Accounting Considerations in the Acquisition of a Failed Bank

After completing an FDIC-assisted transaction, the acquirer faces the task of accounting for the transaction in accordance with FASB ASC 805, Business Combinations (formerly SFAS141R). ASC 805 requires the acquirer to record purchased loans at their fair value, or the amount that would be received upon the sale of the subject loans in a transaction between market participants. Given the credit deterioration evident in the loan portfolios of most failed banks, the book values and fair values of acquired loans may diverge to a material degree.

Deposit assumption transactions generally present no complex accounting or valuation issues. Demand and savings accounts are recorded at their book values, which equal fair value. The acquired time deposit portfolio may require a determination of fair value. Unlike a non-assisted transaction, however, acquirers in assisted transactions have the right to adjust the rates on time deposit accounts immediately upon the acquisition. These rate adjustments, along with any attendant deposit run-off, may require consideration in the fair value analysis. Lastly, although not recorded in some transactions, the acquirer may recognize a core deposit intangible asset. While the acquirer may agree upon a deposit premium with the FDIC (or agree that a premium is not appropriate), this premium may not be determinative of fair value, as the intent of fair value is to determine a price in an “orderly” transaction. An FDIC-assisted transaction may not meet the definition of an “orderly” transaction for purposes of determining fair value.

Assisted transactions whereby the acquirer obtains the failed bank’s assets, including its loans, along with a loss-sharing agreement present a much more complicated series of valuation and accounting issues. The valuation and accounting issues can be grouped in two primary categories:

- Issues that arise upon recording the transaction at the acquisition date; and,

- Issues that arise in the post-acquisition accounting for the acquired assets.

Mercer Capital reviewed SEC filings of banks participating in loss-share transactions. From this review, there appears to be some diversity of practice as to the accounting for loss-share transactions. The following discussion, therefore, is general in nature. Banks participating in loss-share transactions are advised to seek guidance from their accounting firms as to the valuation and accounting issues raised by the transactions.

Acquisition Date Issues

At the acquisition date, an acquirer would need to determine the fair value of the following assets:

- The loan portfolio, inclusive of consideration of the credit risk associated with the portfolio;

- The loss-share agreement, for which the fair value is tied to the projected losses covered by the FDIC;

- The core deposit intangible asset related to the assumed deposits; and,

- The time deposit portfolio assumed in the transaction.

Based on the preceding determinations of fair value, the acquirer would then calculate the amount of goodwill or negative goodwill. While goodwill is recorded as an asset on the balance sheet, negative goodwill results in a gain to the acquirer in the period surrounding the acquisition (included in non-interest income).

To demonstrate the preceding accounting and valuation issues, consider the following hypothetical transaction:

- An acquirer enters into a loss-share agreement with the FDIC regarding a failed bank with assets at book value of $1,000 and liabilities of $1,000. The acquirer agrees to purchase these assets for a discount of 15%.

- The acquired loan portfolio has a stated interest rate of 5% and amortizes over a three year term to maturity.

- After reviewing the loans, the acquirer estimates that loan losses of 10% on the remaining outstanding principal balance will occur in each of the three years remaining to maturity of the loans.

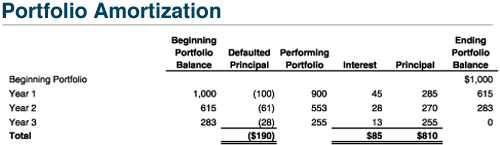

Based on the preceding, Figure One amortizes the acquired loans:

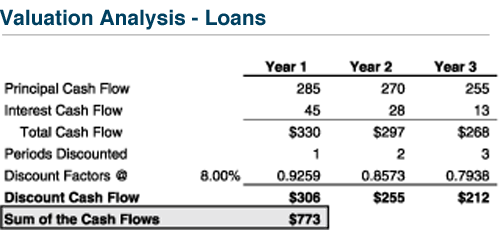

After determining the expected cash flows from the portfolio, the acquirer can then determine the fair value of the acquired loans. Because credit spreads have widened since origination of the loans, and to reflect the risk of adverse deterioration in default rates, the acquirer estimates that an 8% discount rate is appropriate.

Figure Two then illustrates the determination of fair value of the acquired loan portfolio:

The acquirer would thus record the acquired loan portfolio at its fair value of $773. Next, the acquirer would determine the fair value of the loss-share agreement, based on the projected loan losses and the loss coverage percentage agreed upon with the FDIC. The valuation of the loss-share agreement generally assumes a lower discount rate than the determination of fair value of the loan portfolio, given the relative assurance of collection of amounts due under the loss-share agreement from the FDIC.

Figure Three shows this calculation.

Based on the preceding determinations of fair value, and assuming the fair value of the liabilities equals book value, Figure Four indicates the assets and liabilities acquired in the transaction.

In the transaction, the acquirer received $1,068 of assets at fair value and assumed $1,000 of liabilities. To balance its books, therefore, the acquirer would need to need to record “negative goodwill” of $68; however, negative goodwill is not recorded as a “negative” asset. Instead, ASC 805 indicates that the acquirer should record a gain equal to the amount of negative goodwill.

Post-Acquisition Date Issues

In many instances, due to the volume of problem assets, the magnitude of the fair value adjustments to the loan portfolio, and the need to track the loss-share asset, the post-acquisition accounting for the acquired loans is more complicated than the acquisition-date accounting. The primary ongoing accounting issues faced by the acquiring bank include the following:

- Estimating the accretion of the loan portfolio discount and the carrying value of the loan portfolio; and,

- Estimating the accretion of the loss share agreement and the carrying value of the loss-share agreement.

Figure Five rolls the loan portfolio balance forward from the acquisition date starting with the beginning fair value of the portfolio ($773).

In each period, the bank collects principal and interest payments on the portfolio, per the amortization of the portfolio in Figure One. In addition, the bank determined the fair value of the portfolio based on the return required by market participants at the valuation date (8%), which exceeded the stated note rate on the portfolio (5%). This disparity results in an additional loan discount accretion.

For example, in year 1, at an 8% interest rate, the portfolio would yield income of $62 ($773 x 8%). However, the bank collects interest of only $45 from borrowers. The $17 difference between the market yield and the note rate is accreted into income by the acquiring bank. The ending portfolio balance therefore equals the beginning portfolio balance ($773), minus principal collections ($285), plus the discount accretion ($17). Figure Six shows the roll-forward of the loss-share asset.

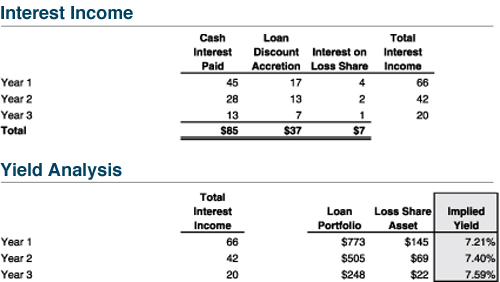

As indicated in Figure Six, the loss-share asset declines as the FDIC remits payments against covered losses. In addition, the fair value of the loss-share agreement was determined based upon an assumed 3% discount rate. As for the loans, this 3% return is accreted into income. Figure Seven summarizes the interest collected and accreted on the loan portfolio and loss-share asset.

In sum, the acquiring bank’s interest income from the acquired loans would consist of three sources – the interest paid by the borrowers, the discount accretion on the loans, and the accretion of interest on the loss-share agreement. Overall, the acquiring bank would earn an effective yield of approximately 7.25% to 7.50% on the assets acquired, versus the actual note rate of 5%.

Conclusion

The preceding analysis, while still complex, is greatly simplified from real world practice. In reality, acquirers are faced with many challenging issues, such as:

- How should the acquirer consider credit deterioration in the determination of the fair value of the loan portfolio, particularly when weak underwriting or servicing lead to great uncertainty as to future credit losses?

- What adjustments are necessary when the actual cash flows from the portfolio differ from the projected cash flows? The preceding analysis made the greatly simplifying assumption that cash flows occur as originally anticipated. In reality, as actual cash flows differ from expected cash flows, the acquirer may need to adjust the loan discount accretion, the loss-share asset, and perhaps even establish a loan loss reserve when anticipated cash flows are lower than initially expected.

Reprinted from Mercer Capital’s Value Added (TM) Vol. 22, No. 1, May 2010