Legislation Update: Grantor Retained Annuity Trusts

In 2008, we described the “perfect storm” of conditions existing at the time that increased the likelihood of success for a grantor retained annuity trust (“GRAT”). Although much has changed since 2008, most of the circumstances promoting the consideration of a GRAT still prevail. The “perfect storm” will likely be stilled if the Senate passes a pending bill. The legislation, called the Small Business and Infrastructure Jobs Tax Act of 2010 (HR 4849), was passed by the House of Representatives on March 24, 2010.

Lawmakers designed the bill to provide incentives for small business and infrastructure job creation, but such incentives require “Revenue Provisions” necessary to offset spending and tax cuts. Section 307 of the bill acts as one of those revenue generators by expanding the rules on GRATs, which in turn increases the transfer tax income to the federal government. The Congress Joint Committee on Taxation estimates that $4.45 billion in revenue will be generated over ten years by this provision.

How Does a GRAT Transfer Wealth?

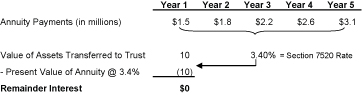

Under certain conditions, a GRAT can result in the transfer of wealth to family members without gift tax. First, a quick overview of how GRATs work. The grantor transfers assets into an irrevocable trust, which is established for a set term, and an annuity is paid back to the grantor during each year of that term. For gift tax assessment, the IRS assumes an expected level of asset appreciation, called the Section 7520 rate. The amount of the taxable gift is the fair market value of the property when it is transferred to the trust less the present value of the grantor’s annuity interest, using the Section 7520 rate as the discount rate. This difference is often referred to as the remainder interest.

Figure One shows a five-year GRAT with the annuity set up such that the remainder interest equals zero, assuming $10 million of assets are placed into the trust with a Section 7520 rate of 3.4%.

In order for the strategy to be successful, a portion of the assets transferred must remain in the trust after the satisfaction of the annuity. For this to occur, the return on the assets must exceed the section 7520 rate and the grantor must survive the term of the trust. If the return on assets does not exceed the 7520 rate, the assets will return to the grantor. If the grantor dies prior to expiration of the term, all assets remaining in the GRAT become a part of his or her estate. Therefore, current law limits downside risk of GRATs to wasted legal and administrative fees.

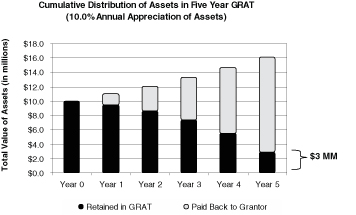

Figure Two displays the potential cumulative transfer of assets through the five year GRAT from Figure One, assuming the $10 million of assets grow at an annual rate of 10.0% after the formation of the GRAT.

At year five, approximately $3 million dollars of appreciated assets remain in the trust. If the grantor survives the five year term, that portion of wealth passes to the beneficiary free of transfer tax. In this example, 18.1% of the assets placed into the GRAT are transferred to the beneficiary free of tax.

The portion of assets shifted to the beneficiary depends on the spread between the actual return on the asset contributed to the trust and the 7520 rate. If these rates are equal, no assets are transferred through the GRAT to the beneficiary. If we assume that the assets will grow at 15.0% in the previous example, 28.8% of wealth is transferred through the trust. In short, this strategy can benefit those planning to gift appreciating assets.

New Legislation

As mentioned earlier, the current law may have a short life. Section 307 of the pending legislation imposes two major additional requirements on GRATs: (1) the term must be no less than ten years and (2) the remainder interest must have a value greater than zero at the time of the transfer. Thus, as the new bill is currently written, the “mortality risk” of the grantor increases and the taxable gift must be greater than zero. The Senate Committee on Finance may suggest a minimum remainder interest such that a minimum taxable gift amount must be transferred, increasing the downside risk of the strategy. If such an amendment is added and the assets in a GRAT fail to appreciate at a rate greater than the 7520 rate, then the grantor will have paid unnecessary taxes in addition to administrative fees. If the bill remains unchanged from its current form, the positive taxable gift requirement is open to interpretation: could the gift value be $0.01?

The “Perfect Storm” Continues

In 2008, we discussed three conditions that provided a “perfect storm” for GRATs: (1) a low section 7520 rate, (2) depressed asset values in most markets, and (3) the uncertainty of GRAT restricting legislation.

- A low IRS 7520 rate increases the probability that the return on contributed assets will exceed the 7520 rate over the term of the GRAT, resulting in a transfer of wealth to the beneficiary without a transfer tax. A low 7520 rate also increases the expected portion of assets that could be passed to a family member by means of a GRAT. The 7520 rate is currently 3.4%. Although the rate was as low as 2.0% during part of 2009, the rate was recently as high as 6.2% in August 2007. Many wealthy individuals are setting up GRATs to lock in this lower rate.

- The S&P 500 has rebounded from 2009 lows, but the value of other assets (privately held companies and other real estate) may not have yet climbed back to pre-recession levels. Realizing a return in excess of the 7520 rate is more likely when starting from a lower base value. Thus, the expected portion of assets passed to a family member increases with relatively lower initial values.

- GRAT restricting legislation is much more certain today than in 2008. As mentioned earlier, the potential effects of the pending legislation may increase the “mortality risk” and other downside risk of a GRAT. The Senate Committee on Finance may require a minimum amount of a taxable gift when establishing a GRAT. If not, interpretation of the “greater than zero” requirement may be supplied by the IRS.

Time to Take Action

If the GRAT strategy meets a potential grantor’s objectives, now may be the time to take swift action.

GRATs are frequently formed using shares or interests in closely-held corporations, or family limited partnerships, and it is necessary to obtain an appraisal of these shares or interests to set the initial fair market value transferred to the GRAT. If the pending legislation is seen as the beginning of an era of increased scrutiny, grantors and beneficiaries will benefit from hiring experienced valuation firms they can trust to appraise the assets placed into their GRATs. As one of the country’s premier business valuation firms, Mercer Capital has vast experience valuing corporations and partnerships. In addition, we can also value GRATs and provide other GRAT valuation consulting. Feel free to give us a call today at 901.685.2120 if we can help you or your client.

Reprinted from Mercer Capital’s Value Added(TM), Vol. 22, No. 1, May 2010