Normalizing Adjustments to the Income Statement

Normalizing adjustments adjust the income statement of a private company to show the prospective purchaser the return from normal operations of the business and reveal a “public equivalent” income stream. If such adjustments were not made, something other than a freely traded value indication of value would be developed by capitalizing the derived earnings stream. For appraisers using benchmark analysis, this would be disastrous, since the restricted stock studies were based on freely traded stock prices.1

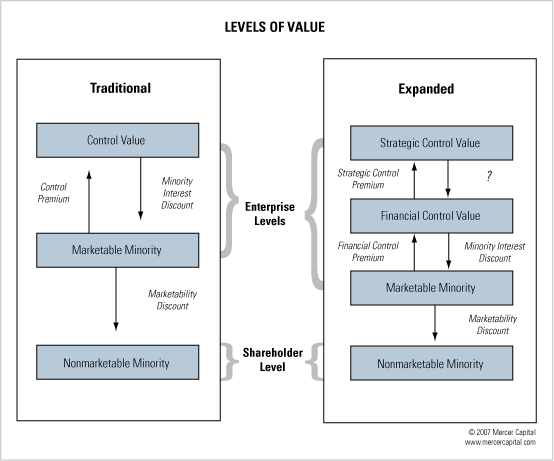

Keep in mind the integration of levels of value in the integrated theory of business valuation. In creating a public equivalent for a private company, it need not have all of the characteristics required to engage in an IPO for this model to be relevant. Another name given to the marketable minority level of value is “as if freely traded.” This terminology emphasizes that earnings are being normalized to where they would be as if the company were public. This framework does not require that a company be public or even that it have the potential to become public.

A new vocabulary is needed to clarify the nature of normalizing income statement adjustments. As noted earlier, there are two types of normalizing adjustments. Being very original, we call them Type 1 and Type 2.

- Type 1 Normalizing Adjustments. These are adjustments that eliminate one-time gains or losses, other unusual items, non-recurring business elements, expenses of non-operating assets, and the like. Every appraiser employs such income statement adjustments in the process of adjusting (normalizing) historical income statements. Regardless of the name given to them, there is virtually universal acceptance that Type 1 Normalizing Adjustments are appropriate for consideration.

- Type 2 Normalizing Adjustments. These are adjustments that normalize officer/owner compensation and other discretionary expenses that would not exist in a reasonably well-run, publicly traded company. Type 2 Normalizing Adjustments should not be confused with control adjustments or Type 1 Normalizing Adjustments.

Normalizing adjustments reveal the income stream available to the controlling interest buyer who will gain control over the income stream and who may be able to do other things with that income stream. They also reveal the income stream that is the source of potential value for the buyer of minority interests.

Appraisers should not be confused by the fact that minority shareholders of private companies lack the control to make normalizing adjustments. Some have argued that because minority shareholders lack control to change things like excess owner compensation, normalizing adjustments should not be made in minority interest appraisals. This position is incorrect. Minority shareholders of public companies lack control as well. The difference is they expect normalized operations and they expect management to perform. If management of a public company does not perform, if egregious salaries are paid, or if expenses are not reasonably managed, minority shareholders of the public company tend to walk. They take their money some place else. And the price of the poorly run public company normally reflects this lack of investor interest.

Shareholders of nonmarketable minority interests often lack this ability to “take my money and run.” These considerations have no impact on the value of the enterprise. Rather, they lower the value of the interest in the enterprise in relationship to its pro rata share of enterprise value. This diminution of value must be considered separately from, but in conjunction with, the valuation of the enterprise.

Normalizing Adjustments Illustrated

While some appraisers still disagree regarding Type 2 Normalizing Adjustments, the logic of this presentation, in conjunction with the conceptual discussions both above and in Chapter 3 of Valuing Enterprise and Shareholder Cash Flows: The Integrated Theory of Business Valuation (see page 8 of this newsletter), is compelling. Consider a concrete example and relate it to the Levels of Value Chart.

In the figure below, ABC, Inc. is a $10 million sales company reporting operating profit of $300,000.

Assume that we are appraising ABC and are now considering normalizing adjustments. There is one Type 1, or unusual, non-recurring normalizing adjustment to be made in this particular appraisal. There are also several Type 2 normalizing adjustments that relate to the owner and the controlling shareholder of the business.

- Type 1 Normalizing Adjustment (Non-Recurring Items):

- The company settled a lawsuit regarding damages when one of its vehicles was in an accident. The settlement, inclusive of attorneys’ fees, was $200,000 in the most recent year. Expenses associated with the lawsuit are eliminated from operating expenses.

- Type 2 Normalizing Adjustments (Agency Costs and Other Discretionary Expenses):

- Our examination of selling expenses reveals that Cousin Joe is on the payroll at $100,000 per year and he is not doing anything for the good of the business. An adjustment is clearly called for regarding Cousin Joe. His compensation must be eliminated in order to see the “as if freely traded” income stream.

- In the Administrative Department, Cousin Al comes to work every day, but it is clear that the department is being run by someone else and that Cousin Al is not productive. We adjust by removing his $100,000 salary.

- Big Daddy takes a substantial salary out of the business. Based on a salary survey, earnings should be adjusted by $600,000 for his excess compensation to lower the expense to a normal, market level of compensation.

- Finally Big Daddy owns a chalet, which costs the company about $400,000 a year. Expenses associated with Big Daddy’s vacation home are adjusted accordingly.

Summing the Type 1 and Type 2 adjustments, a total of $1.2 million of adjustments to operating expenses have been identified. These adjustments raise the adjusted operating profit to the level expected were this company publicly traded (even though it likely never will be!). The adjusted (normalized) operating margin of 15%, and adjusted earnings are stated “as if freely traded.”2

Before proceeding to examine control adjustments, we should carry the discussion of normalizing adjustments a step further in order to address any lingering concerns. Some appraisers will still want to say that Type 2 Normalizing Adjustments are really control adjustments and that they should not be made when valuing minority interests.

Why, they may ask, should we not value the minority interest directly and forego making Type 2 Normalizing Adjustments? Let’s be explicit. If we do not make these adjustments:

- The earnings stream that would be valued would not be “public equivalent” in nature.

- Discount rate based on build-up (CAPM) or a guideline company analysis would not be appropriate and the resulting value indication would not be at the marketable minority level.

- Marketability discounts referencing restricted stock and pre-IPO transactions involving public companies would be inappropriate if needed Type 2 Normalizing Adjustments are not made. The various restricted stock and pre-IPO studies are based on marketable minority value bases and the resulting, non-normalized base would not be at the marketable minority level.

- There would be an implicit assumption that the shareholder would never realize his or her pro rata share of the value of the enterprise. In the alternative, there would be no basis to estimate what that future terminal value might be. There would be no basis, for example, to estimate the expected growth in value of the enterprise over any relevant expected holding period, since that base, marketable minority value is not specified.

The bottom line is that, absent making Type 2 Normalizing Adjustments (when appropriate of course), an appraiser is not able to specify that his or her conclusion is at the nonmarketable minority level of value, which is typically the objective of minority interest appraisals. The bottom, bottom line is that appraisers who do not make Type 2 Normalizing Adjustments in the process of reaching value conclusions at the nonmarketable minority level have neither the appropriate theoretical nor practical bases for their conclusions.

Endnotes

1 In other words, the value indication derived from the use of non-normalized earnings for a private company and the application of a marketability discount derived from freely traded transactional bases would yield something other than a nonmarketable minority value indication. Because the earnings capitalized were not normalized, and a “normal” marketability discount was applied, the indicated value conclusion would likely be below that of the nonmarketable minority level.

2 Note that this appraisal process would not ignore the valuation impact of the agency costs associated with Big Daddy and his family if the objective were a nonmarketable minority value indication. The economic impact of the excess compensation not accruing to all shareholders would substantially impact the expected growth in value of the business and the dividend policy (key assumptions of the Quantitative Marketability Discount Model). The risks of illiquidity over an appropriate expected holding period would also be considered.