public equivalent for a private company, it need not have all of the characteristics required to engage in an IPO for this model to be relevant. Another name given to the marketable minority level of value is “as if freely traded.” This terminology emphasizes that earnings are being normalized to where they would be as if the company were public. This framework does not require that a company be public or even that it have the potential to become public.

A new vocabulary is needed to clarify the nature of normalizing income statement adjustments. As noted earlier, there are two types of normalizing adjustments. Being very original, we call them Type 1 and Type 2.

- Type 1 Normalizing Adjustments. These are adjustments that eliminate one-time gains or losses, other unusual items, non-recurring business elements, expenses of non-operating assets, and the like. Every appraiser employs such income statement adjustments in the process of adjusting (normalizing) historical income statements. Regardless of the name given to them, there is virtually universal acceptance that Type 1 Normalizing Adjustments are appropriate for consideration.

- Type 2 Normalizing Adjustments. These are adjustments that normalize officer/owner compensation and other discretionary expenses that would not exist in a reasonably well-run, publicly traded company. Type 2 Normalizing Adjustments should not be confused with control adjustments or Type 1 Normalizing Adjustments.

Normalizing adjustments reveal the income stream available to the controlling interest buyer who will gain control over the income stream and who may be able to do other things with that income stream. They also reveal the income stream that is the source of potential value for the buyer of minority interests.

Appraisers should not be confused by the fact that minority shareholders of private companies lack the control to make normalizing adjustments. Some have argued that because minority shareholders lack control to change things like excess owner compensation, normalizing adjustments should not be made in minority interest appraisals. This position is incorrect. Minority shareholders of public companies lack control as well. The difference is they expect normalized operations and they expect management to perform. If management of a public company does not perform, if egregious salaries are paid, or if expenses are not reasonably managed, minority shareholders of the public company tend to walk. They take their money some place else. And the price of the poorly run public company normally reflects this lack of investor interest.

Shareholders of nonmarketable minority interests often lack this ability to “take my money and run.” These considerations have no impact on the value of the enterprise. Rather, they lower the value of the interest in the enterprise in relationship to its pro rata share of enterprise value. This diminution of value must be considered separately from, but in conjunction with, the valuation of the enterprise.

Normalizing Adjustments Illustrated

While some appraisers still disagree regarding Type 2 Normalizing Adjustments, the logic of this presentation, in conjunction with the conceptual discussions both above and in Chapter 3 of Valuing Enterprise and Shareholder Cash Flows: The Integrated Theory of Business Valuation (see page 8 of this newsletter), is compelling. Consider a concrete example and relate it to the Levels of Value Chart.

In the figure below, ABC, Inc. is a $10 million sales company reporting operating profit of $300,000.

Assume that we are appraising ABC and are now considering normalizing adjustments. There is one Type 1, or unusual, non-recurring normalizing adjustment to be made in this particular appraisal. There are also several Type 2 normalizing adjustments that relate to the owner and the controlling shareholder of the business.

- Type 1 Normalizing Adjustment (Non-Recurring Items):

- The company settled a lawsuit regarding damages when one of its vehicles was in an accident. The settlement, inclusive of attorneys’ fees, was $200,000 in the most recent year. Expenses associated with the lawsuit are eliminated from operating expenses.

- Type 2 Normalizing Adjustments (Agency Costs and Other Discretionary Expenses):

- Our examination of selling expenses reveals that Cousin Joe is on the payroll at $100,000 per year and he is not doing anything for the good of the business. An adjustment is clearly called for regarding Cousin Joe. His compensation must be eliminated in order to see the “as if freely traded” income stream.

- In the Administrative Department, Cousin Al comes to work every day, but it is clear that the department is being run by someone else and that Cousin Al is not productive. We adjust by removing his $100,000 salary.

- Big Daddy takes a substantial salary out of the business. Based on a salary survey, earnings should be adjusted by $600,000 for his excess compensation to lower the expense to a normal, market level of compensation.

- Finally Big Daddy owns a chalet, which costs the company about $400,000 a year. Expenses associated with Big Daddy’s vacation home are adjusted accordingly.

Summing the Type 1 and Type 2 adjustments, a total of $1.2 million of adjustments to operating expenses have been identified. These adjustments raise the adjusted operating profit to the level expected were this company publicly traded (even though it likely never will be!). The adjusted (normalized) operating margin of 15%, and adjusted earnings are stated “as if freely traded.”2

Before proceeding to examine control adjustments, we should carry the discussion of normalizing adjustments a step further in order to address any lingering concerns. Some appraisers will still want to say that Type 2 Normalizing Adjustments are really control adjustments and that they should not be made when valuing minority interests.

Why, they may ask, should we not value the minority interest directly and forego making Type 2 Normalizing Adjustments? Let’s be explicit. If we do not make these adjustments:

- The earnings stream that would be valued would not be “public equivalent” in nature.

- Discount rate based on build-up (CAPM) or a guideline company analysis would not be appropriate and the resulting value indication would not be at the marketable minority level.

- Marketability discounts referencing restricted stock and pre-IPO transactions involving public companies would be inappropriate if needed Type 2 Normalizing Adjustments are not made. The various restricted stock and pre-IPO studies are based on marketable minority value bases and the resulting, non-normalized base would not be at the marketable minority level.

- There would be an implicit assumption that the shareholder would never realize his or her pro rata share of the value of the enterprise. In the alternative, there would be no basis to estimate what that future terminal value might be. There would be no basis, for example, to estimate the expected growth in value of the enterprise over any relevant expected holding period, since that base, marketable minority value is not specified.

The bottom line is that, absent making Type 2 Normalizing Adjustments (when appropriate of course), an appraiser is not able to specify that his or her conclusion is at the nonmarketable minority level of value, which is typically the objective of minority interest appraisals. The bottom, bottom line is that appraisers who do not make Type 2 Normalizing Adjustments in the process of reaching value conclusions at the nonmarketable minority level have neither the appropriate theoretical nor practical bases for their conclusions.

Endnotes

1 In other words, the value indication derived from the use of non-normalized earnings for a private company and the application of a marketability discount derived from freely traded transactional bases would yield something other than a nonmarketable minority value indication. Because the earnings capitalized were not normalized, and a “normal” marketability discount was applied, the indicated value conclusion would likely be below that of the nonmarketable minority level.

2 Note that this appraisal process would not ignore the valuation impact of the agency costs associated with Big Daddy and his family if the objective were a nonmarketable minority value indication. The economic impact of the excess compensation not accruing to all shareholders would substantially impact the expected growth in value of the business and the dividend policy (key assumptions of the Quantitative Marketability Discount Model). The risks of illiquidity over an appropriate expected holding period would also be considered.

Valuing Phantom Stock

Phantom stock is sometimes more “phantom” than valuation and accounting professionals would like. Small business owners may make phantom stock agreements with key employees, but fail to mention these agreements to their financial advisors, particularly, but not exclusively, when the agreements are verbal. While there is clearly an economic impact on a company’s value due to the existence of a phantom stock agreement, there are also accounting requirements that phantom stock be expensed as it is awarded (for tax purposes, it is expensed when exercised). Despite an impact on value and the reporting requirements, the agreement is frequently overlooked until exercised.

What is Phantom Stock?

Phantom stock is deferred or incentive compensation which involves a promise to pay an amount to an employee at some future date. The future date may be defined in terms of a certain number of years, or by a triggering event, such as the employee’s retirement, a change in controlling ownership of the company, or the employee’s attainment of a certain age. The amount to be paid at the defined future date is tied to the value of the company’s stock, sometimes, but not necessarily, reflecting dividends.

A phantom stock plan is typically not a tax-qualified plan because it is normally designed to cover a very limited number of key employees. However, it should be noted that should a phantom stock plan attempt to include a broad spectrum of employees and defer some or all of the phantom stock payments until after retirement (or other termination), the plan could potentially be considered an ERISA plan.

Reasons for Phantom Stock

There are a variety of reasons a company may choose to create a phantom stock arrangement. One of the most obvious reasons is the ownership restriction for certain types of entities, such as a sole proprietorship, a partnership, a limited liability corporation, or the S corporation 75-owner rule. If a company has no ownership restrictions but the owner wants to retain ownership, phantom stock provides incentives based on the value of the company while allowing the owner(s) to maintain the ownership interest.

Some companies have an equity ownership plan in place but desire to provide equity-type incentives to a restricted group of individuals. This could be a group of managers or one division of a company. The equity price is sometimes based on a value for a group or division within a larger company.

Management, particularly in a smaller company, may find conventional ownership plans too restrictive or cost of implementation too high. Additionally, there are on-going administrative costs that may be prohibitive. A phantom plan typically provides a less expensive alternative that is not subject to the same restrictions as most equity ownership plans.

Valuation Considerations

A key valuation consideration is that the phantom share liability not dilute the value of the company’s equity shares, rather, remain equal in value to the equity shares. Therefore, a circular, or iterative calculation is necessary to make the phantom and equity share price equal.

While there is a phantom share “price” equal to equity shares, phantom shares typically have an element of risk that common shares do not have, in that they are frequently tied to a period of time, or a triggering event. There may also be an “option price” whereby the phantom shareholder only receives the amount above a certain level, similar to stock options. Therefore, the expected life of the “option” and volatility of the stock must be estimated, so that a present value calculation can be performed. If dividends are a factor, a dividend yield should be estimated. The considerations above amount to an analysis that is similar to that used in the valuation of stock options.

Conclusion

There are a variety of factors to consider when a company has phantom stock agreements; not the least of which is whether an agreement is in place that is not reflected on the company’s financial statements. While these plans do provide some flexibility to the company, they can create some complications in the determination of value.

Organizing Principles of Business Valuation: The Grapes of Value

Introduction

After nearly ten years in the business of valuing companies — as a securities analyst at an investment banking firm from 1978 to 1982, and during Mercer Capital’s early years — I became a member of the American Society of Appraisers in 1987. During those formative years of my business valuation career, I gradually became aware that consideration of six underlying financial, economic, logical, and psychological principles provide a solid basis for considering valuation questions and issues.

Each of these principles provides a way of looking at the world from a valuation perspective. The combination of the principles, or rather, their integration, provides a logical and consistent framework within which to examine business valuation questions and issues.

These principles need a name for this article to make sense, so let’s call them the “Organizing Principles of Business Valuation,” or, for short, the “Organizing Principles.” The acronym, GRAPES, provides a convenient word to help organize and remember the Organizing Principles, which we will sometimes refer to here (with a tip of the hat to John Steinbeck) as the GRAPES of Value. Here they are used in the manner in which they describe the world we live in, and below they are discussed as principles.

We live in a world that needs to be viewed, from a valuation perspective as being described in terms of the Grapes of Value:

G rowth world

R isk/reward world

A lternative investment world

P resent value world

E xpectational world

S ane, rational and consistent world

The real world may not always conform to all of the Organizing Principles. More concretely, specific situations in the real world may not conform or appear to conform. But there is a congruence between theses principles and the business appraisers’ hypothetical world of fair market value. And specific situations in the real world can often be reconciled to the Organizing Principles when we discover which principle has been “violated.”

Background

The Organizing Principles provide a mental checklist and form the basis for addressing nearly every business valuation issue. They are, I believe, descriptive of the underlying behavior of public securities markets which, as we will see, form the comparative basis for the valuation of most businesses. The principles also provide an implicit set of standards for testing the rationality or reasonableness of valuation positions advanced by appraisers.

I have used these principles actively for many years, both as an organizing tool for valuation thinking and as a review tool for our own work and that of others.

I didn’t consciously articulate the Organizing Principles prior to joining the American Society of Appraisers, but they were firmly established in my thinking by the time I began writing my earliest articles addressed to the business appraisal profession in 1988 and 1989:

- “Not So Random Thoughts Regarding the Business of Business Appraisal,” BUSINESS VALUATION REVIEW, June 1988, pp. 62-63. This article, which was written in response to an earlier article by John Emory, ASA (who prepares the Emory Restricted Stock Studies).

- “Issues in Recurring Valuations: Methodological Comparisons from Year-to-Year,” A Letter to the Editor to the BUSINESS VALUATION REVIEW, December 1988, pp. 171-173.

- “The Adjusted Capital Asset Pricing Model for Developing Capitalization Rates: An Extension of Previous ‘Build-Up’ Methodologies Based Upon the Capital Asset Pricing Model,” BUSINESS VALUATION REVIEW, December 1989, pp. 147-156. All of the Organizing Principles were present in this article.

In the following sections, we will discuss each of the Organizing Principles. At the conclusion of the article we will see that while each principle is separate, it is their integration that provides for solid understanding of valuation issues.

G – the principle of GROWTH and time

We live in a growing world. Evolution and growth are an integral part of nature, economies, and the business world. Investors look at the world, the economy, and individual businesses with an underlying assumption that growth will occur. Implicitly, growth occurs over time, so we call the growth principle the Principle of Growth and Time. There can, of course, be negative aspects to economic, industrial or business growth. But we live in an economic world where growth is viewed, on balance, as good.

Other things being equal, a growing business is more valuable than a similar business that is not growing. Other things being equal, a business that is growing more rapidly than another, similar business is more valuable than the slower-growing entity. The Growth Principle suggests, in nonmathematical terms, that there is an underlying relationship over time between growth and value.

Appraisers need to focus on relevant aspects of growth as they address appraisal questions — ranging from the world economy, to the national economy, to the regional economy, to a particular industry, to a particular company, or to the facts and circumstances influencing the ownership of a particular business interest.

The principle of growth is often linked, as we will see, to the principle of Expectation. But they are not the same principle.

R – the principle of RISK and REWARD

Life is full of risks and rewards. In the context of life, there is a relationship between risk and reward that has been known for many centuries — long before the development of modern financial and valuation theory.

This relationship is evidenced by the Biblical “Parable of the Talents” (Matthew 25:14-30). In this New Testament parable, there are three servants who, upon the departure of the master, were given stewardship responsibility for resources. One steward received five talents (currency-equivalent units), another two talents, and the third, one talent.

The first servant invested the five talents and grew the master’s stake until his return. The second servant invested the two talents and similarly grew the master’s stake. The third steward was fearful of loss and buried his talent until the master’s return.

When, the master returned, the first servant rendered his report and told the master of his gain. The second servant reported similarly. And the third steward gave the original talent back to the master. The master was pleased with the work of the first two servants. But the third servant, who was not a good steward, was rebuked. The master took away the talent and gave it to the first steward who had handled his responsibilities well.

The “Parable of the Talents” is summarized here, not to make a theological statement (if, indeed I could), but to illustrate that the concept of the relationship between risk and reward has been in existence for thousands of years.

The Principle of Risk/Reward can be summed up in the words of an immortal unknown: “No risk, no blue chips!” This principle is integrated within the Present Value Principle via the factor known as the discount rate, or required rate of return. It is also embodied, implicitly or explicitly when we employ the Principle of Alternative Investments.

A – the principle of ALTERNATIVE investments

We live in an alternative investment world. This Principle of Alternative Investments suggests that investments are made in the context of making choices between or among competing alternatives. When investors make investment decisions, there are almost always choices that must be made. In the public securities markets investors ask questions like: “Should we buy Compaq or Dell or Gateway stock?” “Should we buy large cap or small cap stocks?” “Should we buy stocks or bonds or real estate?”

Already, we can see that by combining principles, we can begin to describe the way the world works. For example, by combining aspects of the Principle of Risk and Reward and the Principle of Alternative Investments, investors make asset allocation decisions regarding their investments.

The Principle of Alternative Investments also is suggestive of the concept of opportunity costs. When resources are deployed to acquire one asset, they are not available to purchase another.

In the valuation of private businesses and business interests, the Principle of Alternative Investments leads to comparing private businesses with similar businesses whose shares (or debt) are publicly traded. When Revenue Ruling 59-60 directs appraisers to make comparisons of a subject enterprise with the securities of similar companies with active public markets, the Principle of Alternative Investments is being invoked.

The public securities markets are massive and active and provide liquid investment alternatives to investments in many privately owned businesses. Business appraisers need to have a thorough working knowledge of these markets in order to provide realistic appraisals of private business interests.

Virtually every appraisal of a minority interest of a private business begins with (or develops as an interim step) a hypothetical value for the company’s shares “as if freely traded.” In other words, we develop value indications at the marketable minority interest level prior to the application of appropriate marketability discounts.

Perhaps the biggest single shortcoming in the business appraisal profession today is the overall level of understanding of the public securities markets and their relationships to private company values. A number of appraisers have experience as securities analysts with investment banking or money management firms. Others have pursued the Chartered Financial Analyst designation to learn about the public markets. And still others have pursued learning about the public markets through personal study and personal experience.

Unfortunately, far too many appraisers who have entered the business in recent years (or who have been here for years) have, at best, a rudimentary knowledge of how the public securities markets work. While I am jumping the gun on the Principle of Expectations, let me illustrate with a concrete example.

In a recent case, I encountered a nationally-known appraiser (who is an ASA, a CPA, and a CFA — with no securities industry experience). This gentleman wrote a report in which he used guideline companies whose earnings in the current year (trailing 12-months) were significantly down from the prior year(s), but whose estimated earnings for the coming year were much higher. He calculated trailing 12-month earnings multiples for the guideline groups which were inflated relative to the multiples for expected earnings (which he did not provide in his report). He then applied these inflated earnings to his subject companies’ trailing 12-month earnings (which, by the way, were expected to be flat or down in nearly every case).

Having demonstrated his lack of understanding of how the public securities work, he nevertheless seemed offended when I criticized his use of the guideline company method and stated that his valuation indications were inflated. A future issue of E-Law will deal with this issue and illustrate the impact of his mistake.

The point of this discussion of the Principle of Alternative Investments is that the principle requires (assumes) that business appraisers are familiar with the public securities markets and capable of making reasonable comparisons of the public and private markets and drawing reasonable valuation inferences.

P — the PRESENT value principle

Stated in its most simple form, the Present Value Principle says that a dollar today is worth more than a dollar tomorrow. Alternatively, a dollar tomorrow is worth less than a dollar today. Present value is really an intuitive concept that even children understand. Ask any child whether it is better to get a toy today or to get the same toy next week!

When we talk about present value, we really talk about four aspects of investments:

- Investments have duration. They exist over time. We forego consumption today (or make a choice among competing alternatives) in order to gain the benefit of the investment over its duration.

- We expect investments to grow in value.

- Investments are not all the same in terms of their cash flows to the investor.

- And investments have different risk characteristics.

The Present Value Principle enables us to compare investments of differing durations, growth expectations, cash flows, and risks. Present value calculations enable us to express the present value of different investments in terms of dollars today and therefore provide a means to make investment or valuation decisions.

Business appraisers use a model known as the Gordon Dividend Growth Model to express the value of a business today. Technically, this model says the following:

Value today is the present value of all expected future dividends (cash flows), beginning with the next period from today, divided by (or capitalized by) a discount rate (k) minus the expected growth rate of the Dividend. This model is reflective of an income approach to valuation, and is often expressed as follows:

This model reflects a single period income capitalization valuation method commonly employed by business appraisers. The appropriate cash flow might be the net income, the pre-tax earnings, or some measure of cash flow that is expected to be achieved and from which income can grow. The discount rate is developed by comparisons with relevant alternative investments, and the expected growth rate of the cash flow is estimated by the appraiser. Valuation methods flow from present value concepts.

The purpose of our discussion today, however, is simply to note that we live in a present value world. Business appraisers must be intimately familiar with present value concepts and be able to articulate valuation facts and circumstances in a present value context. That is why my HP 12-C calculator travels with me everywhere I go. I’m lost without it in this present value world.

E – the principle of EXPECTATIONS

The example of the Gordon Dividend Growth Model makes it clear that today’s value is a function of tomorrow’s expected cash flows, not yesterday’s performance. This is a simple but often overlooked aspect of valuation.

Appraisers routinely examine a company’s historical performance and develop estimates of earning power based on that history. The earnings capitalized may be an average of recent years’ earnings, or a weighted average of those earnings. In the alternative, an appraiser might capitalize the current year’s earnings or make a specific forecast of expected earnings for next year. The purpose of all historical analysis, however, is to develop reasonable expectations for the future of a business.

We noted the expectational nature of the public securities markets in the example above. The Gordon Model could not be clearer about the expectational nature of valuation. Nevertheless, the Principle of Expectations is one of the most difficult for beginning (and even experienced) appraisers, particularly those with limited public securities market backgrounds, to embrace in practice.

A sidebar to this brief discussion of the role of expectations in valuation relates to the use of unrealistic expectations. One of the most frequent problems seen in appraisal reports today is the use of projected earnings that bear little or no resemblance to those of the past. These projections often lack any explanation of how the rose-colored glasses, through which they view a business, reflect realistic expectations for the future of a business. The projection phenomena just described is so common that it has been given a name — “hockey-stick projections.”

S – the principle of SANITY (and Rationality and Consistency)

The Principle of Sanity might have been that of Rationality had another “R” fit into my acronym of GRAPES. But sanity will do.

When I speak to appraisers about the nature of the public securities markets, many are quick to explain to me the many (apparent or real) exceptions to sane, rational or consistent investment behavior. However, while the exceptions are always interesting, what we are discussing is the underlying rationality of the markets operating as a whole.

Many an unthinking investor has been taken to the proverbial cleaners by the investment pitch that “seemed almost too good to be true.” It probably was too good to be true. Lying beneath the surface of this comment are implicit comparisons with alternative investments that are sane, rational, or consistent with normal expectations.

Some appraisers are also quick to point out that the markets themselves sometimes behave abnormally or, seemingly, irrationally.

I make observations about the comments of appraisers for a specific reason. Too many of us get caught up in the exceptions and miss the big picture that is played out in the public securities markets. If we can understand the underlying rationality or sanity of the markets, we then have a basis to explain or to understand the seeming exceptions.

The Principle of Sanity should be applied to appraisers as well as markets. Revenue Ruling 59-60, in the paragraph prior to the enumeration of the famous factors that are listed in nearly every appraisal report, suggests that appraisers employ three additional factors — common sense, informed judgment and reasonableness. We call the famous eight factors the Basic Eight factors of valuation. We call the less well-known factors from RR 59-60 the

Critical Three factors of valuation.

The Principle of Sanity (among others) suggests that appraisers need to study the markets they use as valuation reference points (comparables or guidelines). It also suggests that valuation conclusions should be sane, rational, consistent and reasonable.

We employ “tests of reasonableness” in Mercer Capital valuation reports to compare our conclusions with relevant alternative investments or to explain why we believe our conclusions are reasonable. Other appraisers call the same process that of using “sanity checks.” Readers of appraisal reports should expect such “proof” of the sanity of the conclusions found in those reports (and often, at critical steps along the way as critical valuation decisions are made).

Concluding Comments

The importance of the Organizing Principles of Business Valuation summarized by GRAPES lies in their integrated consideration by appraisers. A couple of brief examples:

G-rowth. Revenue Ruling 59-60 and common sense tell us to examine the “outlook for the future” of the business, i.e., for its earnings and cash flows.

R-isk/Reward. We examine the history and nature of a business to discern its particular risk characteristics. These characteristics are used in the overall assessment of riskiness, which, as seen in the Gordon model above, impacts value through the discount rate (R) selected.

A-lternative Investments. We compare subject private companies to publicly trade securities because the later represent realistic alternative investments for hypothetical buyers. Conceptually, when we develop a value indication at the “as if freely traded” level, we are developing a hypothetical value. Since the interest is not marketable like the selected guidelines, we then adjust up or down the levels of value hierarchy to develop valuation conclusions at the appropriate level of value.

P-resent Value. The common denominator for comparing alternative or competing investments is found in present value analysis. Value for a business today is, conceptually, the present value of the expected future cash flows of the enterprise discounted to the present at an appropriate discount rate. Value for an illiquid interest in a business is, conceptually, the expected future cash flows attributable to the interest discounted to the present at an appropriate discount rate.

E-xpectations. The market price securities in companies based on expected future benefits. The baseline valuation question is not: “What have you done for me in the past?” Nor is it even: “What can I (reasonably) expect that you will do for me tomorrow?” Valuation is a forward looking or expectational science/philosophy/art/psychology/religion.

S-anity. There is an underlying sanity and rationality and consistency to the public markets that is sometimes difficult to discern. Appraisers who focus on exceptions in the marketplace rather than on underlying logic and rationality are prone to major swings of overvaluation or undervaluation.

Appraisers who have a grasp on the GRAPES of Value have a leg up in the process of developing reasonable valuation conclusions. Attorneys and other advisors to business owners who use the GRAPES of Value as a framework in which to discuss valuation questions can get to bottom-line issues more rapidly and effectively.

(Reprinted from Mercer Capital’s E-Law Newsletter, 99-11, July 22, 1999)

Assessing the Quality of Earnings

A critical aspect of any valuation analysis is the appraiser’s ability to read, understand and interpret a Company’s financial statements – a skill vital to making an accurate assessment of the value of any company. This is because most valuation methodologies incorporate adjustments to value based upon facts discovered during the course of the appraisal process, many of which relate to the Company’s financial statements. In addition, the appraiser is trying to assess the quality of the company’s historical and projected future earnings, which in most companies is a key component of valuation.

What are some of the basic factors an analyst or appraiser must assess in the analysis of the quality of a company’s earnings? The following items are not all-encompassing, but discusses a few balance sheet and income statement considerations appraisers examine in the determination of earnings trends and quality.

Receivables

Receivables on an upward trend can be the result of rising sales, or can be an indication of slow collections, or an acceleration of future sales. If a company’s revenues are growing rapidly, it naturally follows that a higher level of receivables can be anticipated, which is positive. However, a high level of receivables can also be an indication of a longer collection period which can be caused by a number of factors including internal organization problems (the absence of a collections person or department), factors related to the customer base which may be slowing payments (such as bankruptcies or financial difficulties), or an economic slowdown in general. The company could also be accelerating future revenue by offering incentives and price cuts to customers if purchases are made early. One of our recent clients with increasing receivables noted that it was a result of a combination of factors including rapid growth, the lack of proper administrative attention to receivables and a large account with a government agency that tended to be slow pay.

Inventories

Swelling inventories may be an indicator of a number of factors, not all of which are necessarily negative. High growth companies tend to have rapidly increasing inventory levels (which are necessary to accommodate increased sales). However, this could be a warning sign, depending on the nature of the business. Stockpiles of perishable inventories or those that become obsolete quickly may present a problem given a rapid downturn in sales or the development by a competitor of a better product. High inventory levels represent the potential for decreased production or a need to decrease prices to move inventory (which will affect gross margin).

An appraiser should compare balance sheet inventories (which represent a picture of inventories at a point in time) with the average inventory turnover ratio (which is a better measurement of how inventories have moved during the course of the year). Inventory turns should also be compared to similar companies in the industry for an accurate picture. A current client who manufactures very large machinery sometimes has a significantly higher level of inventories at the end of its fiscal year if it has recently completed the manufacture of a couple of machines that will be shipped in the next year. However, its inventory turns are comparable to those in the industry.

Fixed Assets

Trends in a company’s property, plant and equipment are typically examined to determine whether capital expenditures have been deferred and if significant expenditures can be anticipated. If this is the case, financing is generally required (which will increase debt service and impact earnings). Recent increases may be an indication of recent expenditures to accommodate growth or to upgrade property or equipment (which will affect cash flow). Information contained in the cash flow statement indicates annual capital expenditure requirements or those that may be necessary on an ongoing basis. If a significant decrease in the trend of capital expenditures occurs, it could be interpreted as neglect or deferred expenditures. Appraisers typically adjust cash flow and earnings proxies for known upcoming capital expenditures and the associated depreciation.

Revenue

“What constitutes revenue and when and how is it recorded?” is an important question asked by appraisers. Revenue recognition practices may distort a company’s revenue. Sales of customized products or services that require additional consulting services to adapt the product or service to the needs of the user after the sale may not be recorded in full immediately upon sale or shipment. If the sale is subject to returns or rebates, a reduction in sales should also be recorded. Service and construction companies record revenues either on a completed contract method (revenues and costs are recorded upon completion of the project) or the percentage of completion method (revenues and costs are recorded based on the portion of the work completed at fiscal year end). Appraisers watch accelerating revenues. Revenue received as the result of deep discounts can adversely affect future projected revenue. The keys are to understanding what actual recorded revenue is, reading the notes to the financial statements about revenue recognition policies and/or asking the client for a detailed explanation about how revenues are recorded. One of our clients recently changed its method of revenue recognition from the completed contract method to the percentage of completion method resulting in a significant nonrecurring charge to earnings.

Pension Plan Expenses

Companies with defined benefit pension plans must record expenses for projected future benefits. The determination of this cost is complicated and is dependent on a number of assumptions and facts including projected future benefits, the expected return on plan assets, interest costs, gains and losses in the plan, and amortization of prior service costs. The assumptions in this calculation, if not realistic, can inflate earnings by putting less in the plan than is necessary to meet future obligation. The footnotes to the financial statements usually contain these calculations and are a starting point to determine whether the assumptions are reasonable. If they are not reasonable, the appraiser can make adjustments to a company’s earnings to normalize pension plan expense.

Gains on Asset Sales

Specific types of companies have recurring gains or losses on asset sales (particularly those with rolling stock or equipment that must be replaced to keep the assets in good condition). However, this item of “Other Income” is examined closely by an appraiser to determine whether asset sales are recurring or if earnings have been distorted in any year by the sale of an asset which is considered nonrecurring. An asset sale, which is a sale of a significant segment of the business, may require deeper examination and a projection of earnings absent the segment. If a company has sold off a subsidiary in an effort to reduce debt, while interest expense may be less, the company may then be dependent on a mature, slow growing subsidiary which may negatively impact earnings going forward.

Nonrecurring Operating Items