Wealth Management Trend Lines May Be Rolling Over

After a Great Year, Higher Rates and Weaker Markets Threaten Continued Growth

While wealth management continues to benefit from demographic trends in the U.S. and the general accumulation of investible assets during the pandemic, 2022 is proving to be somewhat more difficult for the sector, and sentiment among investors in wealth management firms has dimmed.

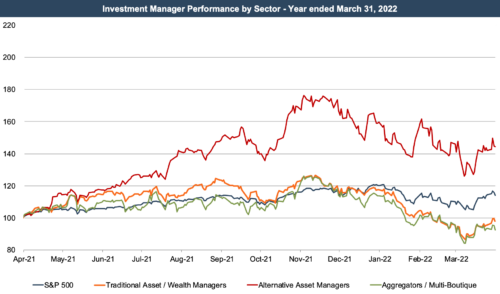

Public firms with substantial operations in the wealth management space have been underperforming alt asset managers and the broader market, and aggregator models like Focus Financial and CI Financial (whose share prices currently trade at 52-week lows) will need organic growth to overcome sluggish financial markets, fee pressure, and higher interest rates.

Recent market activity is a strong contrast to the uptrend seen for much of 2021. Prices for aggregator models accelerated into December of last year, peaking as transaction activity in the space hit a fever pitch, fueled by higher multiples and the threat of changes in tax law that would make selling after year-end potentially disadvantageous.

The annual Schwab survey of wealth management firms confirmed this bullish sentiment, with advisors generally more optimistic about industry growth prospects than they were a year earlier.

Source: June 2021 Schwab Advisor Services Independent Advisor Outlook Study

It’s noteworthy that the survey represents sentiment in mid-summer. In the nine months that have transpired since the survey was taken, the market has had to digest higher inflation, a new uptrend in global interest rates, the Federal Reserve shrinking its balance sheet, and the war in Ukraine. The survey to be taken in 2022 could prove less sanguine.

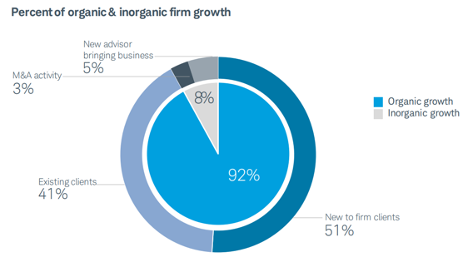

Despite all of the media attention given to consolidation activity in the wealth management sector, it’s noteworthy that the advisors surveyed by Schwab saw ample opportunity to grow their firms organically, with less than 10% of expected growth coming from recruiting or M&A.

Also noteworthy is a generally positive look back at the impact of the COVID pandemic on the wealth management industry, with most firms reporting better performance working remotely than expected. Many firms found opportunities for efficiency in video calls, better staff utilization by cutting staff community times, and expense saving opportunities by cuts in travel costs and office space.

Technology investment is a continued theme in the wealth management space, as firms look to new resources for investment management, client management, and firm management to improve service and efficiency. Most firms expect technology spending to increase in 2022, and some view it as a way to overcome staffing challenges presented by tremendous growth in clients and lack of available talent.

By the spring of 2022, many of the industry trends facing and favoring wealth managers started to shift, threatening margins and valuations.

Higher interest rates are undermining valuations in both debt and equity markets, taking an unusually strong toll on everything from U.S. treasuries to tech stocks. This shift creates a downward gravitational pull on assets under management, and therefore revenue, for wealth management firms. At the same time, inflationary forces are pushing up on both labor and non-labor expenses for RIAs. The consequence could be challenging for margins in 2022 and could deflate some of the positive influences on profitability that have provided a tailwind to RIA valuations for several years.

Valuations may ultimately suffer as well because of higher interest rates, as other income producing assets provide an alternative to investing in RIAs, and the cost of capital increases on both the equity and debt sides of the equation for leveraged consolidators of wealth management firms.

RIA Valuation Insights

RIA Valuation Insights